A Side Letter in a fund context allows investors to negotiate specific terms tailored to their needs, offering bespoke rights or restrictions outside of the standard fund agreement. Most Favored Nation (MFN) clauses ensure that an investor receives terms no less favorable than those granted to any other investor, promoting fairness across stakeholders. Understanding the differences helps investors balance personalized benefits with protections against less advantageous terms.

Table of Comparison

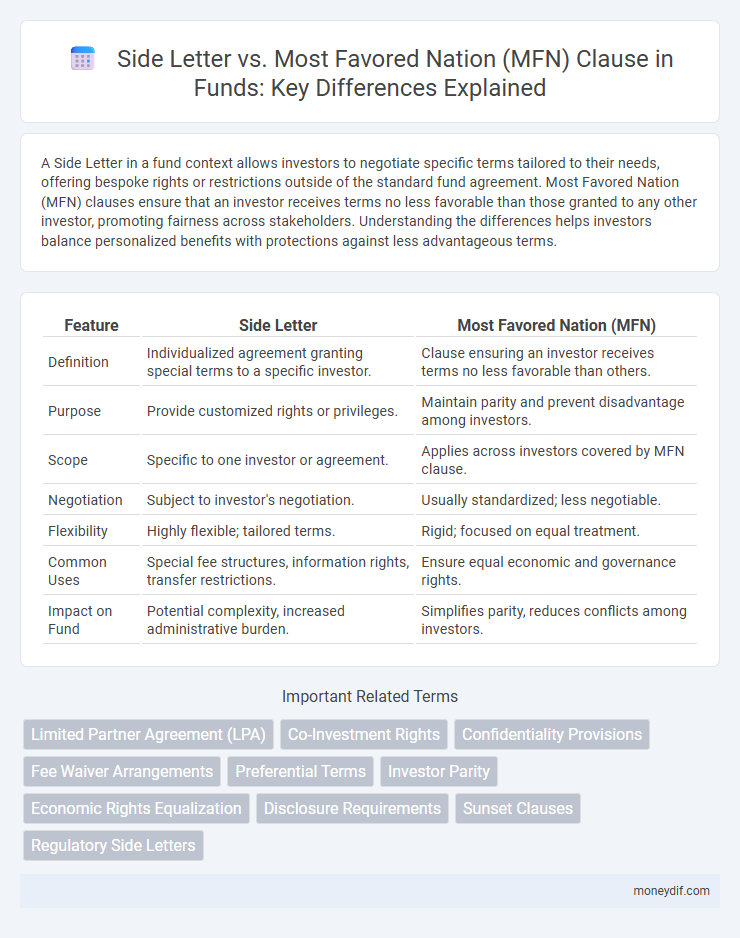

| Feature | Side Letter | Most Favored Nation (MFN) |

|---|---|---|

| Definition | Individualized agreement granting special terms to a specific investor. | Clause ensuring an investor receives terms no less favorable than others. |

| Purpose | Provide customized rights or privileges. | Maintain parity and prevent disadvantage among investors. |

| Scope | Specific to one investor or agreement. | Applies across investors covered by MFN clause. |

| Negotiation | Subject to investor's negotiation. | Usually standardized; less negotiable. |

| Flexibility | Highly flexible; tailored terms. | Rigid; focused on equal treatment. |

| Common Uses | Special fee structures, information rights, transfer restrictions. | Ensure equal economic and governance rights. |

| Impact on Fund | Potential complexity, increased administrative burden. | Simplifies parity, reduces conflicts among investors. |

Understanding Side Letters in Fund Agreements

Side letters in fund agreements provide specific contractual rights or benefits to certain investors that are not included in the main fund documentation, allowing customization based on investor needs. Unlike Most Favored Nation (MFN) clauses, which ensure all investors receive the best terms offered to any party, side letters create tailored provisions such as fee discounts, reporting rights, or liquidity preferences. Understanding side letters is crucial for fund managers and investors to navigate preferential treatment and maintain compliance with regulatory frameworks.

Defining Most Favored Nation (MFN) Clauses

Most Favored Nation (MFN) clauses in fund agreements ensure that an investor receives terms no less favorable than those offered to any subsequent investor. These provisions safeguard equal treatment by automatically extending superior rights or benefits granted later to original investors. MFN clauses contrast with side letters, which provide customized terms to specific investors without universally applying to others.

Key Differences Between Side Letters and MFN Provisions

Side letters provide tailored agreements between specific investors and fund managers, granting unique rights or terms that differ from the main fund documents. Most Favored Nation (MFN) provisions ensure that an investor receives the best terms offered to any other investor, promoting uniformity and fairness across the fund. Key differences include the personalized nature of side letters versus the general equalization intent of MFN clauses, impacting investor rights, fee structures, and information access within the fund.

Legal Implications of Side Letters vs MFN

Side letters create legally binding agreements that grant specific rights or exceptions to certain investors, potentially leading to disclosure and enforcement challenges due to their bespoke nature. Most Favored Nation (MFN) clauses ensure equal treatment among investors by automatically extending favorable terms granted to one party to others, reducing legal disputes but increasing the complexity of contract administration. The legal implications of side letters include heightened negotiation risks and confidentiality concerns, whereas MFN clauses promote fairness but may limit flexibility in investor relations.

Common Uses of Side Letters in Fund Structures

Side letters in fund structures are commonly used to grant specific investors tailored rights, such as preferential reporting, fee arrangements, or liquidity terms, ensuring alignment with their unique investment requirements. These agreements provide flexibility beyond the standard Limited Partnership Agreement, addressing issues like co-investment opportunities or transfer restrictions. Unlike Most Favored Nation (MFN) clauses that guarantee equal treatment among investors, side letters customize individual investor relations within the fund.

How MFN Clauses Impact Investor Equality

Most Favored Nation (MFN) clauses in fund agreements ensure that investors receive terms no less favorable than those offered to subsequent investors, promoting investor equality by preventing preferential treatment. These clauses can limit the ability of fund managers to grant special rights through side letters without extending similar benefits to all MFN investors. Consequently, MFN provisions create a more transparent and balanced investment environment by standardizing key economic and governance terms across investor classes.

Negotiation Strategies: Side Letter or MFN?

Negotiation strategies in fund agreements often hinge on choosing between a Side Letter and a Most Favored Nation (MFN) clause, each offering distinct advantages for investor protections and flexibility. Side Letters allow for tailored, confidential terms specific to individual investors, enhancing customization but requiring careful drafting to avoid conflicts with the fund's standard terms. MFN clauses ensure equal treatment among investors by automatically extending favorable terms granted to one party to all applicable investors, promoting fairness but potentially limiting negotiation leverage in future agreements.

Regulatory Considerations for Side Letters and MFN

Regulatory considerations for Side Letters and Most Favored Nation (MFN) clauses in fund agreements primarily revolve around disclosure obligations and fairness principles under securities laws. Side Letters must be carefully structured to avoid creating preferential treatment that could trigger regulatory scrutiny for disparate investor rights, while MFN clauses are often used to maintain consistent terms among investors and mitigate compliance risks. Ensuring transparency with regulators and adhering to fiduciary duties are critical to managing potential conflicts and avoiding violations under frameworks such as the SEC's anti-fraud provisions and investor protection rules.

Risks and Challenges Associated with Side Letters and MFN

Side letters in fund agreements pose risks such as inconsistent terms creating conflicts among investors and potential breaches of fairness or transparency obligations. Most Favored Nation (MFN) clauses challenge fund managers by requiring uniform treatment of investors, which can limit flexibility in negotiating individualized agreements. Both mechanisms necessitate careful legal scrutiny to mitigate risks of disputes, regulatory scrutiny, and operational complexities in fund administration.

Best Practices for Managing Side Letter and MFN Provisions

Effective management of Side Letter and Most Favored Nation (MFN) provisions in fund agreements involves clear documentation to avoid conflicts and ensure alignment with investor rights. Best practices include maintaining detailed records of all Side Letter terms, regularly reviewing MFN clauses to uphold fairness among investors, and implementing robust tracking systems to monitor compliance. Transparent communication with stakeholders and legal counsel is essential to mitigate risks and preserve fund integrity.

Important Terms

Limited Partner Agreement (LPA)

A Limited Partner Agreement (LPA) often incorporates Side Letters to provide specific investors customized terms while employing Most Favored Nation (MFN) clauses to ensure those investors receive treatment no less favorable than others under subsequent agreements.

Co-Investment Rights

Co-Investment Rights granted through Side Letters provide specific investors preferential terms, while Most Favored Nation (MFN) clauses ensure these investors receive any more favorable rights offered subsequently.

Confidentiality Provisions

Confidentiality provisions in side letters typically restrict the disclosure of specific negotiated terms between parties, ensuring sensitive information remains private, while Most Favored Nation (MFN) clauses mandate that one party receives terms no less favorable than those offered to others, potentially limiting confidentiality by requiring disclosure of comparable agreements. In practice, balancing confidentiality with MFN obligations requires careful drafting to protect proprietary or strategic details without breaching the fair treatment guarantees inherent in MFN clauses.

Fee Waiver Arrangements

Fee waiver arrangements in Side Letters often provide customized benefits, while Most Favored Nation (MFN) clauses ensure party access to the best fee terms negotiated across all agreements.

Preferential Terms

Preferential terms in a side letter grant specific parties more favorable conditions than the Most Favored Nation (MFN) clause, which ensures no other party receives better terms.

Investor Parity

Investor parity ensures equal treatment of investors by applying Side Letters or Most Favored Nation (MFN) clauses to grant specific investors rights or benefits without disadvantaging others.

Economic Rights Equalization

Economic Rights Equalization ensures fair treatment by applying Side Letter agreements to grant specific benefits while Most Favored Nation (MFN) clauses guarantee non-discriminatory, equal treatment among all parties in international trade agreements.

Disclosure Requirements

Disclosure requirements for Side Letters and Most Favored Nation (MFN) clauses mandate transparent reporting of preferential terms and benefits to ensure equitable treatment among stakeholders in contractual agreements.

Sunset Clauses

Sunset clauses in side letters limit the duration of special terms, whereas Most Favored Nation (MFN) clauses ensure ongoing equal treatment by granting parties the best terms offered to others.

Regulatory Side Letters

Regulatory side letters often address specific compliance terms or unique obligations that differ from the standard agreement, while Most Favored Nation (MFN) clauses ensure that parties receive terms no less favorable than those granted to any other party. In contrast to MFN clauses, which standardize benefits across agreements, regulatory side letters customize obligations to meet particular legal or regulatory requirements.

Side Letter vs Most Favored Nation (MFN) Infographic

moneydif.com

moneydif.com