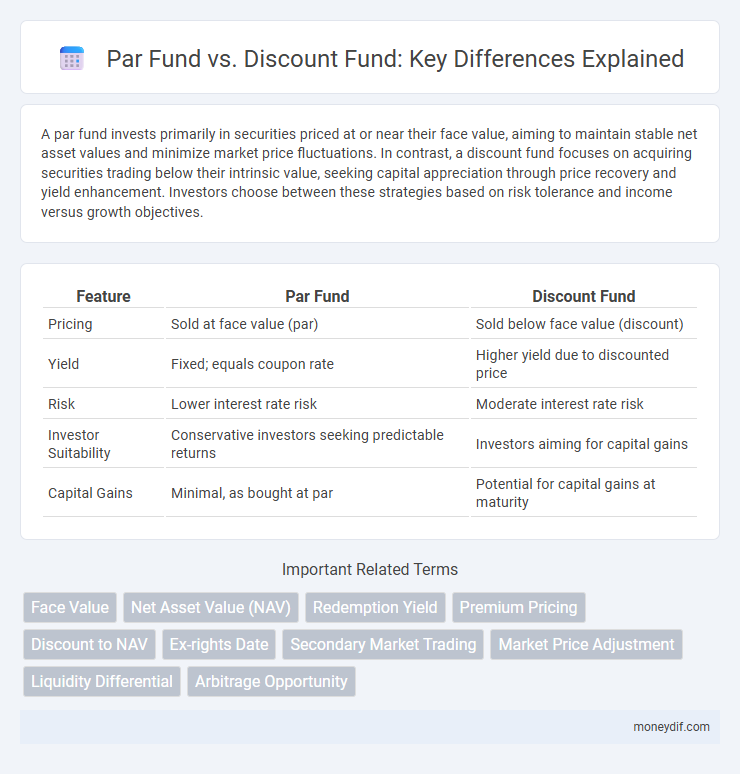

A par fund invests primarily in securities priced at or near their face value, aiming to maintain stable net asset values and minimize market price fluctuations. In contrast, a discount fund focuses on acquiring securities trading below their intrinsic value, seeking capital appreciation through price recovery and yield enhancement. Investors choose between these strategies based on risk tolerance and income versus growth objectives.

Table of Comparison

| Feature | Par Fund | Discount Fund |

|---|---|---|

| Pricing | Sold at face value (par) | Sold below face value (discount) |

| Yield | Fixed; equals coupon rate | Higher yield due to discounted price |

| Risk | Lower interest rate risk | Moderate interest rate risk |

| Investor Suitability | Conservative investors seeking predictable returns | Investors aiming for capital gains |

| Capital Gains | Minimal, as bought at par | Potential for capital gains at maturity |

Understanding Par Funds and Discount Funds

Par funds trade at their face value, meaning the market price equals the fund's net asset value (NAV), ensuring investors receive the full principal amount upon maturity. Discount funds, however, are purchased below their face value, allowing investors to gain from the difference between the purchase price and the maturity value, often compensating for lower coupon rates or market conditions. Understanding these distinctions helps investors assess yield potential, risk factors, and investment strategies tied to fixed-income securities and bond funds.

Key Differences Between Par Funds and Discount Funds

Par funds are investment vehicles purchased at their face value, ensuring investors receive the full principal upon maturity, while discount funds are bought below face value, offering potential capital gains as they mature at par. Par funds typically provide steady income through periodic interest payments, whereas discount funds generate returns primarily through the appreciation of the discount to par value. Risk profiles differ, with par funds considered more stable due to predictable cash flows, whereas discount funds involve higher risk and reward potential driven by market price fluctuations.

How Par Funds Work: Features and Benefits

Par funds invest in bonds purchased at face value and hold them until maturity, ensuring predictable income streams through regular interest payments. These funds benefit from minimal price volatility compared to discount funds, providing stability and consistent returns for conservative investors. They are ideal for risk-averse portfolios seeking steady cash flow and preservation of capital.

The Mechanics of Discount Funds Explained

Discount funds operate by purchasing securities below their face value, generating returns through the appreciation to par value at maturity, distinguishing them from par funds which invest at or near face value to prioritize income through interest payments. Investors in discount funds benefit from capital gains realized upon maturity or sale, as the fund's net asset value increases with the discount recovery, whereas par funds focus on consistent income streams. Understanding these mechanics clarifies why discount funds attract investors seeking price appreciation alongside modest income, balancing risk and return in fixed-income portfolios.

Risk Profiles: Par Fund vs. Discount Fund

Par funds typically exhibit lower risk profiles due to their investment in securities priced at or near par value, ensuring more stable returns and reduced price volatility. Discount funds invest in securities purchased below par, which introduces higher potential yield but also greater risk from price fluctuations and credit exposure. Investors aiming for conservative growth often prefer par funds, while those accepting higher risk for enhanced returns may opt for discount funds.

Return Potential: Comparing Par and Discount Funds

Par funds typically offer stable returns by investing in securities priced at or near face value, minimizing price volatility risks. Discount funds purchase assets below their par value, providing higher return potential through capital gains as these securities approach maturity or market revaluation. Investors seeking growth may prefer discount funds for increased yield opportunities, while conservative investors often favor par funds for predictable income streams.

Investment Strategies for Par and Discount Funds

Par funds primarily invest in securities trading at or near their face value, focusing on stable returns and preserving capital by minimizing price volatility and credit risk. Discount funds target undervalued securities priced below their par value, employing opportunistic strategies to capitalize on price appreciation and potential yield enhancement through market inefficiencies. Investment approaches for par funds emphasize income stability and risk aversion, while discount funds leverage market timing and credit analysis to achieve higher returns.

Suitability: Who Should Invest in Par or Discount Funds?

Par funds suit conservative investors seeking stable returns and preservation of capital, as these funds invest primarily in bonds priced near face value with minimal price volatility. Discount funds appeal to investors willing to accept higher risk for potential capital gains, since they invest in bonds trading below par, often reflecting credit risk or market inefficiencies. Understanding individual risk tolerance and investment horizon is crucial in choosing between par and discount funds to align portfolio objectives effectively.

Regulatory and Tax Implications

Par funds are structured to issue and redeem shares at their net asset value (NAV), minimizing capital gains distributions and offering favorable tax treatment under regulations such as the Investment Company Act of 1940. Discount funds purchase securities below their face value, potentially realizing taxable gains upon redemption, which can result in higher tax liabilities for investors and stricter compliance requirements due to fluctuating NAV adjustments. Fund managers must navigate specific IRS rules and SEC guidelines that govern income recognition and reporting, impacting portfolio strategies and investor distributions differently for par and discount funds.

Making the Right Choice: Par Fund vs. Discount Fund

Choosing between a par fund and a discount fund depends on investment goals and risk tolerance, as par funds invest at face value ensuring stable returns, while discount funds purchase bonds below par, offering potential capital gains but increased volatility. Investors seeking predictable income streams often prefer par funds, given their focus on principal preservation and steady coupon payments. Discount funds attract those aiming for higher total returns by exploiting market price inefficiencies, but this strategy involves heightened sensitivity to interest rate fluctuations and credit risk.

Important Terms

Face Value

Face value represents the nominal worth of a security, with a par fund issued at face value and a discount fund sold below face value.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of a mutual fund or ETF, calculated by dividing the total value of the fund's assets minus liabilities by the number of outstanding shares; a Par fund trades at a price equal to its NAV, while a Discount fund trades below its NAV, often indicating market undervaluation or investor pessimism. Understanding NAV fluctuations helps investors assess whether a fund is priced fairly, with Par funds reflecting asset value accurately and Discount funds potentially offering buying opportunities.

Redemption Yield

Redemption yield measures the annual return on a bond held to maturity, factoring in purchase price, par value, coupon payments, and time remaining; par funds invest primarily at or near face value, while discount funds purchase bonds below par, typically resulting in higher redemption yields due to capital gains at maturity. Comparing redemption yields between par and discount funds reveals that discount funds often provide superior returns by capturing both coupon income and the discount appreciation, enhancing total yield relative to funds investing at par.

Premium Pricing

Premium pricing occurs when a fund trades above its net asset value (NAV), often seen in par funds, while discount pricing reflects a fund trading below its NAV, typical of discount funds.

Discount to NAV

Discount to NAV in Par funds is typically minimal or zero, reflecting stable net asset value, whereas Discount funds often trade below NAV due to market perception of higher risk or lower liquidity.

Ex-rights Date

The ex-rights date marks the deadline for purchasing shares to receive rights in a par fund, whereas discount funds typically do not issue rights, affecting investor eligibility for dividends or capital gains.

Secondary Market Trading

Secondary market trading of par funds occurs near face value while discount funds trade below face value, reflecting differing investor perceptions of credit risk and interest rate movements.

Market Price Adjustment

Market Price Adjustment (MPA) affects Par funds and Discount funds differently by adjusting redemption values based on current market yields to protect remaining investors; Par funds typically maintain net asset value (NAV) at par by applying MPA charges or bonuses, whereas Discount funds may see adjusted NAVs reflecting prevailing market conditions more directly, influencing investor returns and fund stability. This mechanism ensures fair treatment across investor transactions by aligning buy or sell prices closer to market realities, reducing dilution effects in fixed income mutual funds.

Liquidity Differential

Liquidity differential refers to the difference in ease of converting assets into cash without significant loss in value between Par funds and Discount funds, where Par funds typically offer higher liquidity due to assets priced at or near face value, whereas Discount funds hold assets below face value, often reflecting longer maturities or credit risk. This liquidity gap impacts investor preference and portfolio strategies, as Par funds provide quicker access to cash, while Discount funds may require longer holding periods to realize full value.

Arbitrage Opportunity

Arbitrage opportunities arise when the price discrepancy between a Par fund trading at face value and a Discount fund selling below face value allows investors to buy low and sell high, capturing risk-free profit. Exploiting these differences requires monitoring interest rate changes, credit spreads, and market liquidity to identify when the Discount fund's undervaluation relative to the Par fund creates profitable trades.

Par fund vs Discount fund Infographic

moneydif.com

moneydif.com