Investing in a fund-of-funds offers diversified exposure by pooling assets across multiple underlying funds, reducing risk through broad allocation. Direct fund investments provide more control and transparency, allowing investors to target specific sectors or strategies without additional management layers. Choosing between these approaches depends on preferences for diversification, fee structures, and investment oversight.

Table of Comparison

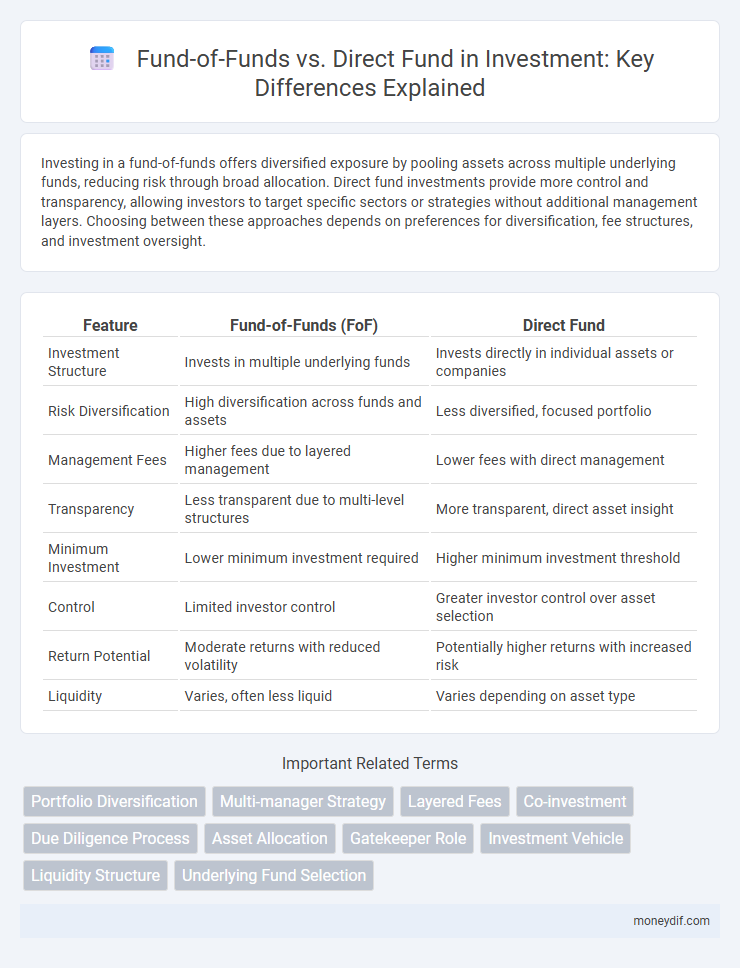

| Feature | Fund-of-Funds (FoF) | Direct Fund |

|---|---|---|

| Investment Structure | Invests in multiple underlying funds | Invests directly in individual assets or companies |

| Risk Diversification | High diversification across funds and assets | Less diversified, focused portfolio |

| Management Fees | Higher fees due to layered management | Lower fees with direct management |

| Transparency | Less transparent due to multi-level structures | More transparent, direct asset insight |

| Minimum Investment | Lower minimum investment required | Higher minimum investment threshold |

| Control | Limited investor control | Greater investor control over asset selection |

| Return Potential | Moderate returns with reduced volatility | Potentially higher returns with increased risk |

| Liquidity | Varies, often less liquid | Varies depending on asset type |

Introduction to Fund-of-Funds and Direct Funds

Fund-of-funds (FoF) invest in multiple underlying funds, providing diversified exposure and risk mitigation through professional portfolio allocation. Direct funds invest directly in stocks, bonds, or other assets, allowing for targeted investment strategies and potentially higher returns but with concentrated risk. Understanding the structural differences between FoFs and direct funds is essential for aligning investment objectives with risk tolerance.

Key Definitions: Fund-of-Funds vs Direct Funds

A fund-of-funds (FoF) is an investment strategy that allocates capital across multiple underlying funds, providing diversification and risk management through varied asset managers. Direct funds invest capital directly into individual securities or projects, offering concentrated exposure and potentially higher returns but with increased risk. Understanding the distinction between FoFs and direct funds is essential for aligning investment goals with risk tolerance and portfolio strategy.

Structure and Composition: How Each Fund Type Operates

Fund-of-funds (FoF) structures consist of pooled capital invested across multiple underlying funds, offering diversified exposure across various strategies, asset classes, and managers. Direct funds deploy capital directly into securities or assets, maintaining a concentrated portfolio typically managed by a single investment team. The multi-layered allocation in FoFs increases complexity and fees, while direct funds provide more transparent performance attribution and streamlined management oversight.

Investment Strategies: Diversification and Risk Management

Fund-of-funds utilize a diversification strategy by investing in multiple underlying funds, spreading risk across various asset classes and sectors to enhance portfolio stability. This multilayered approach reduces exposure to any single fund's poor performance, offering robust risk management compared to direct funds, which concentrate investments in specific assets or companies. Direct funds enable targeted investment in high-conviction opportunities but carry higher idiosyncratic risk due to limited diversification.

Cost Analysis: Management Fees and Expenses

Fund-of-funds generally incur higher management fees due to layered fee structures, combining both the underlying fund fees and the overarching fund manager's charges, often resulting in total expense ratios ranging from 1.5% to 3%. Direct funds typically have lower expense ratios averaging between 0.5% and 1.5%, as fees are applied solely at the investment level without additional layers. This cost differential significantly impacts net returns, making careful analysis of fee breakdowns crucial for investors seeking cost-efficient fund management.

Liquidity and Accessibility Considerations

Fund-of-funds typically offer enhanced liquidity due to their diversified holdings across multiple underlying funds, allowing investors more frequent redemption opportunities compared to direct funds, which often have longer lock-up periods and restricted withdrawal schedules. Accessibility in fund-of-funds is generally higher, as they require lower minimum investments and provide exposure to a broader range of asset classes, whereas direct funds often demand substantial capital and specialized knowledge to manage individual investments effectively. Investors prioritizing flexible liquidity and ease of entry might favor fund-of-funds, while those seeking tailored portfolio control may prefer direct funds despite their limited accessibility and liquidity constraints.

Performance Tracking and Benchmarking

Performance tracking in fund-of-funds involves aggregating returns from multiple underlying funds, making benchmarking complex due to diverse asset allocations and strategies. Direct funds offer more transparency and straightforward performance measurement against specific benchmarks tailored to a single asset class or investment style. Fund-of-funds require multi-layered analysis to evaluate risk-adjusted returns and correlate performance with composite indices reflecting aggregated asset exposures.

Pros and Cons of Fund-of-Funds

Fund-of-funds offer diversified exposure by pooling investments across multiple underlying funds, reducing single-fund risk and providing access to professional management. However, they typically incur higher fees due to layered management costs, and may suffer from reduced transparency compared to direct funds. Investors sacrifice some control over individual asset selection, potentially leading to diluted returns relative to direct investments in single funds.

Pros and Cons of Direct Funds

Direct funds offer investors greater control over asset selection and the potential for higher returns by eliminating intermediaries, but they require significant expertise and active management to navigate market risks effectively. Investors face increased due diligence responsibilities and exposure to volatility, making direct funds less suitable for those seeking diversified risk through professional fund managers. While direct funds can reduce management fees, the lack of diversification inherent in a single portfolio can elevate the risk profile compared to fund-of-funds structures.

Choosing the Right Approach: Factors for Investors to Consider

Investors must evaluate diversification, risk tolerance, and fee structures when choosing between fund-of-funds and direct funds. Fund-of-funds offer broader diversification and professional management but often come with higher fees and layered expenses. Direct funds typically provide lower costs and more control but require greater due diligence and expertise in selecting individual investments.

Important Terms

Portfolio Diversification

Portfolio diversification is enhanced by fund-of-funds through exposure to multiple underlying funds, offering broader risk mitigation compared to investing directly in a single fund.

Multi-manager Strategy

A multi-manager strategy involves investing in multiple fund managers to enhance diversification and reduce risk compared to direct fund investment, which concentrates exposure in a single fund. Fund-of-funds structures utilize this approach by allocating capital across various underlying funds, providing broader asset class access and professional selection benefits.

Layered Fees

Layered fees occur when investors in a fund-of-funds pay management and performance fees at both the underlying fund and the fund-of-funds levels, increasing the overall cost compared to direct fund investments. Direct funds typically charge a single set of fees, offering a more transparent and potentially cost-effective investment structure.

Co-investment

Co-investment offers limited partners access to specific portfolio companies alongside fund-of-funds investments, enabling more targeted exposure and potentially lower fees compared to traditional fund-of-funds structures. Direct fund investments provide broader diversification but often come with higher management fees and less influence over individual asset selection.

Due Diligence Process

The due diligence process for fund-of-funds focuses on evaluating multiple underlying funds' performance, diversification, and risk management strategies, while direct fund due diligence emphasizes assessing individual portfolio companies, management teams, and sector-specific risks. Fund-of-funds due diligence demands extensive analysis of fund selection criteria, fee structures, and historical returns, contrasting with the detailed operational, financial, and strategic reviews typical in direct investment assessments.

Asset Allocation

Asset allocation in a fund-of-funds approach diversifies risk by investing in multiple underlying funds, enhancing exposure across asset classes and strategies while potentially reducing volatility and improving portfolio stability. Direct fund investments allow for targeted allocation and more precise control over asset selection, but may increase concentration risk and require deeper individual fund analysis.

Gatekeeper Role

The Gatekeeper role in fund-of-funds involves rigorous due diligence and portfolio diversification across multiple underlying funds, mitigating risk compared to direct fund investments. This intermediary function provides investors access to curated, vetted fund managers, optimizing capital allocation and enhancing risk-adjusted returns.

Investment Vehicle

Investment vehicles such as fund-of-funds provide diversified exposure by pooling capital into multiple underlying funds, reducing risk through broader asset allocation compared to direct funds, which invest directly into specific assets or companies for potentially higher returns but with increased concentration risk. Fund-of-funds appeal to investors seeking professional management and diversification, whereas direct funds favor those aiming for targeted control and potentially faster capital appreciation.

Liquidity Structure

Liquidity structure in fund-of-funds typically offers enhanced diversification and staggered redemption schedules, resulting in more stable cash flow management compared to direct funds, which may face higher liquidity risk due to concentrated investments and lock-up periods. Fund-of-funds often provide more frequent liquidity windows and lower redemption gates, optimizing investor access to cash while mitigating market volatility impacts inherent in direct fund investments.

Underlying Fund Selection

Selecting an underlying fund in a fund-of-funds structure involves evaluating diversification benefits, risk-adjusted returns, and management expertise compared to direct fund investments. Fund-of-funds offer broader exposure and professional allocation strategies, while direct fund selection allows for targeted investment choices with potentially lower fees and greater control.

fund-of-funds vs direct fund Infographic

moneydif.com

moneydif.com