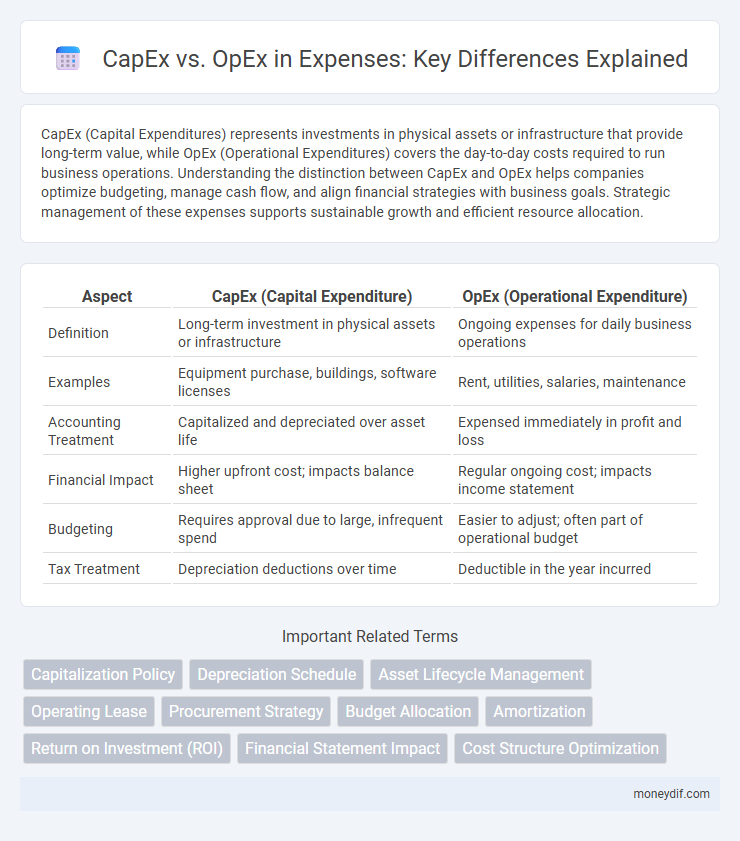

CapEx (Capital Expenditures) represents investments in physical assets or infrastructure that provide long-term value, while OpEx (Operational Expenditures) covers the day-to-day costs required to run business operations. Understanding the distinction between CapEx and OpEx helps companies optimize budgeting, manage cash flow, and align financial strategies with business goals. Strategic management of these expenses supports sustainable growth and efficient resource allocation.

Table of Comparison

| Aspect | CapEx (Capital Expenditure) | OpEx (Operational Expenditure) |

|---|---|---|

| Definition | Long-term investment in physical assets or infrastructure | Ongoing expenses for daily business operations |

| Examples | Equipment purchase, buildings, software licenses | Rent, utilities, salaries, maintenance |

| Accounting Treatment | Capitalized and depreciated over asset life | Expensed immediately in profit and loss |

| Financial Impact | Higher upfront cost; impacts balance sheet | Regular ongoing cost; impacts income statement |

| Budgeting | Requires approval due to large, infrequent spend | Easier to adjust; often part of operational budget |

| Tax Treatment | Depreciation deductions over time | Deductible in the year incurred |

Understanding CapEx and OpEx Basics

Capital Expenditure (CapEx) refers to funds used by a company to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment, essential for long-term business growth. Operating Expenditure (OpEx) covers the day-to-day expenses required to run a business, including rent, utilities, and salaries, directly impacting the profit and loss statement. Understanding the distinction between CapEx and OpEx is crucial for effective financial planning, tax treatment, and cash flow management.

Key Differences Between CapEx and OpEx

CapEx (Capital Expenditure) involves investments in physical assets like buildings, machinery, or technology infrastructure, resulting in long-term benefits and depreciation over time. OpEx (Operational Expenditure) covers day-to-day expenses such as salaries, rent, utilities, and maintenance, which are fully deductible in the fiscal year they occur. The key differences between CapEx and OpEx lie in their accounting treatment, tax implications, cash flow impact, and strategic planning requirements.

Financial Impact of CapEx vs OpEx

Capital Expenditures (CapEx) represent significant upfront investments in assets such as equipment or property, impacting cash flow immediately and appearing as long-term assets on the balance sheet with depreciation expenses spread over time. Operational Expenditures (OpEx) consist of ongoing costs for running daily business activities, directly affecting profit and loss statements and reducing taxable income in the period incurred. Understanding the financial impact of CapEx versus OpEx is crucial for budgeting, tax planning, and cash flow management, influencing decisions on asset acquisition and operational efficiency.

Accounting Treatment of CapEx and OpEx

CapEx (Capital Expenditures) is recorded as an asset on the balance sheet and depreciated over its useful life, reflecting long-term investment in physical or intangible assets. OpEx (Operational Expenditures) is expensed immediately on the income statement, reducing the period's net profit as these costs are associated with day-to-day business operations. The distinction in accounting treatment impacts financial metrics, cash flow analysis, and tax reporting.

Tax Implications: CapEx vs OpEx

CapEx expenses are capitalized and depreciated over time, reducing taxable income gradually through depreciation deductions, which can create long-term tax benefits. OpEx expenses are fully deductible in the year they occur, providing immediate tax relief and lowering taxable income for that fiscal period. Understanding these tax treatments helps businesses optimize cash flow and tax strategies by balancing immediate deductions with long-term depreciation advantages.

Budgeting Strategies for CapEx and OpEx

Effective budgeting strategies for CapEx prioritize long-term asset acquisition and depreciation schedules to maximize capital efficiency and support growth initiatives. OpEx budgeting focuses on controlling operational costs through regular expense tracking, optimizing resource allocation, and improving cash flow management. Balancing CapEx and OpEx budgets requires aligning expenditure with organizational goals, ensuring sustainable investment without compromising daily operational liquidity.

CapEx and OpEx in Business Decision-Making

CapEx (Capital Expenditure) and OpEx (Operational Expenditure) critically influence business decision-making by impacting cash flow and budgeting strategies. CapEx involves significant upfront investments in assets or infrastructure, affecting long-term growth and depreciation schedules, while OpEx represents ongoing costs necessary for daily operations, which can be adjusted more flexibly to align with revenue fluctuations. Understanding the balance between CapEx and OpEx enables businesses to optimize financial planning, enhance tax management, and maintain operational efficiency.

Benefits of Shifting from CapEx to OpEx

Shifting from CapEx to OpEx improves cash flow management by reducing upfront investments and spreading costs over time, enabling businesses to allocate capital more efficiently. This transition enhances financial flexibility and scalability, allowing companies to quickly adapt to market changes without the burden of long-term assets. Operational expenses often align better with actual usage, promoting cost transparency and simplifying budgeting processes.

CapEx vs OpEx in Cloud Computing

CapEx in cloud computing involves upfront investments in physical hardware and infrastructure, which require significant capital expenditure and long-term depreciation. OpEx, on the other hand, refers to ongoing operational expenses such as subscription fees and pay-as-you-go pricing models, offering flexibility and scalability without large initial costs. Organizations often prefer OpEx for cloud services because it enables better cash flow management and aligns expenses directly with usage.

Best Practices for Managing CapEx and OpEx

Effective CapEx and OpEx management involves thorough budgeting, regular financial reviews, and aligning expenses with strategic business goals to maximize ROI. Implementing robust tracking systems and leveraging forecasting tools enable accurate expense monitoring and timely adjustments. Prioritizing cost-control measures and investing in scalable technologies optimize cash flow and operational efficiency for sustained growth.

Important Terms

Capitalization Policy

Effective Capitalization Policy ensures that expenditures meeting predefined thresholds for long-term asset value are recorded as CapEx, while routine operational costs are classified as OpEx to optimize financial reporting and tax treatment.

Depreciation Schedule

A depreciation schedule allocates CapEx costs over time, converting capital expenditures into periodic OpEx expenses for accurate financial reporting and tax purposes.

Asset Lifecycle Management

Asset Lifecycle Management optimizes CapEx and OpEx by strategically planning acquisition, maintenance, and disposal to maximize return on investment and reduce operational costs.

Operating Lease

Operating leases classify expenses as OpEx, preserving CapEx by avoiding asset ownership and capital expenditure on the balance sheet.

Procurement Strategy

Effective procurement strategy balances CapEx and OpEx by prioritizing long-term asset investments and operational cost efficiencies to optimize financial performance.

Budget Allocation

Effective budget allocation requires balancing CapEx investments in long-term assets with OpEx expenditures for ongoing operational costs to optimize financial performance.

Amortization

Amortization allocates the capital expenditure (CapEx) of long-term assets over their useful life, converting large upfront costs into manageable operating expenses (OpEx) reflected on the income statement.

Return on Investment (ROI)

Return on Investment (ROI) improves when businesses strategically balance Capital Expenditures (CapEx) on long-term assets with Operating Expenditures (OpEx) on day-to-day expenses to optimize cash flow and asset utilization.

Financial Statement Impact

CapEx impacts financial statements by increasing asset value and depreciation expenses, while OpEx directly reduces net income through operating expenses on the income statement.

Cost Structure Optimization

Optimizing cost structure by balancing Capital Expenditures (CapEx) and Operating Expenditures (OpEx) enhances financial agility and long-term profitability.

CapEx vs OpEx Infographic

moneydif.com

moneydif.com