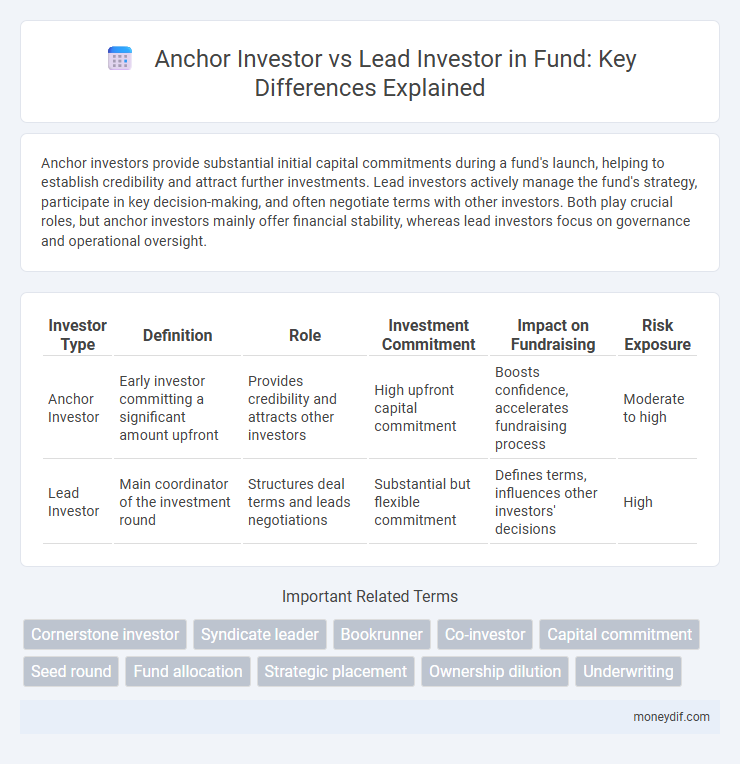

Anchor investors provide substantial initial capital commitments during a fund's launch, helping to establish credibility and attract further investments. Lead investors actively manage the fund's strategy, participate in key decision-making, and often negotiate terms with other investors. Both play crucial roles, but anchor investors mainly offer financial stability, whereas lead investors focus on governance and operational oversight.

Table of Comparison

| Investor Type | Definition | Role | Investment Commitment | Impact on Fundraising | Risk Exposure |

|---|---|---|---|---|---|

| Anchor Investor | Early investor committing a significant amount upfront | Provides credibility and attracts other investors | High upfront capital commitment | Boosts confidence, accelerates fundraising process | Moderate to high |

| Lead Investor | Main coordinator of the investment round | Structures deal terms and leads negotiations | Substantial but flexible commitment | Defines terms, influences other investors' decisions | High |

Defining Anchor Investor and Lead Investor

An anchor investor is a major investor who commits a significant portion of the fund's capital prior to its launch, providing credibility and attracting other investors. A lead investor, in contrast, plays a proactive role during the fundraising process by negotiating terms, conducting due diligence, and often influencing investment decisions. Both types of investors are crucial for fundraising success but differ in timing, commitment, and involvement levels.

Core Roles in a Fund: Anchor vs. Lead

Anchor investors provide initial substantial capital commitments that signal confidence and attract other investors, establishing a fund's credibility. Lead investors actively manage the fund's operations, including deal sourcing, due diligence, and portfolio oversight, ensuring strategic direction and operational efficiency. While anchors primarily serve as trust builders, lead investors drive execution and fund governance.

Capital Commitment: Anchor vs. Lead Investor

Anchor investors typically provide a significant capital commitment at the early closing stage, establishing fund credibility and attracting additional investors. Lead investors often negotiate the largest capital commitment overall and influence key terms in the fund agreement during the final closing. The distinction lies in timing and influence, with anchor investors securing initial capital, while lead investors shape fund structure and governance through their capital contribution.

Influence on Fund Structure and Strategy

Anchor investors provide substantial initial capital that shapes the fund's structure by setting early valuation benchmarks and investment terms, often leading to greater stability and credibility in fundraising. Lead investors actively influence fund strategy by taking a central role in deal sourcing, portfolio management, and governance, driving key investment decisions and strategic direction. Their involvement typically ensures alignment between the fund's objectives and operational execution, optimizing overall fund performance.

Stake and Negotiation Power Comparison

Anchor investors typically hold a substantial stake in a fund, often securing preferential terms that enhance their negotiation power during fundraising. Lead investors, while influential in steering deal terms and investor coordination, may possess a comparatively smaller equity stake but compensate with strategic authority in decision-making. The distinction in stake size directly impacts their leverage, with anchor investors wielding greater financial commitment and negotiation strength, whereas lead investors leverage influence through leadership roles in the investment process.

Participation in Fundraising Rounds

Anchor investors commit a substantial portion of capital early in a fundraising round, providing credibility and attracting other investors by signaling confidence in the fund. Lead investors not only participate with significant capital but also take an active role in structuring the deal, negotiating terms, and coordinating due diligence. While anchor investors primarily influence fund momentum through early financial commitment, lead investors drive the fund's strategic direction and investor relations during the round.

Reputation and Signaling Impact

Anchor investors typically carry strong reputations that provide significant signaling effects to other potential investors, enhancing fund credibility and attracting capital inflows. Lead investors play a critical role by actively managing the investment process and reinforcing confidence through their due diligence and oversight, further amplifying the fund's market reputation. The combined reputation of both investor types significantly influences investor perception, risk assessment, and fund valuation during capital raising rounds.

Regulatory and Compliance Considerations

Anchor investors often receive regulatory exemptions from detailed disclosures due to their pre-commitment status, reducing compliance burdens in fundraising. Lead investors must adhere strictly to regulatory requirements, including anti-money laundering (AML) checks and investor suitability assessments, ensuring transparency and protecting fund integrity. Regulatory frameworks like the Securities Act and AIFMD impose specific compliance obligations on lead investors to maintain market stability and investor confidence.

Typical Profiles of Anchor and Lead Investors

Anchor investors typically consist of large institutional entities such as pension funds, sovereign wealth funds, and insurance companies that provide substantial initial capital to establish credibility and attract other investors. Lead investors are often experienced venture capital firms or private equity groups with expertise in managing investments and actively guiding portfolio companies. These investors not only contribute significant funding but also bring strategic value through governance, deal structuring, and market insight.

Choosing Between Anchor and Lead Investors for Your Fund

Choosing between anchor and lead investors for your fund depends on your capital requirements and strategic goals. Anchor investors typically provide significant upfront capital, enhancing fund credibility and attracting additional investors, while lead investors actively manage fundraising and due diligence processes. Understanding the distinct roles helps optimize fund structure and investor relations for successful capital deployment.

Important Terms

Cornerstone investor

A cornerstone investor commits substantial capital before a public offering, providing market confidence and stability, whereas an anchor investor similarly secures large share allocations early but usually participates during the book-building process to attract other investors. Lead investors play a dynamic role by managing the syndicate, negotiating terms, and coordinating the investment, differentiating them from cornerstone and anchor investors who primarily focus on capital commitment.

Syndicate leader

A syndicate leader coordinates a group of anchor investors to secure substantial funding and establish credibility in an investment round, while the lead investor takes a more active role by negotiating terms and often guiding the startup's strategic direction. Anchor investors provide stability and confidence early on, and the syndicate leader leverages these commitments to attract additional investors, distinguishing their role from that of the lead investor who manages the overall investment process.

Bookrunner

A bookrunner manages the issuance and allocation of shares in a capital raising event, coordinating with both anchor investors, who commit sizable funds early to boost confidence, and lead investors, who set valuation benchmarks and often influence syndicate formation. Anchor investors provide initial demand support during IPOs or placements, while lead investors negotiate terms and drive pricing, making the bookrunner essential for aligning interests between these key stakeholders.

Co-investor

Co-investors partner alongside anchor investors and lead investors by contributing capital to a funding round, often sharing risks and leveraging the due diligence conducted by these primary stakeholders. While anchor investors provide significant initial capital to attract other investors, lead investors typically manage deal negotiation and investor relations, positioning co-investors as supportive participants in the investment ecosystem.

Capital commitment

Capital commitment from anchor investors typically involves a significant upfront investment to instill confidence in other investors, often shaping the initial funding momentum. Lead investors not only contribute substantial capital but also play a strategic role in structuring deals and guiding subsequent investment rounds.

Seed round

Anchor investors commit substantial capital early in a seed round to build confidence and attract other investors, while lead investors actively negotiate terms and manage the investment process.

Fund allocation

Anchor investors commit substantial capital early to stabilize fund allocation, while lead investors actively manage and allocate funds during subsequent investment rounds.

Strategic placement

Strategic placement involves positioning anchor investors to establish confidence and attract subsequent investments, while lead investors typically drive deal negotiation and due diligence processes. Anchor investors provide early capital commitment and market validation, whereas lead investors actively manage transaction execution and stakeholder communication.

Ownership dilution

Ownership dilution occurs when new shares are issued, reducing existing shareholders' percentage of ownership; anchor investors typically invest large amounts early, securing significant stakes without immediate dilution, while lead investors coordinate funding rounds and may experience dilution if subsequent investments bring in additional shareholders. Understanding the roles and timing of anchor versus lead investors is crucial in managing dilution impact during funding rounds.

Underwriting

Underwriting in the context of anchor investors involves securing a substantial commitment to stabilize the offering, ensuring confidence and credibility for the issuance, whereas lead investors actively coordinate the syndicate, pricing, and marketing efforts to drive the success of the deal. Anchor investors typically provide early capital to set the foundation, while lead investors manage the strategic allocation and distribution of shares to optimize market reception.

anchor investor vs lead investor Infographic

moneydif.com

moneydif.com