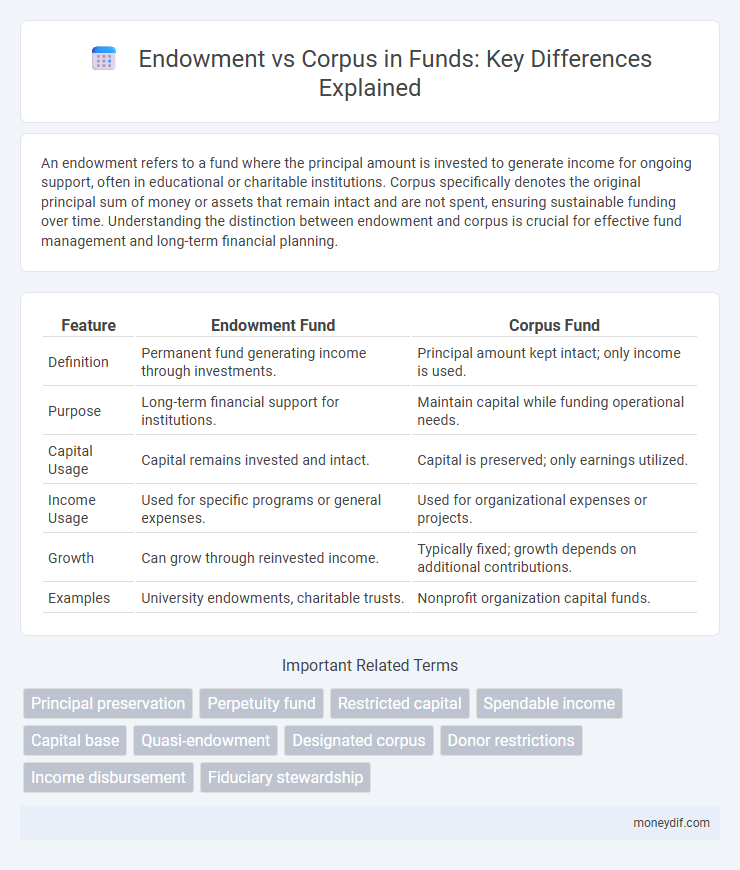

An endowment refers to a fund where the principal amount is invested to generate income for ongoing support, often in educational or charitable institutions. Corpus specifically denotes the original principal sum of money or assets that remain intact and are not spent, ensuring sustainable funding over time. Understanding the distinction between endowment and corpus is crucial for effective fund management and long-term financial planning.

Table of Comparison

| Feature | Endowment Fund | Corpus Fund |

|---|---|---|

| Definition | Permanent fund generating income through investments. | Principal amount kept intact; only income is used. |

| Purpose | Long-term financial support for institutions. | Maintain capital while funding operational needs. |

| Capital Usage | Capital remains invested and intact. | Capital is preserved; only earnings utilized. |

| Income Usage | Used for specific programs or general expenses. | Used for organizational expenses or projects. |

| Growth | Can grow through reinvested income. | Typically fixed; growth depends on additional contributions. |

| Examples | University endowments, charitable trusts. | Nonprofit organization capital funds. |

Understanding Endowment and Corpus: Key Definitions

An endowment refers to a fund where the principal is invested to generate income for ongoing support, preserving the original capital. Corpus represents the total accumulated capital or principal amount of the fund, which remains intact to ensure long-term financial sustainability. Understanding the distinction between endowment and corpus is essential for effective fund management and ensuring consistent revenue streams.

Historical Evolution of Endowment and Corpus Funds

Endowment funds originated in medieval Europe, primarily established by religious institutions to provide perpetual financial support through invested assets, ensuring long-term sustainability. Corpus funds evolved later as the principal amount of these endowments, representing the core capital that remains intact while only the generated income is used, safeguarding the fund's longevity. Historically, the distinction between endowment and corpus funds enabled non-profit organizations to balance asset preservation with operational funding needs, shaping modern financial stewardship practices.

Legal Framework: Endowment vs Corpus in Fund Management

The legal framework governing endowments and corpus funds delineates their distinct purposes and restrictions, where endowments typically require permanent preservation of the principal with only income utilized for funding activities. Corpus funds encompass both the principal and any accumulated income, allowing more flexible use or reinvestment according to organizational bylaws. Compliance with fiduciary duties and state-specific regulations ensures proper fund management and protects the funds' intended benefits over time.

Purpose and Usage: Distinguishing Endowment from Corpus Funds

Endowment funds are established to provide a perpetual source of income, with the principal typically preserved and only the generated earnings used for specific organizational purposes. Corpus funds refer to the principal amount donated or invested, which may be utilized or invested according to the organization's financial policies, often allowing more flexibility in usage. Understanding the distinct purposes of endowment versus corpus funds is essential for effective financial management and ensuring sustained support for institutional goals.

Fund Structure: How Endowment and Corpus Differ

Endowment funds consist of invested principal with earnings used to support ongoing operations, ensuring perpetual financial sustainability. Corpus funds represent the original capital amount, often preserved intact, with income generated deployed for specific purposes or projects. The key structural difference lies in endowment's emphasis on maintaining and growing the principal, while corpus may allow for principal utilization depending on fund terms.

Investment Strategies for Endowment and Corpus Funds

Endowment funds typically pursue diversified, long-term investment strategies aiming for stable returns and growth to support ongoing organizational needs, often including equities, fixed income, and alternative assets for risk mitigation. Corpus funds emphasize capital preservation with conservative investment approaches, favoring low-risk instruments like government bonds and stable income securities to maintain principal value. Both fund types require tailored asset allocation to balance liquidity, risk tolerance, and intended use of funds.

Governance and Oversight: Ensuring Fund Integrity

Endowment funds benefit from stringent governance structures with dedicated oversight committees that uphold spending policies and long-term investment strategies, ensuring sustainable growth and donor intent protection. Corpus funds require transparency through regular audits and board reviews to maintain principal preservation and regulatory compliance. Strong governance frameworks for both funds minimize mismanagement risks and enhance fund integrity for enduring financial support.

Tax Implications: Endowment vs Corpus Funding

Endowment funds generate tax-exempt income through invested capital, allowing organizations to preserve principal while supporting ongoing activities. Corpus funds, representing the original principal amount, often face different tax treatments depending on jurisdiction, sometimes limiting the tax benefits available from income generated. Understanding the distinct tax implications of endowment versus corpus funding is crucial for maximizing financial efficiency and compliance in nonprofit management.

Benefits and Limitations of Endowment and Corpus Funds

Endowment funds provide a stable, long-term source of income by investing principal capital to generate returns, ensuring financial sustainability for organizations, but their use is often restricted to preserve the principal. Corpus funds, while similar in capital preservation intent, offer more flexibility for principal utilization, enabling organizations to support immediate or evolving needs but with potential risk to long-term financial stability. Both fund types require careful management to balance benefits like income generation and financial security against limitations such as restricted fund use and investment risk.

Choosing the Right Fund: Endowment or Corpus for Your Organization

Choosing the right fund, whether an endowment or corpus, depends on your organization's long-term financial goals and funding needs. Endowments provide a sustainable income stream by investing the principal and using only the returns, ideal for ongoing operational support. Corpus funds, on the other hand, may allow more flexible use of the principal, suitable for projects requiring lump-sum expenditures or capital purchases.

Important Terms

Principal preservation

Principal preservation ensures that the original endowment or corpus remains intact and unimpaired, allowing only the generated income or returns to be spent. This financial strategy safeguards the longevity of charitable funds, maintaining the corpus's value while funding ongoing operations or programs.

Perpetuity fund

A perpetuity fund is a financial mechanism designed to provide a continuous stream of income without depleting the principal, making it similar to an endowment that preserves the principal while funding ongoing expenses. Unlike a corpus, which refers to the total capital accumulated, the perpetuity fund focuses on generating sustainable returns to support designated purposes indefinitely.

Restricted capital

Restricted capital in endowments refers to funds that donors earmark for specific purposes, limiting their use to predefined projects or operational costs, whereas corpus denotes the principal amount of the endowment that is typically preserved to generate income without being spent. Understanding the distinction between restricted capital and corpus is crucial for managing endowment funds effectively, ensuring compliance with donor intentions and sustaining long-term financial support.

Spendable income

Spendable income generated from an Endowment is derived from the investment returns on the principal, allowing the Corpus to remain intact for long-term financial stability. Effective management balances preserving the Endowment Corpus while maximizing spendable income to support ongoing organizational goals.

Capital base

Capital base in finance refers to the core funds held by an institution, with endowment representing a permanently invested fund generating income without depleting the principal, while corpus denotes the total accumulated principal amount of the endowment. Maintaining a strong capital base through an adequately sized corpus ensures financial stability and sustainable income streams for long-term institutional goals.

Quasi-endowment

A quasi-endowment is a fund designated by the governing board to function like an endowment but can be spent at the board's discretion, distinguishing it from a true endowment, which is legally restricted to preserve the principal. Unlike corpus funds that strictly maintain principal integrity, quasi-endowments provide flexibility in spending while supporting long-term financial stability for institutions.

Designated corpus

A designated corpus refers to a specific fund or asset pool set aside for long-term investment, often used interchangeably with endowment but distinguished by its strict allocation to a predetermined purpose or project. Unlike a general endowment, which may support broader institutional needs, a designated corpus is legally or contractually restricted to generate income solely for the designated activity, ensuring sustained financial support without depleting the principal.

Donor restrictions

Donor restrictions on endowments mandate that principal amounts, or corpus, be preserved permanently while allowing only income or appreciation to be expended according to donor stipulations. These restrictions ensure long-term financial sustainability by distinguishing the corpus, which remains intact, from earnings that support specific programs or operational needs.

Income disbursement

Income disbursement from an endowment typically involves allocating a fixed percentage of the endowment's total value annually to support operational or charitable activities, ensuring long-term financial sustainability. In contrast, a corpus refers to the principal amount that is preserved intact, with income generated from investments used for spending, while the corpus itself remains untapped to maintain the fund's longevity.

Fiduciary stewardship

Fiduciary stewardship involves the responsible management and oversight of endowment and corpus funds to ensure long-term financial stability and mission alignment. Endowments consist of invested principal generating income for ongoing organizational needs, while corpus refers to the original donated capital that must be preserved to maintain perpetual funding.

Endowment vs Corpus Infographic

moneydif.com

moneydif.com