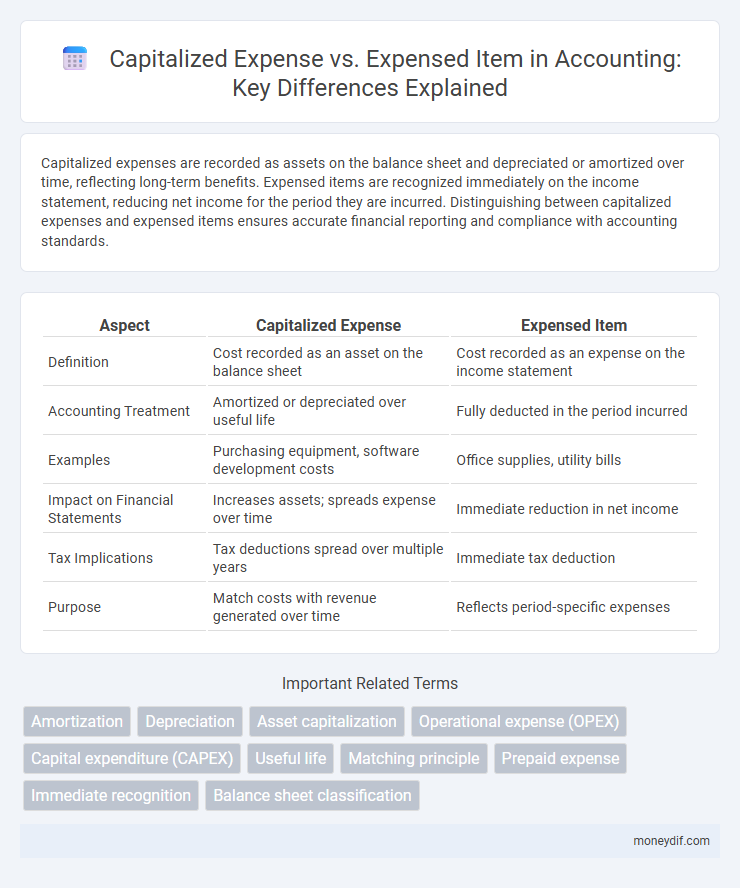

Capitalized expenses are recorded as assets on the balance sheet and depreciated or amortized over time, reflecting long-term benefits. Expensed items are recognized immediately on the income statement, reducing net income for the period they are incurred. Distinguishing between capitalized expenses and expensed items ensures accurate financial reporting and compliance with accounting standards.

Table of Comparison

| Aspect | Capitalized Expense | Expensed Item |

|---|---|---|

| Definition | Cost recorded as an asset on the balance sheet | Cost recorded as an expense on the income statement |

| Accounting Treatment | Amortized or depreciated over useful life | Fully deducted in the period incurred |

| Examples | Purchasing equipment, software development costs | Office supplies, utility bills |

| Impact on Financial Statements | Increases assets; spreads expense over time | Immediate reduction in net income |

| Tax Implications | Tax deductions spread over multiple years | Immediate tax deduction |

| Purpose | Match costs with revenue generated over time | Reflects period-specific expenses |

Understanding Capitalized Expenses vs Expensed Items

Capitalized expenses refer to costs incurred to acquire or improve long-term assets, recorded on the balance sheet and depreciated over time, enhancing the asset's value on financial statements. Expensed items are costs recognized immediately in the income statement, reducing net income for the period and reflecting routine operational expenditures. Understanding the distinction between capitalized expenses and expensed items is crucial for accurate financial reporting, tax treatment, and investment analysis.

Key Differences Between Capitalization and Expensing

Capitalized expenses are recorded as assets on the balance sheet, providing long-term value and depreciated over time, whereas expensed items are immediately recognized on the income statement, reducing net income in the current period. The key difference lies in timing and impact on financial statements: capitalization delays expense recognition, improving short-term profitability, while expensing reflects costs immediately. Capitalization applies to significant investments like equipment or software, while routine costs such as maintenance or supplies are typically expensed.

Criteria for Capitalizing an Expense

Capitalized expenses must meet specific criteria including probable future economic benefits and the ability to reliably measure the cost. Items that extend the asset's useful life, improve efficiency, or increase capacity are generally capitalized rather than expensed immediately. Expenses failing to meet these criteria are recognized as an expensed item in the income statement.

Examples of Capitalized Expenses

Capitalized expenses include costs such as purchasing machinery, building renovations, and software development expenses directly related to creating a new product. These costs are recorded as assets on the balance sheet and depreciated over their useful life, contrasting with expensed items like office supplies or utility bills that are immediately recognized in the income statement. Capitalizing expenses improves financial analysis by matching the cost of long-term investments with the revenue they generate over time.

When Should an Expense Be Expensed?

An expense should be expensed when it provides no future economic benefit beyond the current accounting period, ensuring accurate reflection of costs on the income statement. Routine costs like office supplies, utilities, and repairs are typically expensed immediately to match revenue with expenses during the period incurred. Capitalized expenses, by contrast, involve significant costs such as equipment or software that are amortized over their useful lives due to their ongoing value.

Impact on Financial Statements

Capitalized expenses appear on the balance sheet as assets and are depreciated or amortized over time, spreading the cost across multiple periods, which improves short-term profitability and asset valuation. Expensed items are recorded immediately on the income statement, reducing net income for the period but providing a clearer view of current operational costs. The choice between capitalization and expensing directly affects key financial ratios such as return on assets (ROA) and earnings before interest and taxes (EBIT), influencing investor perception and loan covenants.

Tax Implications: Capitalized vs Expensed

Capitalized expenses are recorded as assets on the balance sheet and depreciated or amortized over time, which defers tax deductions and spreads the tax benefit across multiple years. Expensed items are fully deducted in the tax year incurred, providing immediate tax relief but no future deductions. Understanding the tax implications between capitalized and expensed costs is essential for optimizing cash flow and accurately managing taxable income.

Best Practices for Accurate Expense Classification

Accurate expense classification requires distinguishing capitalized expenses, which are recorded as assets and depreciated over time, from expensed items that are immediately recognized in the income statement. Best practices include implementing clear accounting policies, conducting regular training for finance teams, and utilizing detailed asset tracking systems to ensure consistent application of capitalization thresholds. Proper documentation and periodic audits help maintain compliance with financial reporting standards and enhance transparency.

Common Mistakes in Expense Recognition

Common mistakes in expense recognition often involve misclassifying capitalized expenses and expensed items, leading to inaccurate financial statements. Capitalized expenses, such as equipment purchases, should be recorded as assets and depreciated over time, while expensed items, like office supplies, must be fully recognized in the period incurred. Confusing these categories results in misstated profits and can affect tax calculations and compliance with accounting standards like GAAP and IFRS.

Decision-Making Tips: Capitalize or Expense?

Evaluating whether to capitalize or expense an item hinges on its expected benefit period and materiality; capitalize costs that provide utility beyond the current fiscal year to enhance asset valuation and financial reporting accuracy. Expensing items immediately reduces taxable income and reflects costs incurred within the accounting period, beneficial for managing short-term profitability metrics. Careful analysis of accounting standards such as GAAP or IFRS, alongside business objectives, ensures optimal decision-making that balances financial performance and compliance.

Important Terms

Amortization

Amortization is the process of gradually writing off the cost of a capitalized expense, such as software development or patent costs, over its useful life, reflecting the asset's consumption over time. In contrast, an expensed item is recognized immediately in the income statement, reducing the period's profit without future allocation.

Depreciation

Depreciation allocates the cost of a capitalized expense, such as equipment or buildings, over its useful life, reflecting the gradual consumption of the asset's value. In contrast, expensed items are fully recognized on the income statement in the period incurred, without capitalization or subsequent depreciation.

Asset capitalization

Asset capitalization involves recording expenditures as assets on the balance sheet when they provide future economic benefits, distinguishing capitalized expenses from expensed items that are immediately recognized on the income statement. Capitalized expenses, such as costs for equipment acquisition or property improvements, increase the asset base and are depreciated over time, while expensed items, like routine maintenance or small repairs, are charged fully in the period incurred.

Operational expense (OPEX)

Operational expense (OPEX) refers to the day-to-day costs required to run a business, distinct from capitalized expenses that are recorded as assets and amortized over time. While expensed items directly impact the profit and loss statement immediately, capitalized expenses improve operational efficiency by spreading costs across multiple accounting periods.

Capital expenditure (CAPEX)

Capital expenditure (CAPEX) refers to funds used by a company to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment, where expenses are capitalized and depreciated over the asset's useful life. In contrast, expensed items are costs recorded immediately on the income statement, reflecting expenses that benefit only the current period without capitalization.

Useful life

Useful life determines the period over which a capitalized expense, such as equipment or property, is depreciated or amortized on the balance sheet, reflecting its value reduction over time. In contrast, expensed items are recorded immediately on the income statement and do not extend over multiple accounting periods.

Matching principle

The matching principle requires capitalized expenses, such as equipment costs, to be recorded as assets and depreciated over their useful life, ensuring expenses align with the revenue generated. In contrast, expensed items are recognized immediately in the income statement, reflecting costs that provide no future economic benefit.

Prepaid expense

Prepaid expenses represent payments made in advance for goods or services, initially recorded as assets and later capitalized as expenses over time to match the benefit period. Unlike expensed items that are immediately recognized on the income statement, capitalized expenses spread the cost across multiple periods, enhancing accurate financial reporting and compliance with accrual accounting principles.

Immediate recognition

Immediate recognition impacts financial statements by recording expenses directly against income, unlike capitalized expenses which are deferred and amortized over time. This approach affects profitability and tax calculations by increasing current period expenses and reducing net income immediately.

Balance sheet classification

Balance sheet classification differentiates capitalized expenses, recorded as assets and amortized over time, from expensed items, which are immediately recognized on the income statement and reduce net income. Proper classification ensures accurate financial statement presentation by reflecting capitalized costs in long-term assets and expensed costs in current period profitability.

Capitalized expense vs Expensed item Infographic

moneydif.com

moneydif.com