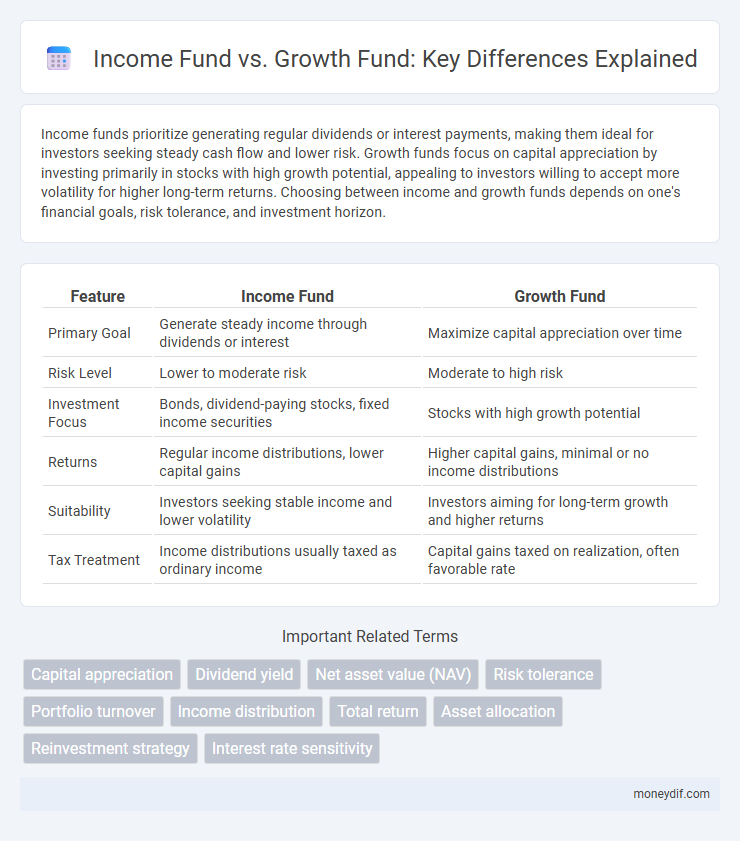

Income funds prioritize generating regular dividends or interest payments, making them ideal for investors seeking steady cash flow and lower risk. Growth funds focus on capital appreciation by investing primarily in stocks with high growth potential, appealing to investors willing to accept more volatility for higher long-term returns. Choosing between income and growth funds depends on one's financial goals, risk tolerance, and investment horizon.

Table of Comparison

| Feature | Income Fund | Growth Fund |

|---|---|---|

| Primary Goal | Generate steady income through dividends or interest | Maximize capital appreciation over time |

| Risk Level | Lower to moderate risk | Moderate to high risk |

| Investment Focus | Bonds, dividend-paying stocks, fixed income securities | Stocks with high growth potential |

| Returns | Regular income distributions, lower capital gains | Higher capital gains, minimal or no income distributions |

| Suitability | Investors seeking stable income and lower volatility | Investors aiming for long-term growth and higher returns |

| Tax Treatment | Income distributions usually taxed as ordinary income | Capital gains taxed on realization, often favorable rate |

Introduction to Income Funds and Growth Funds

Income funds primarily invest in bonds, dividend-paying stocks, and other securities that generate steady income, targeting investors seeking regular cash flow and lower risk. Growth funds focus on capital appreciation by investing in stocks with high growth potential, appealing to investors aiming for long-term wealth accumulation. Understanding the risk tolerance and investment goals is essential when choosing between income funds and growth funds.

Key Differences Between Income and Growth Funds

Income funds primarily focus on generating regular income through dividends and interest payments by investing in bonds, dividend-paying stocks, and other income-producing assets. Growth funds emphasize capital appreciation by investing in companies with strong potential for earnings growth, often reinvesting profits instead of paying dividends. Key differences include income distribution frequency, risk tolerance, and investment objectives, with income funds appealing to conservative investors seeking steady cash flow and growth funds attracting those aiming for long-term wealth accumulation.

Investment Objectives: Income vs Growth

Income funds prioritize generating regular dividends and interest by investing in bonds, dividend-paying stocks, and other income-producing assets, aiming to provide steady cash flow for investors. Growth funds focus on capital appreciation by investing primarily in equities with high growth potential, targeting long-term increases in portfolio value rather than immediate income. Investors choose income funds for stability and predictable returns, while growth funds suit those seeking significant wealth accumulation over time.

Risk Profile Comparison of Income and Growth Funds

Income funds typically exhibit a lower risk profile due to their focus on generating stable dividends and interest income from bonds and dividend-paying stocks, attracting conservative investors seeking steady cash flow. Growth funds generally carry higher risk by investing in equities with potential for capital appreciation but increased volatility, appealing to investors with a longer time horizon willing to accept market fluctuations. Understanding the risk disparity between income and growth funds guides investors in aligning fund choices with their risk tolerance and financial goals.

Types of Assets in Income and Growth Funds

Income funds primarily invest in fixed-income securities such as bonds, dividend-paying stocks, and money market instruments to generate regular income. Growth funds concentrate on equity assets, including stocks of companies with high earnings potential and capital appreciation prospects. While income funds emphasize stability and cash flow, growth funds prioritize long-term capital gains through asset appreciation.

Target Investors for Income vs Growth Funds

Income funds primarily target conservative investors seeking steady, predictable cash flow through dividends or interest, often appealing to retirees or those needing regular income. Growth funds attract investors with a higher risk tolerance aiming for capital appreciation over time, typically younger individuals or those with longer investment horizons. Understanding these target investor profiles helps in aligning fund selection with financial goals and risk appetite.

Performance Metrics: Yield vs Capital Appreciation

Income funds prioritize generating regular income through dividends and interest, resulting in higher yield percentages that appeal to conservative investors seeking steady cash flow. Growth funds emphasize capital appreciation by reinvesting earnings to increase the fund's net asset value, often resulting in lower current yields but greater long-term capital gains. Performance metrics for income funds focus on yield and distribution consistency, while growth funds are evaluated primarily on price appreciation and total return over time.

Tax Implications of Income and Growth Funds

Income funds primarily generate regular dividends and interest, which are typically taxed as ordinary income, leading to higher annual tax liabilities for investors. Growth funds, on the other hand, focus on capital appreciation and usually incur taxes only when shares are sold, often resulting in lower tax burdens due to long-term capital gains rates. Understanding these tax implications helps investors optimize their portfolio strategies based on their income needs and tax efficiency goals.

Pros and Cons of Income Funds

Income funds primarily aim to generate regular income for investors through dividends and interest payments, making them ideal for those seeking steady cash flow. Pros include lower volatility compared to growth funds and a more consistent income stream, which can provide financial stability during market downturns. However, income funds may offer less capital appreciation potential and higher tax liabilities on distributions compared to growth funds.

Pros and Cons of Growth Funds

Growth funds prioritize capital appreciation by investing in companies with high growth potential, offering the advantage of potentially higher returns over the long term. However, the increased exposure to market volatility and risk from investing in less-established or overvalued companies can lead to larger fluctuations in portfolio value. Limited dividend payouts are another drawback, as growth funds typically reinvest earnings instead of providing regular income.

Important Terms

Capital appreciation

Capital appreciation typically occurs faster in Growth Funds due to reinvested earnings, whereas Income Funds prioritize steady distributions with moderate capital gains.

Dividend yield

Income Funds typically offer higher dividend yields as they prioritize distributing regular income through dividends from bond interest or stock dividends, while Growth Funds focus on capital appreciation with lower or no dividend payouts, reinvesting earnings to fuel portfolio growth. Investors seeking steady cash flow often prefer Income Funds, whereas those aiming for long-term value increase usually choose Growth Funds despite their lower dividend yield.

Net asset value (NAV)

Net Asset Value (NAV) measures the per-share value of an Income Fund, which typically prioritizes regular dividend payouts and capital preservation, versus a Growth Fund, which reinvests earnings to maximize capital appreciation over time. Comparing NAV trends helps investors assess the performance differences where Income Funds usually show steadier NAV growth and Growth Funds often exhibit higher volatility with potential for greater long-term gains.

Risk tolerance

Risk tolerance influences the choice between income funds and growth funds, as income funds prioritize capital preservation with lower volatility, focusing on steady dividend payments and interest income. Growth funds carry higher risk due to their emphasis on capital appreciation and investing in equities with potential for significant price fluctuations.

Portfolio turnover

Portfolio turnover in Income Funds typically remains lower than in Growth Funds, as Income Funds focus on stable dividend-paying assets with less frequent trading, whereas Growth Funds actively buy and sell equities to capitalize on capital appreciation. This difference in turnover rates impacts tax efficiency and transaction costs, with Growth Funds often incurring higher short-term capital gains distributions due to their increased trading activity.

Income distribution

Income funds prioritize regular dividend or interest payments, offering steady income distribution predominantly from bonds, dividend-paying stocks, and other income-generating assets. Growth funds focus on capital appreciation by reinvesting earnings and predominantly investing in stocks with high growth potential, generally resulting in lower or no income distribution.

Total return

Total return of an Income Fund combines regular income distributions with moderate capital appreciation, while a Growth Fund's total return primarily depends on higher capital appreciation with minimal income payouts.

Asset allocation

Asset allocation in income funds emphasizes stable dividend payouts and lower risk by investing primarily in bonds and high-dividend equities, while growth funds allocate more assets to equities with higher capital appreciation potential and increased volatility. Strategic distribution between these fund types balances portfolio risk and return based on investor income needs versus long-term growth objectives.

Reinvestment strategy

Reinvestment strategy in an Income Fund focuses on distributing regular dividends or interest payments to investors, while in a Growth Fund, earnings are typically reinvested to maximize capital appreciation over time. Income Funds prioritize steady cash flow, whereas Growth Funds emphasize long-term wealth accumulation through reinvestment of returns.

Interest rate sensitivity

Income Funds typically exhibit lower interest rate sensitivity due to their focus on bonds and dividend-paying stocks, which provide steady income streams less affected by rate fluctuations. Growth Funds often face higher interest rate sensitivity as their investments in equities rely on future earnings growth that can be negatively impacted by rising rates increasing capital costs.

Income Fund vs Growth Fund Infographic

moneydif.com

moneydif.com