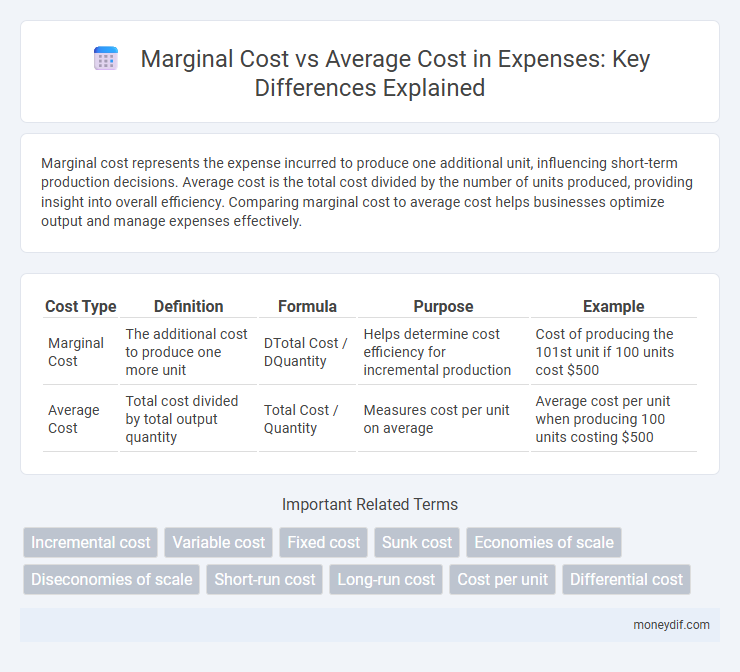

Marginal cost represents the expense incurred to produce one additional unit, influencing short-term production decisions. Average cost is the total cost divided by the number of units produced, providing insight into overall efficiency. Comparing marginal cost to average cost helps businesses optimize output and manage expenses effectively.

Table of Comparison

| Cost Type | Definition | Formula | Purpose | Example |

|---|---|---|---|---|

| Marginal Cost | The additional cost to produce one more unit | DTotal Cost / DQuantity | Helps determine cost efficiency for incremental production | Cost of producing the 101st unit if 100 units cost $500 |

| Average Cost | Total cost divided by total output quantity | Total Cost / Quantity | Measures cost per unit on average | Average cost per unit when producing 100 units costing $500 |

Introduction to Marginal and Average Cost

Marginal cost represents the expense incurred to produce one additional unit of output, highlighting the incremental increase in total cost. Average cost calculates the total expense divided by the number of units produced, reflecting the per-unit production cost. Understanding these cost concepts is essential for businesses to optimize pricing strategies and manage operational efficiency.

Defining Marginal Cost in Expense Management

Marginal cost in expense management represents the additional expense incurred from producing one more unit of a product or service, crucial for optimizing resource allocation and controlling incremental spending. It differs from average cost, which calculates the total expense divided by the number of units produced, providing a broader view of overall cost efficiency. Understanding marginal cost enables businesses to make informed decisions on scaling production without disproportionately increasing total expenditures.

Understanding Average Cost in Business Operations

Average cost in business operations represents the total cost of production divided by the number of units produced, providing insight into the efficiency of resource utilization. It includes fixed and variable expenses, helping managers set pricing strategies and forecast profitability. Monitoring average cost is crucial for identifying economies of scale and making informed decisions to optimize operational expenses.

Key Differences Between Marginal Cost and Average Cost

Marginal cost represents the expense incurred to produce one additional unit of output, reflecting variable cost changes at the production margin. Average cost calculates the total cost divided by the number of units produced, incorporating both fixed and variable costs to show per-unit expenditure. The primary difference lies in marginal cost's focus on incremental cost impact, while average cost provides an overall cost efficiency measure across all units.

Importance of Marginal Cost in Budgeting

Marginal cost plays a crucial role in budgeting by helping businesses determine the expense of producing one additional unit, enabling precise cost control and efficient allocation of resources. Unlike average cost, which provides the overall expense per unit, marginal cost offers real-time insight into incremental changes that directly impact profitability. Accurate assessment of marginal costs supports informed decision-making in scaling production and managing variable expenses.

Impact of Average Cost on Expense Analysis

Average cost significantly influences expense analysis by providing a clear metric for evaluating overall production efficiency. Tracking average cost helps businesses identify pricing strategies and optimize resource allocation to reduce expenses. Understanding average cost trends enables better budgeting and financial forecasting for sustained profitability.

When to Use Marginal Cost vs Average Cost

Marginal cost should be used when analyzing the expense of producing one additional unit, providing insights for decision-making on scaling production or pricing strategies. Average cost is more appropriate for evaluating overall efficiency and cost structure across total output, useful for budgeting and long-term financial planning. Understanding when to apply marginal cost versus average cost helps businesses optimize resource allocation and maximize profitability.

Real-World Examples: Marginal vs Average Cost

In manufacturing, marginal cost reflects the expense of producing one additional unit, such as in a car factory where adding an extra vehicle incurs costs for materials and labor specific to that unit, while average cost spreads total expenses across all units produced, providing insight into overall efficiency. For example, a bakery's marginal cost includes ingredients and labor for one more loaf, whereas the average cost accounts for all loaves baked over a period, helping price products competitively. Understanding marginal cost versus average cost enables businesses to make informed production level decisions that optimize profitability and resource allocation.

How Marginal and Average Costs Affect Pricing Strategies

Marginal cost represents the expense incurred to produce one additional unit, crucial for setting competitive prices that maximize profit without overproducing. Average cost, calculated by dividing total cost by total units produced, helps determine the break-even price point, guiding long-term pricing decisions. Companies prioritize marginal cost to adjust prices dynamically in response to market demand while using average cost to ensure prices cover overall expenses and sustain profitability.

Conclusion: Choosing the Right Cost Concept for Expense Control

Marginal cost analysis provides precise insights into the cost of producing one additional unit, making it essential for short-term expense control and decision-making. Average cost, spreading total expenses over all units produced, offers a broader perspective useful for long-term budgeting and pricing strategies. Balancing marginal and average cost assessments enables businesses to optimize expense control, improve profitability, and adapt to changing market conditions effectively.

Important Terms

Incremental cost

Incremental cost measures the expense of producing one additional unit, closely aligning with marginal cost, which represents the cost of the next unit produced; both focus on the variable cost changes tied to production volume. Average cost, however, calculates total production cost divided by the number of units, providing a per-unit cost perspective without isolating the impact of one additional unit.

Variable cost

Variable cost directly influences marginal cost, which represents the cost of producing one additional unit, while average cost calculates the total cost per unit by dividing overall costs by output volume. Marginal cost typically fluctuates with changes in variable cost, but average cost smooths these variations over total production.

Fixed cost

Fixed costs remain constant regardless of production level, causing average cost to decrease as output increases, while marginal cost reflects the cost of producing one additional unit without being affected by fixed costs.

Sunk cost

Sunk costs do not affect marginal cost or average cost calculations since they are past expenses that cannot be recovered and do not change with production levels.

Economies of scale

Economies of scale occur when increasing production reduces the average cost per unit, causing the average cost curve to decline as output expands. During this phase, the marginal cost typically remains below the average cost, pulling the average down and enhancing overall cost efficiency.

Diseconomies of scale

Diseconomies of scale occur when marginal cost rises above average cost, causing average cost to increase as production expands.

Short-run cost

Short-run marginal cost intersects average cost at its minimum point, indicating the level of output where producing one more unit shifts average cost from decreasing to increasing.

Long-run cost

Long-run cost minimizes average cost by adjusting all inputs, where marginal cost intersects average cost at its minimum point, indicating optimal production efficiency.

Cost per unit

Cost per unit decreases when marginal cost is below average cost and increases when marginal cost exceeds average cost.

Differential cost

Differential cost measures the cost difference between two alternatives, closely related to marginal cost which represents the cost of producing one additional unit, while average cost calculates the total cost per unit produced.

Marginal cost vs Average cost Infographic

moneydif.com

moneydif.com