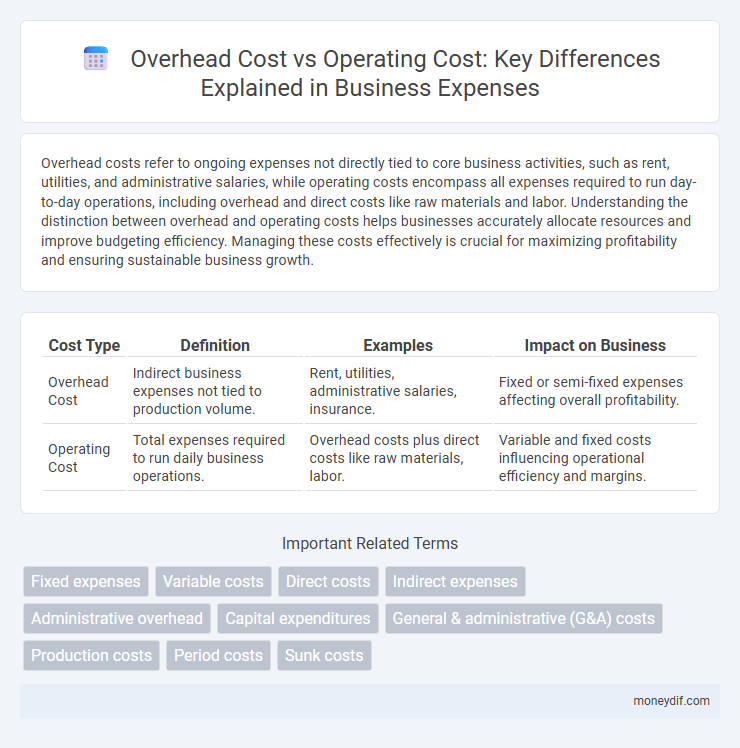

Overhead costs refer to ongoing expenses not directly tied to core business activities, such as rent, utilities, and administrative salaries, while operating costs encompass all expenses required to run day-to-day operations, including overhead and direct costs like raw materials and labor. Understanding the distinction between overhead and operating costs helps businesses accurately allocate resources and improve budgeting efficiency. Managing these costs effectively is crucial for maximizing profitability and ensuring sustainable business growth.

Table of Comparison

| Cost Type | Definition | Examples | Impact on Business |

|---|---|---|---|

| Overhead Cost | Indirect business expenses not tied to production volume. | Rent, utilities, administrative salaries, insurance. | Fixed or semi-fixed expenses affecting overall profitability. |

| Operating Cost | Total expenses required to run daily business operations. | Overhead costs plus direct costs like raw materials, labor. | Variable and fixed costs influencing operational efficiency and margins. |

Understanding Overhead Costs

Overhead costs refer to ongoing business expenses not directly tied to product creation or service delivery, including rent, utilities, and administrative salaries. These costs are crucial for maintaining daily operations but do not fluctuate with production volume, unlike operating costs that encompass both fixed overhead and variable expenses. Understanding overhead costs helps businesses allocate resources efficiently, control expenses, and improve profitability by distinguishing between essential fixed costs and operational expenditures.

Defining Operating Costs

Operating costs refer to the ongoing expenses required for the day-to-day functioning of a business, including costs such as wages, raw materials, and utility bills. Overhead costs are a subset of operating costs that cover indirect expenses like rent, administrative salaries, and depreciation. Accurate identification and management of operating costs are essential for budgeting, pricing strategies, and profitability analysis.

Key Differences Between Overhead and Operating Costs

Overhead costs refer to ongoing business expenses not directly tied to production or service delivery, such as rent, utilities, and administrative salaries, while operating costs encompass both overhead and direct costs like raw materials and labor. Operating costs measure the total expenses required to run daily business operations, including cost of goods sold (COGS), which overhead costs exclude. Understanding the distinction aids in accurate financial analysis, budgeting, and pricing strategies by isolating indirect expenses from total operational expenditure.

Components of Overhead Costs

Overhead costs consist primarily of indirect expenses such as rent, utilities, depreciation, and administrative salaries that support overall business operations but are not directly tied to production. These costs differ from operating costs, which include direct expenses like raw materials and labor directly involved in manufacturing goods or delivering services. Properly categorizing overhead costs is crucial for accurate budgeting, cost control, and pricing strategies.

Types of Operating Costs

Operating costs include variable costs such as raw materials, direct labor, and utility expenses directly tied to production levels, as well as fixed costs like rent, salaries, and equipment depreciation that remain constant regardless of output. Overhead costs, a subset of operating costs, specifically cover indirect expenses like administrative salaries, office supplies, and facility maintenance that support overall business operations but are not directly linked to product manufacturing. Understanding the distinction between direct operating costs and overhead helps businesses manage budgets and improve cost efficiency effectively.

Impact of Overhead on Business Profitability

Overhead costs, including rent, utilities, and administrative expenses, directly reduce net profit margins by increasing the fixed expenses that a business must cover regardless of sales volume. Operating costs encompass both overhead and variable costs like raw materials and labor, but overhead's impact remains critical in determining overall profitability due to its inflexibility in short-term adjustments. Efficient management of overhead expenses enhances business profitability by lowering break-even points and increasing operational leverage.

Managing and Reducing Overhead Expenses

Overhead costs include fixed expenses like rent, utilities, and administrative salaries, essential for maintaining daily operations but not directly tied to product production. Operating costs encompass both overhead and variable costs such as raw materials and direct labor, representing the total expenses needed to run the business. Effective management and reduction of overhead expenses can be achieved through energy-efficient solutions, renegotiating supplier contracts, and automating administrative tasks to enhance profitability and operational efficiency.

Role of Operating Costs in Daily Business Functions

Operating costs encompass the day-to-day expenses essential for running a business, including wages, utilities, and raw materials, directly impacting cash flow and operational efficiency. Unlike overhead costs, which are fixed and indirect, operating costs vary with production levels, influencing pricing strategies and profit margins. Effective management of operating costs ensures sustained business operations and supports scalable growth in a competitive market.

Overhead vs. Operating Costs: Examples

Overhead costs include expenses such as rent, utilities, and administrative salaries that are not directly tied to production, while operating costs encompass all expenses required to run the core business activities, including raw materials, direct labor, and production supplies. For example, factory electricity bills and maintenance fees are overhead costs, whereas wages for assembly line workers and costs of raw materials are operating costs. Understanding the distinction helps businesses allocate expenses accurately for budgeting and financial analysis.

Strategies for Balancing Overhead and Operating Costs

Effective strategies for balancing overhead and operating costs involve detailed cost analysis and prioritizing expense categories to maximize profitability. Implementing budgeting software and regularly reviewing expenditure patterns helps identify inefficiencies in overhead costs such as rent and utilities while controlling variable operating costs like wages and raw materials. Leveraging automation and outsourcing non-core functions can reduce overhead expenses without compromising operational effectiveness.

Important Terms

Fixed expenses

Fixed expenses such as rent, salaries, and insurance are key components of overhead costs that remain constant regardless of production levels. Operating costs encompass both fixed and variable expenses, including overhead costs and direct costs like materials and labor used in day-to-day business operations.

Variable costs

Variable costs fluctuate directly with production volume and are a key component of operating costs, which encompass expenses necessary for daily business operations. Overhead costs, often fixed or semi-variable, include indirect expenses like rent and utilities, differing from variable operating costs tied directly to production activities.

Direct costs

Direct costs are expenses directly attributable to production, such as raw materials and labor, and are excluded from overhead costs which cover indirect expenses like utilities, rent, and administrative salaries. Operating costs encompass both direct costs and overhead costs, representing the total expenses required to run daily business operations efficiently.

Indirect expenses

Indirect expenses, often categorized as overhead costs, include expenses such as rent, utilities, and administrative salaries that are not directly tied to production but are necessary for overall business operations. These overhead costs differ from operating costs, which encompass all expenses related to the core business activities, including both direct and indirect costs essential for running daily operations.

Administrative overhead

Administrative overhead comprises indirect expenses such as management salaries, office supplies, and administrative support costs, distinguishing it from direct operating costs like production labor and raw materials. Understanding the difference between overhead cost and operating cost is crucial for accurate budgeting and financial analysis, as operating costs include both overhead expenses and direct costs essential for core business operations.

Capital expenditures

Capital expenditures (CapEx) refer to funds used to acquire or upgrade physical assets, impacting both overhead and operating costs by increasing depreciation and maintenance expenses within overhead costs, while reducing certain operating costs through improved efficiency. Overhead costs include ongoing expenses such as rent, utilities, and administrative salaries, whereas operating costs cover day-to-day expenses directly tied to production, making CapEx a strategic investment to balance and optimize long-term cost structures.

General & administrative (G&A) costs

General & administrative (G&A) costs represent overhead expenses including salaries, office rent, and utilities that are not directly tied to production but essential for overall business operations. These costs differ from operating costs, which encompass expenses directly related to core business activities such as manufacturing, marketing, and sales.

Production costs

Production costs encompass overhead costs, which include indirect expenses like rent, utilities, and administrative salaries, while operating costs cover all expenses required to run daily production activities, including both direct costs such as raw materials and indirect costs like maintenance and depreciation. Managing the balance between overhead and operating costs is crucial for optimizing manufacturing efficiency and improving overall profitability.

Period costs

Period costs primarily include overhead costs such as administrative expenses, rent, and utilities that are not directly tied to production but are essential for overall business operations. Operating costs encompass both period costs and direct costs like raw materials and labor, reflecting the total expenses required to run the company's core business activities.

Sunk costs

Sunk costs refer to expenses already incurred and not recoverable, often embedded within overhead costs such as rent or administrative salaries, which remain constant regardless of production levels. Operating costs, unlike sunk costs, include variable expenses directly tied to production and can be adjusted or eliminated, making them critical for short-term financial decisions and cost management.

Overhead cost vs Operating cost Infographic

moneydif.com

moneydif.com