Direct costs are expenses that can be directly attributed to the production of goods or services, such as raw materials and labor. Indirect costs, also known as overhead, include expenses that support operations but cannot be traced to a specific product, like utilities and administrative salaries. Differentiating between direct and indirect costs is essential for accurate budgeting, pricing, and financial analysis.

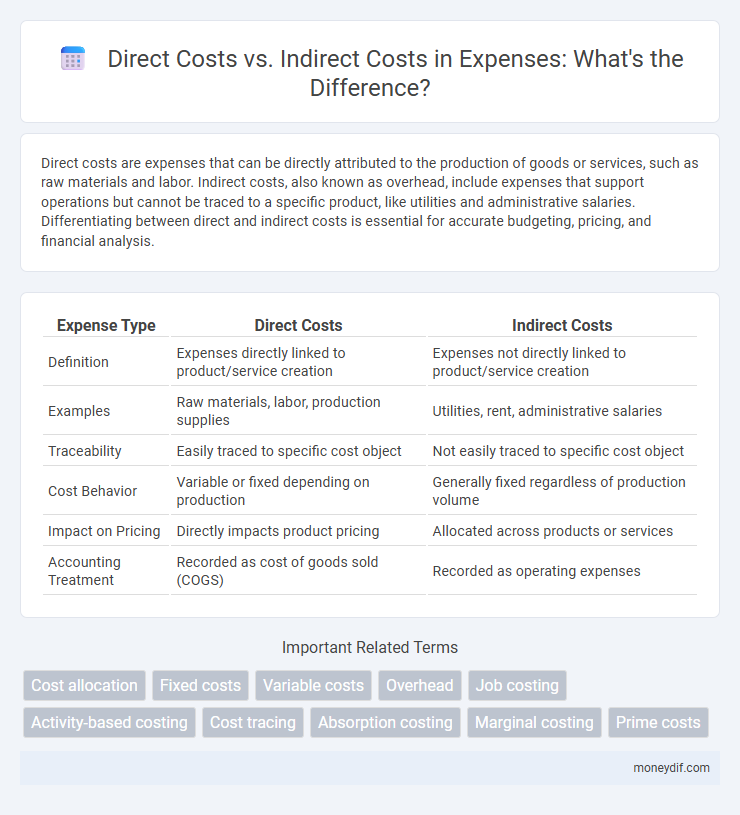

Table of Comparison

| Expense Type | Direct Costs | Indirect Costs |

|---|---|---|

| Definition | Expenses directly linked to product/service creation | Expenses not directly linked to product/service creation |

| Examples | Raw materials, labor, production supplies | Utilities, rent, administrative salaries |

| Traceability | Easily traced to specific cost object | Not easily traced to specific cost object |

| Cost Behavior | Variable or fixed depending on production | Generally fixed regardless of production volume |

| Impact on Pricing | Directly impacts product pricing | Allocated across products or services |

| Accounting Treatment | Recorded as cost of goods sold (COGS) | Recorded as operating expenses |

Understanding Direct and Indirect Costs

Direct costs refer to expenses that can be directly traced to a specific product, project, or department, such as raw materials and labor. Indirect costs, on the other hand, are overhead expenses not directly linked to production, including rent, utilities, and administrative salaries. Accurate differentiation between these costs is essential for precise budgeting, cost control, and profitability analysis.

Key Differences Between Direct and Indirect Costs

Direct costs can be traced specifically to a cost object like raw materials used in production or labor for manufacturing, while indirect costs are expenses that support multiple cost objects, such as utilities and administrative salaries. Direct costs vary directly with production volume, whereas indirect costs tend to be fixed or semi-variable, making them less sensitive to changes in output. Understanding these distinctions is crucial for accurate cost allocation, budgeting, and financial analysis in business operations.

Examples of Direct Costs in Business

Direct costs in business primarily include expenses directly attributable to the production of goods or services, such as raw materials, labor wages for factory workers, and manufacturing supplies. These costs vary proportionally with production levels and can be traced specifically to a cost object, like a product or project. Examples also encompass equipment depreciation used exclusively for manufacturing and costs of packaging materials.

Common Indirect Costs Explained

Common indirect costs include utilities, administrative salaries, and rent, which are not directly traceable to a specific project or product but are necessary for overall business operations. These expenses are allocated across multiple departments or projects using cost allocation methods to ensure accurate financial reporting. Understanding indirect costs is essential for budgeting, pricing, and financial analysis to maintain profitability.

Importance of Categorizing Costs Properly

Properly categorizing direct costs and indirect costs is crucial for accurate budgeting, cost control, and financial reporting in any business. Direct costs, such as raw materials and labor directly tied to production, can be traced to specific products, while indirect costs, including utilities and administrative expenses, support overall operations. Clear differentiation enhances cost allocation accuracy, improves profitability analysis, and informs strategic decision-making.

Impact of Direct and Indirect Costs on Budgeting

Direct costs, such as raw materials and labor, have a clear and immediate impact on budgeting by allowing precise cost allocation to specific projects or products, improving cost control accuracy. Indirect costs, including utilities and administrative expenses, complicate budgeting processes due to their shared nature, requiring allocation methods like activity-based costing to distribute expenses effectively. Understanding the balance between direct and indirect costs ensures more accurate budget forecasts and effective financial management.

Direct vs Indirect Costs in Financial Reporting

Direct costs refer to expenses that can be directly traced to the production of goods or services, such as raw materials and labor, making them essential for accurate financial reporting and product costing. Indirect costs, including overhead expenses like utilities and administrative salaries, cannot be directly attributed to specific products but are allocated across multiple departments or projects. Proper classification of direct versus indirect costs enhances the transparency and accuracy of financial statements, aiding stakeholders in better assessing company profitability and operational efficiency.

Allocation Methods for Indirect Costs

Allocation methods for indirect costs include the traditional cost allocation, activity-based costing (ABC), and the reciprocal method, each designed to accurately distribute overhead expenses to cost objects. Traditional cost allocation often uses a single cost driver like labor hours or machine hours to assign indirect costs, while ABC assigns costs based on multiple activities driving overhead expenses. The reciprocal method accounts for mutual services among departments, providing a more precise allocation by recognizing interdepartmental cost exchanges.

Reducing Direct and Indirect Costs Effectively

Reducing direct costs involves streamlining production processes, negotiating better supplier contracts, and optimizing raw material usage to lower expenses associated with goods sold. Effective management of indirect costs requires implementing energy-efficient practices, automating administrative tasks, and controlling overhead through regular budget reviews. Combining these strategies enhances overall cost efficiency and increases organizational profitability.

Best Practices for Managing Business Expenses

Accurately categorizing expenses into direct costs, such as raw materials and labor directly involved in production, and indirect costs, including utilities and administrative salaries, enables precise budgeting and financial analysis. Implementing regular expense tracking and allocating overhead through activity-based costing improves transparency and cost control. Leveraging software tools for real-time monitoring ensures timely adjustments, optimizing overall expense management and enhancing profit margins.

Important Terms

Cost allocation

Cost allocation distinguishes direct costs, which can be traced to specific products or departments, from indirect costs, which are shared expenses allocated across multiple cost centers.

Fixed costs

Fixed costs remain constant regardless of production volume, while direct costs are directly attributable to a specific product and indirect costs support general operations without direct traceability.

Variable costs

Variable costs fluctuate directly with production volume, encompassing direct materials and direct labor, which are traceable to specific products, while indirect costs, such as utilities and maintenance, remain fixed or semi-variable and are not directly attributable to individual units. Understanding the distinction between variable direct costs and fixed indirect costs is essential for accurate cost allocation and effective budgeting in manufacturing and service operations.

Overhead

Overhead costs represent indirect expenses that cannot be directly traced to a specific product or service, unlike direct costs which are directly attributable to production or operations.

Job costing

Job costing accurately tracks direct costs such as labor, materials, and equipment directly associated with a specific job, ensuring precise expense allocation. Indirect costs, including overhead expenses like utilities and administrative salaries, are allocated based on cost drivers to avoid distorting job profitability analysis.

Activity-based costing

Activity-based costing accurately assigns indirect costs to products by analyzing activities, while direct costs are traced straightforwardly to specific cost objects.

Cost tracing

Cost tracing accurately assigns direct costs to specific cost objects while indirect costs require allocation methods due to their shared nature across multiple cost objects.

Absorption costing

Absorption costing allocates both direct costs, such as raw materials and direct labor, and indirect costs, including manufacturing overhead like utilities and depreciation, to product units for comprehensive cost measurement. This method ensures all production costs are absorbed into inventory valuation, facilitating accurate profit analysis and compliance with GAAP standards.

Marginal costing

Marginal costing focuses on direct costs such as raw materials and labor, treating indirect costs like overheads as fixed expenses not included in product cost calculation.

Prime costs

Prime costs encompass direct costs such as raw materials and direct labor, excluding indirect costs like overhead expenses.

Direct costs vs Indirect costs Infographic

moneydif.com

moneydif.com