Performance fees reward fund managers based on the fund's returns, aligning their interests with investors by incentivizing strong performance. Management fees are fixed charges calculated as a percentage of assets under management, ensuring consistent revenue regardless of fund returns. Understanding the distinction helps investors evaluate cost structures and potential impacts on net returns.

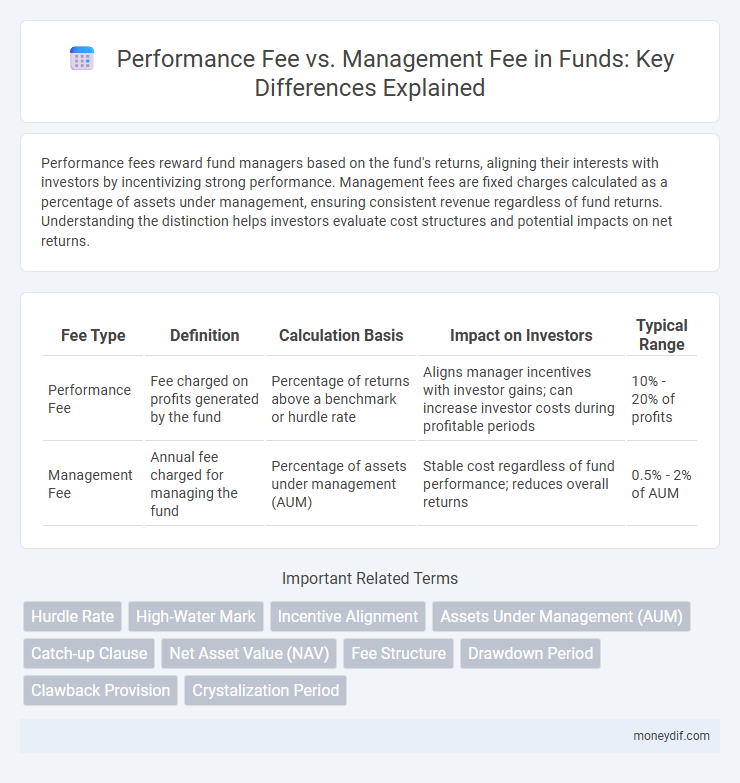

Table of Comparison

| Fee Type | Definition | Calculation Basis | Impact on Investors | Typical Range |

|---|---|---|---|---|

| Performance Fee | Fee charged on profits generated by the fund | Percentage of returns above a benchmark or hurdle rate | Aligns manager incentives with investor gains; can increase investor costs during profitable periods | 10% - 20% of profits |

| Management Fee | Annual fee charged for managing the fund | Percentage of assets under management (AUM) | Stable cost regardless of fund performance; reduces overall returns | 0.5% - 2% of AUM |

Understanding Performance Fees in Fund Management

Performance fees in fund management reward fund managers based on exceeding predefined benchmarks or achieving positive returns, aligning their interests with investors. Unlike management fees, which are fixed percentages of assets under management regardless of performance, performance fees tend to be a percentage of profits earned, incentivizing superior fund performance. This fee structure motivates managers to maximize returns but can also introduce higher risk-taking behaviors to achieve those profits.

The Basics of Management Fees in Investment Funds

Management fees in investment funds are typically calculated as a fixed percentage of assets under management (AUM), providing ongoing compensation to fund managers for daily operations and portfolio management. These fees cover expenses such as research, compliance, and administrative costs, and are charged regardless of the fund's performance. Understanding management fees is crucial for investors as they directly impact net returns and are distinct from performance fees, which are contingent on exceeding benchmark returns.

Key Differences Between Performance Fee and Management Fee

Performance fees are calculated as a percentage of the fund's profits, incentivizing the manager to achieve higher returns, while management fees are fixed charges based on the total assets under management (AUM), regardless of performance. Performance fees typically include a hurdle rate or high-water mark to ensure fees are only collected on new profits, whereas management fees provide consistent revenue to cover operational costs. The key distinction lies in performance fees aligning the manager's interests with investors' returns, contrasting with management fees that offer stable income regardless of the fund's success.

How Performance Fees Align Manager and Investor Interests

Performance fees create a direct link between the fund manager's compensation and the fund's success, incentivizing managers to achieve higher returns for investors. Unlike management fees that are fixed regardless of performance, performance fees ensure managers benefit only when investors realize gains. This alignment of interests encourages active portfolio management and risk-taking aimed at maximizing investor value.

Impact of Management Fees on Fund Returns

Management fees directly reduce the net returns of a fund by deducting a fixed percentage of assets under management annually, which can significantly erode investor gains over time. Compared to performance fees, which are contingent on positive fund performance, management fees impose a predictable cost regardless of returns, potentially diminishing compound growth effects. High management fees can also offset the benefits of superior fund performance, underscoring the importance of evaluating fee structures when assessing overall fund efficiency and investor value.

Performance Fee Structures: Hurdle Rates and High-Water Marks

Performance fees in fund management are often structured with hurdle rates, which set a minimum return investors must receive before fees are charged, ensuring the manager only profits after surpassing a specific benchmark. High-water marks protect investors by allowing performance fees only on new gains beyond the highest previous net asset value, preventing repeated fees on the same gains. These mechanisms align fund managers' incentives with investors' interests by emphasizing actual value creation rather than simply positive returns.

Typical Management Fee Rates Across Fund Types

Typical management fee rates vary significantly across fund types, with mutual funds charging around 0.5% to 1.0%, while hedge funds often command 1.5% to 2.0% annually. Private equity funds usually impose management fees between 1.5% and 2.5%, reflecting more intensive asset management. These fees cover operational costs and fund administration, differing substantially from performance fees, which are contingent on fund returns.

Risks and Drawbacks of Performance-Based Fees

Performance fees align fund manager incentives with investor returns but introduce volatility risk by encouraging excessive risk-taking to achieve high short-term gains. These fees can lead to fee escalation during market upswings while providing limited cost relief in down markets, reducing overall investor profitability. The complexity of performance fee structures often results in opaque costs, making it difficult for investors to accurately assess true fund expenses and risks.

Choosing the Right Fee Structure for Your Investment

Performance fees align the interests of fund managers and investors by rewarding managers based on the fund's returns, typically calculated as a percentage of profits above a benchmark. Management fees are fixed percentages of assets under management, providing predictable costs but without direct linkage to fund performance. Choosing the right fee structure depends on investment goals, risk tolerance, and preferences for cost predictability versus incentivized performance.

Industry Trends: The Future of Fund Fee Models

Performance fees are increasingly favored in the fund industry as investors demand alignment of interests between fund managers and limited partners, driving transparent and results-oriented compensation structures. Management fees, traditionally fixed, face pressure to become more flexible or reduced due to the rise of passive investing and regulatory scrutiny. Industry trends indicate hybrid models combining lower base management fees with performance-based incentives will dominate future fund fee structures, promoting fairness and enhanced fund performance.

Important Terms

Hurdle Rate

The hurdle rate is the minimum return that a fund must achieve before the performance fee is charged, ensuring alignment between investor and manager interests by only rewarding profits above this threshold. Management fees are charged regardless of fund performance, covering operational costs, while performance fees incentivize managers to exceed the hurdle rate, typically expressed as a percentage of profits earned beyond that benchmark.

High-Water Mark

High-Water Mark ensures performance fees are only charged on new profits exceeding the previous peak asset value, preventing fees on recovered losses unlike management fees which are charged regardless of performance.

Incentive Alignment

Incentive alignment in fund management is optimized when performance fees motivate managers to achieve higher returns, unlike management fees which provide fixed compensation regardless of performance.

Assets Under Management (AUM)

Performance fees align asset manager incentives with investor returns by charging a percentage of profits above a benchmark, while management fees provide steady revenue based on a fixed percentage of Assets Under Management (AUM) regardless of performance.

Catch-up Clause

A Catch-up Clause in investment funds ensures the manager receives a specified percentage of profits as a performance fee after surpassing a predetermined hurdle rate, aligning their rewards with fund outperformance beyond the management fee. This clause effectively balances performance incentives by allowing the manager to "catch up" on missed performance fees before profit-sharing returns to the investor.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of a fund's assets minus liabilities and serves as the basis for calculating both performance fees and management fees. Performance fees are typically charged as a percentage of NAV only when the fund exceeds a predetermined benchmark, while management fees are assessed consistently as a fixed percentage of NAV regardless of fund performance.

Fee Structure

Performance fees are typically calculated as a percentage of the investment gains above a predefined benchmark or hurdle rate, aligning the interests of fund managers with investors by rewarding outperformance. Management fees are charged as a fixed percentage of assets under management (AUM), providing steady revenue regardless of fund performance and covering operational costs.

Drawdown Period

The drawdown period directly impacts performance fees by delaying their accrual until profits exceed prior losses, while management fees apply consistently regardless of fund profitability.

Clawback Provision

A clawback provision in investment funds mandates that excess performance fees distributed to fund managers above a predetermined hurdle rate must be returned if subsequent losses occur, ensuring alignment with investors' interests. This mechanism primarily impacts performance fees, as management fees are generally fixed and not subject to repayment adjustments.

Crystalization Period

The crystallization period refers to the specific timeframe when a hedge fund or investment manager calculates and charges the performance fee based on the profits generated, distinct from the ongoing management fee charged regardless of performance. Performance fees align the manager's incentives with investor returns during this period, while management fees provide stable revenue for asset management activities.

Performance Fee vs Management Fee Infographic

moneydif.com

moneydif.com