A feeder fund pools capital from investors and channels it into a master fund, which manages the actual investments. This structure allows multiple feeder funds to feed into one master fund, providing economies of scale and centralized portfolio management. Investors benefit from streamlined access to diverse assets while the master fund maintains consolidated control over investment decisions and operations.

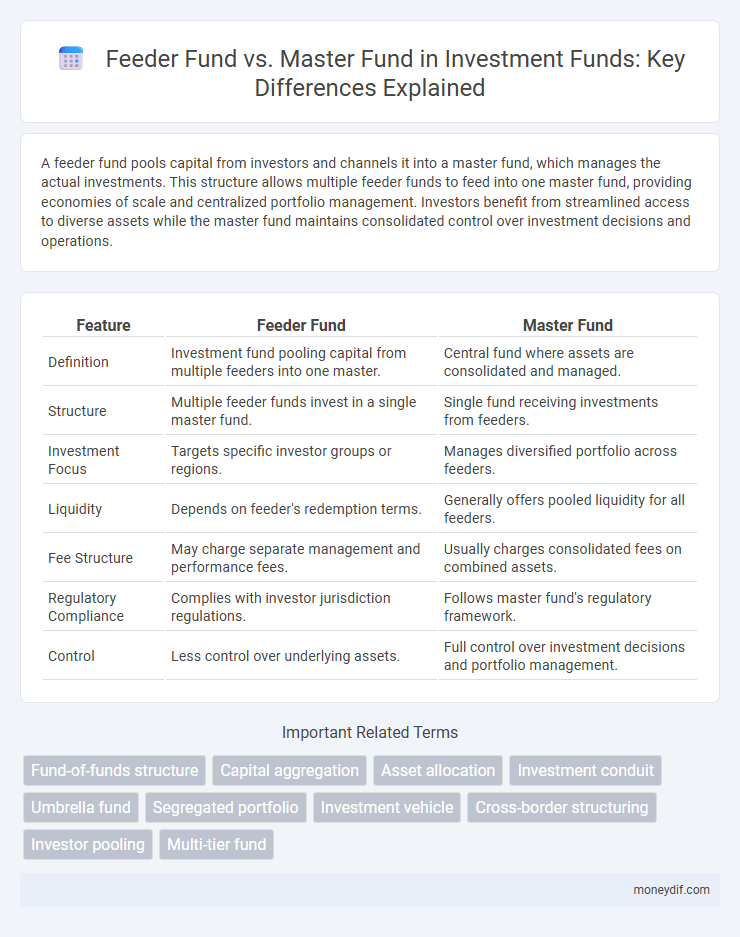

Table of Comparison

| Feature | Feeder Fund | Master Fund |

|---|---|---|

| Definition | Investment fund pooling capital from multiple feeders into one master. | Central fund where assets are consolidated and managed. |

| Structure | Multiple feeder funds invest in a single master fund. | Single fund receiving investments from feeders. |

| Investment Focus | Targets specific investor groups or regions. | Manages diversified portfolio across feeders. |

| Liquidity | Depends on feeder's redemption terms. | Generally offers pooled liquidity for all feeders. |

| Fee Structure | May charge separate management and performance fees. | Usually charges consolidated fees on combined assets. |

| Regulatory Compliance | Complies with investor jurisdiction regulations. | Follows master fund's regulatory framework. |

| Control | Less control over underlying assets. | Full control over investment decisions and portfolio management. |

Introduction to Feeder and Master Funds

Feeder funds pool capital from investors and channel it into a master fund, which handles all investment decisions and portfolio management. The master fund consolidates assets from multiple feeders, enabling economies of scale and streamlined administration. This structure improves operational efficiency while providing investors access to diversified investments through the feeder fund.

Key Definitions: What Are Feeder and Master Funds?

Feeder funds are investment vehicles that pool capital from multiple investors and channel it into a master fund, which manages the consolidated assets and executes the overall investment strategy. The master fund holds the primary portfolio of securities and handles day-to-day trading, while feeder funds provide a way for investors to participate indirectly and may offer different fee structures or tax efficiencies. This structure streamlines administration and allows for greater economies of scale within pooled investment strategies.

Structural Differences Between Feeder and Master Funds

A feeder fund pools capital from individual investors and channels it into a master fund, which centrally manages the investment portfolio and executes trades. The master fund consolidates assets to achieve economies of scale, while feeder funds maintain separate investor records and regulatory compliance in different jurisdictions. Structural differences include the legal entities used, with feeder funds typically structured as limited partnerships or corporations, and the master fund often established as a limited partnership or trust to optimize tax efficiency and governance.

How Feeder and Master Funds Operate Together

Feeder funds pool capital from individual investors and channel it into a master fund, which centralizes portfolio management and investment decisions. This structure allows the master fund to efficiently execute trades and allocate assets on behalf of multiple feeders, optimizing economies of scale and reducing operational costs. Coordination between feeder and master funds ensures transparency, streamlined reporting, and alignment of investment objectives across diverse investor bases.

Advantages of Feeder Fund Structures

Feeder fund structures offer investors easier access to large master funds by pooling capital from multiple sources, enabling diversified participation with lower minimum investment thresholds. These structures enhance operational efficiency through centralized management and administration at the master fund level, reducing overall costs. Feeder funds also provide regulatory flexibility, allowing investors from different jurisdictions to invest according to their local compliance requirements.

Benefits of Master Fund Structures

Master fund structures offer significant benefits including centralized portfolio management that enhances investment efficiency and reduces operational costs. They provide greater transparency and streamlined reporting for investors by consolidating assets under a single entity. This structure also enables better risk management through diversified asset allocation and simplified regulatory compliance.

Regulatory Considerations: Feeder vs Master Funds

Feeder funds and master funds face distinct regulatory considerations due to their structural roles, as feeder funds primarily invest in the master fund, which holds the underlying assets. Regulatory compliance for feeder funds often involves adherence to jurisdiction-specific investor eligibility requirements, anti-money laundering rules, and reporting obligations, while master funds focus on broader portfolio management regulations and risk disclosures. Understanding these differences is crucial for fund managers to ensure compliance with securities laws across multiple jurisdictions and optimize tax efficiency.

Tax Implications for Investors

Feeder funds often provide tax advantages by allowing investors to participate in a master fund's diversified portfolio while maintaining separate tax treatments based on their jurisdiction. Master funds typically consolidate income, gains, and losses, which may simplify tax reporting but can lead to different tax liabilities compared to feeder structures. Understanding the specific tax rules in the investor's country is essential, as feeder funds can enable more favorable tax planning, including the potential to avoid double taxation or benefit from treaty provisions.

Suitability for Different Investor Profiles

Feeder funds are suitable for smaller or individual investors seeking access to diversified strategies managed by a master fund, offering lower minimum investment thresholds and simplified administration. Master funds cater to institutional or large investors who require direct exposure, greater control, and cost efficiencies through consolidated investment management. Each structure aligns with varying risk appetites, investment horizons, and regulatory considerations tailored to distinct investor profiles.

Feeder Fund vs Master Fund: Which is Right for You?

Feeder funds pool investor capital into a master fund, enabling access to diverse investments with lower minimum commitments and streamlined administration. Master funds directly manage the underlying portfolio, offering greater control and cost efficiency for larger investors. Choosing between feeder and master funds depends on your investment size, control preferences, and cost sensitivity.

Important Terms

Fund-of-funds structure

A Fund-of-Funds structure typically involves multiple feeder funds investing into a single master fund, which consolidates assets to achieve greater diversification and centralized management. Feeder funds allow investors to access the master fund's portfolio while maintaining separate legal, tax, and regulatory considerations.

Capital aggregation

Capital aggregation in feeder funds involves pooling investments from multiple investors into a single fund, which then channels the combined capital into a master fund, maximizing operational efficiencies and investment scale. This structure allows master funds to centralize portfolio management and reduce costs, while feeder funds provide tailored access for diverse investor types with varying regulatory or tax requirements.

Asset allocation

Asset allocation within a feeder fund and master fund structure optimizes diversification by channeling investor capital through feeder funds that pool resources into a centralized master fund, which executes the core investment strategy across asset classes. This framework enhances cost efficiency and simplifies portfolio rebalancing by consolidating asset allocation decisions at the master fund level, ensuring consistent exposure to targeted equities, fixed income, and alternative investments.

Investment conduit

Investment conduits often structure assets through feeder funds pooling capital from multiple investors, which then channel investments into a master fund that holds the underlying portfolio securities. This feeder-master fund structure enhances operational efficiency, tax optimization, and centralized portfolio management while accommodating diverse investor bases.

Umbrella fund

An umbrella fund is a single investment vehicle containing multiple sub-funds that allow investors to diversify assets under one umbrella structure, optimizing cost and management efficiency. Feeder funds pool capital from investors and funnel it into a master fund, which actively manages the combined investments, streamlining administration and reducing duplication of expenses.

Segregated portfolio

A segregated portfolio in a feeder fund structure isolates assets and liabilities associated with a specific feeder's investments from the master fund, enhancing risk management and investor protection.

Investment vehicle

A feeder fund pools capital from individual investors and channels it into a master fund that consolidates assets for centralized management and investment strategies.

Cross-border structuring

Cross-border structuring in investment funds involves the strategic use of feeder funds and master funds to optimize tax efficiency, regulatory compliance, and investor access across jurisdictions. A feeder fund pools capital from investors in specific regions and channels it into a master fund, which conducts all investments, thereby streamlining administration and minimizing legal complexities in multiple countries.

Investor pooling

Investor pooling in feeder funds aggregates capital from multiple investors to invest collectively in a master fund, enhancing diversification and operational efficiency.

Multi-tier fund

A multi-tier fund structure typically involves a feeder fund that pools capital from investors and channels it into a master fund where all investments are consolidated to achieve economies of scale and streamlined management. The feeder fund allows individual investors to access the master fund's diversified portfolio while optimizing tax efficiency and regulatory compliance across different jurisdictions.

Feeder fund vs Master fund Infographic

moneydif.com

moneydif.com