Flow-through funds allow investors to receive tax deductions directly from certain types of expenses incurred by the fund, often linked to exploration or development activities, maximizing tax benefits early on. Pass-through funds, on the other hand, distribute income, losses, and credits to investors who then report these items on their individual tax returns, reflecting the fund's earnings without additional tax at the fund level. Understanding the differences between flow-through and pass-through funds is crucial for optimizing investment returns and tax strategies in fund management.

Table of Comparison

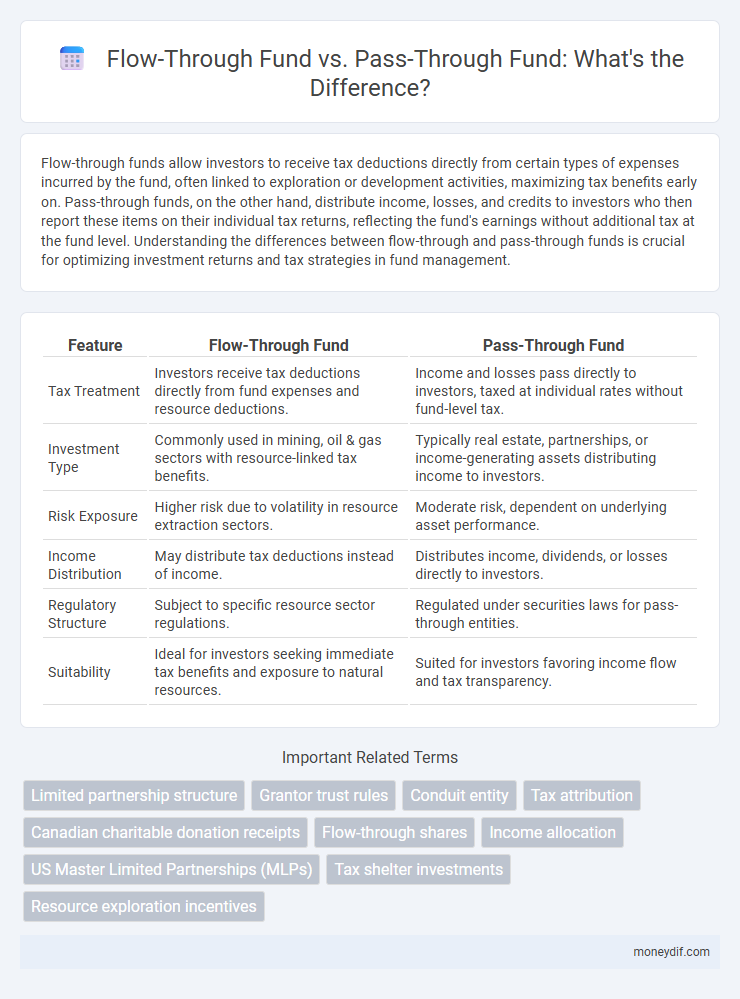

| Feature | Flow-Through Fund | Pass-Through Fund |

|---|---|---|

| Tax Treatment | Investors receive tax deductions directly from fund expenses and resource deductions. | Income and losses pass directly to investors, taxed at individual rates without fund-level tax. |

| Investment Type | Commonly used in mining, oil & gas sectors with resource-linked tax benefits. | Typically real estate, partnerships, or income-generating assets distributing income to investors. |

| Risk Exposure | Higher risk due to volatility in resource extraction sectors. | Moderate risk, dependent on underlying asset performance. |

| Income Distribution | May distribute tax deductions instead of income. | Distributes income, dividends, or losses directly to investors. |

| Regulatory Structure | Subject to specific resource sector regulations. | Regulated under securities laws for pass-through entities. |

| Suitability | Ideal for investors seeking immediate tax benefits and exposure to natural resources. | Suited for investors favoring income flow and tax transparency. |

Introduction to Flow-through and Pass-through Funds

Flow-through funds allow investors to receive tax deductions by passing exploration and development expenses directly to them, commonly used in the mining and energy sectors. Pass-through funds, on the other hand, distribute income, losses, and tax credits directly to investors without the fund paying corporate tax, frequently utilized in real estate and income-producing assets. Understanding the distinction between these funds is essential for optimizing tax benefits and investment returns based on industry-specific opportunities.

Key Definitions: Flow-through vs. Pass-through Funds

Flow-through funds allow investors to directly claim tax deductions from resource exploration expenses, effectively passing these benefits through the fund to individuals. Pass-through funds distribute income, losses, and tax credits to investors proportionally without altering the tax attributes of the underlying assets. Understanding these distinctions is crucial for optimizing tax strategies and investment returns in sectors like natural resources and real estate.

Structural Differences Between the Fund Types

Flow-through funds allocate investment expenses and tax deductions directly to investors, allowing them to claim tax benefits individually, whereas pass-through funds distribute income and expenses without specific tax attribute allocation. Flow-through structures typically involve specific tax credits and depreciation benefits passed to investors, while pass-through funds treat the income as ordinary distributions. These structural differences impact investor tax filings and the timing of tax benefits realization.

Tax Treatment and Implications

Flow-through funds allow investors to receive direct tax deductions from resource exploration expenses, effectively reducing taxable income and deferring taxes until asset disposition. Pass-through funds distribute income, losses, and credits directly to investors without entity-level taxation, leading to immediate tax obligations based on individual shares. Understanding the distinct tax treatments of both funds is crucial for optimizing investment strategies and managing tax liabilities effectively.

Legal Frameworks Governing Each Fund

Flow-through funds operate under specific securities regulations that allow tax attributes to be transferred directly to investors, often governed by national tax laws and securities commissions. Pass-through funds are structured to avoid double taxation by distributing income directly to investors, complying with corporate and tax codes that dictate income flow and shareholder reporting. Legal frameworks for both fund types prioritize transparency, investor protection, and adherence to regulatory filings to maintain compliance and optimize tax treatments.

Investor Eligibility and Participation

Flow-through funds typically require investors to meet specific eligibility criteria such as being accredited or qualified investors, allowing for the direct allocation of tax benefits to these investors. Pass-through funds offer broader eligibility, enabling a wider range of investors to participate by passing income, deductions, and credits directly to shareholders without restriction. Investor participation in flow-through funds is limited by regulatory qualifications, whereas pass-through funds promote inclusivity by distributing earnings proportionally to all eligible participants.

Advantages of Flow-through Funds

Flow-through funds offer significant tax advantages by allowing investors to deduct exploration expenses directly from their taxable income, enhancing cash flow and reducing overall tax liability. These funds provide exposure to high-potential sectors like natural resources and mining, often supported by government incentives that further improve returns. Investors benefit from the deferral of capital gains taxes until the disposition of underlying assets, making flow-through funds an attractive vehicle for tax-efficient investing.

Advantages of Pass-through Funds

Pass-through funds offer the advantage of direct income distribution to investors, enabling earnings to bypass corporate taxation and avoid double taxation. These funds provide greater transparency and flexibility by allowing investors to receive income, dividends, and capital gains proportionate to their ownership. The structure of pass-through funds often results in tax efficiency and can enhance after-tax returns for investors compared to flow-through funds.

Risks and Considerations

Flow-through funds carry risks including regulatory compliance complexities and potential tax benefit reversals if investment criteria are not met. Pass-through funds expose investors to direct operational and market risks without the protective tax deferrals offered by flow-through structures. Careful consideration of liquidity constraints, investor eligibility, and sector-specific volatility is critical when choosing between these fund types.

Choosing the Right Fund Structure for Investors

Flow-through funds provide direct tax benefits by allowing investors to deduct expenses and claim tax credits from flow-through shares, making them ideal for high-income investors seeking tax-efficient opportunities. Pass-through funds, in contrast, distribute income, deductions, and credits directly to investors without taxation at the fund level, offering transparency and avoiding double taxation. Choosing the right fund structure depends on an investor's tax profile, income level, and preference for simplicity versus direct tax benefits.

Important Terms

Limited partnership structure

Limited partnership structures enable flow-through funds to pass income directly to investors without entity-level taxation, while pass-through funds facilitate similar tax transparency by distributing income based on ownership interests.

Grantor trust rules

Grantor trust rules require income from flow-through funds to be reported directly to the grantor for tax purposes, whereas pass-through funds distribute income to investors without affecting the grantor's tax return.

Conduit entity

Conduit entities facilitate the efficient transfer of income in flow-through funds, allowing investors to receive direct shares of earnings without additional taxation at the entity level. In contrast, pass-through funds distribute income directly to investors, ensuring that taxes are paid solely at the investor level, avoiding double taxation.

Tax attribution

Tax attribution determines how income and losses are allocated among investors in flow-through funds, which pass income directly to shareholders for taxation, whereas pass-through funds generally allow investors to report income at their individual tax rates without corporate-level tax burdens.

Canadian charitable donation receipts

Canadian charitable donation receipts for flow-through funds provide tax benefits by attributing resource expenses directly to investors, whereas pass-through funds issue receipts based on the fund's overall charitable contributions without specific tax attribution.

Flow-through shares

Flow-through shares enable Flow-through funds to allocate tax deductions directly to investors, whereas Pass-through funds distribute income without such tax attribute transfers.

Income allocation

Income allocation in flow-through funds directs tax deductions and credits to investors, enabling efficient tax planning, while pass-through funds allocate income and losses directly, maintaining transparency but often resulting in immediate taxable events for investors. Both structures facilitate income distribution but differ in tax treatment and investor benefit timing.

US Master Limited Partnerships (MLPs)

US Master Limited Partnerships (MLPs) function as pass-through funds that allow income to flow directly to investors avoiding corporate taxes, whereas flow-through funds typically reallocate tax attributes to investors in resource sectors like mining or oil and gas exploration.

Tax shelter investments

Flow-through funds direct income and tax deductions from resource exploration to investors, while pass-through funds distribute income without tax attribute transfers, impacting investor tax benefits differently.

Resource exploration incentives

Flow-through funds offer tax incentives to investors by allowing resource exploration expenses to be deducted against their income, whereas pass-through funds primarily pass income and losses directly to investors without such specific exploration tax benefits.

Flow-through fund vs Pass-through fund Infographic

moneydif.com

moneydif.com