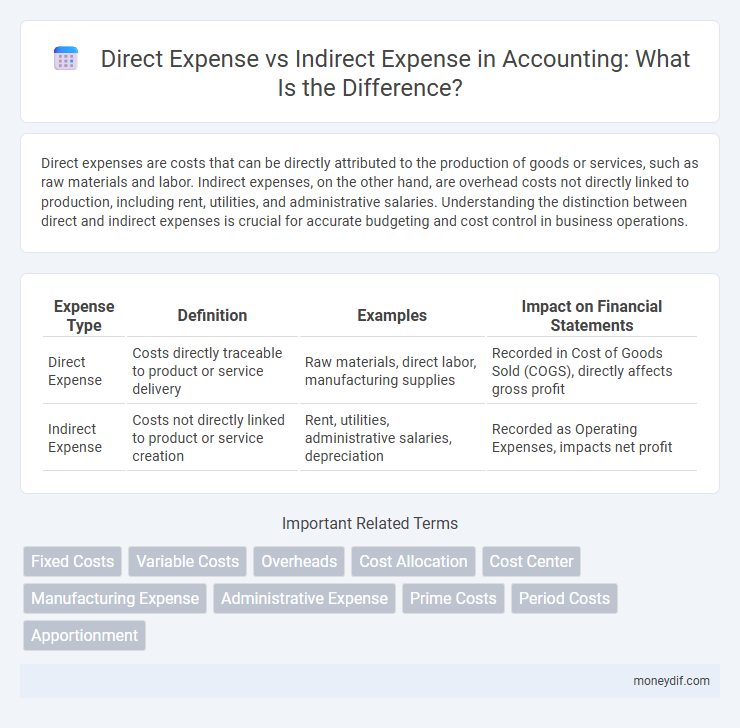

Direct expenses are costs that can be directly attributed to the production of goods or services, such as raw materials and labor. Indirect expenses, on the other hand, are overhead costs not directly linked to production, including rent, utilities, and administrative salaries. Understanding the distinction between direct and indirect expenses is crucial for accurate budgeting and cost control in business operations.

Table of Comparison

| Expense Type | Definition | Examples | Impact on Financial Statements |

|---|---|---|---|

| Direct Expense | Costs directly traceable to product or service delivery | Raw materials, direct labor, manufacturing supplies | Recorded in Cost of Goods Sold (COGS), directly affects gross profit |

| Indirect Expense | Costs not directly linked to product or service creation | Rent, utilities, administrative salaries, depreciation | Recorded as Operating Expenses, impacts net profit |

Understanding Direct and Indirect Expenses

Direct expenses are costs that can be directly attributed to the production of goods or services, such as raw materials, labor, and manufacturing supplies. Indirect expenses, also known as overhead costs, include utilities, rent, and administrative salaries that are not directly linked to production but support overall business operations. Properly distinguishing between direct and indirect expenses is essential for accurate cost allocation, budgeting, and financial reporting.

Key Differences Between Direct and Indirect Expenses

Direct expenses are costs that can be directly traced to the production of goods or services, such as raw materials and labor wages. Indirect expenses, including utilities, rent, and administrative salaries, support overall business operations but are not linked to specific products. Understanding these distinctions is crucial for accurate cost allocation, budgeting, and financial reporting.

Examples of Direct Expenses in Business

Direct expenses in business include costs that can be directly traced to the production of goods or services, such as raw materials, manufacturing labor, and packaging supplies. These expenses fluctuate with the level of production and are essential for calculating the cost of goods sold (COGS). Examples also encompass expenses like factory rent and utilities when they are exclusive to the production process.

Common Indirect Expenses and Their Impact

Common indirect expenses include utilities, rent, administrative salaries, and office supplies, which are not directly tied to product manufacturing but essential for overall operations. These costs significantly impact a company's profitability by increasing overhead, making precise allocation critical for accurate financial analysis and pricing strategies. Proper management of indirect expenses ensures better budgeting, improved cost control, and enhanced decision-making capabilities within the organization.

Importance of Accurate Expense Classification

Accurate classification of direct and indirect expenses is crucial for precise financial reporting and cost control. Direct expenses, such as raw materials and labor, are directly traceable to specific products or projects, while indirect expenses like rent and utilities support overall operations but cannot be linked to a single cost object. Proper classification ensures better budgeting, cost allocation, and profitability analysis for informed decision-making.

Effects on Financial Statements: Direct vs Indirect Expenses

Direct expenses directly impact the cost of goods sold (COGS) and reduce gross profit on the income statement, providing a clear view of production costs. Indirect expenses affect operating expenses, influencing net income and operating profit without altering gross profit. Accurate classification of expenses ensures precise financial reporting and aids in effective cost management and profitability analysis.

Direct and Indirect Expenses in Cost Accounting

Direct expenses in cost accounting are costs directly attributed to the production of goods or services, such as raw materials and labor expenses, enabling precise cost allocation to products. Indirect expenses, including utilities, rent, and administrative salaries, cannot be directly traced to a specific product and are typically allocated across departments or cost centers using predetermined overhead rates. Proper classification and allocation of direct and indirect expenses are essential for accurate product costing, financial reporting, and cost control in manufacturing and service industries.

Tax Implications of Direct and Indirect Expenses

Direct expenses, such as raw materials and labor directly tied to production, are typically deductible as business expenses, reducing taxable income immediately. Indirect expenses, including overhead costs like rent, utilities, and administrative salaries, may also be deductible but often require allocation and are subject to different tax treatment. Accurate classification of direct versus indirect expenses ensures compliance with tax regulations and optimizes tax benefits for businesses.

How to Allocate Indirect Expenses Effectively

Allocating indirect expenses effectively requires accurate identification and classification of costs such as utilities, rent, and administrative salaries that cannot be directly traced to a single product or service. Employing cost allocation methods like activity-based costing (ABC) enhances precision by linking indirect expenses to specific activities or cost drivers. Regular review and adjustment of allocation bases ensure indirect expenses reflect current operational realities and support informed decision-making.

Best Practices for Managing Business Expenses

Effective management of business expenses involves clearly distinguishing between direct and indirect expenses to allocate costs accurately and optimize budgeting. Direct expenses, such as raw materials and labor directly tied to production, should be closely monitored for cost control and pricing strategies. Indirect expenses, including utilities and administrative salaries, require regular review to enhance operational efficiency without compromising business support functions.

Important Terms

Fixed Costs

Fixed costs are expenses that remain constant regardless of production levels, often classified as indirect expenses since they cannot be directly traced to a specific product or service. Direct expenses fluctuate with production volume and are typically variable, making fixed costs distinct in budgeting and cost management for activities such as rent, salaries, and depreciation.

Variable Costs

Variable costs fluctuate directly with production volume and are typically classified as direct expenses since they are traceable to specific products or services, such as raw materials and direct labor. Indirect expenses, in contrast, generally remain fixed regardless of output and include overhead costs like utilities and administrative salaries that are not directly tied to production levels.

Overheads

Overheads are classified as indirect expenses because they cannot be directly traced to a specific product or service, unlike direct expenses which are directly attributable to production activities such as raw materials and labor costs. Examples of overheads include rent, utilities, and administrative salaries, which support overall operations without being linked to individual cost units.

Cost Allocation

Cost allocation distinguishes direct expenses, which are traceable to specific cost objects like products or departments, from indirect expenses, which support multiple cost centers and require systematic distribution methods such as activity-based costing for accurate financial reporting and resource management. Effective cost allocation ensures precise profit analysis, informed budgeting, and optimized operational efficiency by correctly attributing expenses to their respective cost drivers.

Cost Center

A cost center is a department or function within an organization responsible for controlling costs, where direct expenses, such as raw materials and labor directly tied to production, are easily traceable, while indirect expenses, like utilities and administrative salaries, support multiple cost centers and require allocation. Effective cost center management enhances budget accuracy by differentiating and monitoring these direct and indirect expenses, facilitating precise financial analysis and cost control.

Manufacturing Expense

Manufacturing expenses are categorized into direct expenses, which include raw materials and direct labor costs directly traceable to production, and indirect expenses, such as factory overhead, maintenance, and utilities that support manufacturing but cannot be linked to a specific product. Proper classification of these expenses is crucial for accurate cost accounting, pricing strategies, and financial reporting in manufacturing operations.

Administrative Expense

Administrative expense refers to costs incurred for general business operations that are not directly tied to production activities, categorizing them as indirect expenses rather than direct expenses. These expenses include salaries of office staff, rent, utilities, and office supplies, which support overall administrative functions instead of specific product manufacturing.

Prime Costs

Prime costs consist of direct expenses such as raw materials and direct labor that are directly traceable to product manufacturing. Indirect expenses, including overhead costs like utilities and indirect labor, are excluded from prime costs and categorized separately as manufacturing overhead.

Period Costs

Period costs are expenses that are not directly tied to the production process and include indirect expenses such as administrative salaries and rent, unlike direct expenses which are directly traceable to manufacturing products. These costs are recorded as operating expenses on the income statement and are expensed in the period incurred rather than being capitalized into inventory costs.

Apportionment

Apportionment involves systematically allocating indirect expenses, such as administrative salaries or rent, across various cost centers based on predefined criteria to ensure accurate cost distribution. Direct expenses, like raw materials or direct labor, are charged directly to specific projects or departments without apportionment due to their traceable nature.

direct expense vs indirect expense Infographic

moneydif.com

moneydif.com