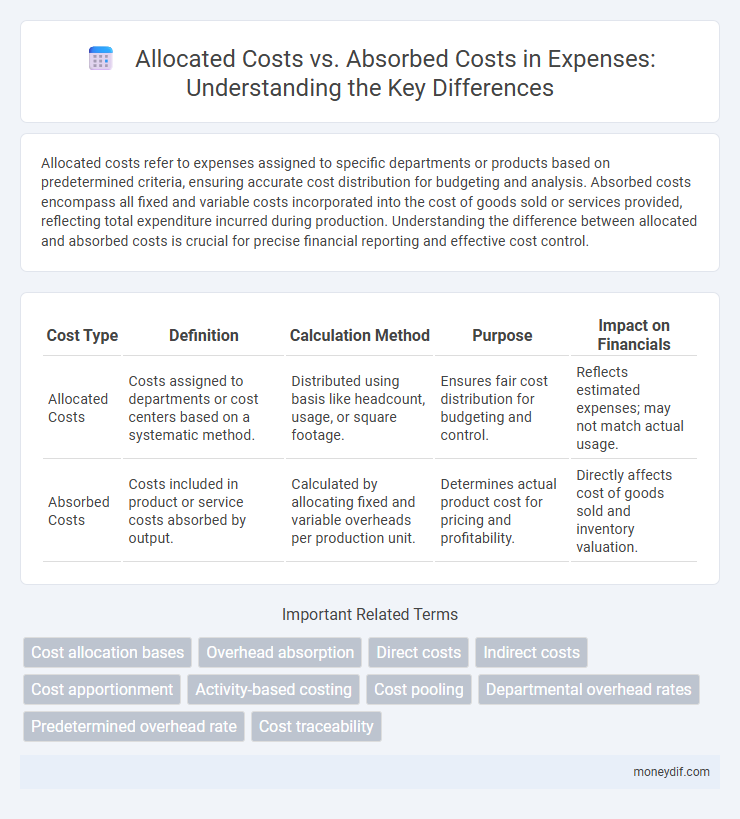

Allocated costs refer to expenses assigned to specific departments or products based on predetermined criteria, ensuring accurate cost distribution for budgeting and analysis. Absorbed costs encompass all fixed and variable costs incorporated into the cost of goods sold or services provided, reflecting total expenditure incurred during production. Understanding the difference between allocated and absorbed costs is crucial for precise financial reporting and effective cost control.

Table of Comparison

| Cost Type | Definition | Calculation Method | Purpose | Impact on Financials |

|---|---|---|---|---|

| Allocated Costs | Costs assigned to departments or cost centers based on a systematic method. | Distributed using basis like headcount, usage, or square footage. | Ensures fair cost distribution for budgeting and control. | Reflects estimated expenses; may not match actual usage. |

| Absorbed Costs | Costs included in product or service costs absorbed by output. | Calculated by allocating fixed and variable overheads per production unit. | Determines actual product cost for pricing and profitability. | Directly affects cost of goods sold and inventory valuation. |

Understanding Allocated Costs in Expense Management

Allocated costs in expense management represent expenses distributed to specific departments, projects, or cost centers based on predetermined criteria like usage or headcount. This method ensures precise tracking of overheads such as rent, utilities, and administrative salaries, facilitating accountability and budgeting accuracy. Understanding allocated costs helps organizations identify cost drivers and optimize resource utilization for better financial control.

What Are Absorbed Costs?

Absorbed costs represent the total expenses incurred to produce a product, including both fixed and variable manufacturing costs allocated to each unit. These costs are integrated into the inventory valuation and cost of goods sold under absorption costing, ensuring that all production overhead is accounted for. Accurately calculating absorbed costs is essential for financial reporting and pricing strategies in manufacturing businesses.

Key Differences Between Allocated and Absorbed Costs

Allocated costs refer to the distribution of indirect expenses to different departments or products based on a specific cost driver, ensuring accurate cost tracking. Absorbed costs include both direct and allocated indirect costs that are factored into the total production cost, reflecting the full expense incurred to produce goods or services. The key difference lies in allocation assigning portions of overhead, while absorption integrates these overhead costs into the final product cost for pricing and profitability analysis.

Importance of Cost Allocation in Financial Reporting

Cost allocation ensures expenses are accurately assigned to specific departments or products, enhancing the accuracy of financial reporting. Absorbed costs, representing both fixed and variable production expenses, provide a complete view of product cost for inventory valuation under absorption costing. Proper cost allocation improves decision-making, compliance with accounting standards, and transparent financial analysis for stakeholders.

How Absorbed Costs Impact Profit Margins

Absorbed costs directly influence profit margins by including both fixed and variable manufacturing expenses in product pricing, ensuring all production costs are accounted for in financial analysis. When absorbed costs are accurately calculated, they prevent underpricing and help maintain targeted profit margins by reflecting the true cost of goods sold. Over-absorbing costs may inflate profit margins superficially but can lead to misguided pricing strategies and inventory valuation errors.

Methods for Allocating Expenses

Methods for allocating expenses include direct allocation, step-down allocation, and reciprocal allocation, each distributing costs based on usage or benefit derived. Absorbed costs reflect expenses assigned to products or services through absorption costing, incorporating both fixed and variable overheads. Allocated costs represent expenses distributed across departments or cost centers to ensure accurate financial reporting and cost control.

Challenges in Absorbing Overhead Costs

Absorbing overhead costs presents significant challenges due to fluctuating production volumes and inaccurate cost drivers, which can lead to cost distortions and misallocation of resources. Allocated costs rely on predetermined rates, but absorbed costs must adjust in real-time to reflect actual overhead consumption, complicating budgeting and financial analysis. Businesses often struggle with overhead absorption in periods of underutilization, resulting in unfavorable variances and profitability issues.

Allocated vs. Absorbed Costs: Which Is More Accurate?

Allocated costs are assigned to cost objects based on estimated usage or pre-determined criteria, often leading to less precise cost representation. Absorbed costs, calculated through actual resource consumption including fixed and variable overheads, provide a more accurate reflection of total production expenses. For precise financial analysis and decision-making, absorbed costs typically offer greater accuracy by capturing real operational costs.

Best Practices for Managing Both Cost Types

Effective management of allocated costs and absorbed costs requires precise tracking and regular variance analysis to identify discrepancies and optimize budgeting accuracy. Implementing activity-based costing (ABC) enhances cost allocation by assigning expenses based on actual resource consumption, improving expense visibility across departments. Leveraging integrated financial software facilitates real-time monitoring, enabling timely adjustments and better alignment of costs with organizational performance goals.

Strategic Decision-Making Using Cost Analysis

Allocated costs represent expenses assigned to specific departments or products based on estimated usage, while absorbed costs reflect the actual expenses absorbed by a particular cost center, including both fixed and variable costs. Analyzing the differences between allocated and absorbed costs enables managers to identify inefficiencies and make informed strategic decisions about budgeting, pricing, and resource allocation. This cost analysis framework supports optimizing profitability by aligning cost control with operational performance and long-term business goals.

Important Terms

Cost allocation bases

Cost allocation bases determine how costs are distributed across departments or products, directly influencing allocated costs, which are assigned based on estimated drivers, versus absorbed costs, which reflect actual resource consumption recorded in financial statements.

Overhead absorption

Overhead absorption compares allocated costs assigned to cost centers with absorbed costs based on actual production output to ensure accurate cost distribution.

Direct costs

Direct costs refer to expenses directly attributable to a product or service, while allocated costs are indirect expenses distributed across cost centers, and absorbed costs represent the total costs assigned to products, including both direct and allocated costs.

Indirect costs

Indirect costs allocated to departments represent estimated expenses assigned based on cost drivers, while absorbed costs reflect the actual indirect costs charged to products or services through predetermined absorption rates.

Cost apportionment

Cost apportionment involves distributing indirect expenses between departments, where allocated costs represent budgeted shares assigned, and absorbed costs reflect actual expenses absorbed by production.

Activity-based costing

Activity-based costing (ABC) allocates costs by assigning overhead expenses to specific activities based on their consumption, ensuring more accurate cost distribution compared to traditional methods. Allocated costs refer to the budgeted or assigned expenses to cost centers, while absorbed costs represent the actual overhead costs applied to products or services based on activity drivers.

Cost pooling

Cost pooling groups similar expenses to allocate overhead efficiently, directly impacting the distinction between allocated costs, which are assigned based on estimated rates, and absorbed costs, representing actual overhead incurred during production. Accurate cost pooling enhances cost control by ensuring allocated costs closely match absorbed costs, improving financial analysis and decision-making in managerial accounting.

Departmental overhead rates

Departmental overhead rates allocate costs based on actual departmental expenses, while absorbed costs reflect overhead allocated to products using predetermined rates.

Predetermined overhead rate

The predetermined overhead rate calculates allocated costs based on estimated activity levels, while absorbed costs represent the actual overhead applied to production using this rate.

Cost traceability

Cost traceability enhances financial accuracy by distinctly identifying allocated costs assigned to cost centers versus absorbed costs representing actual expenses incurred during production.

Allocated costs vs Absorbed costs Infographic

moneydif.com

moneydif.com