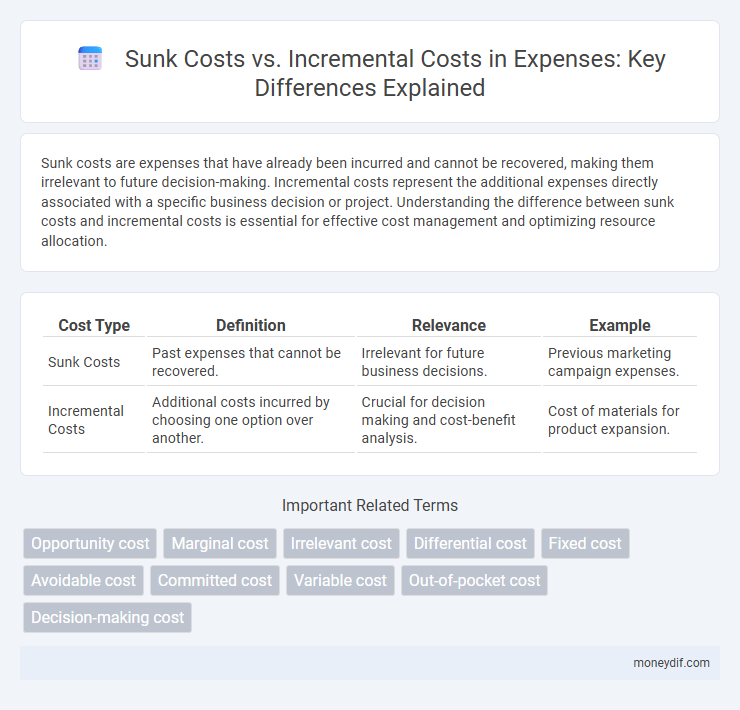

Sunk costs are expenses that have already been incurred and cannot be recovered, making them irrelevant to future decision-making. Incremental costs represent the additional expenses directly associated with a specific business decision or project. Understanding the difference between sunk costs and incremental costs is essential for effective cost management and optimizing resource allocation.

Table of Comparison

| Cost Type | Definition | Relevance | Example |

|---|---|---|---|

| Sunk Costs | Past expenses that cannot be recovered. | Irrelevant for future business decisions. | Previous marketing campaign expenses. |

| Incremental Costs | Additional costs incurred by choosing one option over another. | Crucial for decision making and cost-benefit analysis. | Cost of materials for product expansion. |

Defining Sunk Costs in Business

Sunk costs in business represent expenses that have already been incurred and cannot be recovered, such as past investments in equipment or marketing campaigns. These costs should not influence future business decisions because they remain constant regardless of the outcome of new projects. Understanding sunk costs helps businesses avoid irrational decision-making by focusing only on incremental costs and benefits relevant to upcoming choices.

Understanding Incremental Costs

Incremental costs represent the additional expenses incurred when choosing one option over another, directly impacting decision-making in business scenarios. Unlike sunk costs, which are past expenses that cannot be recovered, incremental costs are future-oriented and relevant for evaluating project feasibility or operational changes. Accurate assessment of incremental costs ensures resource allocation aligns with potential benefits and avoids inefficient spending.

Key Differences Between Sunk and Incremental Costs

Sunk costs represent past expenditures that cannot be recovered and should not influence future business decisions, whereas incremental costs are the additional expenses directly associated with a specific decision or project. Unlike sunk costs, incremental costs vary with the level of activity and are crucial for cost-benefit analysis in decision-making processes. Understanding the distinction ensures accurate financial evaluation, preventing misallocation of resources and optimizing profitability.

Examples of Sunk Costs in Real-World Scenarios

Sunk costs refer to expenses that have already been incurred and cannot be recovered, such as money spent on non-refundable marketing campaigns or obsolete machinery. For instance, a company investing $50,000 in research and development that yields no viable product must consider this amount a sunk cost. Recognizing sunk costs helps businesses avoid irrational decision-making by focusing solely on incremental costs, which are the additional expenses incurred from a new business choice or project expansion.

Illustrations of Incremental Costs in Decision Making

Incremental costs represent the additional expenses incurred when choosing one option over another, such as the extra cost of producing 100 more units of a product. In decision making, incremental cost analysis helps businesses evaluate the profitability of new projects by comparing only the relevant changes in expenses, excluding sunk costs which are past and unrecoverable. For example, a company deciding whether to accept a special order will focus on the incremental costs like materials and labor that vary with the order, rather than fixed overheads already incurred.

Why Sunk Costs Should Not Influence Future Decisions

Sunk costs represent past expenditures that cannot be recovered and should be excluded from future decision-making processes to avoid irrational financial commitments. Incremental costs, on the other hand, are the additional expenses directly associated with a decision, providing relevant data for evaluating future options. Focusing on incremental costs ensures resources are allocated efficiently, maximizing profitability and minimizing unnecessary losses.

Role of Incremental Costs in Financial Planning

Incremental costs play a critical role in financial planning by representing the additional expenses directly associated with a specific business decision. These costs help managers evaluate the financial impact of new projects or changes by comparing the incremental outflows against potential incremental revenues. Unlike sunk costs, which are past expenditures and irrelevant to future decisions, incremental costs provide actionable data for budgeting, forecasting, and optimizing resource allocation.

Common Mistakes Businesses Make with Sunk Costs

Many businesses mistakenly treat sunk costs, such as past marketing expenditures or obsolete equipment investments, as relevant to current decision-making, leading to inefficient resource allocation. Ignoring incremental costs, like the additional expenses of producing one more unit, causes misjudgment in pricing and project evaluation. Properly distinguishing sunk costs from incremental costs ensures more rational financial decisions and improved profitability.

Strategies to Minimize Incremental Costs

Minimizing incremental costs involves carefully evaluating variable expenses directly associated with specific business decisions while disregarding sunk costs that cannot be recovered. Strategies include negotiating better supplier contracts, improving operational efficiency, and implementing cost-control measures tailored to incremental changes in production or service levels. Focusing on incremental costs ensures more accurate budgeting and decision-making that enhances profitability and resource allocation.

The Impact of Sunk and Incremental Costs on Profitability

Sunk costs, which are past expenses that cannot be recovered, should not influence current profitability decisions since they do not affect future cash flows. Incremental costs represent additional expenses incurred from a specific business decision directly impacting net profit margins and overall financial performance. Focusing on incremental costs allows for more accurate profitability analysis by highlighting differences in cost and revenue relevant to decision-making.

Important Terms

Opportunity cost

Opportunity cost measures the potential benefit lost when choosing an alternative, emphasizing that sunk costs are irrecoverable past expenses, while incremental costs represent the additional expenses incurred from a specific decision.

Marginal cost

Marginal cost focuses on the expense of producing one additional unit, excluding sunk costs which are irrecoverable past expenses and do not affect future decisions. Incremental costs represent the additional expenses incurred from a decision or change, aligning closely with marginal costs but often encompassing broader project or operational changes beyond a single unit.

Irrelevant cost

Irrelevant costs include sunk costs, which are past expenses that cannot be recovered, unlike incremental costs that represent additional expenses directly associated with a decision.

Differential cost

Differential cost represents the difference in total cost between two alternatives and excludes sunk costs, which are past and unrecoverable, while focusing on incremental costs that directly impact future decision-making.

Fixed cost

Fixed costs, such as rent and salaries, remain constant regardless of production levels and often include sunk costs like initial investments that cannot be recovered. Incremental costs, which vary directly with production volume, exclude sunk costs and focus on the additional expenses incurred when increasing output.

Avoidable cost

Avoidable costs refer to expenses that can be eliminated by choosing one alternative over another, contrasting with sunk costs which are past expenses irrecoverable and irrelevant to future decisions, while incremental costs specifically represent the additional costs incurred from selecting a particular option.

Committed cost

Committed costs, which are unavoidable fixed expenses due to past decisions, differ from sunk costs that cannot be recovered and incremental costs that represent additional expenses incurred by specific business choices.

Variable cost

Variable costs fluctuate directly with production volume, reflecting expenses like raw materials and labor that increase as output rises. Unlike sunk costs, which are irrecoverable past expenditures, variable costs are analyzed alongside incremental costs to evaluate the financial impact of producing one additional unit.

Out-of-pocket cost

Out-of-pocket costs refer to actual cash expenses incurred in a decision, distinguishing them from sunk costs which are past and irrecoverable, while incremental costs represent the additional expenses directly resulting from a specific choice.

Decision-making cost

Decision-making cost analysis emphasizes ignoring sunk costs and focusing on incremental costs to optimize resource allocation and improve financial outcomes.

Sunk costs vs Incremental costs Infographic

moneydif.com

moneydif.com