Discretionary expenses are non-essential costs that can be adjusted or eliminated based on budget flexibility, such as entertainment or dining out. Committed expenses represent fixed obligations, like rent or loan payments, which must be paid regularly regardless of financial changes. Understanding the difference between these expenses is crucial for effective budgeting and financial management.

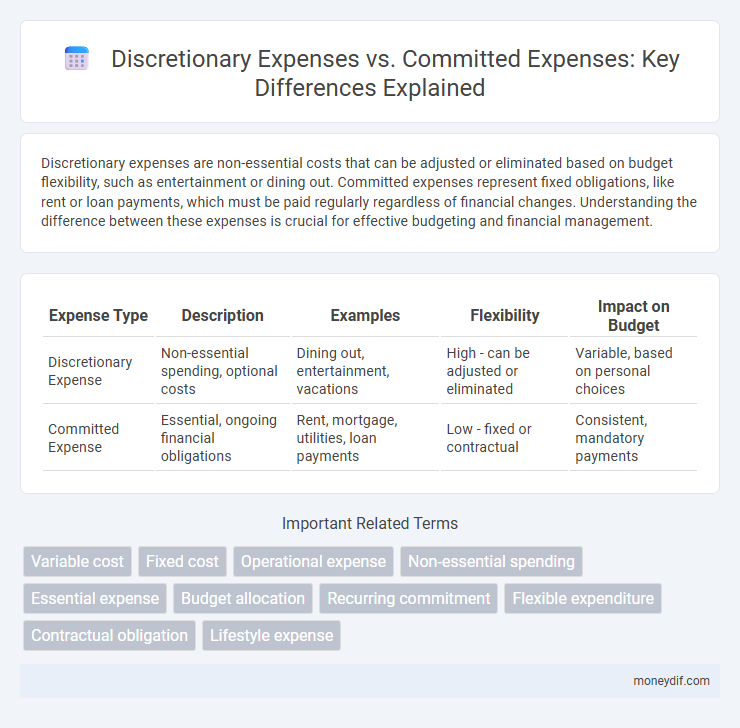

Table of Comparison

| Expense Type | Description | Examples | Flexibility | Impact on Budget |

|---|---|---|---|---|

| Discretionary Expense | Non-essential spending, optional costs | Dining out, entertainment, vacations | High - can be adjusted or eliminated | Variable, based on personal choices |

| Committed Expense | Essential, ongoing financial obligations | Rent, mortgage, utilities, loan payments | Low - fixed or contractual | Consistent, mandatory payments |

Understanding Discretionary vs Committed Expenses

Discretionary expenses are non-essential costs that individuals or businesses can adjust or eliminate, such as entertainment or dining out, providing flexibility in budgeting. Committed expenses are fixed obligations like rent, loan payments, and insurance premiums that must be paid regularly and cannot be easily changed. Understanding the distinction between discretionary and committed expenses is crucial for effective financial management and cash flow planning.

Key Differences Between Discretionary and Committed Expenses

Discretionary expenses are variable costs that can be adjusted or eliminated based on financial priorities, such as entertainment or dining out, whereas committed expenses are fixed obligations like rent, mortgage, or loan payments that must be paid regularly. Discretionary expenses offer flexibility in budgeting, while committed expenses represent unavoidable financial commitments that impact cash flow stability. Understanding the distinction helps individuals and businesses manage cash flow effectively and prioritize spending during financial planning.

Examples of Discretionary Expenses

Discretionary expenses include non-essential costs such as dining out, entertainment, luxury clothing, and travel, which can be adjusted or eliminated based on budget constraints. Examples also encompass hobbies, gym memberships, and subscription services like streaming platforms or magazines. Unlike committed expenses, discretionary spending is flexible and often related to lifestyle choices rather than fixed financial obligations.

Common Committed Expenses in Your Budget

Common committed expenses in your budget typically include rent or mortgage payments, utility bills, insurance premiums, loan repayments, and subscription services. These recurring costs are essential financial obligations that remain consistent each month, making them predictable and crucial for maintaining financial stability. Understanding the distinction between committed and discretionary expenses helps prioritize budgeting efforts and avoid potential cash flow issues.

Why Distinguishing Expense Types Matters

Distinguishing discretionary expenses from committed expenses is crucial for effective budgeting and financial planning. Discretionary expenses, such as entertainment and dining out, are flexible and can be adjusted or eliminated during financial constraints, while committed expenses like rent, utilities, and loan payments are fixed obligations that must be met monthly. Understanding these differences helps individuals and businesses prioritize spending, maintain cash flow, and make informed decisions to achieve financial stability and long-term goals.

Managing Discretionary Expenses Wisely

Managing discretionary expenses wisely involves prioritizing spending on non-essential items that do not impact fixed financial obligations. Discretionary expenses such as entertainment, dining out, and luxury purchases should be regularly reviewed and adjusted based on budget constraints and financial goals. Tracking variable costs and setting clear limits helps prevent overspending and improves overall cash flow management.

Tips to Reduce Committed Expenses

Reducing committed expenses starts with reviewing fixed costs such as rent, subscriptions, and insurance policies to identify opportunities for renegotiation or cancellation. Implementing cost-efficient alternatives, like switching to lower-tier service plans or consolidating recurring payments, can significantly lower monthly obligations. Regularly auditing these obligations ensures timely adjustments aligned with changing financial goals and market conditions.

Impact on Financial Planning: Discretionary vs Committed

Discretionary expenses, such as entertainment and dining out, offer flexibility and can be adjusted based on financial goals, aiding in dynamic financial planning. Committed expenses, including rent, mortgage, and insurance, are fixed obligations that must be prioritized, ensuring stability but limiting budget flexibility. Effective financial planning requires balancing discretionary spending with committed costs to maintain cash flow and achieve long-term financial objectives.

How to Prioritize Expense Categories

Prioritizing expense categories requires distinguishing between discretionary expenses, which are flexible and non-essential, and committed expenses, which are fixed and necessary for financial obligations. Focus on covering committed expenses first, such as rent, utilities, and loan payments, to maintain financial stability before allocating funds to discretionary spending like entertainment or dining out. Regularly reviewing budget allocations ensures optimized cash flow management and prevents overspending on non-essential items.

Balancing Lifestyle: Controlling Discretionary Spending

Balancing lifestyle involves carefully managing discretionary expenses, such as dining out, entertainment, and hobbies, which can fluctuate based on personal preferences and financial goals. Committed expenses like rent, utilities, and loan payments remain fixed and require consistent budgeting to ensure financial stability. Controlling discretionary spending helps maintain a healthy balance between enjoying lifestyle choices and meeting essential financial commitments.

Important Terms

Variable cost

Variable costs fluctuate directly with production volume or business activity, often including discretionary expenses such as advertising or office supplies, which management can adjust in the short term. Committed expenses, like rent or salaried wages, remain relatively fixed and are less influenced by changes in production levels, representing long-term financial obligations.

Fixed cost

Fixed costs include both discretionary expenses, such as advertising and research and development, which management can adjust in the short term, and committed expenses like rent and salaries, which are long-term obligations that cannot be easily altered without significant impact. Understanding the distinction between these fixed cost types is crucial for budgeting, as discretionary fixed costs offer flexibility while committed fixed costs enforce financial constraints.

Operational expense

Operational expenses consist of discretionary expenses, which are variable and can be adjusted or eliminated without immediate impact, and committed expenses, which are fixed obligations that a business must continuously pay due to contractual or long-term commitments. Effective management of discretionary versus committed operational expenses is crucial for maintaining financial flexibility and optimizing budget allocation.

Non-essential spending

Non-essential spending primarily falls under discretionary expenses, which include flexible costs like entertainment, dining, and hobbies, unlike committed expenses such as rent, utilities, and loan payments that are fixed and mandatory. Managing discretionary expenses effectively can improve budgeting flexibility and increase savings potential without impacting essential financial obligations.

Essential expense

Essential expenses include committed expenses like rent, utilities, and loan payments that are necessary for basic living and financial obligations, while discretionary expenses cover non-essential spending such as dining out, entertainment, and luxury items, which can be adjusted or eliminated based on budget flexibility. Differentiating essential from discretionary expenses helps in effective budgeting and financial planning by prioritizing mandatory payments over optional expenditures.

Budget allocation

Budget allocation distinguishes discretionary expenses--flexible costs like marketing and entertainment that can be adjusted monthly--from committed expenses, which are fixed obligations such as rent, salaries, and loan payments that require consistent funding. Efficient financial planning prioritizes managing discretionary spending to maintain cash flow while ensuring committed expenses are fully covered to avoid operational disruptions.

Recurring commitment

Recurring commitments refer to ongoing financial obligations expected to continue regularly, often classified as either discretionary expenses, such as entertainment or dining out, which can be adjusted or eliminated, or committed expenses like rent and utilities, which are fixed and mandatory. Properly distinguishing between these expense types helps in budgeting and managing cash flow effectively, ensuring essential payments are prioritized while allowing flexibility in non-essential spending.

Flexible expenditure

Flexible expenditure refers to costs that can vary in amount and can be adjusted based on business activity, often classified as discretionary expenses such as marketing or travel costs that managers can control. In contrast, committed expenses are fixed obligations like rent or salaries that must be paid regardless of operational changes, representing non-discretionary costs tied to long-term contracts or essential business functions.

Contractual obligation

Contractual obligations define committed expenses that are legally binding and must be paid regardless of business discretion, such as lease agreements or long-term service contracts. Discretionary expenses differ as they involve non-essential spending like marketing or employee training, which can be adjusted or deferred based on financial strategy and cash flow considerations.

Lifestyle expense

Lifestyle expenses include both discretionary expenses, such as dining out, entertainment, and leisure activities, which are flexible and non-essential, and committed expenses like housing, utilities, and insurance, which are fixed and necessary for maintaining daily living standards. Effectively managing the balance between discretionary and committed lifestyle expenses is crucial for financial stability and long-term wealth accumulation.

discretionary expense vs committed expense Infographic

moneydif.com

moneydif.com