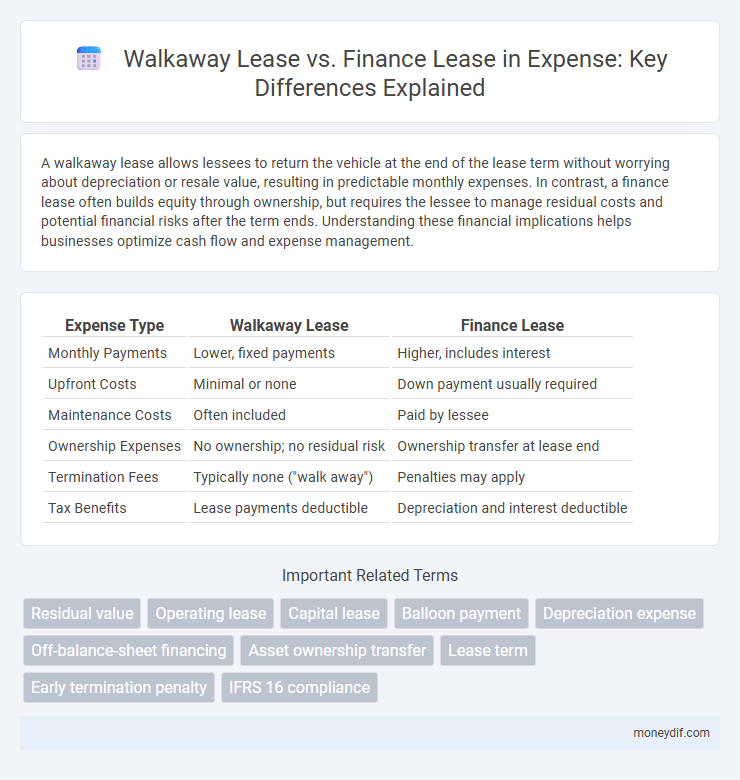

A walkaway lease allows lessees to return the vehicle at the end of the lease term without worrying about depreciation or resale value, resulting in predictable monthly expenses. In contrast, a finance lease often builds equity through ownership, but requires the lessee to manage residual costs and potential financial risks after the term ends. Understanding these financial implications helps businesses optimize cash flow and expense management.

Table of Comparison

| Expense Type | Walkaway Lease | Finance Lease |

|---|---|---|

| Monthly Payments | Lower, fixed payments | Higher, includes interest |

| Upfront Costs | Minimal or none | Down payment usually required |

| Maintenance Costs | Often included | Paid by lessee |

| Ownership Expenses | No ownership; no residual risk | Ownership transfer at lease end |

| Termination Fees | Typically none ("walk away") | Penalties may apply |

| Tax Benefits | Lease payments deductible | Depreciation and interest deductible |

Introduction to Walkaway Lease vs Finance Lease

Walkaway leases provide a fixed monthly expense with no obligation at the end of the term, ideal for businesses seeking predictable cash flow and minimal residual value risk. Finance leases, in contrast, resemble asset purchases with capitalized expenses, impacting balance sheets and requiring end-of-term decisions regarding ownership or return. Understanding these distinctions is crucial for accurately managing lease expenses and optimizing financial planning.

Key Differences Between Walkaway and Finance Leases

Walkaway leases require no payment or penalty at lease end, offering flexibility and lower financial risk, while finance leases involve ownership responsibilities and higher long-term costs. In walkaway leases, lessees return the asset without residual value concerns, whereas finance leases often demand payment of residual value or asset purchase. The key differences lie in risk exposure, expense predictability, and end-of-lease obligations affecting overall financial planning.

Expense Structures: Walkaway Lease vs Finance Lease

Walkaway leases typically present fixed monthly expenses with minimal upfront costs, as they include maintenance and insurance, reducing financial unpredictability. Finance leases, however, involve higher initial payments and variable expenses tied to asset depreciation and interest, impacting long-term cash flow stability. Understanding these expense structures allows businesses to optimize budgeting strategies based on predictable versus variable lease costs.

Upfront and Ongoing Costs Comparison

Walkaway leases typically feature lower upfront costs, including minimal or no down payments and reduced acquisition fees, making them more affordable initially compared to finance leases. Ongoing expenses in walkaway leases are usually limited to fixed monthly payments and potential mileage or wear-and-tear charges, whereas finance leases may entail higher monthly payments that contribute toward ownership and additional maintenance costs. Understanding these cost structures is essential for accurately budgeting total vehicle expenses in lease agreements.

Impact on Monthly Cash Flow

Walkaway leases typically reduce monthly cash flow impact by offering lower monthly payments compared to finance leases, as they often include maintenance and end-of-term flexibility. Finance leases require higher monthly obligations since payments cover the asset's full value plus interest, affecting cash flow more significantly. Choosing walkaway leases can improve short-term cash management, while finance leases impact long-term financial planning due to fixed, higher monthly expenses.

End-of-Term Expense Considerations

End-of-term expense considerations for walkaway leases typically involve minimal costs as lessees return the vehicle without purchase obligations, avoiding residual value risk or significant repair expenses. Finance leases often require lessees to cover residual value discrepancies, excessive wear, or mileage overages, leading to higher potential end-of-term costs. Accurate calculation of these expenses is crucial for effective budgeting and financial planning in lease agreements.

Tax Implications of Walkaway and Finance Leases

Walkaway leases typically allow lessees to deduct lease payments as operating expenses, providing immediate tax benefits without asset depreciation concerns. Finance leases require capitalization of the leased asset, enabling depreciation and interest expense deductions, which may result in longer-term tax advantages. Understanding the distinctions in deductible expenses and asset treatment is crucial for optimizing tax outcomes in lease agreements.

Residual Value and Final Payments

Walkaway leases typically include a predetermined residual value that allows lessees to return the vehicle without further payments, minimizing financial risk at lease-end. In contrast, finance leases often require final payments based on the residual value, obligating lessees to purchase the asset or cover any negative equity. Understanding the impact of residual value on payment structures can significantly influence overall leasing expenses and budgeting decisions.

Hidden Fees and Additional Expenses

Walkaway leases often feature lower monthly payments but can include hidden fees such as excessive wear-and-tear charges and mileage overage penalties, which increase total expenses. Finance leases may have higher upfront costs but typically provide clearer terms with fewer unexpected fees, aligning monthly payments more closely with the vehicle's depreciation. Understanding the full cost structure, including potential end-of-lease fees and early termination penalties, is essential for accurate expense forecasting in both lease types.

Choosing the Right Lease for Your Expense Strategy

Walkaway leases offer fixed monthly expenses and minimal end-of-term costs, ideal for businesses aiming to maintain predictable cash flow and low maintenance overhead. Finance leases capitalize on long-term asset control and potential tax benefits through asset depreciation, suitable for companies prioritizing ownership and higher initial expenses. Selecting the right lease hinges on your expense strategy: fixed, limited liabilities with walkaway leases or asset acquisition with finance leases.

Important Terms

Residual value

Residual value represents the estimated worth of a leased asset at the end of the lease term, playing a crucial role in determining monthly payments and buyout options for both walkaway and finance leases. In walkaway leases, the residual value is set higher to lower monthly costs without the lessee's responsibility to purchase the asset, whereas finance leases use residual value to calculate ownership equity and final purchase price.

Operating lease

An operating lease allows lessees to use an asset without ownership, often seen in walkaway leases where the lessee can return the asset at lease end without further obligation, contrasting with finance leases that transfer ownership risks and benefits to the lessee and are capitalized on the balance sheet. Walkaway leases provide flexibility and lower financial commitment, while finance leases resemble asset purchases with long-term liability recognition under accounting standards like IFRS 16 or ASC 842.

Capital lease

A capital lease, often synonymous with a finance lease, transfers ownership risks and rewards to the lessee, contrasting with a walkaway lease where the lessee has the option to return the asset at lease end without further obligation. Capital leases require lessees to record the leased asset and liability on the balance sheet, reflecting long-term financial commitments typically absent in walkaway leases.

Balloon payment

A balloon payment in a finance lease represents a large, final lump sum due at the end of the lease term, often making monthly payments more affordable but requiring significant final payment, whereas walkaway leases typically avoid this by allowing lessees to return the asset without paying a residual amount. Balloon payments increase financial risk in finance leases compared to walkaway leases, which provide flexibility and limited end-of-term obligations.

Depreciation expense

Depreciation expense for walkaway leases, typically operating leases, is not recorded on the lessee's balance sheet as the asset remains with the lessor, while finance leases require the lessee to capitalize the asset and record depreciation expense over the lease term. Under finance leases, depreciation expense affects net income and asset value, impacting financial ratios and tax calculations, whereas walkaway leases mainly impact lease expense recognition in profit and loss statements.

Off-balance-sheet financing

Off-balance-sheet financing often involves walkaway leases, which allow lessees to use an asset without recognizing the corresponding liability on their balance sheet, unlike finance leases that require capitalization of both the asset and liability. This distinction impacts financial ratios and transparency, with walkaway leases offering more favorable leverage metrics by keeping obligations off the balance sheet.

Asset ownership transfer

Asset ownership transfer distinguishes walkaway leases, where the lessee returns the asset without purchase obligation, from finance leases that typically involve transfer of ownership or a bargain purchase option at lease end; finance leases are recognized as asset and liability on the balance sheet due to their ownership attributes, while walkaway leases are treated as operating leases with no asset acquisition. Lessees in finance leases capitalize the asset and record depreciation, whereas in walkaway leases, lease payments are expensed without ownership rights or residual value concerns.

Lease term

A walkaway lease offers flexible lease terms with minimal penalties, allowing lessees to return the vehicle at lease-end without further obligations, contrasting with a finance lease that typically spans a fixed term where the lessee assumes ownership risks and responsibilities. Finance leases often involve longer lease durations, mandatory maintenance, and options to purchase the asset, whereas walkaway leases prioritize convenience and lower commitment.

Early termination penalty

Early termination penalties in walkaway leases typically involve a flat fee or remaining lease payments, reflecting the lessor's risk of returning the vehicle, while finance leases impose penalties based on outstanding loan balances or depreciation costs. Walkaway leases offer greater flexibility with predetermined fees, whereas finance leases often require settling the residual value and accrued interest upon early termination.

IFRS 16 compliance

IFRS 16 compliance requires lessees to recognize most leases on the balance sheet, distinguishing between finance leases, which transfer substantially all risks and rewards of ownership, and walkaway leases, typically short-term or low-value leases with minimal obligations. Finance leases result in recognizing a right-of-use asset and a corresponding lease liability, while walkaway leases often qualify for exemption, allowing lessees to expense lease payments without capitalization.

walkaway lease vs finance lease Infographic

moneydif.com

moneydif.com