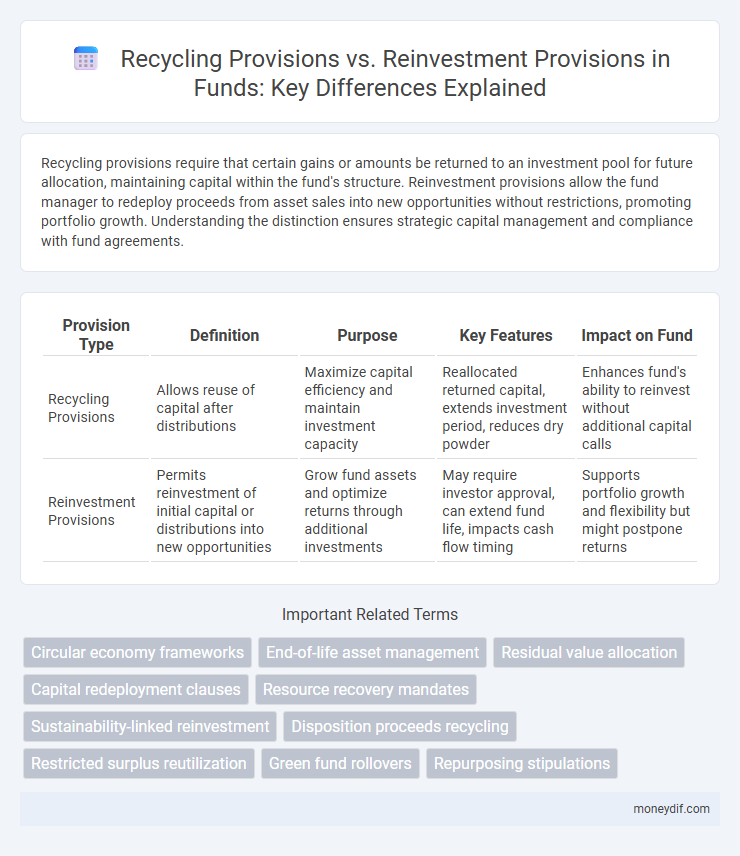

Recycling provisions require that certain gains or amounts be returned to an investment pool for future allocation, maintaining capital within the fund's structure. Reinvestment provisions allow the fund manager to redeploy proceeds from asset sales into new opportunities without restrictions, promoting portfolio growth. Understanding the distinction ensures strategic capital management and compliance with fund agreements.

Table of Comparison

| Provision Type | Definition | Purpose | Key Features | Impact on Fund |

|---|---|---|---|---|

| Recycling Provisions | Allows reuse of capital after distributions | Maximize capital efficiency and maintain investment capacity | Reallocated returned capital, extends investment period, reduces dry powder | Enhances fund's ability to reinvest without additional capital calls |

| Reinvestment Provisions | Permits reinvestment of initial capital or distributions into new opportunities | Grow fund assets and optimize returns through additional investments | May require investor approval, can extend fund life, impacts cash flow timing | Supports portfolio growth and flexibility but might postpone returns |

Introduction to Fund Provisions: Recycling vs Reinvestment

Recycling provisions in funds allow the redeployment of realized gains or returned capital back into new investments, enhancing overall capital efficiency and extending the fund's capacity to generate returns. Reinvestment provisions typically refer to the fund's ability to allocate income distributions or dividends directly into additional shares or assets, supporting compounded growth over time. Understanding the distinctions between recycling and reinvestment provisions is crucial for optimizing fund performance and aligning investment strategies with investor objectives.

Defining Recycling Provisions in Investment Funds

Recycling provisions in investment funds allow funds to reuse capital gains or realized capital to make additional investments without increasing the fund's capital base, enhancing flexibility in portfolio management. These provisions differ from reinvestment provisions, which typically require the redeployment of income distributions back into the fund. Clearly defining recycling provisions is essential for investors to understand the mechanisms that enable ongoing capital deployment while maintaining regulatory compliance and optimizing fund performance.

Understanding Reinvestment Provisions in Fund Structures

Reinvestment provisions in fund structures allow fund managers to redeploy capital from realized investments into new opportunities without distributing proceeds to investors, enhancing portfolio growth potential. These provisions often specify timelines and eligible asset classes for reinvestment, ensuring aligned fund objectives and risk management. Understanding the distinction between recycling and reinvestment provisions is critical, as recycling typically refers to the reuse of committed capital prior to full deployment, whereas reinvestment involves funds generated from exits that are reinvested during the fund's lifecycle.

Key Differences: Recycling vs Reinvestment Explained

Recycling provisions in funds require the return of distributed capital to be reinvested within the same investment vehicle, enhancing capital efficiency and enabling multiple investment cycles without additional capital calls. Reinvestment provisions allow the fund manager to allocate returns or income generated by investments into new opportunities, expanding the fund's portfolio without returning capital to investors. The key difference lies in recycling provisions emphasizing reuse of distributed capital, whereas reinvestment provisions focus on the deployment of generated income or gains for portfolio growth.

Legal and Regulatory Framework for Fund Provisions

Fund provisions related to recycling and reinvestment are governed by legal and regulatory frameworks that dictate the permissible scope, timing, and conditions under which capital can be reused or reinvested. Recycling provisions enable the redeployment of returned capital within the fund's lifecycle, subject to compliance with securities laws, fund agreements, and regulatory approvals to prevent unauthorized extensions of investment periods. Reinvestment provisions, often defined in fund governing documents and regulatory statutes, specify limits on new investments post-extension or after liquidity events, ensuring adherence to fiduciary duties and investor protection mandates.

Impact on Fund Performance and Returns

Recycling provisions allow funds to reuse capital from realized investments, increasing the potential for multiple investments within the fund's lifecycle and enhancing overall fund returns by maximizing capital efficiency. Reinvestment provisions enable the allocation of distributions back into the fund, supporting sustained investment activity and potentially improving long-term performance by fostering continuous portfolio growth. The strategic use of recycling provisions generally results in higher net internal rates of return (IRR) and total value to paid-in (TVPI) multiples compared to reinvestment provisions, which may limit reinvestment flexibility and growth opportunities.

Investor Perspectives: Preferences and Implications

Investors often favor reinvestment provisions over recycling provisions due to the potential for higher long-term returns and increased capital growth. Recycling provisions may appeal to investors seeking flexibility in reallocating capital within the fund, but they can also increase complexity and risk exposure. Understanding investor risk tolerance and return expectations is essential when balancing these provisions in fund structuring.

Best Practices for Drafting Fund Agreements

Recycling provisions in fund agreements allow limited partners to redeploy returned capital without increasing their commitment, enhancing capital efficiency by maximizing investment opportunities. Reinvestment provisions permit the fund to invest additional capital beyond the committed amount, often subject to specific conditions to safeguard investor interests and maintain fund discipline. Best practices for drafting fund agreements include clearly defining the scope, limits, and timing of these provisions to balance flexibility for the general partner with protections for limited partners, ensuring transparent capital management and alignment of interests.

Challenges and Risks Associated with Each Provision

Recycling provisions in funds pose challenges such as complex tracking of distributed capital and potential delays in fund deployment, increasing administrative burdens. Reinvestment provisions carry risks of suboptimal asset allocation and market timing errors, potentially diminishing returns and increasing portfolio volatility. Both provisions require rigorous compliance monitoring to mitigate regulatory risks and ensure alignment with investor expectations.

Strategic Considerations for Fund Managers

Recycling provisions enable fund managers to reuse capital from realized investments for new opportunities, enhancing portfolio flexibility and potentially increasing returns. Reinvestment provisions require redeployment of proceeds within specific sectors or timeframes, aligning with focused investment strategies and risk management. Strategic consideration involves balancing capital recycling to maintain portfolio diversification while adhering to investor expectations and regulatory constraints.

Important Terms

Circular economy frameworks

Circular economy frameworks prioritize recycling provisions that recover materials and reinvestment provisions that fund sustainable innovations to maximize resource efficiency and economic value.

End-of-life asset management

End-of-life asset management involves balancing recycling provisions, which focus on resource recovery and environmental sustainability, against reinvestment provisions that allocate funds for upgrading or replacing assets to maintain operational efficiency. Effective strategies optimize asset lifecycle costs by integrating circular economy principles with financial planning for future capital expenditures.

Residual value allocation

Residual value allocation determines how remaining asset value is distributed, impacting recycling provisions by enabling reinvestment of recovered amounts back into new assets within certain accounting frameworks. Recycling provisions facilitate recognizing gains or losses upon asset disposal, whereas reinvestment provisions allow deferring taxation by rolling over proceeds into replacement assets, both influencing residual value treatment in financial reporting.

Capital redeployment clauses

Capital redeployment clauses enable fund managers to reallocate capital from realized investments into new opportunities without returning funds to limited partners, enhancing portfolio flexibility. Recycling provisions specifically allow the reuse of capital proceeds within the same fund cycle to maximize investment capacity, while reinvestment provisions may refer more broadly to deploying returns into new assets, potentially extending beyond the original fund scope.

Resource recovery mandates

Resource recovery mandates enforce specific recycling provisions to maximize the extraction of materials from waste streams, thereby reducing landfill use and conserving natural resources. These mandates often include reinvestment provisions that allocate recovered funds or savings towards infrastructure upgrades and education programs, enhancing long-term sustainability and efficiency in waste management systems.

Sustainability-linked reinvestment

Sustainability-linked reinvestment focuses on aligning capital allocation with environmental goals, where recycling provisions enable funds generated from sustainable activities to be redeployed into similar green projects, enhancing resource efficiency. Reinvestment provisions set broader criteria for allocating returns, potentially including non-environmental investments, but recycling provisions specifically ensure continuous funding support for sustainability initiatives, promoting circular economy practices.

Disposition proceeds recycling

Disposition proceeds recycling allows the reuse of funds generated from asset sales to finance new projects without violating tax deferral rules, aligning with recycling provisions that mandate the reinvestment of proceeds into similar assets. Reinvestment provisions require that the proceeds from disposed assets be allocated promptly to maintain tax benefits, ensuring compliance with IRS regulations and optimizing capital efficiency in corporate asset management.

Restricted surplus reutilization

Restricted surplus reutilization balances recycling provisions that allow limited distribution of surplus funds with reinvestment provisions mandating the allocation of surplus for growth or capital projects.

Green fund rollovers

Green fund rollovers allow investors to defer capital gains taxes by reinvesting proceeds into qualified environmental projects, adhering to reinvestment provisions that ensure funds support sustainable initiatives. Recycling provisions mandate the continuous reuse of capital within green funds, promoting long-term environmental impact by preventing funds from being withdrawn without reinvestment into eligible green assets.

Repurposing stipulations

Repurposing stipulations prioritize recycling provisions by mandating material reuse and waste reduction over reinvestment provisions that focus primarily on financial returns or asset reallocation.

recycling provisions vs reinvestment provisions Infographic

moneydif.com

moneydif.com