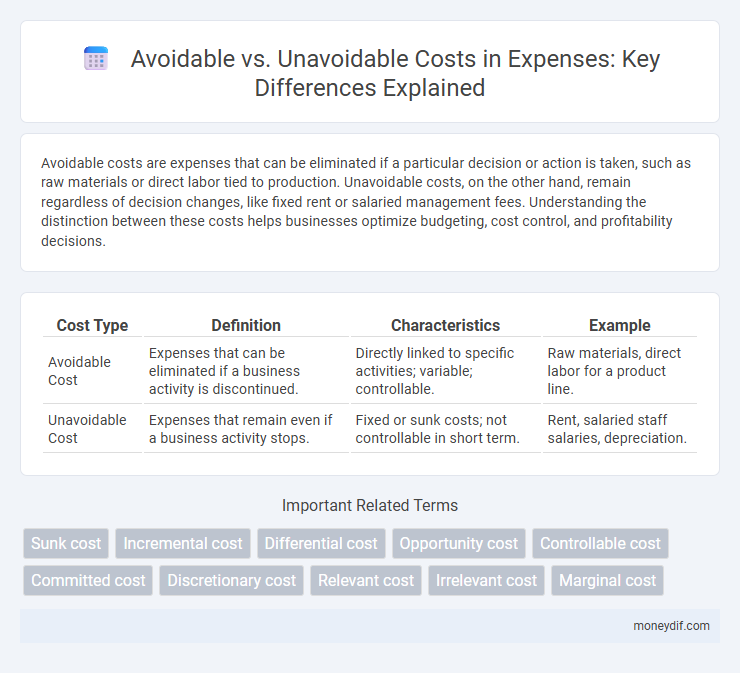

Avoidable costs are expenses that can be eliminated if a particular decision or action is taken, such as raw materials or direct labor tied to production. Unavoidable costs, on the other hand, remain regardless of decision changes, like fixed rent or salaried management fees. Understanding the distinction between these costs helps businesses optimize budgeting, cost control, and profitability decisions.

Table of Comparison

| Cost Type | Definition | Characteristics | Example |

|---|---|---|---|

| Avoidable Cost | Expenses that can be eliminated if a business activity is discontinued. | Directly linked to specific activities; variable; controllable. | Raw materials, direct labor for a product line. |

| Unavoidable Cost | Expenses that remain even if a business activity stops. | Fixed or sunk costs; not controllable in short term. | Rent, salaried staff salaries, depreciation. |

Introduction to Avoidable and Unavoidable Costs

Avoidable costs directly fluctuate with business decisions, such as materials or labor expenses that can be eliminated if a particular activity or production is stopped. Unavoidable costs remain constant regardless of business choices, like rent or salaried employee wages, which must be paid even if operations change. Understanding the distinction between avoidable and unavoidable costs is essential for effective cost management and decision-making within financial analysis.

Defining Avoidable Costs in Expense Management

Avoidable costs are expenses that can be eliminated if a particular activity, service, or project is discontinued, directly impacting overall cost reduction strategies in expense management. These costs typically include variable expenses such as raw materials, direct labor, and utilities tied to specific operations, enabling businesses to identify and control expenditures efficiently. Understanding avoidable costs helps organizations prioritize resource allocation and improve financial decision-making by distinguishing between controllable and fixed expenses.

Understanding Unavoidable Costs in Business

Unavoidable costs in business refer to expenses that must be incurred regardless of operational changes, such as rent, salaries of permanent staff, and insurance premiums. These costs remain fixed even when production levels fluctuate or business activities are scaled down, impacting financial planning and budgeting. Distinguishing unavoidable costs from avoidable costs is critical for accurate cost management and effective decision-making in expense control.

Key Differences Between Avoidable and Unavoidable Costs

Avoidable costs are expenses that can be eliminated if a specific business activity or decision is discontinued, such as raw materials or direct labor costs linked to production. Unavoidable costs persist regardless of business choices, including fixed expenses like rent and insurance that must be paid even if operations pause. The key difference lies in the control managers have over these costs: avoidable costs are variable and controllable, whereas unavoidable costs are fixed and unavoidable.

Impact of Avoidable Costs on Profitability

Avoidable costs directly influence profitability by reducing expenses when business activities or production levels are adjusted, enabling more strategic cost management. Identifying and eliminating avoidable costs enhances operational efficiency, thereby increasing profit margins and financial flexibility. Firms that effectively manage avoidable costs can respond swiftly to market fluctuations, improving overall competitiveness and sustainability.

How Unavoidable Costs Affect Financial Planning

Unavoidable costs, such as rent and salaried employee wages, significantly impact financial planning by setting a baseline for minimum expenditure regardless of business activity. These fixed expenses limit the flexibility to reduce overall costs during downturns, requiring more precise budgeting and cash flow management. Effective financial planning must account for these continuous obligations to maintain operational stability and support long-term strategic goals.

Strategies to Reduce Avoidable Expenses

Implementing strategies such as streamlining operational processes, renegotiating supplier contracts, and adopting technology-driven solutions significantly reduces avoidable costs. Focusing on employee training to minimize errors and waste further decreases unnecessary expenditures. Regular expense audits help identify and eliminate redundant costs, optimizing overall budget efficiency.

Recognizing Common Unavoidable Cost Categories

Common unavoidable cost categories include rent, salaries of permanent staff, and insurance premiums, which persist regardless of production levels or business activity. These fixed expenses must be accounted for in budgeting and financial planning to ensure accurate cost management. Understanding these costs helps businesses differentiate from avoidable expenses that can be trimmed during downturns.

Decision-Making Based on Cost Classification

Avoidable costs are expenses that can be eliminated if a particular decision is made, playing a crucial role in cost-benefit analysis by highlighting potential savings. Unavoidable costs remain fixed regardless of the decision, thus requiring careful differentiation to prevent misallocation of resources. Effective decision-making hinges on accurately classifying costs, ensuring that only relevant expenses influence strategic choices for maximizing profitability and operational efficiency.

Case Studies: Managing Avoidable vs Unavoidable Costs

Case studies in managing avoidable versus unavoidable costs highlight the importance of precise cost classification in optimizing operational decisions. Firms that effectively identify avoidable costs, such as direct materials or variable labor, can make strategic choices to reduce expenses during downturns, while acknowledging unavoidable costs like fixed lease payments ensures accurate financial forecasting. This targeted cost management approach enhances profitability and supports sustainable budget control.

Important Terms

Sunk cost

Sunk costs are past expenses that cannot be recovered and should be excluded from decision-making, while avoidable costs can be eliminated if a decision is changed, in contrast to unavoidable costs which must be incurred regardless.

Incremental cost

Incremental cost represents the additional expense incurred when producing one more unit, directly aligning with avoidable costs, which can be eliminated if the activity ceases. In contrast, unavoidable costs persist regardless of production changes and do not impact incremental cost analysis for decision-making.

Differential cost

Differential cost represents the difference between avoidable costs, which can be eliminated by choosing one alternative over another, and unavoidable costs, which remain regardless of the decision made.

Opportunity cost

Opportunity cost represents the potential benefits lost when choosing one alternative over another, directly linked to avoidable costs, which can be eliminated if a decision is changed, whereas unavoidable costs persist regardless of the decision made. Understanding the distinction between avoidable and unavoidable costs is crucial for accurately assessing the true opportunity cost of business choices.

Controllable cost

Controllable costs are expenses that management can influence or change, distinctly different from avoidable costs which can be eliminated by ceasing an activity, and unavoidable costs that remain regardless of management decisions.

Committed cost

Committed costs represent fixed expenses that cannot be eliminated in the short term and differ from avoidable costs, which can be reduced or eliminated, while unavoidable costs remain regardless of business decisions.

Discretionary cost

Discretionary costs are expenses that can be adjusted or eliminated in the short term without significantly impacting business operations, contrasting with unavoidable costs that must be incurred regardless of decisions. These costs differ from avoidable costs, which are directly tied to specific activities and can be eliminated if those activities cease, whereas discretionary costs are often planned expenditures subject to managerial discretion.

Relevant cost

Relevant cost refers to the avoidable cost that will change due to a decision, while unavoidable cost remains constant regardless of the decision made.

Irrelevant cost

Irrelevant costs are expenses that do not affect decision-making because they remain constant regardless of the choice, distinguishing them from avoidable costs, which can be eliminated by not pursuing an option, and unavoidable costs, which persist regardless of the decision.

Marginal cost

Marginal cost represents the additional expense incurred from producing one more unit and aligns closely with avoidable costs, which can be eliminated when production stops, unlike unavoidable costs that persist regardless of output changes.

Avoidable cost vs Unavoidable cost Infographic

moneydif.com

moneydif.com