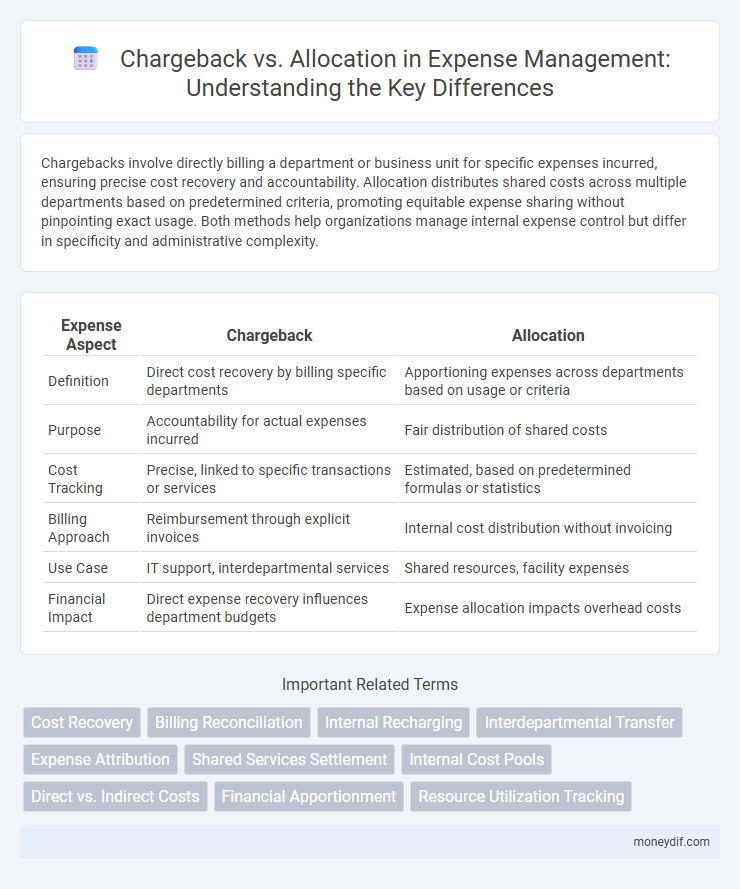

Chargebacks involve directly billing a department or business unit for specific expenses incurred, ensuring precise cost recovery and accountability. Allocation distributes shared costs across multiple departments based on predetermined criteria, promoting equitable expense sharing without pinpointing exact usage. Both methods help organizations manage internal expense control but differ in specificity and administrative complexity.

Table of Comparison

| Expense Aspect | Chargeback | Allocation |

|---|---|---|

| Definition | Direct cost recovery by billing specific departments | Apportioning expenses across departments based on usage or criteria |

| Purpose | Accountability for actual expenses incurred | Fair distribution of shared costs |

| Cost Tracking | Precise, linked to specific transactions or services | Estimated, based on predetermined formulas or statistics |

| Billing Approach | Reimbursement through explicit invoices | Internal cost distribution without invoicing |

| Use Case | IT support, interdepartmental services | Shared resources, facility expenses |

| Financial Impact | Direct expense recovery influences department budgets | Expense allocation impacts overhead costs |

Understanding Chargebacks and Allocations

Chargebacks involve reallocating expenses from one department to another to reflect actual usage, ensuring accurate financial reporting and cost accountability. Allocations distribute shared costs across departments based on predetermined criteria, promoting fair expense sharing and budget management. Understanding the distinction enables precise tracking of internal expense flows and supports effective cost control strategies.

Key Differences Between Chargebacks and Allocations

Chargebacks involve transferring specific expenses from one department to another to accurately reflect cost usage, while allocations distribute shared costs across multiple departments based on predetermined criteria. Chargebacks provide precise cost accountability for direct usage, whereas allocations support budget planning by spreading indirect expenses proportionally. Understanding these differences helps organizations optimize internal cost management and enhance financial transparency.

How Chargebacks Work in Expense Management

Chargebacks in expense management involve reallocating costs from one department or business unit to another based on resource usage or services rendered. This process ensures accurate financial tracking by directly attributing expenses to the responsible parties rather than distributing costs arbitrarily. Chargebacks improve budget accountability and transparency compared to simple allocation methods, which often spread expenses evenly without reflecting actual consumption.

Overview of Allocation Methods in Expense Tracking

Allocation methods in expense tracking involve systematically distributing costs across departments, projects, or cost centers based on predefined criteria such as usage, headcount, or revenue contribution. This contrasts with chargebacks, which directly bill one business unit for expenses incurred by another, often leading to interdepartmental cost recovery. Effective allocation ensures more accurate financial reporting and resource management by reflecting the true consumption of shared services and resources.

Benefits of Using Chargebacks for Expenses

Chargebacks provide precise cost tracking by directly attributing expenses to the responsible department or project, enhancing financial accountability and budget accuracy. This method facilitates real-time expense visibility, enabling organizations to identify cost drivers and optimize resource allocation efficiently. Using chargebacks reduces interdepartmental disputes over costs and encourages responsible spending behaviors, driving overall financial discipline.

Advantages of Allocation in Cost Distribution

Allocation in cost distribution enhances financial accuracy by assigning expenses directly to specific departments or projects, promoting transparent budget tracking. It optimizes resource management by ensuring expenditures reflect actual usage, facilitating detailed financial analysis. This targeted approach reduces the risk of disputes common with chargebacks, streamlining accounting processes and improving organizational efficiency.

Common Challenges with Chargebacks vs Allocations

Chargebacks often face common challenges such as complex reconciliation processes, delayed payments, and disputes over expense accuracy, which can strain vendor relationships and accounting teams. Allocations, while simplifying cost distribution across departments, frequently encounter difficulties in maintaining precise data inputs and ensuring equitable expense apportionment. Both methods require robust financial controls and transparency to mitigate errors and improve overall expense management efficiency.

Best Practices for Implementing Chargebacks and Allocations

Establish clear guidelines that define eligible expenses for chargebacks and allocations to ensure transparency and accuracy in cost distribution. Utilize automated tracking and reporting tools to monitor expense flows and reconcile charges promptly, reducing errors and disputes. Regularly review allocation bases and chargeback policies to align with organizational changes and promote fairness among departments.

Selecting the Right Approach: Chargeback or Allocation?

Selecting the right approach for managing expenses involves understanding the key differences between chargeback and allocation methods. Chargebacks provide direct accountability by billing individual departments for their actual usage, promoting cost transparency and responsible consumption. Allocation, on the other hand, distributes shared expenses based on predetermined metrics, simplifying budgeting while potentially diluting precise cost visibility across units.

Impact on Financial Reporting and Budget Planning

Chargebacks ensure accurate cost tracking by directly attributing expenses to specific departments or projects, enhancing the precision of financial reporting and facilitating detailed budget planning. Allocations distribute shared costs based on predetermined criteria, which can simplify expense management but may reduce transparency and accuracy in reporting. This distinction affects how organizations assess departmental spending and forecast budgets, influencing financial decision-making and resource optimization.

Important Terms

Cost Recovery

Cost recovery involves recouping expenses incurred by a department or project, using chargeback systems that bill actual usage to consumers, creating direct financial accountability. Allocation methods distribute costs based on predetermined metrics or formulas, ensuring equitable sharing without individual chargebacks, facilitating budget planning and internal cost transparency.

Billing Reconciliation

Billing reconciliation involves comparing chargeback and allocation data to ensure accurate cost distribution across departments. Chargeback assigns direct expenses to specific users or units based on actual usage, while allocation distributes costs proportionally according to predefined criteria, enabling precise financial accountability in internal billing processes.

Internal Recharging

Internal recharging involves reallocating costs within an organization to accurately reflect resource consumption by different departments or projects, enhancing budget transparency and accountability. Unlike chargebacks that directly invoice departments for services used, internal recharging adjusts internal ledgers without the formal billing process, streamlining financial management and reducing administrative overhead.

Interdepartmental Transfer

Interdepartmental transfer involves reallocating costs or resources between departments, where chargeback refers to directly billing the receiving department for actual expenses incurred, enhancing accountability and cost transparency. In contrast, allocation distributes costs based on predetermined criteria or usage estimates, promoting equitable expense sharing without direct billing between departments.

Expense Attribution

Expense attribution distinguishes chargeback, where costs are directly billed to the responsible department for precise accountability, from allocation, which distributes expenses proportionally based on predefined criteria to reflect shared resource usage. Accurate expense attribution enhances financial transparency and supports strategic budgeting and cost management across organizational units.

Shared Services Settlement

Shared Services Settlement involves allocating costs internally to reflect resource usage accurately, typically through chargeback or allocation methods. Chargeback assigns expenses directly to departments based on actual consumption, ensuring precise accountability, while allocation distributes costs using predetermined metrics, facilitating budget planning and cost control.

Internal Cost Pools

Internal cost pools aggregate expenses within an organization to facilitate accurate chargeback and allocation processes. Chargeback directly assigns costs to specific departments based on actual resource consumption, while allocation distributes costs using predetermined metrics, ensuring financial transparency and accountability.

Direct vs. Indirect Costs

Direct costs, such as raw materials and labor, are easily traceable to specific projects or departments and are typically recovered through chargebacks, ensuring precise cost accountability. Indirect costs, including utilities and administrative expenses, are distributed across departments using allocation methods to fairly share overhead expenses among various organizational units.

Financial Apportionment

Financial apportionment involves distributing costs or revenues among multiple departments or projects based on predefined criteria, with chargebacks directly billing specific units for actual resource usage, while allocations assign shared expenses proportionally without direct billing. Chargebacks enhance accountability by linking expenses to consumption, whereas allocations simplify budgeting by spreading costs according to general formulas like headcount or revenue percentages.

Resource Utilization Tracking

Resource utilization tracking enables organizations to monitor actual consumption of IT resources, providing precise data for chargeback models where costs are billed based on usage. Allocation methods distribute resources or budgets according to predefined criteria, but tracking utilization ensures accurate alignment of costs with the true demand and efficiency of resource usage.

chargeback vs allocation Infographic

moneydif.com

moneydif.com