GP commitment refers to the general partner's financial stake in a fund, aligning their interests with limited partners by investing their own capital. LP commitment represents the capital contributed by limited partners who provide the majority of the fund's investment capital but have limited liability and no active management role. A higher GP commitment can signal strong confidence from the management team, fostering trust and alignment with LPs' investment goals.

Table of Comparison

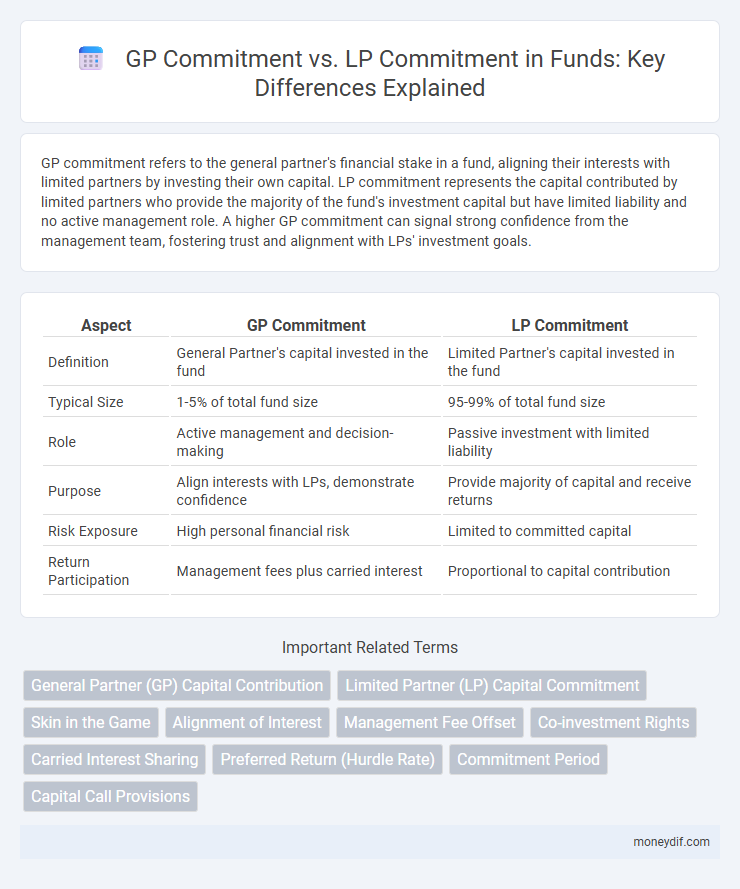

| Aspect | GP Commitment | LP Commitment |

|---|---|---|

| Definition | General Partner's capital invested in the fund | Limited Partner's capital invested in the fund |

| Typical Size | 1-5% of total fund size | 95-99% of total fund size |

| Role | Active management and decision-making | Passive investment with limited liability |

| Purpose | Align interests with LPs, demonstrate confidence | Provide majority of capital and receive returns |

| Risk Exposure | High personal financial risk | Limited to committed capital |

| Return Participation | Management fees plus carried interest | Proportional to capital contribution |

Understanding GP Commitment in Fund Structures

GP commitment represents the capital portion that General Partners invest in a fund, typically ranging from 1% to 5% of total commitments, aligning their interests with Limited Partners (LPs). This investment demonstrates the GP's confidence and ensures they share in both risks and rewards, promoting disciplined fund management and long-term value creation. Understanding GP commitment is crucial for evaluating fund alignment, as it directly impacts governance, incentives, and overall fund performance.

Defining LP Commitment and Its Significance

LP commitment represents the capital that limited partners legally agree to invest in a fund, often spanning several years and drawn down gradually as investment opportunities arise. This commitment is crucial for fund managers as it signals financial backing stability, enabling strategic investment planning and operational confidence. Understanding LP commitment helps clarify the alignment of interests between limited partners and general partners and the fund's overall capital structure.

Key Differences: GP vs LP Commitment

GP commitment involves the general partner investing personal capital into the fund, aligning their interests with limited partners by demonstrating confidence in the fund's success. LP commitment refers to limited partners pledging capital but having a passive role without direct management responsibility, focusing on financial return rather than operational control. The key difference lies in GP's active management role and skin in the game versus LP's primarily financial investment with limited liability.

Why GP Commitment Matters to Investors

GP commitment matters to investors because it aligns the general partner's interests with those of limited partners, ensuring that GPs have significant skin in the game and are motivated to maximize fund performance. A meaningful GP commitment serves as a signal of confidence and confidence in the investment strategy, reducing agency risk. This alignment promotes accountability and fosters trust, making it a critical factor in limited partners' investment decisions.

How LP Commitments Drive Fund Size and Strategy

LP commitments significantly influence fund size by providing the majority of capital, enabling greater investment capacity and diversification. The amount committed by LPs shapes the fund's strategic direction, as GPs tailor investment opportunities to meet LPs' risk tolerance, return expectations, and sector preferences. Large LP commitments also enhance credibility, attracting co-investors and facilitating access to premium deals that align with the fund's objectives.

Risks and Rewards: GP vs LP Perspectives

GP commitment involves the general partner investing their own capital into the fund, aligning interests with limited partners while assuming higher risk due to active management and potential liability. LP commitment represents limited partners' capital contribution with limited liability and passive involvement, focusing on potential diversified returns but limited control over fund decisions. The reward for GPs includes management fees and carried interest, reflecting performance incentives, whereas LPs rely mainly on return on investment and capital protection within the fund's risk framework.

Impact of GP Commitment on Fund Performance

GP Commitment directly influences fund performance by aligning the general partner's financial interests with those of limited partners, fostering stronger incentives for prudent decision-making and value creation. Evidence suggests funds with higher GP commitments often demonstrate superior returns and lower risk profiles due to this skin-in-the-game effect. Studies from Cambridge Associates and Preqin indicate that a GP commitment of at least 1-5% of the fund size correlates with enhanced operational discipline and improved portfolio outcomes.

Negotiating LP Commitment Terms

Negotiating LP commitment terms requires careful consideration of capital call schedules, management fees, and distribution waterfalls to align interests between General Partners (GPs) and Limited Partners (LPs). LPs often seek protections such as clawback provisions, key person clauses, and transparency in reporting to minimize risk exposure. Clear agreement on fund duration, commitment triggers, and co-investment rights enhances trust and ensures smoother capital deployment throughout the fund lifecycle.

Best Practices for Aligning GP and LP Interests

GP commitment typically ranges from 1% to 5% of the total fund size, signaling skin in the game and fostering trust with LPs. LPs prioritize transparent reporting, clear vesting schedules, and proportional GP contributions to ensure aligned incentives throughout the fund's lifecycle. Structured co-investment opportunities and clawback provisions further enhance alignment by balancing risk-sharing and performance rewards between GPs and LPs.

Trends in GP and LP Commitments in the Fund Industry

GP commitments have steadily increased, reflecting a growing alignment of interest between general partners and limited partners in private equity funds. Limited partner commitments continue to diversify, with institutional investors expanding allocations to niche sectors and emerging markets. Both trends indicate a robust confidence in fund performance and a strategic shift toward long-term value creation.

Important Terms

General Partner (GP) Capital Contribution

General Partner (GP) Capital Contribution typically ranges from 1% to 5% of total fund commitments, significantly lower than Limited Partner (LP) commitments, reinforcing the GP's alignment of interest without disproportionately diluting LP equity.

Limited Partner (LP) Capital Commitment

Limited Partner (LP) capital commitments typically exceed General Partner (GP) commitments, reflecting LPs' primary role in providing the bulk of funding while GPs contribute a smaller stake to align interests and ensure active management.

Skin in the Game

Skin in the Game indicates that General Partners (GPs) invest a significant portion of their own capital alongside Limited Partners (LPs) to align interests and ensure prudent fund management.

Alignment of Interest

Alignment of interest between General Partners (GPs) and Limited Partners (LPs) is demonstrated by GP commitments typically ranging from 1% to 5% of total capital, ensuring GPs have significant financial stakes aligned with LPs' investment outcomes.

Management Fee Offset

Management fee offset reduces the limited partners' commitment by applying a portion of the general partner's committed capital to cover management fees, aligning GP commitment with fund expenses.

Co-investment Rights

Co-investment rights allow limited partners (LPs) to invest alongside general partners (GPs), proportionally enhancing LPs' exposure relative to GP commitment in private equity deals.

Carried Interest Sharing

Carried interest sharing primarily depends on the ratio between General Partner (GP) commitment and Limited Partner (LP) commitment, influencing profit distribution and alignment of investment incentives.

Preferred Return (Hurdle Rate)

Preferred Return (Hurdle Rate) is a fixed annual percentage that Limited Partners (LPs) must receive on their committed capital before General Partners (GPs) participate in profit sharing, ensuring LPs achieve a minimum return on their investment relative to both GP and LP commitments.

Commitment Period

The Commitment Period defines the timeframe during which a General Partner (GP) can call capital commitments from Limited Partners (LPs) for investment purposes. GP Commitment typically ranges from 1% to 5% of the total fund size, aligning the GP's interests with those of LPs by ensuring skin in the game during the Commitment Period.

Capital Call Provisions

Capital call provisions define the process and timing for General Partners (GPs) and Limited Partners (LPs) to contribute their committed capital, often specifying GP commitments as a minimum percentage to align interests with LP commitments.

GP Commitment vs LP Commitment Infographic

moneydif.com

moneydif.com