Imputed cost represents the opportunity expenses of using resources owned by the business, reflecting potential income forgone, while explicit cost involves direct monetary payments for resources and services. Understanding the distinction between imputed and explicit costs is essential for accurate financial analysis and decision-making. Evaluating both costs helps businesses gauge true economic profitability beyond just accounting expenses.

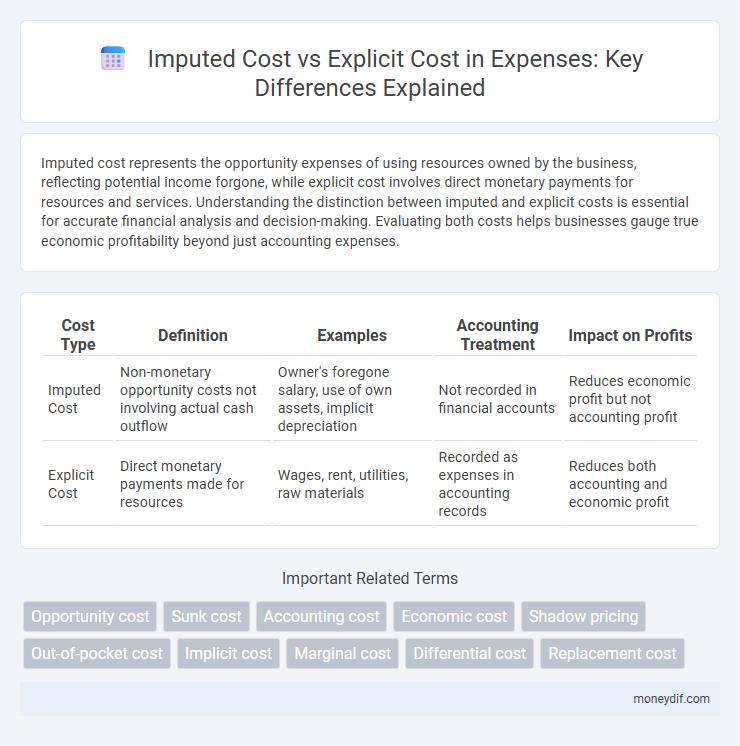

Table of Comparison

| Cost Type | Definition | Examples | Accounting Treatment | Impact on Profits |

|---|---|---|---|---|

| Imputed Cost | Non-monetary opportunity costs not involving actual cash outflow | Owner's foregone salary, use of own assets, implicit depreciation | Not recorded in financial accounts | Reduces economic profit but not accounting profit |

| Explicit Cost | Direct monetary payments made for resources | Wages, rent, utilities, raw materials | Recorded as expenses in accounting records | Reduces both accounting and economic profit |

Understanding Imputed Cost and Explicit Cost

Imputed cost represents the opportunity cost of using resources already owned by a business without direct monetary payment, such as the owner's time or capital invested. Explicit cost involves actual outlays of cash or payments made to external parties for goods, services, wages, and rent. Understanding the distinction helps businesses evaluate true economic profit by accounting for both explicit expenses and the hidden costs reflected in imputed expenses.

Key Definitions: Imputed Cost vs Explicit Cost

Imputed cost refers to the opportunity cost of using resources that do not involve direct cash payments, such as the owner's time or the use of owned assets. Explicit cost involves actual monetary payments made for expenses like wages, rent, and materials, clearly recorded in accounting records. Understanding the distinction between imputed and explicit costs is essential for accurate financial analysis and decision-making.

Core Differences Between Imputed and Explicit Costs

Imputed costs represent the opportunity costs of using resources owned by the business, such as owner's time or capital, that do not involve direct monetary payment. Explicit costs are actual out-of-pocket expenses like wages, rent, and materials recorded in accounting records. The core difference lies in explicit costs being tangible and recorded transactions, whereas imputed costs are intangible, reflecting potential earnings foregone, essential for comprehensive economic decision-making.

Real-World Examples of Imputed Costs

Imputed costs represent the opportunity costs of resources owned by a business, such as the owner's time or use of personal equipment, which do not involve direct monetary payment but affect economic decision-making. A real-world example includes the salary foregone by a business owner who works without drawing a wage, representing imputed labor costs that influence profit calculations. Another example is the rental income lost when an entrepreneur uses their own property for business operations instead of leasing it out, highlighting hidden expenses crucial for accurate financial assessments.

Real-World Examples of Explicit Costs

Explicit costs involve direct monetary payments such as wages, rent, and materials, clearly reflected in accounting records and business budgets. For example, a manufacturing firm pays explicit costs like $50,000 monthly for raw materials and $20,000 for employee salaries, which are straightforward expenses deducted from revenue. These explicit costs contrast with imputed costs, which represent opportunity costs not involving actual cash transactions, underscoring the tangible financial outlays businesses face in daily operations.

Significance of Imputed Costs in Decision-Making

Imputed costs represent the opportunity costs of resources owned by a firm, reflecting the value of benefits foregone when these resources are utilized internally rather than rented or sold. These costs are crucial in decision-making as they provide a more comprehensive view of true economic costs beyond explicit monetary payments, enabling businesses to evaluate the profitability of different projects accurately. By accounting for imputed costs, managers can make informed choices that optimize resource allocation and long-term financial performance.

How Explicit Costs Influence Financial Statements

Explicit costs directly affect financial statements by appearing as actual cash outflows, such as payments for wages, rent, and materials, which reduce net income on the income statement. These expenses are recorded as liabilities or reductions in assets on the balance sheet, providing a clear picture of a company's operational costs. Accurate reporting of explicit costs ensures transparency in financial performance and aids stakeholders in assessing profitability and cash flow management.

Imputed vs Explicit Costs in Cost Accounting

Imputed costs represent the opportunity costs of using resources owned by the firm that do not involve direct monetary payment, while explicit costs are actual outlays of cash for expenses like wages, rent, and materials. In cost accounting, distinguishing between imputed and explicit costs is essential for accurate product costing and profitability analysis because explicit costs reflect tangible expenditures, and imputed costs capture the value of foregone alternatives. Understanding both cost types enables better decision-making by incorporating the true economic cost of resource utilization beyond just cash transactions.

Pros and Cons of Focusing on Imputed or Explicit Costs

Focusing on explicit costs provides clear, quantifiable expenses like wages, rent, and materials, ensuring precise financial statements and tax calculations but may overlook opportunity costs. Emphasizing imputed costs incorporates the value of foregone alternatives such as owner's time or capital, offering a comprehensive economic perspective but introduces estimation challenges and potential subjectivity. Balancing both cost types enhances decision-making by blending concrete data with implicit economic insights, enabling businesses to optimize resource allocation and long-term profitability.

Practical Applications: Choosing Between Imputed and Explicit Costs

Businesses often analyze explicit costs, such as wages and materials, for straightforward financial accounting and tax reporting, while imputed costs, like foregone rent or owner's time, are crucial for internal decision-making and opportunity cost evaluation. Selecting between imputed and explicit costs depends on the context--explicit costs are essential for calculating actual cash outflows, whereas imputed costs provide a deeper understanding of potential alternatives and long-term profitability. Effective budgeting and resource allocation require integrating both cost types to capture true economic costs and optimize operational efficiency.

Important Terms

Opportunity cost

Opportunity cost represents the total value of the next best alternative foregone, incorporating both imputed costs, which are the implicit non-monetary expenses, and explicit costs, which are actual out-of-pocket expenditures.

Sunk cost

Sunk costs represent past expenditures that cannot be recovered and differ from explicit costs, which are actual out-of-pocket payments, and imputed costs, which reflect opportunity costs without monetary transactions.

Accounting cost

Accounting costs include explicit costs, which involve direct monetary payments, while imputed costs represent the estimated value of foregone opportunities without actual cash outflow.

Economic cost

Economic cost encompasses both explicit costs, which refer to direct monetary payments such as wages, rent, and materials, and imputed costs, representing the opportunity costs of using resources owned by the firm, such as the owner's time or capital. Understanding the distinction between imputed cost and explicit cost is crucial for accurate profit measurement and informed business decision-making.

Shadow pricing

Shadow pricing evaluates imputed costs by assigning monetary values to non-market resources, contrasting with explicit costs that represent direct monetary payments in economic analysis.

Out-of-pocket cost

Out-of-pocket cost refers to explicit costs involving direct monetary payments, while imputed cost represents implicit, non-monetary opportunity costs not reflected in actual cash outflows.

Implicit cost

Implicit cost, also known as imputed cost, represents the opportunity cost of using owned resources, whereas explicit cost involves direct out-of-pocket expenses paid to others.

Marginal cost

Marginal cost represents the additional expense incurred from producing one more unit and includes explicit costs like raw materials and labor, while imputed costs reflect opportunity costs such as foregone alternatives. Understanding the distinction between explicit and imputed costs is essential for accurately calculating marginal cost in economic decision-making.

Differential cost

Differential cost measures the change in total cost between alternatives, explicitly accounting for explicit costs while excluding imputed costs, which represent non-cash opportunity expenses.

Replacement cost

Replacement cost reflects the imputed cost of substituting an asset, focusing on opportunity cost rather than the explicit cost recorded on financial statements.

Imputed cost vs Explicit cost Infographic

moneydif.com

moneydif.com