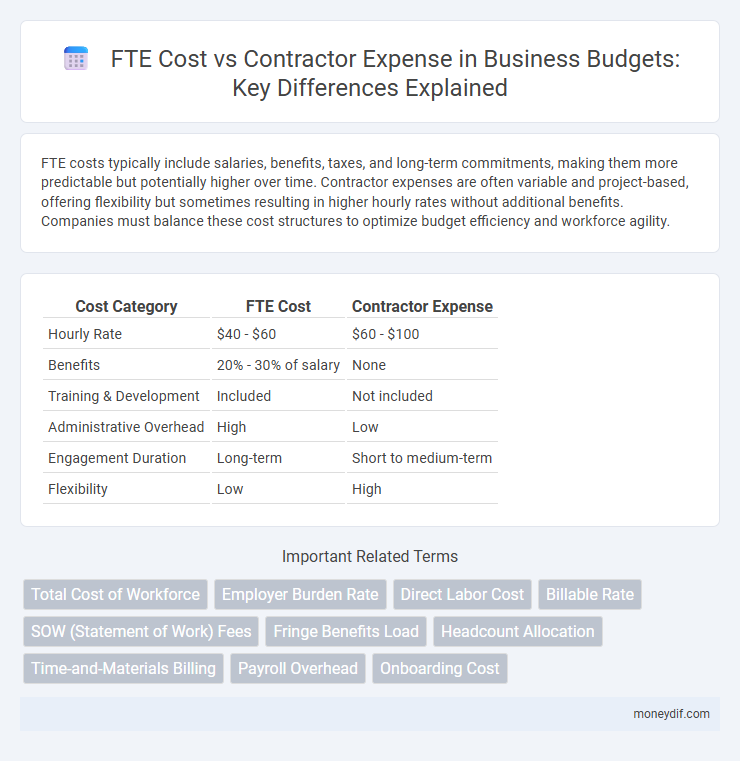

FTE costs typically include salaries, benefits, taxes, and long-term commitments, making them more predictable but potentially higher over time. Contractor expenses are often variable and project-based, offering flexibility but sometimes resulting in higher hourly rates without additional benefits. Companies must balance these cost structures to optimize budget efficiency and workforce agility.

Table of Comparison

| Cost Category | FTE Cost | Contractor Expense |

|---|---|---|

| Hourly Rate | $40 - $60 | $60 - $100 |

| Benefits | 20% - 30% of salary | None |

| Training & Development | Included | Not included |

| Administrative Overhead | High | Low |

| Engagement Duration | Long-term | Short to medium-term |

| Flexibility | Low | High |

Understanding FTE and Contractor Cost Structures

FTE cost structures encompass fixed salaries, benefits, taxes, and overhead expenses, providing predictable and consistent expense management for businesses. Contractor expenses typically include hourly rates or project-based fees without long-term commitments, often lacking benefits and overhead costs but potentially incurring higher per-hour charges. Understanding these differences helps organizations optimize workforce budgeting, balancing stability and flexibility based on project demands and financial strategies.

Key Differences Between FTE and Contractor Expenses

FTE expenses include fixed salaries, benefits, taxes, and long-term overhead costs, resulting in a stable but higher overall expenditure. Contractor expenses are typically variable, billed hourly or per project, with fewer associated benefits and lower administrative costs. Key differences lie in cost predictability, budgeting flexibility, and the inclusion of indirect expenses in FTE costs versus the straightforward fees for contractors.

Factors Influencing FTE Costs

FTE costs are primarily influenced by salary, benefits, taxes, and overhead expenses, which often exceed direct compensation alone. Contractor expenses, however, are typically limited to hourly or project-based fees without additional benefits, leading to differing cost structures. Factors such as employee turnover rates, training requirements, and organizational benefits packages significantly impact the total FTE cost compared to contractor expenses.

Factors Impacting Contractor Expenses

Contractor expenses are influenced by factors such as hourly rates, project duration, and the complexity of specialized skills required. Unlike fixed FTE costs that include salaries and benefits, contractor costs can fluctuate based on market demand and contract terms. Effective management of contractor expenses requires careful evaluation of scope, resource availability, and potential overtime or rush fees.

Salary vs. Hourly Rates: A Cost Comparison

FTE cost typically includes a fixed annual salary, encompassing benefits, taxes, and paid time off, making it a predictable expense for budgeting. In contrast, contractor expense is calculated on hourly rates, which can vary depending on project scope and duration, offering flexibility but potential cost fluctuations. Comparing salary against hourly rates reveals that while FTEs provide long-term stability, contractors may incur higher hourly costs but reduced overhead expenses.

Hidden Expenses: Benefits, Taxes, and Overheads

FTE cost often includes hidden expenses such as employee benefits, payroll taxes, and overhead costs like office space and equipment, which significantly increase the total cost beyond base salary. Contractor expenses, while typically higher per hour, usually exclude benefits and taxes, reducing overhead but potentially leading to higher upfront charges. Understanding these hidden costs is essential for accurate budgeting and effective resource allocation.

Flexibility and Scalability: Expense Considerations

FTE costs typically involve fixed salaries, benefits, and long-term commitments, impacting overall budget flexibility. Contractor expenses offer greater scalability by allowing companies to adjust workforce size based on project demands without incurring long-term financial obligations. Organizations prioritize contractor expenses to manage variable workloads efficiently while balancing control and operational costs.

Long-Term Expense Implications

FTE costs typically include salary, benefits, training, and long-term retention expenses, which contribute to higher upfront investment but lower turnover over time. Contractor expenses, while often appearing lower in the short term due to flexible engagements and reduced benefits, can lead to increased costs related to knowledge gaps, onboarding, and inconsistent project continuity. Evaluating the long-term expense implications requires analyzing total cost of ownership, including productivity, scalability, and workforce stability factors.

Cost Optimization Strategies for FTEs and Contractors

Optimizing cost between FTEs and contractors involves analyzing fully burdened FTE costs, including salaries, benefits, taxes, and overhead, versus contractor hourly rates that often lack long-term obligations but carry higher per-hour expenses. Strategies include leveraging contractors for short-term, specialized projects to minimize fixed overhead and utilizing FTEs for core functions to benefit from lower long-term cost per output and employee retention. Effective workforce planning and predictive analytics enable balancing resource allocation to achieve maximum cost efficiency and agility.

Making the Right Choice: Expense-Based Recommendations

Evaluating FTE cost versus contractor expense requires analyzing total compensation, including benefits, training, and overhead associated with full-time employees compared to the hourly rates and flexibility of contractors. Companies often find contractors reduce fixed costs and provide scalability, while FTEs offer long-term stability and institutional knowledge retention. Making the right choice hinges on project duration, budget predictability, and the strategic value of embedded expertise in minimizing overall expense impact.

Important Terms

Total Cost of Workforce

Total Cost of Workforce (TCOW) encompasses both Full-Time Employee (FTE) costs and contractor expenses, highlighting the financial impact of salaries, benefits, training, and overhead against hourly rates, project fees, and agency charges. Analyzing TCOW helps organizations optimize resource allocation by balancing the stability and long-term investment of FTEs with the flexibility and scalability offered by contractors.

Employer Burden Rate

Employer Burden Rate quantifies the total cost of employing a full-time equivalent (FTE), including wages, benefits, payroll taxes, and overhead, often making FTEs more expensive than contractors whose costs primarily include hourly rates without additional employer-incurred expenses. Comparing FTE cost with contractor expenses reveals that while FTEs incur a higher Employer Burden Rate, contractors offer flexibility and potential cost savings by excluding benefit-related burdens from overall labor costs.

Direct Labor Cost

Direct labor cost encompasses expenses related to full-time employees (FTEs), including salaries, benefits, and payroll taxes, which typically offer long-term cost efficiency and workforce stability. Contractor expenses involve higher hourly rates without benefits, resulting in flexible labor solutions but often increased per-unit labor costs compared to FTEs.

Billable Rate

Billable rate calculations often weigh Full-Time Equivalent (FTE) costs against contractor expenses, factoring in salary, benefits, overhead, and productivity to determine profitability. Contractors typically command higher hourly rates due to the absence of long-term benefits and overhead, influencing project budgeting and resource allocation decisions.

SOW (Statement of Work) Fees

SOW fees often reflect a comparison between FTE costs and contractor expenses, where FTE costs typically include base salary, benefits, and overhead, while contractor expenses usually cover higher hourly rates without long-term commitments or benefits. Organizations analyze these differences to optimize budgeting, balancing the fixed expenses of FTEs against the flexible, potentially higher short-term costs of contractors.

Fringe Benefits Load

Fringe Benefits Load represents the additional cost percentage applied to Full-Time Equivalent (FTE) salaries to cover benefits such as health insurance, retirement plans, and paid leave, typically ranging from 20% to 40% of the base salary. Contractor expenses exclude fringe benefits but often include higher hourly rates that compensate for the absence of benefits, making direct cost comparisons between FTEs and contractors essential for accurate budgeting and workforce planning.

Headcount Allocation

Headcount allocation directly impacts budget management by balancing Full-Time Equivalent (FTE) costs, which include salaries, benefits, and overhead, against contractor expenses that often incur higher hourly rates but offer flexibility without long-term commitments. Optimizing the mix of FTEs and contractors enhances financial efficiency while maintaining project agility and resource scalability.

Time-and-Materials Billing

Time-and-Materials billing tracks costs based on actual hours worked and materials used, often leading to variable expenses compared to fixed FTE costs. Contractor expenses typically exceed FTE costs due to higher hourly rates and lack of benefits, impacting budget allocation and financial forecasting.

Payroll Overhead

Payroll overhead significantly impacts the total cost of Full-Time Employees (FTEs), including expenses like benefits, taxes, and insurance, often ranging from 20% to 40% of the base salary. Contractor expenses may appear higher hourly but exclude payroll overhead costs, making direct cost comparison complex when evaluating workforce budgeting strategies.

Onboarding Cost

Onboarding cost significantly impacts overall workforce expenditure, with full-time employee (FTE) onboarding typically involving higher upfront training and integration expenses compared to contractors, who usually incur lower initial costs but may result in higher hourly rates. Evaluating the total cost of ownership, including recruitment, training, benefits, and turnover rates, reveals that contractors might offer short-term cost efficiency while FTEs provide long-term value through skill retention and organizational knowledge.

FTE cost vs contractor expense Infographic

moneydif.com

moneydif.com