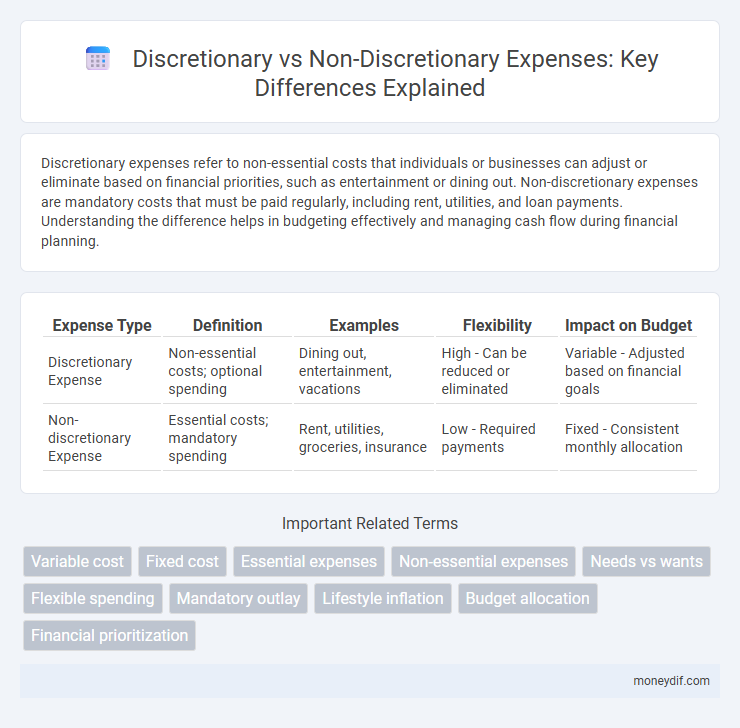

Discretionary expenses refer to non-essential costs that individuals or businesses can adjust or eliminate based on financial priorities, such as entertainment or dining out. Non-discretionary expenses are mandatory costs that must be paid regularly, including rent, utilities, and loan payments. Understanding the difference helps in budgeting effectively and managing cash flow during financial planning.

Table of Comparison

| Expense Type | Definition | Examples | Flexibility | Impact on Budget |

|---|---|---|---|---|

| Discretionary Expense | Non-essential costs; optional spending | Dining out, entertainment, vacations | High - Can be reduced or eliminated | Variable - Adjusted based on financial goals |

| Non-discretionary Expense | Essential costs; mandatory spending | Rent, utilities, groceries, insurance | Low - Required payments | Fixed - Consistent monthly allocation |

Understanding Discretionary and Non-Discretionary Expenses

Discretionary expenses refer to non-essential costs such as entertainment, dining out, and luxury items, which can be reduced or eliminated based on budget flexibility. Non-discretionary expenses include essential costs like rent, utilities, groceries, and insurance premiums that are necessary for daily living and must be paid regardless of financial conditions. Understanding the difference helps individuals and businesses manage cash flow effectively by prioritizing mandatory payments while controlling flexible spending.

Key Differences Between Discretionary and Non-Discretionary Costs

Discretionary expenses are optional costs that can be adjusted or eliminated without affecting basic living standards, such as entertainment or dining out, whereas non-discretionary expenses are essential and fixed, including rent, utilities, and insurance. The key difference lies in flexibility: discretionary costs vary based on personal choices, while non-discretionary costs are mandatory financial obligations that must be met regularly. Understanding these distinctions helps in budgeting by distinguishing between flexible spending areas and fixed necessary expenditures.

Examples of Discretionary Expenses

Discretionary expenses include costs such as dining out, entertainment, travel, and luxury clothing, reflecting non-essential lifestyle choices. These expenses contrast with non-discretionary costs like rent, utilities, and groceries, which cover indispensable living needs. Monitoring discretionary spending helps individuals manage budgets and prioritize savings effectively.

Common Non-Discretionary Expenses Explained

Common non-discretionary expenses include rent or mortgage payments, utilities, groceries, insurance premiums, and transportation costs, which are essential for daily living and financial stability. These fixed or necessary expenses must be paid regularly regardless of income fluctuations, making them critical components of personal and household budgets. Understanding non-discretionary expenses helps individuals prioritize spending and manage cash flow effectively.

The Impact of Discretionary vs Non-Discretionary Spending on Budgeting

Discretionary expenses, such as entertainment and dining out, offer flexibility but can disrupt budgeting if overspent, whereas non-discretionary expenses like rent and utilities are fixed costs essential for maintaining financial stability. Effective budgeting requires prioritizing non-discretionary expenses to ensure basic needs are covered before allocating funds to discretionary spending. Balancing these spending categories helps prevent overspending and promotes financial discipline.

How to Identify Your Own Discretionary and Non-Discretionary Expenses

To identify your discretionary and non-discretionary expenses, start by categorizing payments essential for basic survival such as rent, utilities, and groceries as non-discretionary expenses. Track spending on non-essential items like dining out, entertainment, and hobbies to classify discretionary expenses. Use budgeting tools or expense tracking apps to analyze spending patterns and differentiate between these categories for better financial management.

Strategies for Managing Discretionary Expenses

Effectively managing discretionary expenses requires prioritizing spending based on essential needs and financial goals while regularly reviewing budgets to identify areas for reduction. Implementing strategies such as setting spending limits, using cash envelopes, and delaying non-essential purchases can help control discretionary costs. Leveraging budgeting apps and tracking tools provides real-time insights, enabling better decision-making and preventing overspending on non-essential items.

Prioritizing Non-Discretionary Expenses in Financial Planning

Non-discretionary expenses, including rent, utilities, and essential groceries, must be prioritized in financial planning to ensure stability and avoid financial distress. These fixed and necessary costs take precedence over discretionary expenses such as entertainment and dining out, which can be adjusted or reduced during budget constraints. Effective budget management involves allocating funds to cover non-discretionary expenses first to maintain basic living standards and financial security.

Adjusting Discretionary Spending During Financial Hardship

Adjusting discretionary spending during financial hardship involves prioritizing essential non-discretionary expenses such as rent, utilities, and groceries, while reducing or eliminating non-essential purchases like dining out, entertainment, and luxury items. This strategic shift helps maintain financial stability by ensuring that necessary obligations are met without incurring additional debt. Tracking and categorizing expenses using budgeting tools enhances control over discretionary spending, enabling quicker adaptation to changing financial conditions.

The Role of Expense Categorization in Achieving Financial Goals

Categorizing expenses into discretionary and non-discretionary types enhances financial planning accuracy by distinguishing between essential costs, such as rent and utilities, and optional spending like entertainment or dining out. This differentiation enables individuals to allocate funds strategically, ensuring non-discretionary expenses are covered while adjusting discretionary spending to meet savings targets or debt reduction goals. Effective expense categorization supports informed decision-making, improving budget management and accelerating the achievement of financial objectives.

Important Terms

Variable cost

Variable costs fluctuate with production levels, while discretionary expenses are non-essential and adjustable, and non-discretionary expenses are fixed obligations critical for operations.

Fixed cost

Fixed costs include discretionary expenses, which can be adjusted or eliminated in the short term, and non-discretionary expenses, which are essential and must be maintained regardless of business conditions.

Essential expenses

Essential expenses include non-discretionary expenses necessary for basic living, while discretionary expenses cover optional spending for non-essential goods and services.

Non-essential expenses

Non-essential expenses, classified as discretionary expenses, differ from non-discretionary expenses by being optional costs such as entertainment and dining out, whereas non-discretionary expenses include mandatory obligations like rent and utilities.

Needs vs wants

Discretionary expenses cover wants, such as entertainment and dining out, while non-discretionary expenses address needs, including rent, utilities, and groceries.

Flexible spending

Flexible spending often falls under discretionary expenses, which are non-essential costs that can be adjusted or eliminated, unlike non-discretionary expenses that are fixed and necessary for basic living. Managing discretionary spending effectively allows individuals to optimize budget flexibility and improve financial control.

Mandatory outlay

Mandatory outlay refers to fixed expenses required by law or contract, contrasting with discretionary expenses that are optional and non-discretionary expenses that are essential but not legally mandated.

Lifestyle inflation

Lifestyle inflation increases discretionary expenses while non-discretionary expenses remain fixed, impacting overall financial stability.

Budget allocation

Budget allocation prioritizes meeting non-discretionary expenses such as rent and utilities before allocating funds to discretionary expenses like entertainment and dining out.

Financial prioritization

Effective financial prioritization requires distinguishing discretionary expenses, which are flexible and non-essential, from non-discretionary expenses, which are mandatory and fixed.

Discretionary expense vs Non-discretionary expense Infographic

moneydif.com

moneydif.com