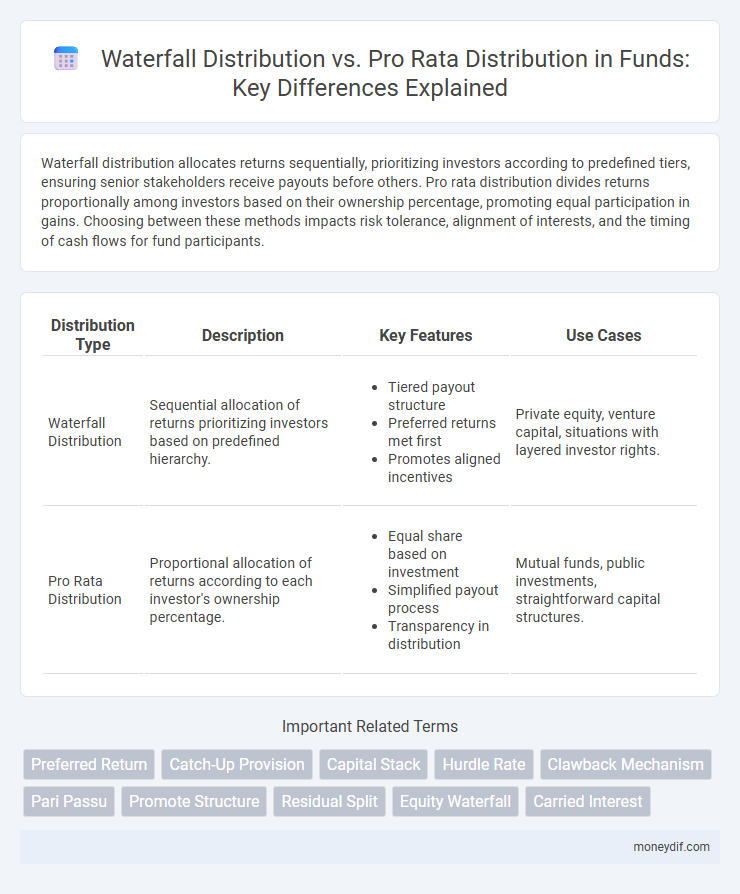

Waterfall distribution allocates returns sequentially, prioritizing investors according to predefined tiers, ensuring senior stakeholders receive payouts before others. Pro rata distribution divides returns proportionally among investors based on their ownership percentage, promoting equal participation in gains. Choosing between these methods impacts risk tolerance, alignment of interests, and the timing of cash flows for fund participants.

Table of Comparison

| Distribution Type | Description | Key Features | Use Cases |

|---|---|---|---|

| Waterfall Distribution | Sequential allocation of returns prioritizing investors based on predefined hierarchy. |

|

Private equity, venture capital, situations with layered investor rights. |

| Pro Rata Distribution | Proportional allocation of returns according to each investor's ownership percentage. |

|

Mutual funds, public investments, straightforward capital structures. |

Understanding Fund Distributions: Waterfall vs Pro Rata

Waterfall distribution allocates fund returns hierarchically, prioritizing preferred returns and returning capital to investors before profits are shared, optimizing incentives between general partners and limited partners. Pro rata distribution divides returns evenly among investors based on their ownership percentage, ensuring a straightforward and transparent allocation method. Understanding these distribution methods is critical for investors assessing risk, return expectations, and alignment of interests within private equity and venture capital funds.

Key Differences Between Waterfall and Pro Rata Distribution

Waterfall distribution allocates returns sequentially, prioritizing investors based on predefined tiers until each tier's threshold is met, while pro rata distribution divides returns proportionally according to each investor's stake. Waterfall structures emphasize performance hurdles and promote aligned incentives between fund managers and investors, whereas pro rata ensures equal, risk-adjusted sharing without performance-based tiers. Understanding these differences is crucial for evaluating investment risk, return profiles, and incentive alignment in fund management.

How Waterfall Distribution Works in Fund Structures

Waterfall distribution in fund structures prioritizes returns by allocating cash flows sequentially, ensuring that limited partners receive their preferred returns before the general partner participates in profits. This tiered approach creates a hierarchy of payments, often starting with return of capital, followed by preferred return, catch-up allocations, and then carried interest. Waterfall distribution aligns incentives by rewarding performance and managing risk among stakeholders.

The Mechanics of Pro Rata Distribution Explained

Pro Rata Distribution in fund management allocates returns proportionally based on each investor's ownership stake, ensuring an equitable division aligned with initial capital contributions. The mechanics involve calculating each participant's share relative to the total invested amount, distributing proceeds accordingly without prioritizing tiers or thresholds. This method contrasts with Waterfall Distribution, which follows a sequential payout hierarchy, making Pro Rata simpler and more transparent for investors seeking proportional equity in returns.

Investor Implications: Choosing Waterfall or Pro Rata

Waterfall distribution prioritizes returning capital to investors in a specific order, often benefiting early investors with higher returns before others receive payouts. Pro rata distribution allocates returns proportionally to all investors based on their individual stakes, promoting fairness but potentially delaying larger returns. Investors must consider their risk tolerance and desired liquidity timing when choosing between waterfall and pro rata distribution methods.

Pros and Cons of Waterfall Distribution in Fund Management

Waterfall distribution in fund management prioritizes returning capital and preferred returns to investors before allocating profits, ensuring a clear hierarchy that aligns interests between general partners and limited partners. This structure incentivizes fund managers by rewarding performance above certain thresholds but may result in delayed payouts for investors with smaller stakes due to the sequential payment process. However, the complexity of waterfall calculations and potential for misalignment in later-tier distributions can create challenges in transparency and investor understanding.

Advantages and Drawbacks of Pro Rata Distribution

Pro Rata Distribution offers investors proportional returns based on their contribution, ensuring fairness and transparency in fund exits. This method facilitates smoother transactions by distributing proceeds simultaneously, reducing complexities related to tiered waterfall structures. However, Pro Rata Distribution may limit incentivization for early-stage investors and lacks the prioritization benefits that Waterfall Distribution provides through hurdle rates and catch-up mechanisms.

Case Studies: Waterfall vs Pro Rata in Real-World Funds

Case studies in real-world funds reveal that waterfall distribution often aligns investor incentives by prioritizing returns based on hierarchy, benefiting early or key stakeholders before others receive payouts. In contrast, pro rata distribution allocates returns evenly based on ownership percentages, promoting fairness but potentially delaying returns for early investors. Analysis of various funds demonstrates that waterfall structures are favored in private equity for aligning risk and reward, while pro rata is common in mutual funds for straightforward proportional sharing.

Best Practices for Implementing Fund Distribution Methods

Best practices for implementing fund distribution methods emphasize clearly defining waterfall distribution tiers and trigger events to ensure accurate allocation of returns based on priority and hurdle rates. Pro rata distribution requires precise calculation of investors' proportional ownership to maintain fairness and transparency throughout capital return phases. Utilizing automated tracking systems minimizes errors and enhances real-time reporting in both distribution models, supporting investor confidence and regulatory compliance.

Legal and Regulatory Considerations for Fund Distributions

Waterfall distribution in funds involves a priority-based allocation of returns, often requiring strict adherence to contractual agreements and regulatory frameworks such as ERISA or the Investment Company Act to ensure compliance and protect investor rights. Pro rata distribution allocates returns proportionally to investors based on their ownership stakes, minimizing legal disputes but still subject to securities laws and fund governance rules. Fund managers must carefully navigate disclosure requirements, fiduciary duties, and jurisdiction-specific regulations to avoid breaches and ensure transparent, equitable distribution practices.

Important Terms

Preferred Return

Preferred Return guarantees investors a fixed priority payout before profits are shared, contrasting Waterfall Distribution's tiered, performance-based allocations with Pro Rata Distribution's proportional sharing based on ownership stakes.

Catch-Up Provision

The Catch-Up Provision in waterfall distribution allows limited partners to receive a prioritized return before general partners participate, contrasting with pro rata distribution where returns are allocated proportionally without preference.

Capital Stack

Capital stacks define investor priority and risk in real estate, where Waterfall Distribution allocates returns sequentially based on agreed tiers, unlike Pro Rata Distribution, which divides returns proportionally among investors regardless of priority.

Hurdle Rate

Hurdle rate determines the minimum return threshold that must be met before profits are distributed in Waterfall Distribution, unlike Pro Rata Distribution which allocates returns proportionally regardless of performance milestones.

Clawback Mechanism

The Clawback Mechanism in Waterfall Distribution ensures excess returns are reclaimed from lower-tier investors before final Pro Rata Distribution adjusts allocations proportionally among all stakeholders.

Pari Passu

Pari passu ensures that stakeholders receive payments proportionally according to their entitlement in both Waterfall Distribution and Pro Rata Distribution methods, maintaining equal ranking without preference. In Waterfall Distribution, funds are allocated in predefined priority tiers, whereas Pro Rata Distribution divides available amounts strictly based on the percentage ownership or claim size.

Promote Structure

Promote structure governs profit allocation in real estate investments by prioritizing preferred returns through waterfall distribution tiers before sharing residual profits on a pro rata basis among equity partners.

Residual Split

Residual Split in private equity often determines the remaining profits allocation after preferred returns, crucially differentiating Waterfall Distribution from Pro Rata Distribution methods. Waterfall Distribution allocates residual profits sequentially to investors according to predefined tiers, whereas Pro Rata Distribution divides residual profits proportionally based on ownership percentages without prioritization.

Equity Waterfall

Equity Waterfall prioritizes cash flow allocation by tiers of investor returns, contrasting with Pro Rata Distribution that allocates cash proportionally based on ownership percentages.

Carried Interest

Carried interest typically follows a waterfall distribution model, where profits are allocated sequentially after returning capital and preferred returns to investors, aligning incentives between general partners and limited partners. In contrast, pro rata distribution allocates profits proportionally to ownership stakes without prioritizing return of capital or hurdle rates, impacting the timing and scale of carried interest realization.

Waterfall Distribution vs Pro Rata Distribution Infographic

moneydif.com

moneydif.com