Allowable costs are expenses that comply with regulatory guidelines and can be charged to a project or budget, including salaries, materials, and approved travel expenses. Unallowable costs refer to expenditures that are prohibited from being charged, such as fines, entertainment, and excessive or personal expenses. Understanding the distinction between allowable and unallowable costs is critical for accurate budgeting and compliance with financial regulations.

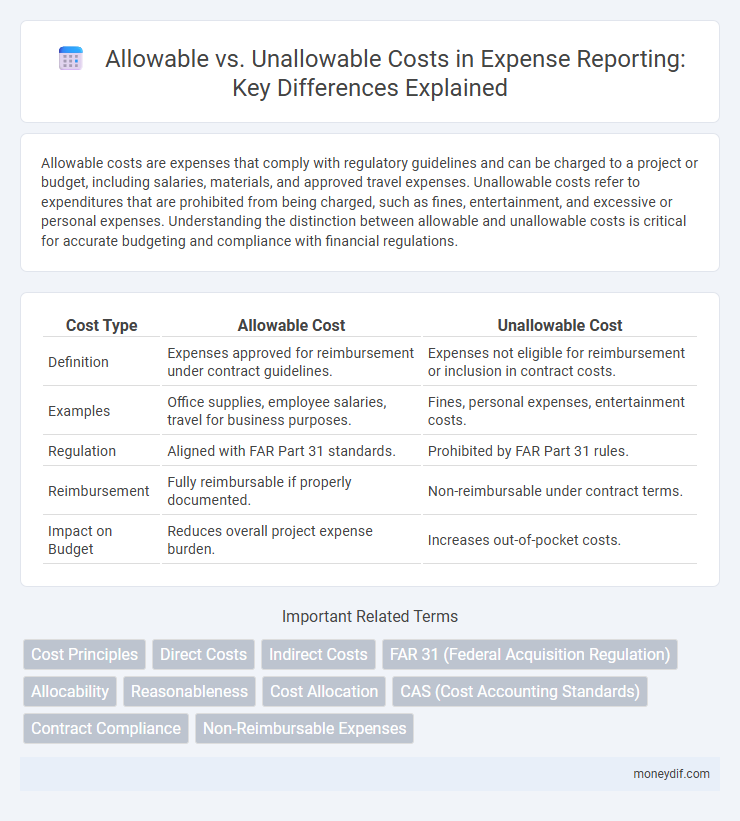

Table of Comparison

| Cost Type | Allowable Cost | Unallowable Cost |

|---|---|---|

| Definition | Expenses approved for reimbursement under contract guidelines. | Expenses not eligible for reimbursement or inclusion in contract costs. |

| Examples | Office supplies, employee salaries, travel for business purposes. | Fines, personal expenses, entertainment costs. |

| Regulation | Aligned with FAR Part 31 standards. | Prohibited by FAR Part 31 rules. |

| Reimbursement | Fully reimbursable if properly documented. | Non-reimbursable under contract terms. |

| Impact on Budget | Reduces overall project expense burden. | Increases out-of-pocket costs. |

Definition of Allowable and Unallowable Costs

Allowable costs are expenses that comply with regulatory standards and grant agreements, making them eligible for reimbursement or inclusion in project budgets. Unallowable costs refer to expenditures that are explicitly prohibited by funding guidelines or organizational policies, thus they cannot be charged to the project or reimbursed. Clear differentiation ensures accurate financial reporting and adherence to compliance requirements in expense management.

Key Criteria for Determining Allowable Costs

Key criteria for determining allowable costs include reasonableness, allocability, and compliance with applicable regulations. Costs must be necessary for the performance of the project, allocable to the specific cost objective, and consistent with the terms of the award or contract. Expenses that are expressly prohibited by federal, state, or organizational policies are classified as unallowable costs and cannot be charged.

Common Examples of Allowable Costs

Common examples of allowable costs include salaries and wages for employees working directly on a project, office supplies essential for project execution, and travel expenses related to project activities. These costs must be necessary, reasonable, and allocable to the specific project to qualify as allowable under federal regulations. Proper documentation and adherence to cost principles such as those in OMB Uniform Guidance (2 CFR Part 200) ensure compliance and reimbursement eligibility.

Typical Unallowable Costs in Expense Management

Typical unallowable costs in expense management include personal expenses, entertainment costs, fines and penalties, lobbying expenses, and alcohol-related expenditures. These costs are excluded from reimbursable expenses under most funding regulations and company policies to ensure compliance and maintain financial integrity. Proper identification and segregation of allowable versus unallowable costs prevent audit risks and support accurate financial reporting.

Regulatory Guidelines Governing Cost Allowability

Regulatory guidelines governing cost allowability, such as the Federal Acquisition Regulation (FAR) and Office of Management and Budget (OMB) Uniform Guidance, define strict criteria to distinguish allowable costs from unallowable costs in government contracting and grant management. Allowable costs must be reasonable, allocable, and compliant with terms of the award, while unallowable costs include expenses like entertainment, personal use, and lobbying. Proper adherence to these guidelines ensures transparent financial reporting and prevents disallowed expenses from jeopardizing funding or contract compliance.

Importance of Proper Cost Classification

Proper cost classification between allowable and unallowable costs is crucial for ensuring compliance with regulatory requirements and avoiding financial penalties. Accurate classification directly impacts budgeting, contract management, and audit readiness by delineating which expenses can be charged to a project or grant. Misclassification can lead to disallowed costs, reduced funding, and damage to organizational reputation.

Impact of Unallowable Costs on Financial Reporting

Unallowable costs, such as personal expenses or lobbying fees, must be excluded from federal grant reimbursements to ensure compliance with funding regulations. Their inclusion can distort financial reporting by inflating operational costs, leading to inaccurate profit margins and potential audit findings. Proper segregation and documentation of these costs are critical to maintain transparency and prevent financial penalties.

Strategies to Ensure Compliance with Cost Regulations

Develop clear internal policies that define allowable costs in accordance with government regulations, emphasizing documentation and justification for each expense. Implement regular training sessions for staff on compliance requirements and update them on changes in cost principles to minimize errors. Utilize audit trails and expense review systems to detect and prevent unallowable costs, ensuring adherence to federal and organizational guidelines.

Documentation and Audit Requirements for Costs

Allowable costs must be documented with detailed invoices, receipts, and proof of payment to meet audit requirements and ensure compliance with funding regulations. Unallowable costs often lack sufficient documentation or fail to meet criteria such as necessity and reasonableness, making them non-reimbursable during audits. Maintaining organized records that clearly segregate allowable and unallowable expenses is critical for transparent reporting and successful audit outcomes.

Consequences of Misclassifying Allowable vs Unallowable Costs

Misclassifying allowable costs as unallowable or vice versa can lead to significant financial penalties, including audit findings and repayment of funds to grantors or contracting agencies. Inaccurate cost classification undermines compliance with federal regulations such as the Uniform Guidance (2 CFR Part 200), potentially resulting in disallowed costs and reduced funding eligibility. Organizations risk damaged reputations and increased scrutiny in future audits, emphasizing the critical need for precise cost reporting and robust internal controls.

Important Terms

Cost Principles

Allowable costs are expenses deemed necessary, reasonable, and allocable to the performance of a contract under federal cost principles, including direct labor, materials, and approved overhead costs. Unallowable costs involve expenses such as entertainment, alcohol, lobbying, and organizational costs that are explicitly excluded from reimbursement as per the Office of Management and Budget (OMB) Uniform Guidance or Federal Acquisition Regulation (FAR) standards.

Direct Costs

Direct costs refer to expenses directly attributable to a specific project or activity, and they must be evaluated against the criteria of allowable versus unallowable costs as defined by federal regulations or funding agency guidelines. Allowable direct costs include salaries, materials, and equipment essential for project performance, while unallowable costs often encompass entertainment, lobbying, or personal expenses that do not directly benefit the project.

Indirect Costs

Indirect costs, also known as overhead costs, include expenses like utilities and administrative salaries that support project activities but are not directly accountable to a specific task; allowable costs comply with federal regulations and can be charged to a grant or contract, while unallowable costs are explicitly excluded, such as entertainment or personal expenses. Understanding the distinction between allowable and unallowable indirect costs is crucial for ensuring compliance with funding guidelines and avoiding financial penalties during audits.

FAR 31 (Federal Acquisition Regulation)

FAR 31 outlines criteria for allowable and unallowable costs in government contracts, emphasizing costs that are reasonable, allocable, and comply with contract terms as allowable. Unallowable costs include those that are illegal, extravagant, or not directly related to contract performance, such as entertainment expenses and fines.

Allocability

Allocability determines whether a cost directly benefits a specific project or activity, influencing if it can be classified as allowable under federal regulations such as the Uniform Guidance (2 CFR Part 200). Allowable costs are those deemed necessary and reasonable for performance, whereas unallowable costs do not meet these criteria or are explicitly excluded by funding rules.

Reasonableness

Reasonableness in cost analysis ensures that allowable costs are necessary, prudent, and consistent with good business practices, while unallowable costs include expenses that are not permitted under regulatory guidelines such as entertainment, alcohol, or personal expenses. Evaluating reasonableness helps distinguish allowable costs that directly benefit contract performance from unallowable costs that could lead to disallowance or repayment.

Cost Allocation

Cost allocation involves distributing allowable costs, which comply with regulatory or contractual guidelines and are eligible for reimbursement, while unallowable costs, such as entertainment or fines, must be excluded to ensure accurate financial reporting and compliance. Proper differentiation between allowable and unallowable costs safeguards budget integrity and supports audit readiness in government contracting and grant management.

CAS (Cost Accounting Standards)

Cost Accounting Standards (CAS) provide guidelines to determine allowable and unallowable costs in government contracts, ensuring accurate cost allocation and compliance. Allowable costs must be reasonable, allocable, and compliant with contract terms, while unallowable costs include expenses such as entertainment, alcohol, and certain legal fees that cannot be charged to the government.

Contract Compliance

Contract compliance requires rigorous differentiation between allowable costs, which are reasonable, allocable, and conform to contract terms, and unallowable costs explicitly excluded by government regulations such as the FAR. Accurate identification and documentation of allowable versus unallowable costs are crucial for avoiding audit risks, ensuring proper cost reimbursement, and maintaining contractual integrity.

Non-Reimbursable Expenses

Non-reimbursable expenses are costs that cannot be charged to a grant or contract because they do not meet the criteria of allowable costs as defined by regulatory guidelines such as the Office of Management and Budget (OMB) Uniform Guidance. Unallowable costs typically include personal expenses, entertainment, lobbying, and bad debts, contrasting with allowable costs that are necessary, reasonable, and allocable to the project.

Allowable cost vs Unallowable cost Infographic

moneydif.com

moneydif.com