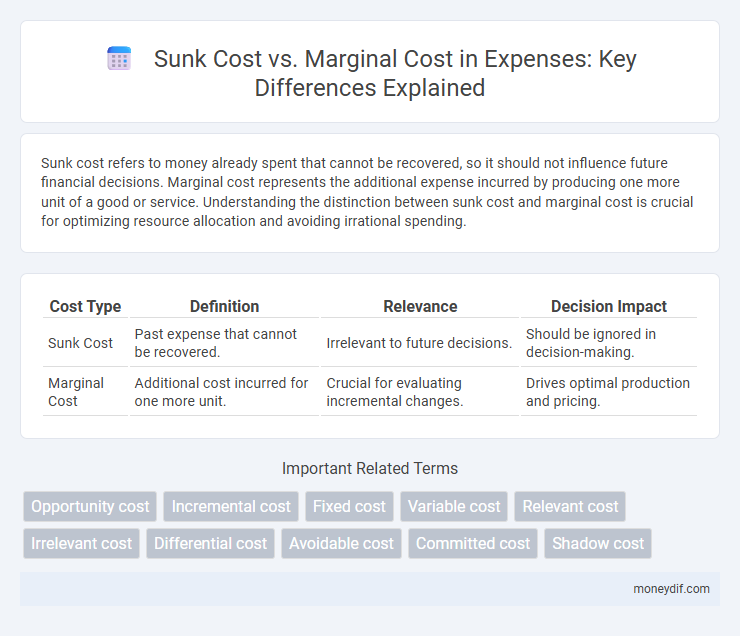

Sunk cost refers to money already spent that cannot be recovered, so it should not influence future financial decisions. Marginal cost represents the additional expense incurred by producing one more unit of a good or service. Understanding the distinction between sunk cost and marginal cost is crucial for optimizing resource allocation and avoiding irrational spending.

Table of Comparison

| Cost Type | Definition | Relevance | Decision Impact |

|---|---|---|---|

| Sunk Cost | Past expense that cannot be recovered. | Irrelevant to future decisions. | Should be ignored in decision-making. |

| Marginal Cost | Additional cost incurred for one more unit. | Crucial for evaluating incremental changes. | Drives optimal production and pricing. |

Understanding Sunk Cost and Marginal Cost

Sunk cost refers to expenses that have already been incurred and cannot be recovered, making them irrelevant for future decision-making. Marginal cost represents the additional expense incurred by producing one more unit of a good or service, crucial for optimizing production levels. Understanding the distinction helps businesses avoid the fallacy of considering past costs while focusing on incremental costs to enhance profitability.

Key Differences Between Sunk Cost and Marginal Cost

Sunk cost refers to expenses already incurred and irrecoverable, while marginal cost represents the additional expense of producing one more unit of a good or service. Sunk costs are irrelevant to future decision-making as they cannot be changed, whereas marginal costs directly influence choices about resource allocation and production levels. Understanding this distinction is crucial for businesses to avoid the sunk cost fallacy and optimize operational efficiency.

The Role of Sunk Costs in Business Decisions

Sunk costs represent past expenditures that cannot be recovered and should not influence current business decisions. Marginal cost, the expense of producing one additional unit, is more relevant for optimizing resource allocation and pricing strategies. Ignoring sunk costs helps firms focus on incremental costs and benefits, leading to more economically sound decisions.

Marginal Cost and Its Impact on Production Choices

Marginal cost represents the additional expense incurred from producing one more unit of a good or service, directly influencing production decisions by determining the optimal output level where profit is maximized. Understanding marginal cost allows firms to avoid inefficient expenditure, as it highlights the incremental impact on total costs rather than sunk costs, which are irrecoverable past expenses. Businesses prioritize marginal cost analysis to ensure resources are allocated efficiently, leading to improved cost management and competitive pricing strategies.

Why Sunk Costs Should Not Influence Future Decisions

Sunk costs represent past expenses that cannot be recovered, making them irrelevant to future decision-making since they do not affect potential outcomes or incremental benefits. Marginal cost, which refers to the additional expense of producing one more unit, should be the primary focus when evaluating future actions for efficient resource allocation. Ignoring sunk costs prevents bias, allowing businesses to optimize profitability by basing decisions on current and future cost-benefit analysis rather than irretrievable losses.

Marginal Cost: Guiding Efficient Resource Allocation

Marginal cost represents the expense incurred by producing one additional unit of a good or service, serving as a critical metric for guiding efficient resource allocation. Unlike sunk costs, which are past expenses that cannot be recovered, marginal cost directly influences decisions on scaling production or adjusting output levels. Accurate assessment of marginal cost ensures businesses optimize operational efficiency and maximize profit margins by focusing only on future, controllable expenses.

Real-World Examples of Sunk Costs

Sunk costs, such as non-refundable deposits on event venues or research and development expenses that cannot be recovered, influence financial decisions differently than marginal costs, which represent the additional expense of producing one more unit. For example, a company that invested heavily in outdated machinery faces sunk costs that do not affect the marginal cost of manufacturing extra products using newer equipment. Ignoring sunk costs helps businesses avoid irrational commitment to failing projects and focus on incremental costs that directly impact profitability.

Marginal Cost Analysis in Pricing Strategies

Marginal cost analysis plays a crucial role in pricing strategies by determining the cost incurred for producing one additional unit of a product or service, enabling firms to set prices that maximize profitability without considering sunk costs. Unlike sunk costs, which are historical and irrelevant to current decision-making, marginal cost helps businesses evaluate the impact of production changes on overall expenses and revenue. Effective pricing strategies leverage marginal cost to optimize output levels, respond to market demand, and enhance competitive positioning.

Avoiding the Sunk Cost Fallacy

Sunk cost refers to expenses already incurred and unrecoverable, while marginal cost involves the additional expense of producing one more unit. Avoiding the sunk cost fallacy requires focusing decision-making on future costs and benefits instead of past investments. Effective expense management hinges on prioritizing marginal cost analysis to optimize resource allocation and avoid irrational financial commitments.

Integrating Sunk Cost and Marginal Cost in Financial Planning

Integrating sunk cost and marginal cost in financial planning enhances decision-making by distinguishing past irrecoverable expenses from incremental costs affecting future operations. Recognizing sunk costs prevents irrational commitments, while analyzing marginal costs ensures efficient resource allocation for each additional unit produced. This approach optimizes budgeting and investment strategies by focusing on relevant, forward-looking financial data.

Important Terms

Opportunity cost

Opportunity cost represents the potential benefits lost when choosing one alternative over another, emphasizing decisions based on marginal cost rather than sunk cost. Ignoring sunk costs, which are past expenditures that cannot be recovered, enables better evaluation of future marginal costs to optimize resource allocation and maximize economic value.

Incremental cost

Incremental cost refers to the additional expense incurred by producing one more unit of output, distinct from sunk costs which are past expenses that cannot be recovered and should not influence current decisions. Unlike marginal cost, which measures the cost of producing a single additional unit, incremental cost can encompass multiple units and strategic considerations in decision-making.

Fixed cost

Fixed costs remain constant regardless of production volume and include expenses like rent and salaries, which are not recoverable once incurred, categorizing them as sunk costs. Marginal cost, in contrast, measures the incremental expense of producing one additional unit and excludes fixed or sunk costs from its calculation.

Variable cost

Variable cost fluctuates directly with production volume, distinguishing it from sunk costs, which are irrecoverable past expenses unaffected by current output decisions. Marginal cost, representing the expense to produce one additional unit, aligns closely with variable cost changes since fixed sunk costs do not influence marginal cost calculations.

Relevant cost

Relevant cost refers to the future expenses directly influenced by a specific business decision, excluding sunk costs, which are past expenditures that remain unaffected by current choices. Marginal cost, the additional cost of producing one more unit, is a key relevant cost metric guiding decisions on production levels and resource allocation.

Irrelevant cost

Irrelevant costs do not impact decision-making as they remain unchanged regardless of the action taken, contrasting with marginal costs, which represent the additional expense incurred from producing one more unit. Sunk costs are historical expenses already incurred and unrecoverable, making them irrelevant for future decisions compared to marginal costs that directly affect cost-benefit analysis.

Differential cost

Differential cost represents the difference in total cost between two alternatives, excluding sunk costs which are irrecoverable past expenses and should not influence future decisions. Marginal cost, focused on the cost of producing one additional unit, is a specific type of differential cost critical for optimizing production levels and pricing strategies.

Avoidable cost

Avoidable cost refers to expenses that can be eliminated if a particular decision or activity is discontinued, contrasting with sunk costs, which are irrecoverable past expenditures. Marginal cost represents the additional cost of producing one more unit, highlighting the relevance of avoidable costs in short-term decision-making and cost management.

Committed cost

Committed costs represent expenses that cannot be recovered once incurred, similar to sunk costs which are past expenditures irrelevant to future decisions; marginal costs, however, reflect the additional cost of producing one more unit and influence operational choices. Understanding the distinction between fixed committed outlays and variable marginal expenses is essential for effective budgeting and cost management.

Shadow cost

Shadow cost represents the true economic value of a resource when market prices are unavailable or distorted, differing from sunk cost which refers to irreversible past expenditures, and marginal cost which focuses on the expense of producing one additional unit. While sunk costs remain irrelevant to current decision-making and marginal costs guide optimal production levels, shadow costs provide critical insights for resource allocation in constrained environments.

Sunk cost vs Marginal cost Infographic

moneydif.com

moneydif.com