Accrual accounting records expenses when they are incurred, regardless of when the payment is made, providing a more accurate financial picture of liabilities and profitability in a given period. Cash-basis accounting recognizes expenses only when cash is actually paid, offering simplicity but potentially misrepresenting financial status during periods of significant payables. Businesses must choose between accrual and cash-basis methods based on their reporting needs, regulatory requirements, and the complexity of their transactions.

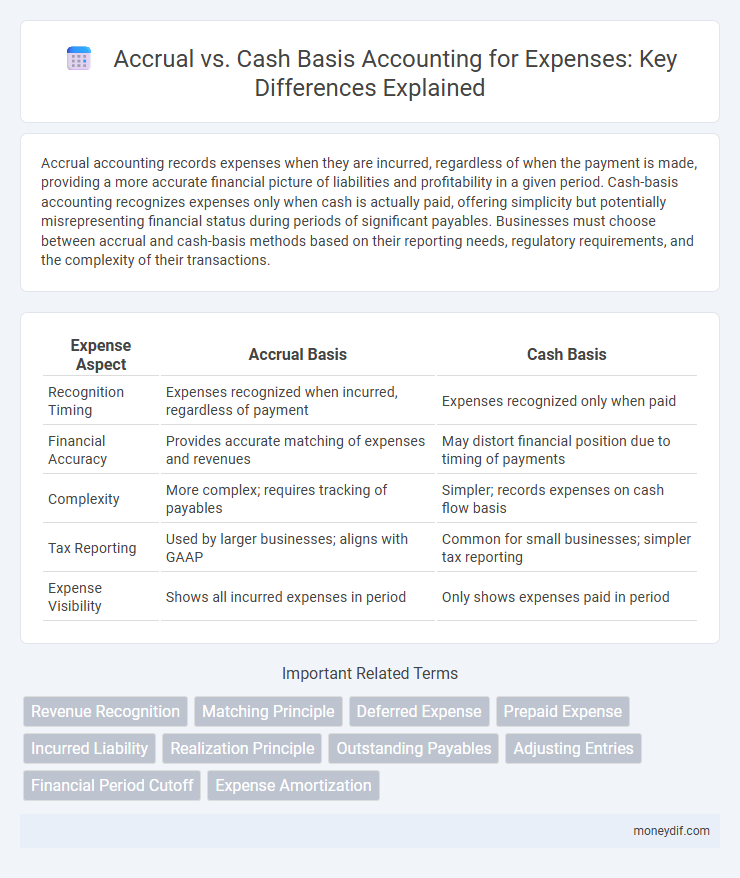

Table of Comparison

| Expense Aspect | Accrual Basis | Cash Basis |

|---|---|---|

| Recognition Timing | Expenses recognized when incurred, regardless of payment | Expenses recognized only when paid |

| Financial Accuracy | Provides accurate matching of expenses and revenues | May distort financial position due to timing of payments |

| Complexity | More complex; requires tracking of payables | Simpler; records expenses on cash flow basis |

| Tax Reporting | Used by larger businesses; aligns with GAAP | Common for small businesses; simpler tax reporting |

| Expense Visibility | Shows all incurred expenses in period | Only shows expenses paid in period |

Understanding Accrual vs Cash-Basis Accounting

Accrual accounting records expenses when they are incurred, regardless of when cash is exchanged, providing a more accurate financial picture by matching revenues with related costs. Cash-basis accounting only records expenses when cash is actually paid, offering simplicity but potentially misrepresenting financial health during periods of delayed payments. Understanding the differences between accrual and cash-basis accounting is crucial for effective expense management and accurate financial reporting.

Key Differences Between Accrual and Cash-Basis

Accrual accounting records expenses when they are incurred, regardless of when cash is exchanged, providing a more accurate picture of financial obligations. Cash-basis accounting recognizes expenses only when cash is paid, making it simpler but less precise in matching expenses to revenues. Key differences include the timing of expense recognition, with accrual offering better matching of income and expenses, while cash-basis focuses on cash flow timing.

How Expenses Are Recorded in Each Method

Expenses in the accrual method are recorded when they are incurred, regardless of when the cash is actually paid, ensuring alignment with the matching principle. In contrast, the cash-basis method records expenses only when cash is paid out, reflecting actual cash flow. This fundamental difference influences financial statements by either recognizing expenses early in accrual or delaying recognition until payment in cash-basis accounting.

Pros and Cons of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recording expenses when they are incurred, regardless of cash flow, enhancing decision-making and long-term planning. This method aligns revenues and expenses in the same period, improving compliance with GAAP and offering better insights into profitability. However, accrual accounting can be complex to implement, requires more detailed record-keeping, and may obscure cash flow issues due to the timing differences between earned revenues and received payments.

Advantages and Disadvantages of Cash-Basis Accounting

Cash-basis accounting records expenses only when cash is paid, simplifying bookkeeping and providing an accurate cash flow picture for small businesses. However, this method can distort financial health by not recognizing outstanding liabilities or receivables, leading to less accurate matching of income and expenses. Its simplicity offers ease of use and tax benefits, but it lacks the detailed financial insights provided by accrual accounting, making it less suitable for larger or more complex enterprises.

Impact of Accounting Method on Business Expenses

Accrual accounting records expenses when they are incurred, providing a more accurate reflection of a company's financial obligations and improving expense matching with related revenues. Cash-basis accounting recognizes expenses only when cash is exchanged, potentially delaying expense recognition and impacting cash flow analysis. The choice between accrual and cash-basis methods directly influences financial statements, tax liabilities, and budgeting processes for businesses.

Choosing the Right Method for Your Business

Selecting the appropriate accounting method between accrual and cash-basis hinges on your business's size, complexity, and financial goals. Accrual accounting offers a comprehensive view by recording expenses and revenues when they are incurred, enhancing long-term financial analysis and compliance with GAAP. Cash-basis accounting provides simplicity and immediate cash flow tracking, ideal for small businesses with straightforward transactions and limited inventory.

Tax Implications: Accrual vs Cash-Basis Expenses

Accrual basis accounting records expenses when they are incurred, allowing businesses to match expenses with related revenues for more accurate tax reporting, while cash-basis accounting records expenses only when payments are made, potentially deferring tax deductions. The Internal Revenue Service (IRS) permits small businesses with average annual gross receipts under $27 million to use cash-basis accounting, which can simplify tax filings but may result in timing differences affecting taxable income. Choosing between accrual and cash-basis accounting impacts taxable income recognition, tax liability, and cash flow management, making it essential for businesses to assess their financial situation and compliance requirements.

Transitioning Between Accrual and Cash-Basis Methods

Transitioning between accrual and cash-basis accounting requires careful adjustment of revenue and expense recognition to align with the new financial reporting method. Businesses must identify outstanding receivables, payables, and prepaid expenses to accurately reflect financial position during the switch. Properly documenting these changes ensures compliance with tax regulations and maintains the integrity of financial statements.

Common Mistakes in Recording Expenses

Recording expenses under accrual accounting often leads to misclassifying prepaid expenses as liabilities instead of assets, skewing financial statements. Cash-basis accounting mistakes frequently include failing to recognize expenses when they are incurred, causing timing mismatches and inaccurate profit reporting. Properly distinguishing between accrued and cash-basis expenses ensures compliance with GAAP and improves financial accuracy.

Important Terms

Revenue Recognition

Revenue recognition under accrual accounting occurs when earned, regardless of cash receipt, ensuring alignment with delivered goods or services and matching expenses to associated revenues. In contrast, cash-basis accounting recognizes revenue only upon cash inflow, potentially distorting financial performance by delaying or accelerating revenue visibility.

Matching Principle

The Matching Principle in accounting mandates that expenses be recognized in the same period as the revenues they help generate, which aligns with accrual basis accounting but contrasts with cash-basis accounting where transactions are recorded only when cash changes hands. Accrual accounting provides a more accurate financial picture by matching revenues and expenses regardless of cash flow timing, while cash-basis accounting may distort profitability by recognizing income and expenses based solely on cash transactions.

Deferred Expense

Deferred expenses represent payments made in advance for goods or services to be consumed in future periods, recognized as assets under the accrual basis of accounting until incurred, whereas cash-basis accounting records these expenses only when cash is actually paid. In accrual accounting, deferred expenses align costs with the period they benefit, improving financial accuracy, while cash-basis accounting can distort financial performance by matching expenses strictly to cash outflows.

Prepaid Expense

Prepaid expenses represent payments made in advance for goods or services to be received in the future and are recorded as assets under the accrual basis of accounting, reflecting expenses when incurred. In contrast, cash-basis accounting recognizes prepaid expenses only when cash is actually paid, potentially misaligning expense recognition with the period they benefit.

Incurred Liability

Incurred liability refers to expenses that have been recognized in the accounting period when the obligation arises, regardless of when payment is made, aligning with the accrual basis of accounting. Cash-basis accounting, however, records expenses only when cash is actually disbursed, ignoring incurred liabilities until payment occurs.

Realization Principle

The Realization Principle dictates that revenue is recognized when goods or services are delivered, aligning closely with accrual accounting, which records income and expenses when earned or incurred regardless of cash flow. In contrast, cash-basis accounting recognizes revenue and expenses only when cash is received or paid, potentially delaying realization recognition and impacting financial statement accuracy.

Outstanding Payables

Outstanding payables represent liabilities recorded when using the accrual basis of accounting, recognizing expenses when incurred regardless of cash flow timing. In contrast, under the cash-basis method, payables are only recorded upon actual cash payment, delaying liability recognition until funds are disbursed.

Adjusting Entries

Adjusting entries ensure accurate financial reporting by recognizing revenues and expenses in the period they occur, aligning with accrual accounting principles rather than cash-basis methods. These entries correct timing differences by recording accrued revenues, accrued expenses, deferred revenues, and deferred expenses, enabling compliance with GAAP.

Financial Period Cutoff

Financial period cutoff ensures revenue and expenses are recorded within the correct accounting period, crucial for accurate financial reporting under both accrual and cash-basis accounting. Accrual accounting recognizes transactions when incurred, while cash-basis records them when cash is exchanged, making cutoff policies essential to align financial statements with underlying economic activities.

Expense Amortization

Expense amortization under the accrual basis recognizes the gradual allocation of expenditure over the relevant periods, matching costs with revenues regardless of cash flow timing. In contrast, the cash-basis method records expense amortization only when actual payment occurs, potentially distorting financial performance by not aligning expenses with earned revenues.

Accrual vs Cash-basis Infographic

moneydif.com

moneydif.com