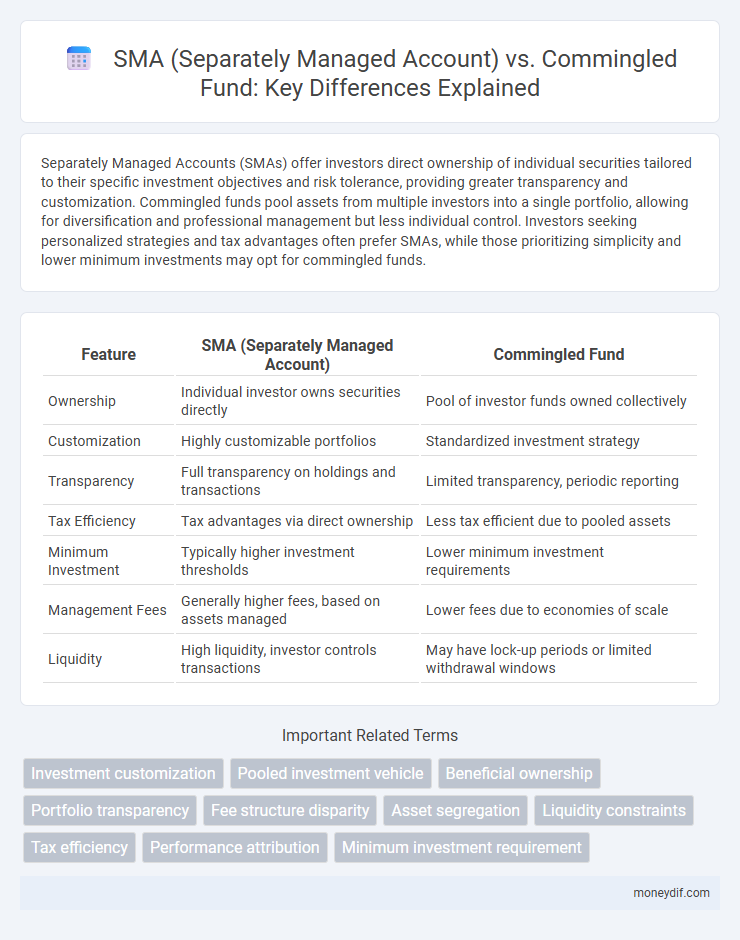

Separately Managed Accounts (SMAs) offer investors direct ownership of individual securities tailored to their specific investment objectives and risk tolerance, providing greater transparency and customization. Commingled funds pool assets from multiple investors into a single portfolio, allowing for diversification and professional management but less individual control. Investors seeking personalized strategies and tax advantages often prefer SMAs, while those prioritizing simplicity and lower minimum investments may opt for commingled funds.

Table of Comparison

| Feature | SMA (Separately Managed Account) | Commingled Fund |

|---|---|---|

| Ownership | Individual investor owns securities directly | Pool of investor funds owned collectively |

| Customization | Highly customizable portfolios | Standardized investment strategy |

| Transparency | Full transparency on holdings and transactions | Limited transparency, periodic reporting |

| Tax Efficiency | Tax advantages via direct ownership | Less tax efficient due to pooled assets |

| Minimum Investment | Typically higher investment thresholds | Lower minimum investment requirements |

| Management Fees | Generally higher fees, based on assets managed | Lower fees due to economies of scale |

| Liquidity | High liquidity, investor controls transactions | May have lock-up periods or limited withdrawal windows |

Overview of SMA and Commingled Fund Structures

Separately Managed Accounts (SMAs) are investment portfolios owned by individual investors, allowing tailored asset selection and direct ownership of securities. Commingled funds pool assets from multiple investors into a single investment vehicle, providing diversification and professional management but with shared ownership of underlying assets. SMAs typically offer greater customization and transparency, while commingled funds benefit from economies of scale and simplified administrative processes.

Key Differences Between SMAs and Commingled Funds

Separately Managed Accounts (SMAs) offer investors direct ownership of individual securities, allowing for tailored investment strategies and greater customization compared to commingled funds, which pool assets from multiple investors into a single portfolio. SMAs provide enhanced transparency and tax efficiency as investors can monitor and manage their specific holdings, whereas commingled funds often result in less visibility and collective tax consequences. The minimum investment threshold for SMAs is typically higher, reflecting personalized management, while commingled funds enable broader accessibility through diversified, professionally managed portfolios.

Investment Customization: SMA vs. Commingled Fund

Separately Managed Accounts (SMAs) offer a higher degree of investment customization by allowing investors to tailor their portfolios according to specific asset preferences, risk tolerance, and tax considerations. In contrast, Commingled Funds pool assets from multiple investors into a single portfolio, limiting individual customization but providing economies of scale and professional management. Investors seeking personalized asset allocation and tax strategies typically prefer SMAs over the standardized approach of Commingled Funds.

Fee Structures and Transparency Comparison

Separately Managed Accounts (SMAs) typically charge asset-based fees that are directly correlated to the individual's portfolio size, offering transparent cost structures with clear breakdowns of management and performance fees. Commingled funds often employ a layered fee approach, combining management fees and performance fees within the fund's overall expense ratio, which may obscure exact costs due to pooling of assets. SMAs provide greater transparency through individualized reporting and fee disclosures, while commingled funds offer less transparency because fees are embedded in the net asset value and not itemized per investor.

Tax Efficiency: SMA vs. Commingled Fund

Separately Managed Accounts (SMAs) offer superior tax efficiency compared to commingled funds due to their customized portfolio management, allowing for direct ownership of securities and tailored tax-loss harvesting. Commingled funds aggregate assets from multiple investors, limiting individual control over tax events and often resulting in less favorable capital gains distributions. Investors seeking to optimize after-tax returns typically prefer SMAs for their ability to manage tax liabilities on a personalized basis.

Portfolio Liquidity and Accessibility

Separately Managed Accounts (SMAs) offer enhanced portfolio liquidity due to direct ownership of individual securities, allowing investors to buy or sell assets without delay. In contrast, Commingled Funds aggregate assets from multiple investors, which can lead to redemption restrictions or delays impacting accessibility. Investors seeking immediate access to their investments typically favor SMAs for their transparent and flexible trading capabilities.

Risk Management Approaches

Separately Managed Accounts (SMAs) offer personalized risk management through tailored asset allocation and direct ownership of securities, enabling investors to align portfolios with specific risk tolerances and investment objectives. In contrast, commingled funds pool assets from multiple investors, employing standardized risk management strategies and diversification across broader market segments to mitigate systemic risk. SMAs provide transparency and individual control over risk exposures, whereas commingled funds rely on professional management to balance risk across aggregated investor capital.

Minimum Investment Requirements

Separately Managed Accounts (SMAs) typically require higher minimum investments, often ranging from $100,000 to $1 million, to provide personalized portfolio management and direct ownership of individual securities. Commingled funds generally have lower minimum investment thresholds, sometimes as low as $25,000, making them more accessible to a broader range of investors. The higher minimum for SMAs reflects the customization and greater control offered, while commingled funds prioritize diversification and economy of scale through pooled assets.

Performance Reporting and Client Communication

Performance reporting in Separately Managed Accounts (SMAs) offers transparency through individualized, real-time data tailored to each investor's holdings, contrasting with commingled funds that provide aggregated results reflecting pooled assets. Client communication in SMAs benefits from personalized portfolio insights and direct ownership clarity, while commingled funds emphasize standardized updates and collective performance summaries. The inherent customization of SMAs enhances precise performance attribution and fosters more detailed, client-specific dialogue compared to the aggregated nature of commingled fund reporting.

Choosing Between SMA and Commingled Fund: Which Is Right for You?

Separately Managed Accounts (SMAs) offer personalized portfolio customization, direct ownership of securities, and enhanced tax efficiency, making them ideal for investors seeking tailored investment strategies and transparency. Commingled Funds pool assets from multiple investors, providing cost-effective diversification and professional management but with less individual control and potential tax inefficiencies. Choosing between an SMA and a Commingled Fund depends on factors like investment size, customization needs, tax considerations, and desired level of control over asset selection.

Important Terms

Investment customization

Investment customization in SMAs (Separately Managed Accounts) offers direct ownership of individual securities, allowing tailored portfolio strategies based on specific client goals, risk tolerance, and tax considerations. In contrast, commingled funds pool investor assets into a single portfolio with standardized strategies, limiting personalization but providing diversification and professional management at a lower minimum investment threshold.

Pooled investment vehicle

Pooled investment vehicles combine assets from multiple investors into a single fund, offering diversified exposure and professional management, while Separately Managed Accounts (SMAs) provide individualized portfolios tailored to specific client objectives and preferences. SMAs offer greater transparency and customization with direct ownership of securities, contrasting with commingled funds where investors share collective ownership and less personalized control.

Beneficial ownership

Beneficial ownership in Separately Managed Accounts (SMAs) allows investors direct ownership of securities, providing transparency and control over individual assets, whereas in commingled funds, investors hold pro-rata shares of the pooled fund without specific security ownership, resulting in less transparency and control. This distinction significantly impacts tax reporting, regulatory compliance, and investor customization in portfolio management.

Portfolio transparency

Portfolio transparency in Separately Managed Accounts (SMAs) allows investors direct insight into individual holdings and real-time position updates, enhancing personalized asset management compared to commingled funds where investments are pooled, and specific asset details remain aggregated and less accessible. SMAs provide greater control over tax strategies and customization due to this transparency, whereas commingled funds offer diversification but with limited visibility into underlying securities.

Fee structure disparity

Fee structure disparity between SMA and commingled funds often arises as SMAs typically charge higher management fees reflecting personalized portfolio management, whereas commingled funds offer lower fees due to pooled asset management.

Asset segregation

Asset segregation in SMAs ensures individual ownership and tailored investment strategies, offering greater transparency and control compared to commingled funds where assets are pooled and managed collectively.

Liquidity constraints

Liquidity constraints in Separately Managed Accounts (SMAs) typically allow for greater customization and more frequent access to assets compared to Commingled Funds, which often impose stricter redemption schedules and less flexibility due to pooled investment structures.

Tax efficiency

Separately Managed Accounts (SMAs) offer superior tax efficiency compared to commingled funds by allowing individualized tax management, such as tailored capital gains harvesting and loss harvesting strategies. SMAs enable investors to directly control tax lot selection and timing of transactions, minimizing the impact of capital gains distributions typically experienced in pooled commingled funds.

Performance attribution

Performance attribution in Separately Managed Accounts (SMAs) offers granular insight into individual security contributions and customization effects, whereas commingled funds provide aggregated performance data that may obscure specific driver analysis.

Minimum investment requirement

The minimum investment requirement for a Separately Managed Account (SMA) typically ranges from $100,000 to $1 million, significantly higher than the lower minimum thresholds often found in commingled funds, which can start as low as $25,000.

SMA (Separately Managed Account) vs Commingled Fund Infographic

moneydif.com

moneydif.com