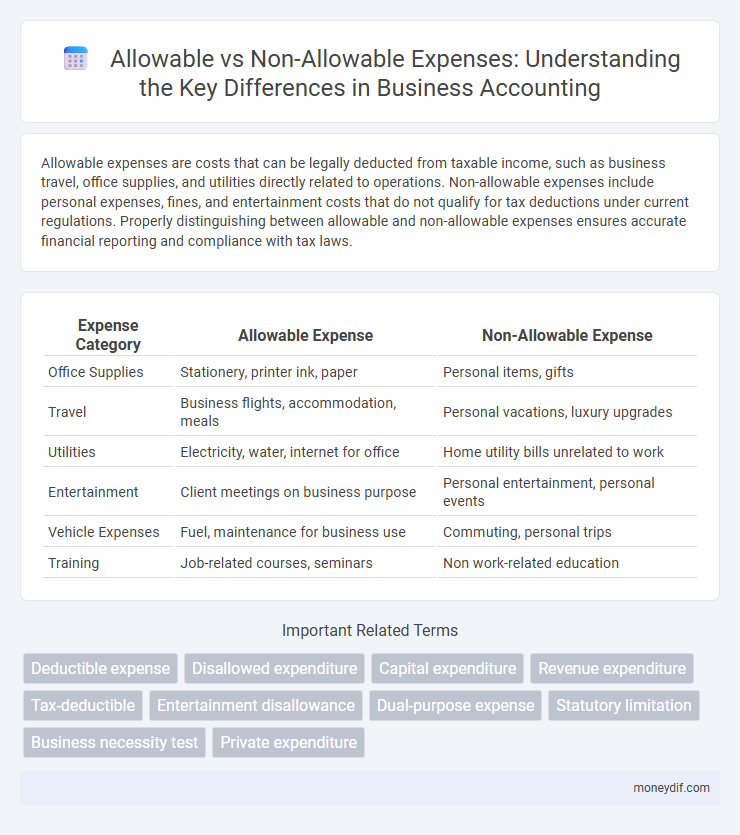

Allowable expenses are costs that can be legally deducted from taxable income, such as business travel, office supplies, and utilities directly related to operations. Non-allowable expenses include personal expenses, fines, and entertainment costs that do not qualify for tax deductions under current regulations. Properly distinguishing between allowable and non-allowable expenses ensures accurate financial reporting and compliance with tax laws.

Table of Comparison

| Expense Category | Allowable Expense | Non-Allowable Expense |

|---|---|---|

| Office Supplies | Stationery, printer ink, paper | Personal items, gifts |

| Travel | Business flights, accommodation, meals | Personal vacations, luxury upgrades |

| Utilities | Electricity, water, internet for office | Home utility bills unrelated to work |

| Entertainment | Client meetings on business purpose | Personal entertainment, personal events |

| Vehicle Expenses | Fuel, maintenance for business use | Commuting, personal trips |

| Training | Job-related courses, seminars | Non work-related education |

Understanding Allowable vs Non-Allowable Expenses

Allowable expenses refer to costs that can be legally deducted from taxable income, such as business-related travel, office supplies, and employee salaries. Non-allowable expenses include personal costs, fines, penalties, and certain entertainment expenses that tax authorities disallow for deductions. Understanding the distinction ensures accurate tax reporting and compliance with regulatory requirements.

Key Differences Between Allowable and Non-Allowable Expenses

Allowable expenses are costs that can be legally deducted from taxable income, such as business-related travel, office supplies, and salaries, directly supporting business operations. Non-allowable expenses include personal expenses, fines, and entertainment costs that are not tax-deductible under tax regulations. Understanding these distinctions is crucial for accurate financial reporting and compliance with tax laws.

Common Types of Allowable Expenses

Common types of allowable expenses typically include business-related costs such as office rent, utilities, employee salaries, and travel expenses directly tied to business operations. Other frequently accepted allowable expenses cover supplies, depreciation on business assets, and marketing costs that contribute to revenue generation. Proper documentation and adherence to tax regulations are essential to ensure these expenses qualify for deductions.

Examples of Non-Allowable Expenses

Non-allowable expenses typically include personal expenses, fines and penalties, and entertainment costs that do not directly relate to business operations. Examples of non-allowable expenses are gifts exceeding the statutory limit, private travel costs, and expenses incurred for club memberships unrelated to the business purpose. These costs cannot be deducted for tax purposes and must be clearly separated from allowable business expenses to maintain accurate financial records.

Tax Implications of Allowable Expenses

Allowable expenses directly reduce taxable income, resulting in lower tax liabilities for businesses and individuals when properly documented and justified. Non-allowable expenses, however, do not qualify for tax deductions and can trigger penalties or additional tax assessments if incorrectly claimed. Accurate classification of expenses ensures compliance with tax regulations and optimizes the overall tax strategy.

How to Identify Non-Allowable Expenses

Non-allowable expenses are costs that cannot be deducted for tax purposes or reimbursed by an organization, often including personal expenses, fines, and penalties. To identify non-allowable expenses, review the company's expense policy and applicable tax laws, focusing on categories explicitly excluded from deductions such as entertainment costs exceeding certain limits or expenses unrelated to business activities. Detailed documentation and clear categorization of receipts and invoices are essential to differentiate allowable from non-allowable expenses accurately.

Record Keeping for Allowable and Non-Allowable Expenses

Maintaining accurate and detailed records for allowable expenses is critical for tax compliance and maximizing deductible amounts, including receipts, invoices, and bank statements that clearly support business-related costs. Non-allowable expenses require equally precise documentation to ensure they are excluded from tax deductions and to avoid disputes during audits, often involving personal expenses or non-deductible items. Effective record keeping differentiates allowable from non-allowable expenses, facilitating clear financial reporting and regulatory adherence.

Impact on Business Profit and Tax Deductions

Allowable expenses reduce taxable income, directly increasing net profit margins by lowering tax liabilities. Non-allowable expenses do not qualify for tax deductions, which can result in higher taxable income and reduced after-tax profit. Understanding the distinction ensures accurate financial reporting and optimizes tax efficiency, enhancing overall business profitability.

Common Mistakes: Misclassifying Expenses

Misclassifying expenses often results in incorrect financial reporting, affecting tax liabilities and budgeting accuracy. Common mistakes include categorizing non-allowable expenses, such as personal costs or fines, as allowable business deductions, leading to potential penalties. Proper expense classification ensures compliance with tax regulations and accurate financial analysis.

Tips for Accurate Expense Classification

Accurate expense classification hinges on distinguishing allowable expenses, such as office supplies and business travel, from non-allowable ones like personal expenses or fines. Detailed documentation, including receipts and clear descriptions, supports compliance with tax regulations and internal policies. Regular training on updated expense guidelines enhances precision in identifying allowable versus non-allowable expenses.

Important Terms

Deductible expense

Deductible expenses are costs that tax authorities recognize as valid for reducing taxable income, falling under allowable expenses such as business operating costs and necessary equipment purchases. Non-allowable expenses, including personal expenses or fines, cannot be deducted and must be excluded from the calculation of taxable income.

Disallowed expenditure

Disallowed expenditure refers to costs that tax authorities specifically exclude from allowable expenses, meaning these expenses cannot be deducted when calculating taxable income. Examples include personal expenses, fines, and capital expenditures, which differ from allowable expenses such as business operating costs and employee salaries that qualify for tax deductions.

Capital expenditure

Capital expenditure (CapEx) includes costs for acquiring or upgrading physical assets and is generally classified as a non-allowable expense for tax purposes since it provides benefits over multiple years rather than within the current accounting period. Allowable expenses typically cover day-to-day operational costs fully deductible in the year incurred, whereas capital expenditures must be capitalized and depreciated or amortized over the asset's useful life.

Revenue expenditure

Revenue expenditure includes costs incurred for the day-to-day running of a business, with allowable expenses such as rent, utilities, and wages deductible for tax purposes, while non-allowable expenses like capital improvements or personal expenses are excluded from tax deductions. Understanding the distinction between allowable and non-allowable expenses is crucial for accurate financial reporting and compliance with tax regulations.

Tax-deductible

Tax-deductible expenses directly reduce taxable income and typically include allowable expenses such as business-related costs, salaries, and office supplies, while non-allowable expenses, like personal expenditures or fines, cannot be deducted for tax purposes. Understanding the distinction between allowable and non-allowable expenses is crucial for accurate tax reporting and maximizing allowable deductions under current tax regulations.

Entertainment disallowance

Entertainment disallowance refers to the portion of business entertainment expenses that tax authorities classify as non-allowable for deduction, differentiating them from allowable expenses which are wholly deductible when incurred entirely for business purposes. Strict guidelines and documentation requirements determine whether entertainment costs qualify as allowable, with personal or non-business related entertainment typically disallowed to prevent tax base erosion.

Dual-purpose expense

Dual-purpose expenses consist of costs incurred for both personal and business use, necessitating careful allocation to separate allowable expenses, which qualify for tax deductions, from non-allowable expenses that do not comply with tax regulations. Accurate documentation and proportional apportionment based on usage are essential to ensure compliance with tax authority guidelines and maximize allowable expense claims.

Statutory limitation

Statutory limitation defines the maximum period within which allowable and non-allowable expenses can be claimed or deducted for tax purposes, directly impacting financial reporting and compliance. Understanding the distinction between allowable expenses, which reduce taxable income, and non-allowable expenses, which are excluded from deductions, is crucial for adhering to tax regulations and optimizing tax liability.

Business necessity test

The Business Necessity Test determines whether an expense is allowable by assessing if it is essential and directly related to generating business income, such as office supplies and employee salaries. Non-allowable expenses typically include personal costs or fines that do not contribute to business operations or revenue generation.

Private expenditure

Private expenditure classifications distinguish allowable expenses, which include essential costs such as rent, utilities, and office supplies, from non-allowable expenses that cover personal costs, fines, and non-business-related purchases. Accurate categorization ensures compliance with tax regulations, maximizes deductible amounts, and aids in precise financial reporting.

Allowable expense vs Non-allowable expense Infographic

moneydif.com

moneydif.com