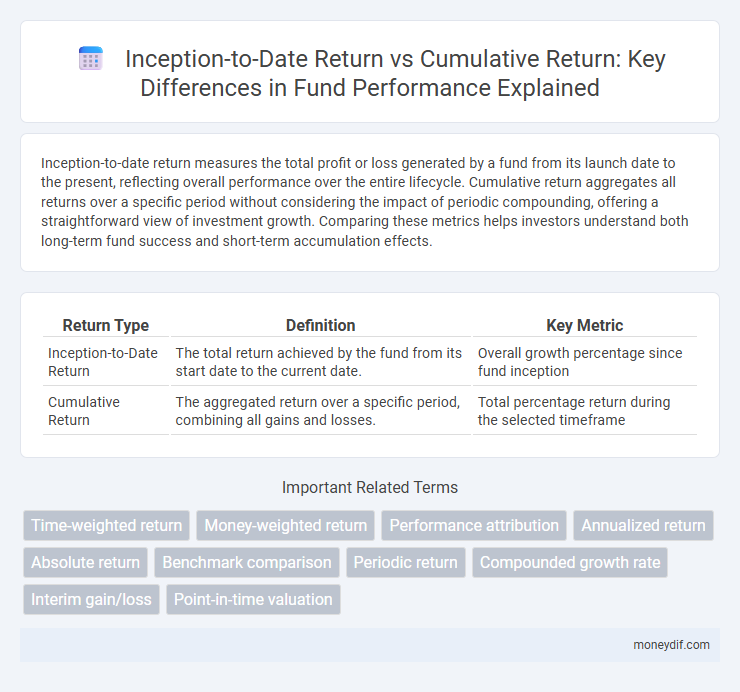

Inception-to-date return measures the total profit or loss generated by a fund from its launch date to the present, reflecting overall performance over the entire lifecycle. Cumulative return aggregates all returns over a specific period without considering the impact of periodic compounding, offering a straightforward view of investment growth. Comparing these metrics helps investors understand both long-term fund success and short-term accumulation effects.

Table of Comparison

| Return Type | Definition | Key Metric |

|---|---|---|

| Inception-to-Date Return | The total return achieved by the fund from its start date to the current date. | Overall growth percentage since fund inception |

| Cumulative Return | The aggregated return over a specific period, combining all gains and losses. | Total percentage return during the selected timeframe |

Definition of Inception-to-Date Return

Inception-to-date return measures the total performance of a fund from its launch date to the current date, reflecting the overall growth including capital gains, dividends, and interest. It differs from cumulative return, which may refer to the aggregated returns over specific intervals but not necessarily from inception. This metric provides investors with a comprehensive view of the fund's long-term profitability and investment success.

What is Cumulative Return?

Cumulative return measures the total gain or loss of an investment over a specific period, expressed as a percentage of the initial investment. It includes all income, such as dividends and interest, compounded over time, providing a comprehensive picture of investment performance. Unlike inception-to-date return, which tracks performance from the fund's start to the present, cumulative return can be calculated for any chosen timeframe.

Key Differences Between Inception-to-Date and Cumulative Return

Inception-to-date return measures the total gain or loss of a fund from the initial investment date to the current date, reflecting the overall performance since inception. Cumulative return aggregates the percentage change in value over a specific period, often shorter and customizable, but does not necessarily start from the fund's inception. Key differences include the time frame reference--full lifespan versus selected period--and the use of inception-to-date return for long-term performance analysis compared to cumulative return's flexibility for periodic evaluation.

Importance of Benchmarking Fund Performance

Inception-to-date return measures the total growth of a fund since its inception, providing a long-term view of performance, while cumulative return represents the aggregate return over a specific period. Benchmarking fund performance against relevant indices or peer groups is crucial for investors to assess relative success and risk-adjusted returns effectively. Accurate benchmarking enables informed decision-making by highlighting strengths and weaknesses compared to market standards and fund objectives.

Calculating Inception-to-Date Return: Methods and Examples

Inception-to-date return measures the total gain or loss of a fund from its inception to the current date, calculated by dividing the current value plus distributions by the initial investment and subtracting one. Methods include using time-weighted rates of return or money-weighted internal rate of return (IRR), each providing insights on different aspects of fund performance. For example, a fund initiated at $10,000 valued at $15,000 with $1,000 in distributions has an inception-to-date return of (15,000 + 1,000) / 10,000 - 1 = 60%.

How to Compute Cumulative Return Accurately

Cumulative return measures the total change in investment value from inception to date, capturing the overall performance without annualizing the gains. Accurately computing cumulative return requires multiplying the periodic returns (expressed as 1 plus each return) sequentially, then subtracting 1 from the result to reflect total growth. This method accounts for compounding effects, ensuring a precise reflection of the fund's accumulated returns over time.

Pros and Cons of Using Inception-to-Date Return

Inception-to-date (ITD) return measures a fund's performance from its start date to the present, providing a comprehensive long-term view essential for assessing overall fund growth. This metric captures cumulative effects of compounding, making it easier to compare funds with different inception dates and evaluate sustained management quality. However, ITD return can mask recent performance trends and may be influenced disproportionately by older performance periods, limiting its usefulness for short-term decision-making.

Advantages and Limitations of Cumulative Return

Cumulative return measures the total gain or loss of an investment over a set period, offering clear insight into overall performance without the daily fluctuations seen in inception-to-date return calculations. Advantages include simplicity and ease of communication for investors tracking long-term growth, while limitations involve lack of time-weighting and inability to account for interim cash flows or varying investment periods. This can lead to misleading conclusions when comparing funds with different investment timelines or cash flow patterns.

Impact on Investment Decision-Making

Inception-to-date return measures the total growth of a fund from its start, offering investors a long-term perspective on performance consistency and risk management. Cumulative return aggregates the total percentage gain or loss over a specific period, providing insight into short- to medium-term fund effectiveness. Comparing these metrics enhances investment decision-making by highlighting both the fund's historical resilience and recent performance trends, which aids in evaluating future growth potential and volatility.

Best Practices for Reporting Return Metrics in Fund Analysis

Inception-to-Date Return measures total growth of a fund from its start date, offering a long-term performance perspective crucial for investors evaluating durability. Cumulative Return aggregates periodic returns over time, providing an easy-to-understand overview of overall profitability without accounting for investment duration. Best practices in fund analysis recommend clearly distinguishing these metrics, using consistent time frames, and presenting context with benchmarks to ensure transparent, meaningful performance evaluation.

Important Terms

Time-weighted return

Time-weighted return measures investment performance by eliminating the impact of cash flows, providing a consistent metric for comparing periods regardless of contributions or withdrawals. Inception-to-date return reflects the total growth from the initial investment date to the present, while cumulative return accounts for the aggregate percentage change over a specific time frame, both illustrating overall portfolio gains but differing in their sensitivity to timing and size of cash flows.

Money-weighted return

Money-weighted return measures investment performance by accounting for the timing and size of cash flows, providing a personalized rate of return that reflects the investor's actual experience. Inception-to-Date Return captures the total growth of an investment since inception, while Cumulative Return aggregates periodic returns without adjusting for cash flow timing, making money-weighted return more precise for evaluating individualized portfolio performance over the same period.

Performance attribution

Performance attribution dissects the drivers behind Inception-to-Date Return by isolating contributions from asset selection, sector allocation, and market timing, offering granular insights into cumulative return components. This method enhances investment analysis precision by linking specific portfolio decisions to overall cumulative performance metrics.

Annualized return

Annualized return measures the geometric average return per year since inception, providing a standardized performance metric over varying time periods. Inception-to-Date Return represents total growth since the start date, while Cumulative Return accounts for the aggregate gain or loss over a specific period without annualization.

Absolute return

Absolute return measures the total gain or loss of an investment without considering external factors, while Inception-to-Date Return calculates the overall performance of an asset from the start date to the current date, reflecting the cumulative return realized. Comparing Inception-to-Date Return versus Cumulative Return enables investors to evaluate long-term growth patterns and assess the effectiveness of investment strategies over time.

Benchmark comparison

Benchmark comparison reveals that Inception-to-Date Return provides a holistic performance measure, while Cumulative Return highlights total gains over specific periods.

Periodic return

Periodic return measures investment performance over specific intervals, providing granular insight into fluctuations, whereas Inception-to-Date Return aggregates overall gains or losses since the start date, reflecting long-term growth. Cumulative Return sums all periodic returns over time, illustrating total growth without adjusting for the timing of gains, unlike the time-weighted Inception-to-Date Return.

Compounded growth rate

The compounded growth rate (CAGR) measures the average annual return of an investment from inception to date, providing a smoothed rate that accounts for cumulative return over the holding period.

Interim gain/loss

Interim gain/loss represents the unrealized profit or loss on investments calculated during the reporting period, impacting the Inception-to-Date Return, which measures total performance from initial investment to the current date. Cumulative Return aggregates all gains and losses, including interim results, reflecting the overall portfolio growth or decline over the entire investment horizon.

Point-in-time valuation

Point-in-time valuation captures the asset value at a specific date, enabling precise Inception-to-Date Return measurement while cumulative return aggregates performance over the entire investment period.

Inception-to-Date Return vs Cumulative Return Infographic

moneydif.com

moneydif.com