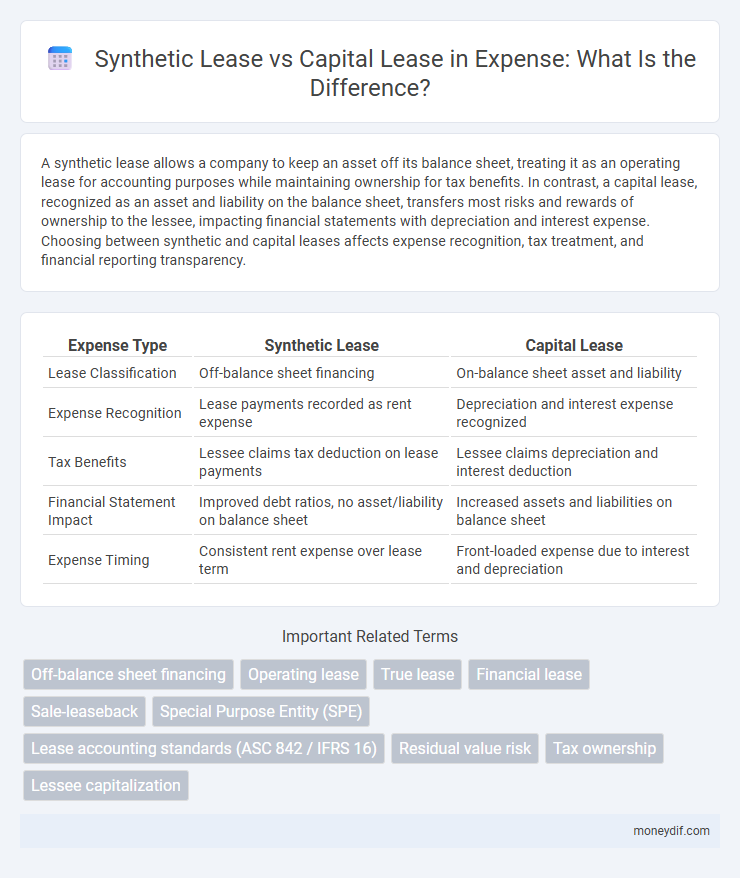

A synthetic lease allows a company to keep an asset off its balance sheet, treating it as an operating lease for accounting purposes while maintaining ownership for tax benefits. In contrast, a capital lease, recognized as an asset and liability on the balance sheet, transfers most risks and rewards of ownership to the lessee, impacting financial statements with depreciation and interest expense. Choosing between synthetic and capital leases affects expense recognition, tax treatment, and financial reporting transparency.

Table of Comparison

| Expense Type | Synthetic Lease | Capital Lease |

|---|---|---|

| Lease Classification | Off-balance sheet financing | On-balance sheet asset and liability |

| Expense Recognition | Lease payments recorded as rent expense | Depreciation and interest expense recognized |

| Tax Benefits | Lessee claims tax deduction on lease payments | Lessee claims depreciation and interest deduction |

| Financial Statement Impact | Improved debt ratios, no asset/liability on balance sheet | Increased assets and liabilities on balance sheet |

| Expense Timing | Consistent rent expense over lease term | Front-loaded expense due to interest and depreciation |

Understanding Synthetic Lease: Definition and Key Features

Synthetic lease is a financing arrangement allowing companies to lease assets off-balance sheet while retaining operational control, combining elements of both operating and capital leases. Key features include the lessee benefiting from tax deductions as if they owned the asset, while the lease is treated as an operating lease for financial reporting, thus not increasing debt on the balance sheet. This structure is often used to optimize financial ratios and manage expense recognition without diluting ownership or increasing reported liabilities.

Capital Lease Explained: An Overview

Capital lease, also known as a finance lease, transfers ownership risks and rewards to the lessee, appearing as both an asset and a liability on the balance sheet. It involves amortizing the leased asset over its useful life, resulting in depreciation expense and interest expense recorded separately on financial statements. Companies use capital leases to finance long-term assets while recognizing expenses that impact profitability and cash flow analysis.

Expense Recognition: Synthetic Lease vs Capital Lease

Expense recognition in a synthetic lease involves operating lease treatment where lease payments are recorded as rental expenses on the income statement, avoiding asset capitalization and depreciation. In contrast, a capital lease requires recognizing both depreciation expense on the leased asset and interest expense on the lease liability, reflecting asset ownership on the balance sheet. This distinction impacts reported operating expenses and financial ratios, influencing profitability and return metrics.

Balance Sheet Impact and Financial Reporting Differences

Synthetic leases allow a company to keep leased assets and corresponding liabilities off the balance sheet, improving financial ratios and debt capacity by treating the lease as an operating lease for accounting purposes. Capital leases require the lessee to recognize the asset and liability on the balance sheet, reflecting ownership and impacting key financial metrics such as debt-to-equity ratio and return on assets. Financial reporting differences include synthetic leases offering off-balance-sheet financing transparency challenges, while capital leases provide clearer asset and liability disclosures under GAAP or IFRS standards.

Tax Treatment: Comparing Synthetic and Capital Leases

Synthetic leases enable companies to treat leased assets as operating leases for accounting purposes, minimizing reported liabilities while allowing assets to remain off the balance sheet. For tax purposes, synthetic leases are classified as capital leases, which permit lessees to claim depreciation and interest deductions, providing valuable tax benefits. In contrast, capital leases are recognized on the balance sheet for both accounting and tax, with lessees claiming depreciation expense and interest deductions but reflecting higher liabilities that may impact financial ratios.

Advantages of Synthetic Lease Structures

Synthetic lease structures offer significant advantages by allowing companies to keep leased assets off their balance sheets, improving financial ratios and return on assets. These leases provide tax benefits similar to ownership while maintaining off-balance-sheet treatment under Generally Accepted Accounting Principles (GAAP). The flexibility in structuring lease terms also helps businesses optimize cash flow and preserve borrowing capacity compared to traditional capital leases.

Benefits and Drawbacks of Capital Leases

Capital leases offer businesses the benefit of asset ownership with the potential for tax deductions through depreciation and interest expense, enhancing financial reporting accuracy by reflecting true asset value. However, they increase liabilities on the balance sheet, potentially impacting debt covenants and borrowing capacity, while requiring full lease payment obligations regardless of asset use. The capitalization of leased assets also affects key financial ratios, which may influence investor perception and credit ratings.

Risk Assessment: Synthetic vs Capital Lease

Synthetic leases minimize on-balance-sheet liabilities by classifying assets as operating leases, reducing risk of financial statement impact; however, they carry risks related to complex legal structures and potential changes in accounting standards. Capital leases, recorded as asset acquisitions with corresponding liabilities, increase balance sheet leverage and financial risk but provide clearer asset control and less regulatory uncertainty. Risk assessment must weigh off-balance-sheet benefits of synthetic leases against transparency and long-term financial commitment inherent in capital leases.

Decision Guidelines: Choosing the Right Lease for Your Business

When deciding between a synthetic lease and a capital lease, businesses should evaluate the impact on balance sheets, tax benefits, and financial reporting requirements. Synthetic leases offer off-balance-sheet financing, preserving debt ratios while capital leases require asset capitalization and affect debt levels. Companies must analyze long-term cost implications, asset control, and compliance with accounting standards like ASC 842 to choose the optimal lease structure for operational and financial goals.

Real-World Examples: Expense Implications in Practice

Real-world examples highlight that synthetic leases keep lease expenses off the balance sheet, reducing reported operating expenses and improving financial ratios, as seen in companies like Amazon during strategic asset management. In contrast, capital leases require recognition of depreciation and interest expenses, increasing overall expense burdens, exemplified by airlines leasing aircraft under capital lease terms. These differing expense treatments significantly impact financial statements and tax liabilities, influencing corporate lease structuring decisions.

Important Terms

Off-balance sheet financing

Off-balance sheet financing through synthetic leases allows companies to keep leased assets and liabilities off their balance sheets, preserving financial ratios by structuring lease agreements as operating leases for accounting purposes while maintaining ownership benefits. In contrast, capital leases require lessees to record the leased asset and corresponding liability on the balance sheet, reflecting long-term financial commitments and impacting leverage ratios.

Operating lease

Operating leases are off-balance-sheet financing arrangements that offer companies flexibility and lower reported liabilities compared to capital leases, which require asset capitalization and depreciation. Synthetic leases combine aspects of both, allowing lessees to report leases as operating leases for financial accounting while treating them as capital leases for tax purposes, optimizing balance sheet presentation and tax benefits.

True lease

A true lease is classified as an operating lease where the lessee does not record the asset or liability on the balance sheet, contrasting with a synthetic lease that appears off-balance-sheet but transfers economic ownership risks. Unlike capital leases, which recognize both asset and liability reflecting ownership, true leases keep the lessor bearing asset risks and rewards, optimizing financial statement presentation and tax benefits.

Financial lease

A financial lease, also known as a capital lease, involves the lessee acquiring substantially all the risks and rewards of ownership, leading to asset and liability recognition on the balance sheet. In contrast, a synthetic lease is structured to keep the leased asset off the lessee's balance sheet for accounting purposes while still providing operational control and tax benefits similar to ownership.

Sale-leaseback

Sale-leaseback transactions enable companies to convert owned assets into liquid capital while maintaining operational control through lease agreements. Compared to synthetic leases, which balance on-balance sheet recognition with off-balance sheet benefits, capital leases fully capitalize the asset and liability, affecting financial ratios and tax implications more significantly.

Special Purpose Entity (SPE)

A Special Purpose Entity (SPE) is often established to facilitate synthetic leases, enabling a company to keep leased assets and related liabilities off its balance sheet by classifying the lease as an operating lease under accounting standards. In contrast, a capital lease involves the lessee recognizing the leased asset and corresponding liability on the balance sheet, reflecting ownership-like benefits and risks associated with the leased property.

Lease accounting standards (ASC 842 / IFRS 16)

ASC 842 and IFRS 16 require lessees to recognize most leases on the balance sheet, eliminating the off-balance-sheet treatment often associated with synthetic leases, which were previously classified as operating leases and kept assets and liabilities hidden. Capital leases under previous standards closely resemble finance leases under ASC 842 and IFRS 16, mandating asset recognition and lease liability measurement that reflect the lessee's right-of-use asset and obligation to make lease payments.

Residual value risk

Residual value risk in synthetic leases is typically lower because the lessee often retains ownership and control of the asset, mitigating uncertainties over the asset's end-of-lease value. In contrast, capital leases transfer ownership risks to the lessee, exposing them to potential fluctuations in residual value that impact financial obligations and asset valuation.

Tax ownership

Tax ownership under a synthetic lease allows the lessee to retain tax benefits such as depreciation deductions by treating the asset as owned for tax purposes while keeping it off the balance sheet; in contrast, a capital lease transfers both legal and tax ownership to the lessee, requiring the asset and corresponding liability to be recorded on the balance sheet, impacting taxable income and financial ratios. Synthetic leases optimize tax advantages without increasing reported debt, whereas capital leases reflect true ownership and associated tax obligations.

Lessee capitalization

Lessee capitalization under synthetic lease structures allows a company to keep leased assets and liabilities off the balance sheet, contrasting with capital leases where the lessee must recognize the leased asset and corresponding liability, impacting financial ratios and debt covenants. Synthetic leases rely on legal ownership by lessors but grant lessees operational control, enabling balance sheet neutrality, whereas capital leases transfer substantially all risks and rewards of ownership to the lessee, mandating full asset capitalization.

synthetic lease vs capital lease Infographic

moneydif.com

moneydif.com