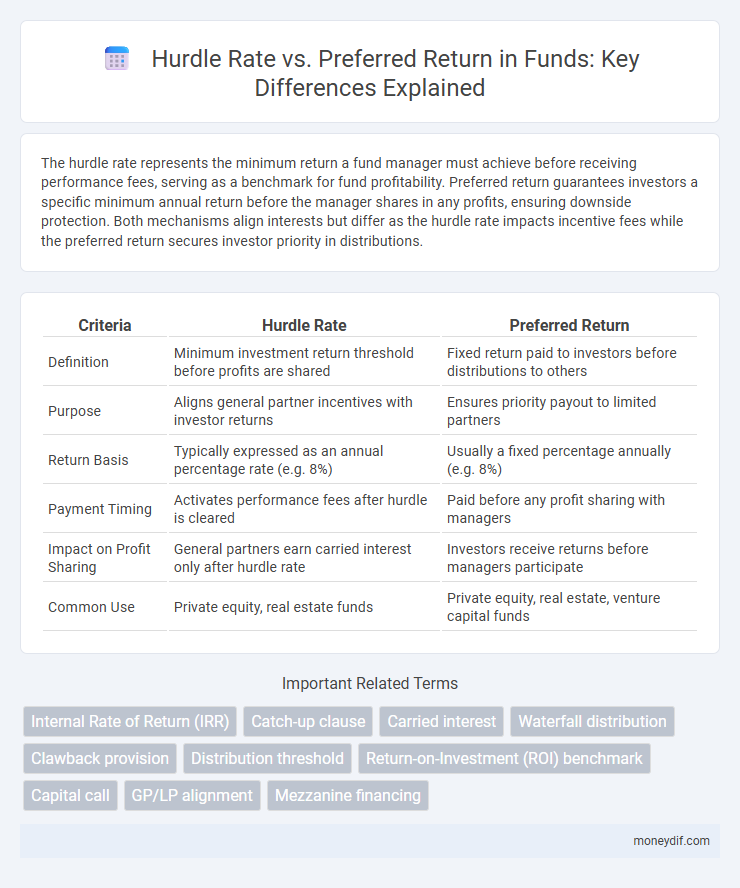

The hurdle rate represents the minimum return a fund manager must achieve before receiving performance fees, serving as a benchmark for fund profitability. Preferred return guarantees investors a specific minimum annual return before the manager shares in any profits, ensuring downside protection. Both mechanisms align interests but differ as the hurdle rate impacts incentive fees while the preferred return secures investor priority in distributions.

Table of Comparison

| Criteria | Hurdle Rate | Preferred Return |

|---|---|---|

| Definition | Minimum investment return threshold before profits are shared | Fixed return paid to investors before distributions to others |

| Purpose | Aligns general partner incentives with investor returns | Ensures priority payout to limited partners |

| Return Basis | Typically expressed as an annual percentage rate (e.g. 8%) | Usually a fixed percentage annually (e.g. 8%) |

| Payment Timing | Activates performance fees after hurdle is cleared | Paid before any profit sharing with managers |

| Impact on Profit Sharing | General partners earn carried interest only after hurdle rate | Investors receive returns before managers participate |

| Common Use | Private equity, real estate funds | Private equity, real estate, venture capital funds |

Understanding Hurdle Rate and Preferred Return

The hurdle rate is the minimum annual return that a private equity or hedge fund must achieve before the fund manager can receive carried interest, ensuring investors are prioritized in profit distribution. Preferred return, often expressed as a fixed percentage like 8%, guarantees that limited partners receive a minimum return on their invested capital before the general partner participates in profits. Understanding the distinction between hurdle rate and preferred return is crucial for investors to evaluate fund performance benchmarks and align expectations regarding profit sharing and risk compensation.

Key Differences Between Hurdle Rate and Preferred Return

The hurdle rate represents the minimum return a fund manager must achieve before earning performance fees, typically expressed as an annual percentage like 8%, while the preferred return guarantees investors a fixed minimum return on their invested capital before profits are shared. Hurdle rates primarily align fund manager incentives with investor interests by setting a performance benchmark, whereas preferred returns provide downside protection to investors by prioritizing their capital recovery. Hurdle rates often apply to performance fee calculations, but preferred returns affect distribution waterfalls, influencing the timing and order of profit allocations between investors and managers.

How Hurdle Rates Work in Investment Funds

Hurdle rates in investment funds represent the minimum return that fund managers must achieve before earning performance fees, aligning their interests with investors' goals. This rate ensures that investors receive a baseline return on their capital before the manager participates in profits, typically expressed as an annual percentage. Unlike preferred returns, which guarantee investors a fixed minimum payout before distributions to managers, hurdle rates trigger performance-based compensation only after surpassing the set threshold, influencing fund strategy and risk management.

The Role of Preferred Return in Fund Structures

Preferred return in fund structures establishes a fixed minimum return threshold that limited partners receive before the general partners earn carried interest, aligning incentives and protecting investor capital. The hurdle rate often serves as a benchmark for performance, but the preferred return specifically ensures priority distribution, creating a clear financial hierarchy within the fund. This mechanism fosters investor confidence by mitigating risk and enhancing alignment between fund managers and investors.

Calculating Hurdle Rate vs Preferred Return

Calculating the hurdle rate involves determining a minimum acceptable return, often expressed as an annual percentage, that a fund must achieve before the general partner can receive carried interest. The preferred return, typically a fixed percentage, guarantees limited partners receive priority distributions up to that rate before profits are shared. Comparing both, the hurdle rate sets a performance benchmark that incentivizes fund managers, while the preferred return ensures investor capital protection through prioritized returns.

Impact on Fund Managers’ Incentives

Hurdle rate and preferred return directly influence fund managers' incentives by defining thresholds for earning performance fees; a higher hurdle rate requires managers to achieve greater returns before profit sharing, aligning their interests closely with investors' success. Preferred return guarantees limited partners a minimum return before managers receive carried interest, motivating fund managers to prioritize consistent fund performance. These mechanisms adjust risk-taking behaviors, impacting managers' strategy and effort to meet or exceed investment benchmarks.

Investor Considerations: Hurdle Rate vs Preferred Return

Investors prioritize the hurdle rate as it sets the minimum performance threshold fund managers must exceed before earning carried interest, aligning incentives with actual fund success. Preferred returns guarantee investors a fixed minimum annual return on their invested capital before profits are shared, providing downside protection in uncertain markets. Comparing hurdle rate versus preferred return helps investors assess risk tolerance and impact on fund manager motivation when evaluating private equity or real estate funds.

Real-World Examples in Private Equity Funds

Hurdle rate in private equity funds typically sets the minimum return level, often around 8%, that must be achieved before the general partner earns carried interest, ensuring alignment with investor interests. Preferred return, commonly set between 6% to 10%, guarantees limited partners receive a priority distribution on invested capital before profit sharing, safeguarding their downside risk. Real-world examples include KKR's use of an 8% hurdle rate in many funds, while Blackstone often emphasizes preferred returns to attract institutional investors seeking capital preservation with a targeted internal rate of return (IRR).

Pros and Cons of Using Hurdle Rate or Preferred Return

Hurdle rate ensures alignment of interests by requiring fund managers to exceed a minimum return before earning performance fees, promoting strong performance but potentially discouraging risk-taking. Preferred return offers investors a prioritized return on capital, enhancing investor protection but can lead to delayed incentivization for managers if returns are below the threshold. Both mechanisms balance risk and reward differently, with hurdle rates focusing on performance benchmarks and preferred returns emphasizing investor priority, influencing fund structure and profitability.

Best Practices for Setting Hurdle Rate and Preferred Return in Funds

Setting the hurdle rate and preferred return in funds requires balancing investor protection with fund performance incentives, typically benchmarking hurdle rates between 6% and 8%. Best practices involve aligning the preferred return with industry standards, often around 8%, ensuring it adequately compensates investors before the general partners collect carried interest. Transparent communication and periodic reviews of these rates are essential to adapt to market conditions and maintain investor confidence.

Important Terms

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) measures the profitability of investments by calculating the discount rate that makes the net present value (NPV) of all cash flows equal to zero, serving as a benchmark against the hurdle rate, which is the minimum acceptable return required by investors. Preferred return, often used in private equity and real estate, represents a fixed priority return to investors before the general partners receive profit, and IRR must exceed both the preferred return and hurdle rate to ensure alignment of interests and maximize investor value.

Catch-up clause

A catch-up clause enables investors to receive a larger share of profits after the preferred return hurdle rate is met, ensuring that general partners quickly "catch up" on their profit share beyond the initial threshold. This mechanism aligns interests by allowing distributions to flow disproportionately to general partners until a pre-agreed profit split is achieved after surpassing the preferred return.

Carried interest

Carried interest represents the share of profits general partners earn, typically after surpassing a hurdle rate, which is the minimum return required before profit-sharing begins. The preferred return ensures limited partners receive a set return--often around 8%--before carried interest is calculated, aligning incentive structures in private equity and real estate investments.

Waterfall distribution

Waterfall distribution structures allocate investment returns by first satisfying the hurdle rate, which is the minimum preferred return investors expect before sponsors receive profits. The preferred return typically represents a fixed percentage of capital, and once achieved, profits are split according to agreed-upon tiers, ensuring investors receive priority payouts before sponsors participate in excess gains.

Clawback provision

A clawback provision ensures that investors receive a preferred return above the hurdle rate before fund managers earn carried interest, protecting investors from excess distributions.

Distribution threshold

The distribution threshold defines the minimum return that investors must receive before sponsors can participate in profits, serving as a key comparison to the hurdle rate which sets the required rate of return to trigger carried interest. Preferred return represents the fixed return priority given to investors, typically expressed as an annual percentage, operating as a baseline that must be met before distributions surpassing the threshold are allocated according to the profit-sharing agreement.

Return-on-Investment (ROI) benchmark

Return-on-Investment (ROI) benchmarks often compare the hurdle rate--the minimum acceptable return set by investors--to the preferred return, which is a prioritized return paid before profits are distributed to equity holders. Aligning ROI benchmarks with these metrics ensures investments exceed the hurdle rate and meet or surpass the preferred return, optimizing capital allocation and investor satisfaction.

Capital call

A capital call is a request by fund managers for committed capital from investors, typically triggered once the fund reaches its hurdle rate, ensuring investors receive their preferred return before profits are shared. The hurdle rate represents the minimum return threshold that must be met, aligning with the preferred return to protect investors' interests before general partners receive carried interest.

GP/LP alignment

Effective GP/LP alignment hinges on balancing the hurdle rate, which sets the minimum return threshold, with the preferred return that ensures LPs receive priority distributions before GPs participate in profits. Setting a hurdle rate above the preferred return motivates GPs to achieve superior performance, aligning interests by rewarding value creation beyond baseline expectations.

Mezzanine financing

Mezzanine financing typically involves a hurdle rate, which sets the minimum return investors expect before the sponsor can share profits, while the preferred return is a fixed rate paid to equity investors before any profit-sharing occurs. The hurdle rate aligns with investor risk by demanding performance thresholds, whereas the preferred return protects investors by securing priority cash flow.

hurdle rate vs preferred return Infographic

moneydif.com

moneydif.com