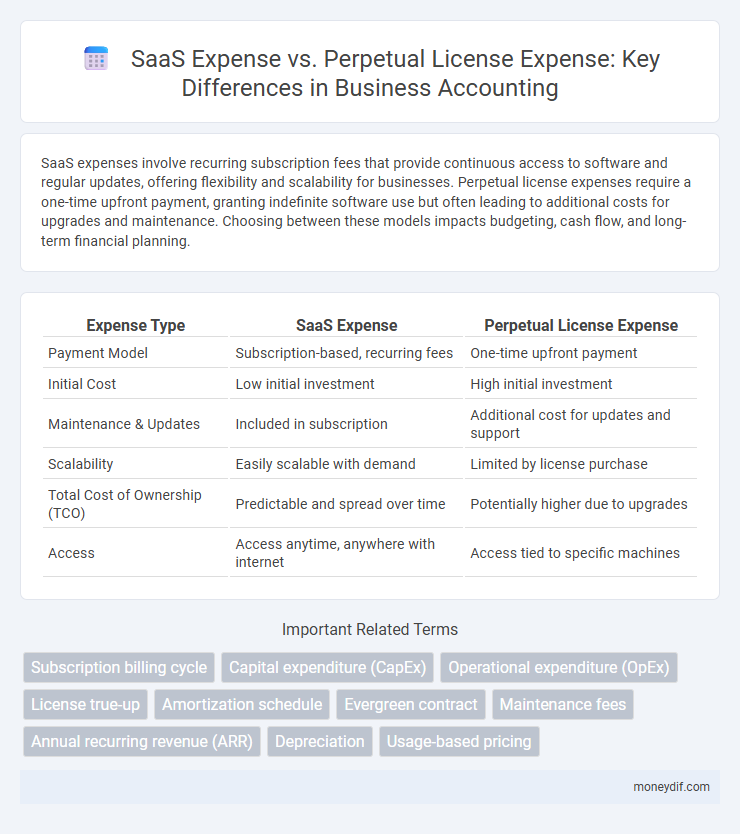

SaaS expenses involve recurring subscription fees that provide continuous access to software and regular updates, offering flexibility and scalability for businesses. Perpetual license expenses require a one-time upfront payment, granting indefinite software use but often leading to additional costs for upgrades and maintenance. Choosing between these models impacts budgeting, cash flow, and long-term financial planning.

Table of Comparison

| Expense Type | SaaS Expense | Perpetual License Expense |

|---|---|---|

| Payment Model | Subscription-based, recurring fees | One-time upfront payment |

| Initial Cost | Low initial investment | High initial investment |

| Maintenance & Updates | Included in subscription | Additional cost for updates and support |

| Scalability | Easily scalable with demand | Limited by license purchase |

| Total Cost of Ownership (TCO) | Predictable and spread over time | Potentially higher due to upgrades |

| Access | Access anytime, anywhere with internet | Access tied to specific machines |

Understanding SaaS Expense Models

SaaS expense models typically involve subscription-based payments, offering predictable, recurring costs that cover updates, maintenance, and support. In contrast, perpetual license expenses require a significant upfront investment, with additional fees for upgrades and support often charged separately. Understanding the total cost of ownership for SaaS versus perpetual licenses is critical for aligning expenses with business cash flow and scalability needs.

Overview of Perpetual License Costs

Perpetual license costs involve a one-time upfront payment granting indefinite software usage rights, often including optional maintenance fees for updates and support. This model contrasts with SaaS expenses, which require ongoing subscription fees based on usage or time. Initial investment in perpetual licenses can be higher, but total cost of ownership may decrease over time if software is used extensively without frequent updates.

Initial Investment: SaaS vs. Perpetual License

SaaS expenses typically involve lower initial investment costs as companies pay subscription fees that cover access, updates, and support without large upfront payments. In contrast, perpetual licenses require a significant initial investment to purchase the software outright, with additional costs for updates and maintenance. This upfront financial commitment in perpetual licensing can impact cash flow but offers long-term ownership without recurring fees.

Recurring Costs: Subscription vs. One-time Payment

SaaS expenses involve recurring subscription fees that cover ongoing access, updates, and support, typically billed monthly or annually, ensuring predictable budget allocation. Perpetual license expenses require a substantial one-time payment for indefinite software use, but often incur additional costs for upgrades, maintenance, and support. Businesses must assess long-term total cost of ownership, balancing steady operational expenses against upfront capital investment.

Maintenance and Support Expenses

SaaS expenses typically include continuous maintenance and support fees bundled within the subscription, ensuring automatic updates and dedicated customer service. Perpetual license expenses often require separate, annual maintenance and support contracts that can cost 15-25% of the original license price. These ongoing maintenance fees for perpetual licenses may result in higher long-term costs compared to the predictable, all-inclusive SaaS subscription model.

Upgrade and Scalability Costs Comparison

SaaS expenses typically include ongoing subscription fees that cover upgrades and scalability, eliminating separate costs for version updates and hardware expansion. Perpetual licenses often require significant upfront payments plus additional fees for upgrades and scalability, leading to unpredictable and potentially higher expenses over time. Scalability in SaaS solutions is more flexible and cost-effective, as expenses adjust based on usage, whereas perpetual licenses may incur substantial investments to increase capacity or integrate new features.

Hidden Fees in SaaS and Perpetual Licensing

SaaS expenses often include hidden fees such as monthly subscription escalations, integration costs, and mandatory updates that may not be immediately apparent, increasing total ownership costs over time. Perpetual licensing can have upfront costs that appear higher but often conceal hidden fees like annual maintenance, support renewals, and upgrade charges. Evaluating the complete cost structure of each model is essential to understanding true expenditure beyond initial pricing.

Cost Predictability and Budgeting

SaaS expenses offer greater cost predictability with fixed, recurring subscription fees, simplifying budgeting efforts and reducing unexpected financial fluctuations. Perpetual license expenses often involve large upfront costs coupled with unpredictable maintenance and upgrade fees, complicating long-term budget planning. Businesses benefit from SaaS models by aligning expenses with usage patterns, enabling more accurate financial forecasting and cash flow management.

Long-term Total Cost of Ownership (TCO)

SaaS expense offers lower initial costs but incurs recurring subscription fees that accumulate over time, impacting the long-term Total Cost of Ownership (TCO). Perpetual license expense requires a significant upfront investment but typically results in lower ongoing costs, potentially reducing TCO in extended use scenarios. Evaluating TCO between SaaS and perpetual licenses depends on factors such as software updates, maintenance, scalability, and user base growth over time.

Financial Flexibility and Business Impact

SaaS expense offers greater financial flexibility through predictable, recurring payments that allow businesses to scale costs with usage and avoid large upfront investments typical of perpetual licenses. This pay-as-you-go model enhances cash flow management and reduces risk by distributing expenses over time, supporting agile budgeting practices. In contrast, perpetual license expenses require substantial initial capital, potentially straining resources and limiting adaptability in fast-changing markets.

Important Terms

Subscription billing cycle

Subscription billing cycles in SaaS models generate recurring monthly or annual expenses, enabling predictable budget management and continuous software updates. Perpetual license expenses involve a one-time payment with potential additional costs for maintenance and upgrades, often leading to higher upfront investment but lower ongoing fees.

Capital expenditure (CapEx)

Capital expenditure (CapEx) for software involves substantial upfront investment, commonly associated with perpetual license expenses that require a one-time purchase for indefinite software use. In contrast, SaaS expenses shift costs to operational expenditure (OpEx) with recurring subscription fees, minimizing initial CapEx while offering scalable and flexible access to software services hosted in the cloud.

Operational expenditure (OpEx)

Operational expenditure (OpEx) for SaaS involves ongoing subscription fees that cover software updates, maintenance, and support, allowing predictable budgeting and reduced upfront costs. In contrast, perpetual license expenses require a significant initial investment with additional costs for upgrades and maintenance, leading to higher Capital Expenditure (CapEx) and potentially unpredictable future expenses.

License true-up

License true-up ensures accurate SaaS expense management by periodically reconciling actual usage against subscriptions, preventing overpayment and optimizing software budget allocation. Unlike perpetual license expense, which is a fixed upfront cost, SaaS true-up aligns ongoing expenses with real-time consumption, enhancing financial flexibility and cost transparency.

Amortization schedule

An amortization schedule for SaaS expenses systematically allocates subscription costs over the service period, reflecting recurring operational expenses, while perpetual license expenses are capitalized and amortized over the software's useful life, indicating a fixed asset investment. This distinction impacts cash flow management and financial reporting, with SaaS modeled as an operating expense and perpetual licenses treated as intangible assets subject to depreciation schedules.

Evergreen contract

Evergreen contracts in SaaS expense management ensure continuous access to software without renewal interruptions, typically resulting in predictable, recurring operating expenses. In contrast, perpetual license expenses involve a one-time payment for indefinite software use, often leading to higher upfront capital expenditures and separate costs for updates or maintenance.

Maintenance fees

Maintenance fees for SaaS expenses are typically included in the subscription cost, providing continuous updates, support, and cloud infrastructure without additional charges. In contrast, perpetual license expenses require separate annual maintenance fees that cover software updates and technical support, often amounting to 20% to 25% of the initial license cost.

Annual recurring revenue (ARR)

Annual recurring revenue (ARR) provides a predictable income metric crucial for SaaS companies, contrasting with the one-time payment structure of perpetual license expenses that lack ongoing revenue streams. SaaS expense models emphasize continuous operational costs and customer retention investments, while perpetual license expenses focus on upfront capital expenditures without guaranteed recurring revenue.

Depreciation

Depreciation does not apply to SaaS expenses because they are treated as operational expenses recognized in the period incurred, whereas perpetual license expenses involve capitalizing the software cost and depreciating it over its useful life, typically using straight-line amortization. SaaS models result in ongoing subscription fees expensed monthly, while perpetual licenses require initial capital expenditure with systematic depreciation impacting the balance sheet and income statement over multiple years.

Usage-based pricing

Usage-based pricing in SaaS models offers scalable cost alignment with actual consumption, minimizing upfront expenses compared to traditional perpetual license fees that demand significant initial investment regardless of usage levels. This pricing strategy enhances budget flexibility and operational efficiency by converting fixed costs into variable expenses based on user activity or resource utilization.

SaaS expense vs perpetual license expense Infographic

moneydif.com

moneydif.com