A blind pool fund raises capital without specifying exact investment targets, allowing fund managers flexibility to pursue diverse opportunities based on market conditions. A sidecar fund, by contrast, invests alongside a primary fund in pre-identified deals, providing investors with targeted exposure and greater transparency. Understanding the differences helps investors align their risk tolerance and investment strategy with the fund's structure.

Table of Comparison

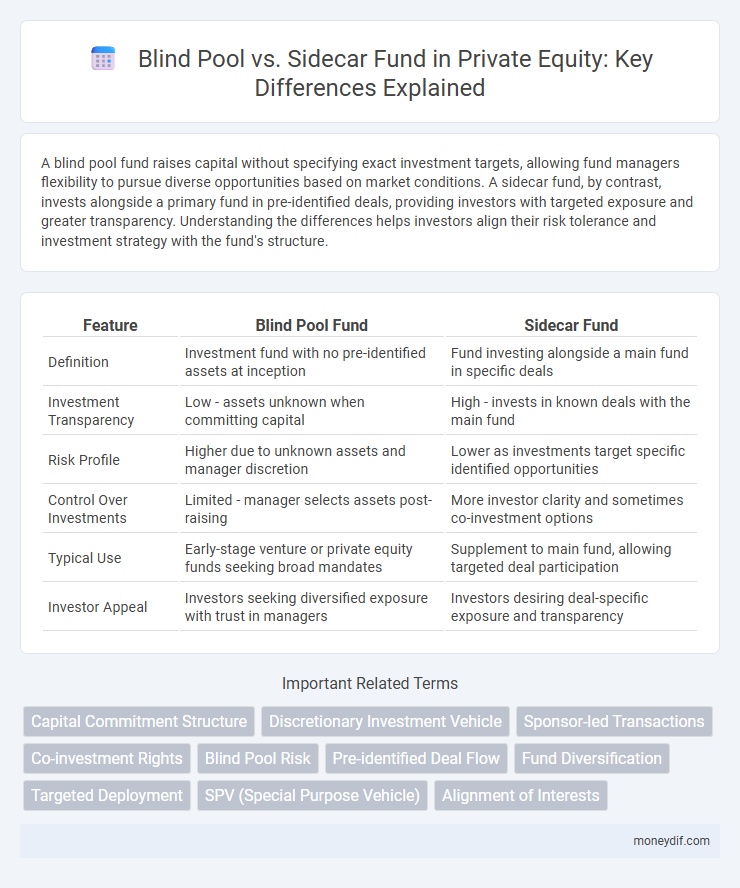

| Feature | Blind Pool Fund | Sidecar Fund |

|---|---|---|

| Definition | Investment fund with no pre-identified assets at inception | Fund investing alongside a main fund in specific deals |

| Investment Transparency | Low - assets unknown when committing capital | High - invests in known deals with the main fund |

| Risk Profile | Higher due to unknown assets and manager discretion | Lower as investments target specific identified opportunities |

| Control Over Investments | Limited - manager selects assets post-raising | More investor clarity and sometimes co-investment options |

| Typical Use | Early-stage venture or private equity funds seeking broad mandates | Supplement to main fund, allowing targeted deal participation |

| Investor Appeal | Investors seeking diversified exposure with trust in managers | Investors desiring deal-specific exposure and transparency |

Understanding Blind Pool Funds

Blind pool funds involve investors committing capital without knowing specific investments in advance, relying on the fund manager's expertise and strategy. This structure contrasts with sidecar funds, which allow investors to co-invest alongside a primary fund with more transparency on individual deals. Understanding blind pool funds is crucial for assessing risk exposure, management track record, and aligning investment goals with fund strategy.

What Is a Sidecar Fund?

A sidecar fund is a type of investment vehicle that co-invests alongside a primary fund, providing additional capital for specific deals without the broader investment scope of a blind pool fund. Unlike a blind pool, where investors commit capital without knowing exact assets upfront, sidecar funds target specific opportunities identified by the lead fund manager. This structure offers investors more clarity and control over individual investments while leveraging the expertise and deal flow of the main fund.

Key Structural Differences: Blind Pool vs Sidecar Fund

A Blind Pool fund raises capital without disclosing specific investment targets, providing managers flexibility to identify opportunities post-funding, while a Sidecar fund is tied to a main investment vehicle and co-invests alongside it in pre-identified deals. The Blind Pool structure allows for broader portfolio diversification but carries higher uncertainty for investors compared to the Sidecar fund's targeted and transparent deployment strategy. Sidecars typically attract investors seeking direct exposure to particular assets with defined risk profiles, contrasting with the Blind Pool's emphasis on managerial discretion and capital allocation agility.

Investment Decision-Making Processes Compared

Blind pools require investors to commit capital without specific asset details, relying heavily on fund managers' expertise and track record for investment decisions. Sidecar funds allow investors to evaluate individual deals alongside lead investors, enabling more selective and transparent investment decisions. The decision-making process in sidecar funds offers greater control and due diligence opportunities compared to the pooled, less targeted approach of blind pools.

Transparency and Due Diligence Issues

Blind pools lack specific disclosures of underlying assets, creating significant transparency challenges for investors who must rely solely on the fund manager's reputation and strategy without detailed due diligence data. Sidecar funds enhance transparency by co-investing alongside a lead fund in identified opportunities, enabling more thorough due diligence on disclosed assets and reducing information asymmetry. The increased visibility in sidecar funds allows for improved risk assessment and investor confidence compared to the inherent uncertainties within blind pools.

Risk Management in Blind Pool and Sidecar Funds

Blind pools carry higher risk due to the lack of disclosed target assets or investment strategies, which limits investor ability to perform thorough due diligence. Sidecar funds enhance risk management by allowing investors to co-invest alongside a lead fund with greater transparency on specific deals, reducing uncertainty. The ability to evaluate each investment individually in sidecar funds provides a more controlled risk exposure compared to the inherent ambiguity in blind pools.

Investor Control and Influence

Blind pools provide investors limited control and influence since the fund manager makes investment decisions without prior disclosure of specific assets. Sidecar funds offer greater investor control by allowing participants to co-invest alongside the main fund, often with transparency on targeted deals. This structure enables sidecar investors to evaluate and influence individual investments directly, enhancing decision-making involvement.

Performance and Return Potential

Blind pools typically offer higher return potential due to early-stage investments made before specific assets are identified, allowing fund managers greater flexibility and potential for outsized gains. Sidecar funds focus on co-investing alongside primary funds with known assets, often resulting in more predictable and stable performance but generally lower returns. Performance variability in blind pools is broader due to the uncertainty and timing of investments, whereas sidecar funds benefit from reduced risk exposure linked to existing portfolio companies.

Regulatory Considerations and Compliance

Blind pools require fund managers to comply with strict disclosure and registration requirements under securities regulations due to the absence of identified investments at the time of fundraising. Sidecar funds offer greater transparency and typically face fewer regulatory burdens since investors are aware of the specific deals being co-invested alongside a lead fund. Compliance frameworks for blind pools often emphasize investor protections through enhanced reporting, whereas sidecar funds prioritize alignment with existing lead fund structures to streamline regulatory adherence.

Choosing Between Blind Pool and Sidecar Funds

Choosing between blind pool and sidecar funds depends on an investor's preference for transparency and control. Blind pool funds offer broad investment potential with less upfront information, relying heavily on the general partner's expertise and track record. Sidecar funds provide co-investment opportunities alongside a primary fund, allowing investors more visibility and selective exposure to specific deals within the fund's portfolio.

Important Terms

Capital Commitment Structure

Capital commitment structure in blind pools involves investors committing funds without direct asset selection, whereas sidecar funds allow co-investors to commit capital specifically to opportunities identified by the lead fund.

Discretionary Investment Vehicle

A Discretionary Investment Vehicle (DIV) allows fund managers to deploy capital without investor consents on individual deals, offering greater flexibility compared to a Blind Pool fund where investors commit capital upfront without knowledge of specific investments. Sidecar funds differ by co-investing alongside a primary fund in selective deals, providing investors targeted exposure without full commitment to the entire Blind Pool.

Sponsor-led Transactions

Sponsor-led transactions involving blind pools raise higher risk due to limited asset visibility, whereas sidecar funds offer investors targeted exposure alongside experienced sponsors with greater transparency and control.

Co-investment Rights

Co-investment rights allow investors to participate alongside a Blind Pool or Sidecar Fund, granting direct exposure to specific portfolio companies and mitigating dilution of ownership in the primary fund. While Blind Pools aggregate capital without predefined targets, Sidecar Funds typically focus on particular deals, making co-investment rights a strategic tool for tailored risk allocation and enhanced returns.

Blind Pool Risk

Blind pool risk arises when investors commit capital without knowing the specific investment targets, increasing uncertainty compared to sidecar funds that co-invest alongside a lead fund with known assets. Sidecar funds mitigate blind pool risk by allowing investors to evaluate the original fund's portfolio and performance, providing greater transparency and reducing the likelihood of unforeseen investment outcomes.

Pre-identified Deal Flow

Pre-identified deal flow in blind pools contrasts with sidecar funds, as blind pools raise capital without specific investments lined up, relying on general strategy and manager expertise, whereas sidecar funds allow investors to co-invest alongside the main fund in pre-identified deals, offering greater transparency and targeted exposure. Sidecar funds mitigate blind pool risk by providing access to vetted opportunities and enabling investors to selectively participate in high-conviction transactions.

Fund Diversification

Fund diversification enhances risk management by distributing capital across multiple investments or strategies, which is critical when comparing blind pools and sidecar funds. Blind pools aggregate investor capital without disclosing specific assets upfront, relying on manager expertise, while sidecar funds allow investors to co-invest alongside primary funds in identified opportunities, providing greater transparency and targeted exposure.

Targeted Deployment

Targeted deployment in venture capital strategically allocates capital to Blind Pool funds that offer diversified early-stage investments with unknown assets versus Sidecar funds that co-invest alongside established vehicles targeting specific companies or sectors.

SPV (Special Purpose Vehicle)

A Special Purpose Vehicle (SPV) is a legal entity created to isolate financial risk and facilitate specific investment projects, commonly used in Blind Pool and Sidecar fund structures. Blind Pool funds raise capital without predefined assets, relying on managers' discretion, while Sidecar funds invest alongside a main fund, targeting specific deals with greater transparency and investor control.

Alignment of Interests

Alignment of interests in blind pools often hinges on the general partner's investment of capital alongside limited partners, ensuring commitment despite inherent uncertainty in asset selection, while sidecar funds offer more transparency and control by allowing investors to participate in specific deals alongside a lead investor. This structural difference impacts risk distribution and incentive mechanisms, with sidecar funds generally providing clearer alignment due to deal-by-deal participation compared to the blind commitment in blind pools.

Blind pool vs Sidecar fund Infographic

moneydif.com

moneydif.com