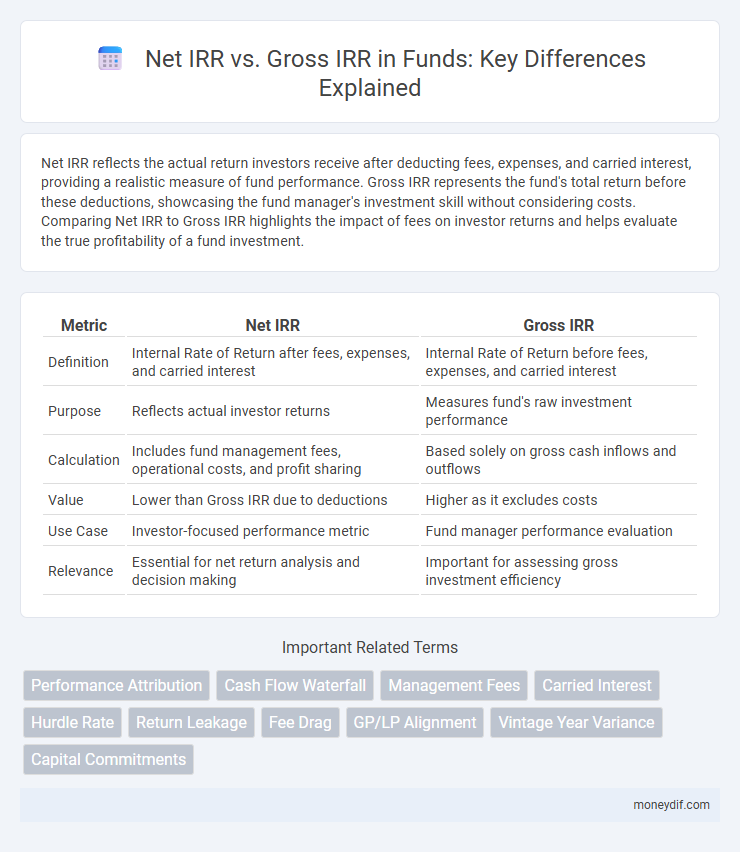

Net IRR reflects the actual return investors receive after deducting fees, expenses, and carried interest, providing a realistic measure of fund performance. Gross IRR represents the fund's total return before these deductions, showcasing the fund manager's investment skill without considering costs. Comparing Net IRR to Gross IRR highlights the impact of fees on investor returns and helps evaluate the true profitability of a fund investment.

Table of Comparison

| Metric | Net IRR | Gross IRR |

|---|---|---|

| Definition | Internal Rate of Return after fees, expenses, and carried interest | Internal Rate of Return before fees, expenses, and carried interest |

| Purpose | Reflects actual investor returns | Measures fund's raw investment performance |

| Calculation | Includes fund management fees, operational costs, and profit sharing | Based solely on gross cash inflows and outflows |

| Value | Lower than Gross IRR due to deductions | Higher as it excludes costs |

| Use Case | Investor-focused performance metric | Fund manager performance evaluation |

| Relevance | Essential for net return analysis and decision making | Important for assessing gross investment efficiency |

Understanding Net IRR and Gross IRR

Net IRR reflects the actual return to investors after deducting fees, expenses, and carried interest, providing a realistic measure of fund performance. Gross IRR shows the total return generated by the fund's investments before any deductions, highlighting the fund manager's ability to generate profits. Comparing Net IRR and Gross IRR helps investors assess the impact of fees and the true profitability of their investment.

Key Differences Between Net IRR and Gross IRR

Gross IRR measures a fund's total internal rate of return before fees, expenses, and carried interest, reflecting the raw performance of underlying investments. Net IRR accounts for all management fees, expenses, and carried interest, providing a more accurate representation of the investor's actual returns. The key difference lies in net IRR's adjustment for costs, making it a crucial metric for assessing fund profitability from an investor's perspective.

Importance of IRR Metrics in Fund Performance

Net IRR and Gross IRR are critical metrics in evaluating fund performance, with Net IRR reflecting the investor's actual return after fees, expenses, and carried interest, making it a more accurate measure of realized profitability. Gross IRR measures the fund's total performance before deductions, providing insight into the fund manager's asset selection and investment skill. Understanding the disparity between Net and Gross IRR helps investors assess the true value generated by the fund and the cost efficiency of management.

How to Calculate Gross IRR

Gross IRR is calculated by measuring the internal rate of return on all cash flows generated by a fund before deducting management fees, carried interest, and other expenses. To compute Gross IRR, sum all investment cash inflows and outflows over the holding period, then solve for the discount rate that sets the net present value (NPV) of these cash flows to zero. This metric reflects the fund's performance at the asset level, providing a pure return measure before any fund-level costs are applied.

How to Calculate Net IRR

Calculate Net IRR by adjusting the Gross IRR for fees, expenses, and carried interest deducted from the fund's returns. Subtract management fees and performance allocations from the gross cash flows before solving for the internal rate of return. Use the net cash inflows and outflows in an IRR formula or financial model to determine the investor's actual profitability after all costs.

Factors That Affect Net IRR and Gross IRR

Net IRR and Gross IRR are influenced by management fees, carried interest, fund expenses, and the timing of cash flows. Gross IRR reflects the fund's raw investment returns before costs, while Net IRR accounts for deductions such as fees and profit-sharing arrangements with general partners. Variations in fee structures, investment holding periods, and reinvestment strategies significantly impact the disparity between Net IRR and Gross IRR values.

Advantages of Using Net IRR vs Gross IRR

Net IRR provides a more accurate reflection of an investor's actual return by considering fees, expenses, and carried interest, which Gross IRR omits. The use of Net IRR facilitates better comparison across funds by incorporating real-world costs, making performance evaluations more realistic. Investors rely on Net IRR to assess the true profitability of their investments, ensuring transparent and practical decision-making.

Limitations and Pitfalls of IRR Metrics

Net IRR reflects a fund's return after fees and expenses, providing a more accurate measure of investor profitability compared to Gross IRR, which excludes these costs. Both metrics can be misleading when used in isolation due to their sensitivity to the timing and scale of cash flows, often overstating performance in early distributions or failing to capture reinvestment risk. IRR calculations also do not account for external market conditions or alternative investment opportunities, limiting their effectiveness as standalone indicators of true fund performance.

Real-World Examples: Net IRR vs Gross IRR

Net IRR reflects the actual investor returns after deducting fees, expenses, and carried interest, whereas Gross IRR measures the fund's performance before these deductions. For example, a private equity fund with a Gross IRR of 20% may deliver a Net IRR closer to 15% once all fees and carried interest are accounted for. Understanding this difference is critical for investors evaluating fund performance and comparing returns across different investment opportunities.

Choosing the Right IRR Metric for Fund Evaluation

Net IRR reflects the actual investor returns after fees and expenses, making it the preferred metric for evaluating fund performance from an investor's perspective. Gross IRR measures the fund's total returns before deductions, providing insights into the manager's raw performance and operational efficiency. Selecting the right IRR metric depends on whether the focus is on investment strategy effectiveness (gross IRR) or net value creation for investors (net IRR).

Important Terms

Performance Attribution

Performance attribution analysis quantifies the impact of fees, expenses, and carried interest by comparing Net IRR, reflecting investor returns after costs, with Gross IRR, representing total portfolio performance before deductions.

Cash Flow Waterfall

The Cash Flow Waterfall allocates distributions prioritizing Gross IRR for initial investors before calculating Net IRR after fees and expenses to reflect actual investor returns.

Management Fees

Management fees reduce Gross IRR to Net IRR by deducting operating expenses and performance-based fees, directly impacting investor returns.

Carried Interest

Carried interest is the profit share earned by fund managers based on the Net IRR, which reflects returns after fees and expenses, whereas Gross IRR measures total investment performance before such deductions.

Hurdle Rate

The hurdle rate sets the minimum acceptable return that Net IRR must exceed after fees and expenses compared to Gross IRR, which reflects total project returns before deductions.

Return Leakage

Return leakage reduces Net IRR compared to Gross IRR by highlighting hidden fees and expenses that erode overall investment returns.

Fee Drag

Fee drag reduces the Net IRR by lowering returns through management and performance fees deducted from the Gross IRR. This difference quantifies the impact of fund expenses on investor profitability in private equity and investment funds.

GP/LP Alignment

GP/LP alignment critically influences the Net IRR, as General Partners' incentives are structured to maximize Gross IRR before fees and carried interest are deducted, directly impacting Limited Partners' realized returns. Effective alignment ensures that General Partners focus on value creation and risk management, optimizing the Net IRR received by Limited Partners after all expenses and profit-sharing arrangements.

Vintage Year Variance

Vintage year variance significantly impacts the difference between Net IRR and Gross IRR by reflecting variations in fund performance and expense ratios across investment cohorts.

Capital Commitments

Capital commitments influence Net IRR by accounting for fees and expenses, causing Net IRR to be lower than Gross IRR, which reflects the investment's raw performance before deductions.

Net IRR vs Gross IRR Infographic

moneydif.com

moneydif.com