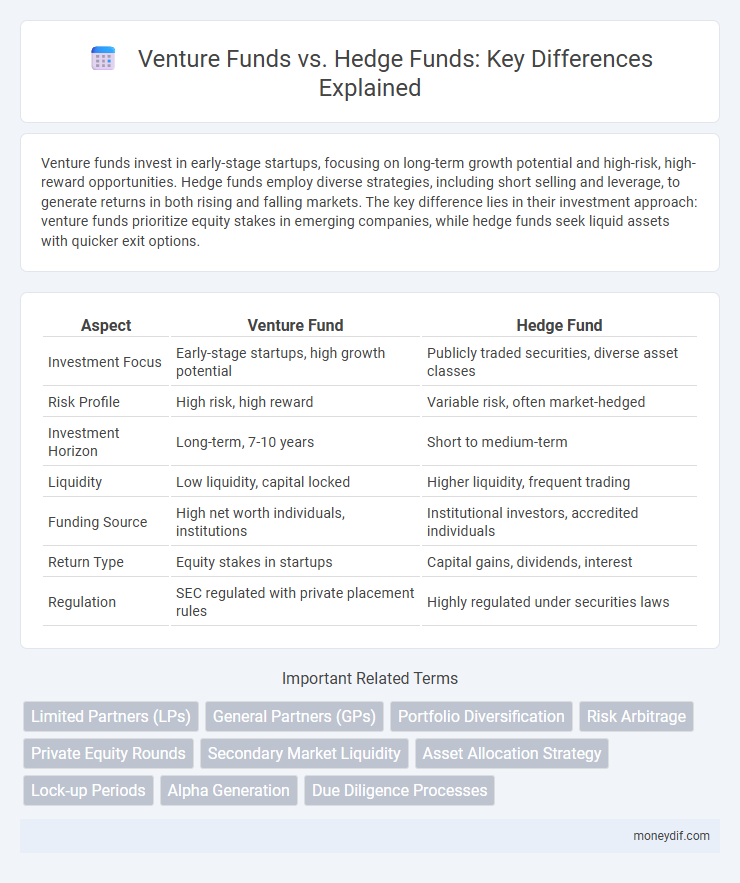

Venture funds invest in early-stage startups, focusing on long-term growth potential and high-risk, high-reward opportunities. Hedge funds employ diverse strategies, including short selling and leverage, to generate returns in both rising and falling markets. The key difference lies in their investment approach: venture funds prioritize equity stakes in emerging companies, while hedge funds seek liquid assets with quicker exit options.

Table of Comparison

| Aspect | Venture Fund | Hedge Fund |

|---|---|---|

| Investment Focus | Early-stage startups, high growth potential | Publicly traded securities, diverse asset classes |

| Risk Profile | High risk, high reward | Variable risk, often market-hedged |

| Investment Horizon | Long-term, 7-10 years | Short to medium-term |

| Liquidity | Low liquidity, capital locked | Higher liquidity, frequent trading |

| Funding Source | High net worth individuals, institutions | Institutional investors, accredited individuals |

| Return Type | Equity stakes in startups | Capital gains, dividends, interest |

| Regulation | SEC regulated with private placement rules | Highly regulated under securities laws |

Understanding Venture Funds: An Overview

Venture funds invest in early-stage startups with high growth potential, aiming for significant returns through equity stakes. These funds typically focus on innovation-driven sectors such as technology, healthcare, and biotech, providing not only capital but also strategic guidance. Unlike hedge funds, venture funds have longer investment horizons and emphasize nurturing companies through multiple growth stages before an exit event like an IPO or acquisition.

What Is a Hedge Fund? Key Characteristics

A hedge fund is a private investment fund that pools capital from accredited investors and employs diverse strategies to generate high returns, including long/short equity, leverage, derivatives, and arbitrage. Key characteristics of hedge funds include their typically high minimum investment requirements, performance-based fees (commonly 2% management fee and 20% performance fee), and less regulatory oversight compared to mutual funds. Unlike venture funds, hedge funds often focus on liquid assets and short-term gains rather than long-term equity stakes in startups.

Investment Strategies: Venture Funds vs. Hedge Funds

Venture funds primarily invest in early-stage startups and emerging companies, focusing on long-term capital appreciation through equity stakes in high-growth potential businesses. Hedge funds employ diverse investment strategies, including long/short equity, arbitrage, and derivatives trading, aiming for short-term gains and risk-adjusted returns across various asset classes. The risk profile and liquidity differ significantly, with venture funds exhibiting higher risk and lower liquidity compared to the more flexible, often liquid strategies of hedge funds.

Risk Profiles: Comparing Venture and Hedge Funds

Venture funds typically involve high-risk investments in early-stage startups with potential for substantial returns but increased uncertainty and illiquidity. Hedge funds employ diverse strategies to manage risk, often aiming for more stable returns through market hedging and leverage, resulting in moderate to high risk depending on the approach. Understanding the distinct risk profiles is crucial for investors seeking either aggressive growth from venture capital or risk-adjusted returns from hedge fund strategies.

Source of Capital: Who Invests in Each Fund Type?

Venture funds primarily attract capital from institutional investors, high-net-worth individuals, and family offices focused on long-term growth through equity stakes in startups. Hedge funds receive capital from accredited investors, including institutional clients and wealthy individuals, seeking diverse strategies to generate returns across public markets. The contrasting investor profiles reflect the differing risk tolerances and liquidity preferences inherent in each fund type.

Regulatory Environments for Venture and Hedge Funds

Venture funds are primarily regulated under the Investment Company Act of 1940 and often qualify for exemptions such as Regulation D, limiting offerings to accredited investors, which reduces regulatory burdens. Hedge funds also operate under similar exemptions but face more scrutiny from the Securities and Exchange Commission (SEC) due to their complex investment strategies, leverage usage, and potential systemic risks. Both fund types must comply with Anti-Money Laundering (AML) laws and periodic reporting but differ significantly in disclosure requirements and investor protections mandated by regulatory agencies.

Liquidity and Exit Options: How Investors Cash Out

Venture funds typically have longer lock-up periods with liquidity events tied to startup exits such as IPOs or acquisitions, often requiring years before investors can cash out. Hedge funds offer greater liquidity with frequent redemptions, sometimes monthly or quarterly, allowing investors more flexibility in accessing their capital. The distinct exit mechanisms reflect venture funds' focus on growth-stage investments and hedge funds' emphasis on marketable securities and short-term strategies.

Fee Structures: Venture Fund vs. Hedge Fund Costs

Venture funds typically charge a 2% management fee and a 20% carried interest, aligning returns with long-term portfolio company growth. Hedge funds usually impose a similar 2% management fee but often apply a 20% performance fee on realized gains, reflecting active trading strategies. Understanding these fee structures is essential for investors assessing cost efficiency and potential returns in venture capital versus hedge fund investing.

Performance Metrics: Measuring Success in Both Fund Types

Venture funds primarily evaluate success through internal rate of return (IRR) and portfolio company valuations, emphasizing long-term capital gains and milestone achievements. Hedge funds rely on metrics such as Sharpe ratio, alpha, and beta to assess risk-adjusted returns and relative performance against benchmark indices over shorter time horizons. Both fund types use performance fees and net asset value (NAV) growth to gauge overall investor value, but their measurement frameworks reflect differing investment strategies and risk profiles.

Which Fund Is Right for You? Choosing Between Venture and Hedge Funds

Venture funds target high-growth startups by investing in early-stage companies with significant innovation potential, appealing to investors seeking long-term capital appreciation despite higher risk. Hedge funds employ diverse strategies including short selling and leverage to generate returns across varied market conditions, suitable for investors seeking liquidity and risk-adjusted performance. Assessing your risk tolerance, investment horizon, and desire for active involvement will guide the choice between venture capital's growth potential and hedge funds' flexible strategies.

Important Terms

Limited Partners (LPs)

Limited Partners (LPs) in venture funds typically commit capital for longer periods, seeking high returns from early-stage, high-growth startups, while LPs in hedge funds benefit from more liquid investments with varied strategies aiming for short- to mid-term gains in public markets. LPs in venture funds usually include institutional investors and family offices focusing on innovation-driven sectors, whereas hedge fund LPs often prioritize diversification and risk-adjusted returns through dynamic trading approaches.

General Partners (GPs)

General Partners (GPs) in venture funds actively manage investments by sourcing startups, conducting due diligence, and providing strategic guidance to portfolio companies, contrasting with hedge fund GPs who primarily focus on liquid securities trading, risk management, and generating short-term returns through diversified asset allocation. Venture fund GPs often take board seats and engage in long-term value creation, while hedge fund GPs emphasize quantitative models and rapid market responsiveness to maximize investor profits.

Portfolio Diversification

Portfolio diversification in venture funds involves allocating capital across early-stage startups with high growth potential, emphasizing innovation and market disruption, whereas hedge funds focus on diverse asset classes including equities, derivatives, and bonds to manage risk and generate absolute returns. Venture funds typically accept higher risk with illiquid investments over longer time horizons, while hedge funds pursue liquidity and risk-adjusted returns through dynamic trading strategies.

Risk Arbitrage

Risk arbitrage in venture funds involves identifying undervalued startups with potential for high returns through early-stage investments, while hedge funds apply risk arbitrage strategies by exploiting price inefficiencies in public mergers and acquisitions for quicker gains. Venture funds focus on long-term growth by supporting innovation and scalability, whereas hedge funds prioritize short-term profit maximization through dynamic trading tactics in volatile markets.

Private Equity Rounds

Private equity rounds typically involve substantial capital investments in mature companies, focusing on long-term value creation and operational improvements, whereas venture funds invest in early-stage startups with high growth potential and greater risk. Hedge funds, unlike venture capital, primarily engage in public market strategies seeking short-term returns through leveraged trading and market speculation rather than direct equity ownership in private companies.

Secondary Market Liquidity

Secondary market liquidity for venture funds is typically lower than hedge funds due to the illiquid nature of startup equity compared to the publicly traded securities hedge funds invest in.

Asset Allocation Strategy

Asset allocation strategy in venture funds focuses on high-growth startups with a longer investment horizon and higher risk tolerance, while hedge funds prioritize diversified, liquid assets aiming for consistent returns through strategies like long-short equity or arbitrage. Venture funds allocate capital primarily to early-stage companies to capture exponential growth, whereas hedge funds dynamically adjust asset classes to manage volatility and maximize risk-adjusted returns.

Lock-up Periods

Lock-up periods in venture funds typically range from 7 to 10 years to align with long-term startup growth, while hedge fund lock-ups are shorter, often 1 year or less, reflecting their focus on liquidity and more frequent trading.

Alpha Generation

Alpha generation in venture funds is primarily driven by identifying early-stage startups with disruptive innovation potential, resulting in high return on investment through equity appreciation. Hedge funds focus on alpha by leveraging market inefficiencies and sophisticated strategies such as arbitrage, long-short equity, and derivatives to achieve consistent risk-adjusted returns.

Due Diligence Processes

Due diligence processes in venture funds primarily focus on evaluating startups' growth potential, market opportunity, and management teams through qualitative assessments and financial projections. Hedge fund due diligence emphasizes rigorous quantitative analysis, risk management, and portfolio performance metrics to ensure alignment with investment strategies and regulatory compliance.

Venture fund vs Hedge fund Infographic

moneydif.com

moneydif.com