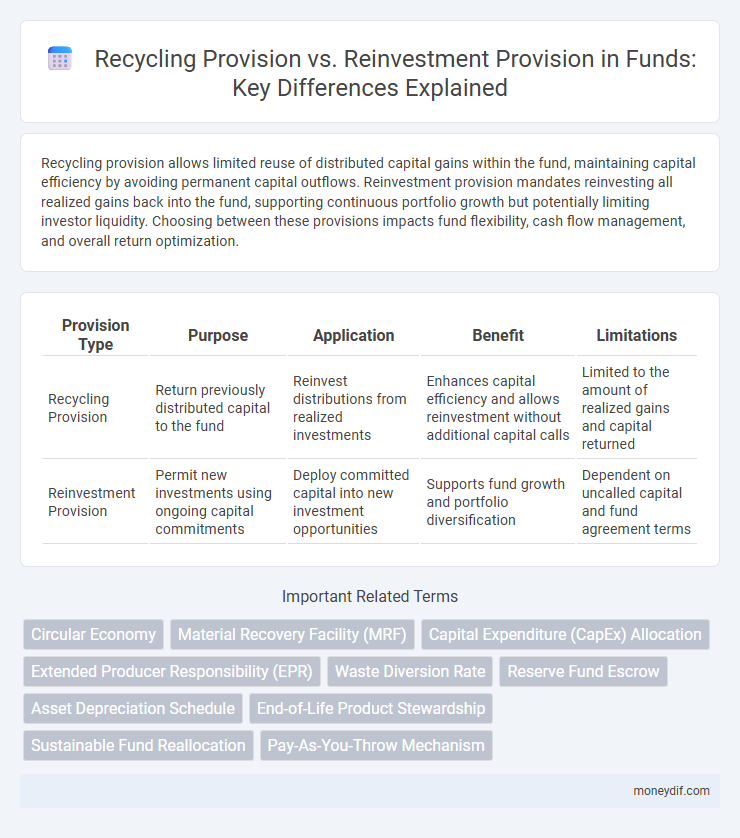

Recycling provision allows limited reuse of distributed capital gains within the fund, maintaining capital efficiency by avoiding permanent capital outflows. Reinvestment provision mandates reinvesting all realized gains back into the fund, supporting continuous portfolio growth but potentially limiting investor liquidity. Choosing between these provisions impacts fund flexibility, cash flow management, and overall return optimization.

Table of Comparison

| Provision Type | Purpose | Application | Benefit | Limitations |

|---|---|---|---|---|

| Recycling Provision | Return previously distributed capital to the fund | Reinvest distributions from realized investments | Enhances capital efficiency and allows reinvestment without additional capital calls | Limited to the amount of realized gains and capital returned |

| Reinvestment Provision | Permit new investments using ongoing capital commitments | Deploy committed capital into new investment opportunities | Supports fund growth and portfolio diversification | Dependent on uncalled capital and fund agreement terms |

Understanding Recycling Provision in Fund Management

Recycling provision in fund management allows a fund to reuse capital from realized investments for new opportunities without distributing proceeds to investors, enhancing capital efficiency and investment flexibility. It contrasts with reinvestment provisions, which typically require explicit approval or are limited to specific circumstances, thereby restricting rapid redeployment of capital. Understanding recycling provisions is crucial for fund managers to optimize portfolio growth and maximize investor returns through continuous capital utilization.

What is Reinvestment Provision: A Comprehensive Overview

Reinvestment provision refers to a fund's policy allowing the proceeds from the sale of an investment to be redeployed into new assets within the same portfolio, aiming to maintain or enhance the fund's overall value and income potential. This provision ensures capital preservation and continuous growth by minimizing cash drag and leveraging compounding returns within the investment mandate. Understanding the nuances of reinvestment provisions is critical for fund managers to optimize asset allocation and achieve long-term financial objectives.

Key Differences Between Recycling and Reinvestment Provisions

Recycling provisions allow fund managers to reuse distributions from realized gains to make new investments, thereby preserving capital and avoiding additional capital calls. Reinvestment provisions require limited partners to commit additional capital when initial investments are redeployed, increasing the fund's overall capital base. The key difference lies in capital commitment flexibility: recycling provisions optimize fund efficiency by reallocating existing capital, while reinvestment provisions expand capital through fresh contributions.

Advantages of Incorporating Recycling Provision

Incorporating a recycling provision within a fund enhances capital efficiency by allowing the reuse of distributed capital for new investments, thereby maximizing the fund's deployment capacity without additional capital calls. This provision supports portfolio optimization by enabling reinvestment of realized returns into high-potential opportunities, increasing the likelihood of enhanced overall fund performance. Recycling provisions also provide greater flexibility in capital allocation, improving investor value through extended exposure to profitable ventures while maintaining disciplined capital management.

Benefits of Reinvestment Provision for Investors

The Reinvestment Provision allows investors to efficiently allocate returns by reinvesting dividends or capital gains back into the fund, promoting compound growth and enhancing long-term wealth accumulation. This provision often provides flexibility and potential tax advantages compared to the Recycling Provision, which typically mandates specified uses of returns. By optimizing capital deployment, the Reinvestment Provision supports portfolio diversification and improves overall investment performance for fund participants.

Impact on Fund Performance: Recycling vs Reinvestment Provision

Recycling provisions allow fund managers to redeploy returned capital from exits into new investments, potentially enhancing overall portfolio diversification and maximizing internal rate of return (IRR). Reinvestment provisions require additional capital calls for new investments, which can dilute existing investors but may provide fresh capital to support growth opportunities. Recycling provisions typically improve fund performance by maintaining investment momentum and reducing capital idle time, while reinvestment provisions offer flexibility but may slow deployment pace and affect net asset value (NAV) growth.

Legal and Regulatory Considerations

Recycling provision in funds allows the redeployment of realized gains back into the portfolio, subject to specific regulatory limits designed to prevent indefinite reinvestment and ensure accurate distribution of returns to investors. Reinvestment provision, on the other hand, governs the use of new capital contributions to acquire additional assets, with legal frameworks emphasizing investor consent, disclosure requirements, and compliance with fund mandates. Both provisions must align with securities laws, fund offering documents, and jurisdictional regulations to maintain transparency, protect investor rights, and avoid conflicts of interest in fund management.

Decision Factors: When to Use Recycling or Reinvestment Provisions

Recycling provisions are advantageous when funds seek flexibility to reuse capital from realized losses or distributions in a closed-end fund environment, optimizing tax efficiency and preserving investment capacity. Reinvestment provisions are preferred in open-end or interval funds aiming to automatically deploy proceeds from distributions or redemptions, maintaining continuous investment momentum without redeployment delays. Decision factors include fund structure, investor liquidity preferences, tax implications, and regulatory constraints influencing capital redeployment strategies.

Case Studies: Real-world Applications in Fund Structures

Case studies reveal that Recycling Provisions in fund structures enable limited partners to redeploy capital from exits or distributions back into new investments, enhancing portfolio flexibility and capital efficiency. In contrast, Reinvestment Provisions typically mandate reinvesting proceeds into the same asset or strategy, supporting asset growth but limiting diversification. Real-world applications demonstrate Recycling Provisions' effectiveness in private equity and venture capital funds for maximizing investment capacity without increasing fund size.

Best Practices for Drafting Provisions in Fund Agreements

Recycling provisions in fund agreements enable the re-use of capital from realized investments, maximizing investment capacity without additional capital calls. Reinvestment provisions allow funds to deploy capital into new investments during an extended period, enhancing portfolio diversification and potential returns. Best practices for drafting these provisions include clear definitions of recycling limits, timing, and conditions to avoid ambiguity, as well as aligning provisions with investor rights and fund lifecycle to balance flexibility and risk management.

Important Terms

Circular Economy

Maximizing circular economy benefits requires balancing recycling provisions, which recover materials, with reinvestment provisions that fund innovation and infrastructure for sustainable resource management.

Material Recovery Facility (MRF)

Material Recovery Facilities (MRFs) enhance recycling rates by efficiently sorting recyclable materials, thereby supporting Recycling Provision goals while enabling Reinvestment Provision through revenue generated from recovered material sales.

Capital Expenditure (CapEx) Allocation

Capital Expenditure (CapEx) allocation balances Recycling Provision, which funds asset replacement through asset sale proceeds, against Reinvestment Provision, targeting growth by allocating surplus funds toward new asset acquisitions.

Extended Producer Responsibility (EPR)

Extended Producer Responsibility (EPR) mandates producers to manage product lifecycle impacts, emphasizing Recycling Provisions that require the efficient collection and processing of waste materials to boost recycling rates. Reinvestment Provisions under EPR focus on allocating funds toward advancing sustainable waste management infrastructure and innovative recycling technologies, enhancing environmental outcomes.

Waste Diversion Rate

The Waste Diversion Rate increases significantly when Recycling Provisions are effectively implemented alongside targeted Reinvestment Provisions to enhance sustainable waste management infrastructure.

Reserve Fund Escrow

Reserve Fund Escrow functions as a financial safeguard within agreements, where Recycling Provisions allow the reuse of distributed funds for new investments, enhancing capital efficiency, while Reinvestment Provisions mandate that returns be directed back into similar assets, ensuring sustained portfolio growth. Understanding the distinction between these provisions is crucial for optimizing fund allocation strategies and maintaining compliance with fiduciary requirements.

Asset Depreciation Schedule

An asset depreciation schedule systematically records the allocation of asset costs over time, incorporating recycling provisions for the recovery of residual values and reinvestment provisions to ensure funds are reserved for asset replacement or upgrades.

End-of-Life Product Stewardship

End-of-Life Product Stewardship emphasizes the importance of prioritizing Recycling Provision to recover valuable materials and reduce environmental impact over Reinvestment Provision, which allocates funds for future product development and sustainability initiatives.

Sustainable Fund Reallocation

Sustainable Fund Reallocation balances Recycling Provision, which reallocates returns into ongoing projects, against Reinvestment Provision, focusing on channeling funds into new sustainable initiatives for long-term impact.

Pay-As-You-Throw Mechanism

The Pay-As-You-Throw mechanism incentivizes waste reduction by charging households based on waste volume while promoting recycling provision through targeted fees and fostering reinvestment provision by allocating collected fees into sustainable waste management and recycling infrastructure.

Recycling Provision vs Reinvestment Provision Infographic

moneydif.com

moneydif.com