Soft money refers to contributions made to political parties for activities like voter mobilization and issue advocacy, which are not regulated by federal campaign finance laws. Hard money consists of contributions directly given to candidates or their campaigns, subject to strict limits and disclosure requirements. Understanding the distinction between soft and hard money is crucial for navigating campaign finance regulations and ensuring compliance.

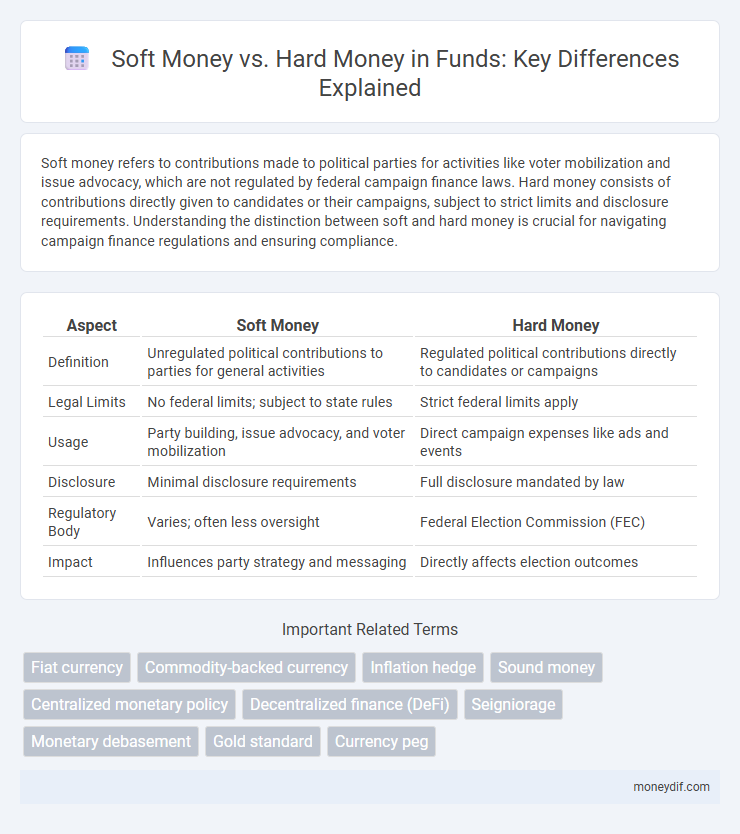

Table of Comparison

| Aspect | Soft Money | Hard Money |

|---|---|---|

| Definition | Unregulated political contributions to parties for general activities | Regulated political contributions directly to candidates or campaigns |

| Legal Limits | No federal limits; subject to state rules | Strict federal limits apply |

| Usage | Party building, issue advocacy, and voter mobilization | Direct campaign expenses like ads and events |

| Disclosure | Minimal disclosure requirements | Full disclosure mandated by law |

| Regulatory Body | Varies; often less oversight | Federal Election Commission (FEC) |

| Impact | Influences party strategy and messaging | Directly affects election outcomes |

Introduction to Soft Money and Hard Money

Soft money refers to funds donated to political parties for general party-building activities, unregulated by federal contribution limits, often used to influence elections indirectly. Hard money involves direct contributions to candidates or campaigns, strictly regulated by the Federal Election Commission to ensure transparency and limit the influence of large donors. Understanding the distinctions between soft money and hard money is essential for navigating campaign finance laws and compliance.

Defining Soft Money in Fundraising

Soft money in fundraising refers to contributions made to political parties or committees that are not subject to federal limits or regulations, often used for party-building activities and issue advocacy rather than direct candidate support. These funds enable organizations to raise unlimited amounts from individuals, corporations, and unions, promoting broader political influence without direct coordination with candidates. The distinction between soft money and hard money lies in regulatory oversight, with hard money subject to strict contribution limits and disclosure rules under the Federal Election Campaign Act (FECA).

Understanding Hard Money in Financial Contexts

Hard money refers to funds raised through regulated channels with strict legal limits on contributions, ensuring transparency and accountability in financial transactions. In political campaigns, hard money is directly contributed to candidates and subject to federal regulations, contrasting with soft money, which is unregulated and often used for indirect support. Understanding hard money is essential for navigating compliance requirements and maintaining ethical fundraising practices in finance.

Key Differences Between Soft Money and Hard Money

Soft money refers to funds raised outside federal election regulations, often used for party-building activities and issue advocacy, while hard money is strictly regulated campaign contributions made directly to candidates for electoral campaigns. Hard money donations have specific limits and disclosure requirements established by the Federal Election Commission (FEC), ensuring transparency and accountability. Soft money lacks such federal limits and is typically raised and spent by political parties or organizations without direct candidate coordination.

Advantages and Disadvantages of Soft Money

Soft money allows unlimited contributions to political parties, enabling significant funding for issue advocacy and campaign infrastructure. Its advantages include flexibility in raising large sums and supporting broad policy initiatives, but disadvantages involve lack of transparency and potential for undue influence due to fewer regulations. This type of funding often faces criticism for enabling bypass of federal limits, reducing accountability in the political finance system.

Pros and Cons of Hard Money

Hard money funding offers fast approval and less stringent credit requirements, making it ideal for borrowers needing quick access to capital or with less-than-perfect credit. However, its higher interest rates and shorter loan terms increase overall borrowing costs and repayment pressure. Limited lender options and strict collateral requirements often restrict accessibility and increase risk for some borrowers.

Regulatory Considerations and Compliance

Soft money contributions are unregulated donations typically directed to political parties for party-building activities, exempt from federal limits but subject to state laws, creating complex compliance challenges for fund managers. Hard money contributions are strictly regulated, with clear federal limits and reporting requirements enforced by the Federal Election Commission (FEC) to ensure transparency and prevent corruption. Effective fund management requires rigorous adherence to distinct regulatory frameworks governing soft and hard money to mitigate legal risks and maintain compliance.

Impact on Investment Strategies

Soft money contributions, often unregulated and unlimited, can create unpredictable funding flows impacting long-term investment strategies by increasing volatility and risk exposure. Hard money, strictly regulated with contribution limits, promotes more stable and transparent funding, enabling investors to plan and allocate assets with greater confidence. The contrasting regulatory environments between soft and hard money influence portfolio diversification and risk management approaches.

Real-World Examples of Soft and Hard Money Funds

Soft money funds, such as super PACs, collect unlimited contributions from individuals and corporations to finance political campaigns, often influencing elections through extensive advertising expenditures. Hard money funds, exemplified by candidate campaigns and political action committees (PACs), adhere to strict contribution limits set by the Federal Election Commission, ensuring regulated transparency and accountability. Notable real-world examples include the 2020 U.S. presidential campaigns, where soft money influx from external groups contrasted sharply with hard money donations reported directly by the candidates.

Choosing the Right Funding Option for Your Needs

Hard money offers regulated campaign contributions with strict limits, ensuring transparency and compliance, while soft money allows unlimited donations primarily for party-building activities but lacks direct candidate support. Selecting the right funding option depends on your campaign's goals, compliance requirements, and the desired impact on voter outreach. Understanding these distinctions helps maximize resources while adhering to legal frameworks and strategic priorities.

Important Terms

Fiat currency

Fiat currency, defined by government decree rather than intrinsic value, contrasts sharply with hard money, which is backed by physical commodities like gold or silver, offering intrinsic worth and stability. Soft money, often associated with fiat currency, tends to be more susceptible to inflation and devaluation due to its elastic supply controlled by central banks.

Commodity-backed currency

Commodity-backed currency relies on physical assets like gold or silver to maintain value, providing stability characteristic of hard money; in contrast, soft money refers to fiat currency without intrinsic backing, often susceptible to inflation and devaluation. This distinction highlights hard money's role in preserving purchasing power versus soft money's flexibility for economic policy but potential for decreased value.

Inflation hedge

Investing in hard money assets such as gold or stable cryptocurrencies provides a reliable inflation hedge by preserving purchasing power during periods of soft money devaluation caused by excessive fiat currency supply. Soft money, often characterized by fiat currencies with elastic supply, tends to lose value over time, making hard money invaluable for mitigating inflation risks and economic uncertainty.

Sound money

Sound money refers to a monetary system backed by a stable asset such as gold or silver, ensuring long-term value preservation and low inflation. Soft money, often linked to fiat currencies, allows for flexible supply expansion, which can lead to inflation, whereas hard money restricts supply to prevent devaluation.

Centralized monetary policy

Centralized monetary policy, controlled by a central bank, influences the supply of soft money, which is inflation-prone and easily expandable, versus hard money, backed by tangible assets like gold offering stability and reduced inflation risk. This policy balance impacts economic factors such as inflation rates, interest levels, and overall financial market stability.

Decentralized finance (DeFi)

Decentralized finance (DeFi) leverages blockchain technology to create transparent, trustless financial systems that contrast soft money's inflationary nature with hard money's fixed supply, exemplified by cryptocurrencies like Bitcoin.

Seigniorage

Seigniorage refers to the profit generated by a government when issuing currency, especially noticeable under soft money systems where inflation can erode currency value, allowing authorities to finance deficits by printing money. In contrast, hard money, typically backed by physical assets like gold, limits seigniorage opportunities due to constrained money supply growth and enhanced currency stability.

Monetary debasement

Monetary debasement occurs when a government reduces the value of its currency by increasing the money supply or lowering the precious metal content in coins, directly impacting the stability of soft money, which lacks intrinsic value, compared to hard money backed by tangible assets like gold or silver. The preference for hard money arises from its resistance to inflation and depreciation, contrasting with the inflationary risks inherent in soft money systems prone to debasement.

Gold standard

The gold standard, a monetary system where currency value is directly linked to gold, contrasts sharply with the concepts of soft money and hard money in economic policy debates; soft money refers to unregulated or less regulated funds often associated with inflationary policies, while hard money advocates support currency backed by tangible assets like gold to ensure stability and control inflation. Historically, adherence to the gold standard has been championed by hard money proponents who argue it prevents excessive monetary expansion, unlike soft money policies that can lead to devaluation and economic instability.

Currency peg

Currency peg stabilizes exchange rates by linking a nation's currency value to a more stable hard currency, mitigating the volatility associated with soft money policies characterized by inflationary pressures and weak monetary discipline. This mechanism enhances investor confidence and promotes economic stability by anchoring soft money economies to the discipline of hard money principles.

Soft money vs Hard money Infographic

moneydif.com

moneydif.com