IRR measures the annualized rate of return on a fund, reflecting the time value of money and the speed at which investments generate returns. MOIC quantifies the total multiple of the invested capital returned without accounting for the time taken to realize those gains. Investors use IRR to assess efficiency over time while relying on MOIC to gauge absolute profitability.

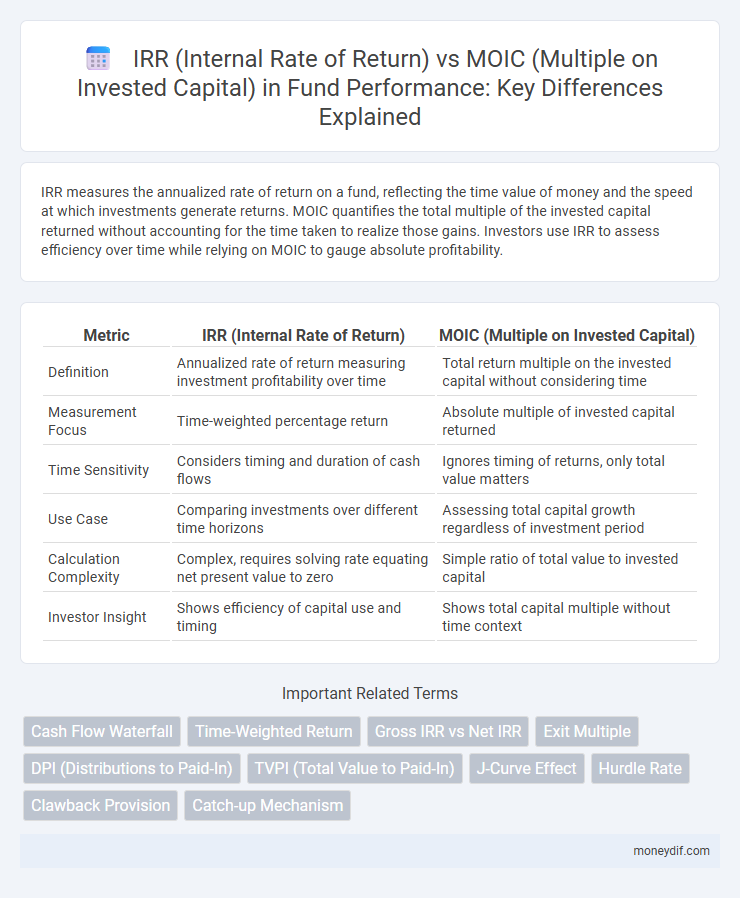

Table of Comparison

| Metric | IRR (Internal Rate of Return) | MOIC (Multiple on Invested Capital) |

|---|---|---|

| Definition | Annualized rate of return measuring investment profitability over time | Total return multiple on the invested capital without considering time |

| Measurement Focus | Time-weighted percentage return | Absolute multiple of invested capital returned |

| Time Sensitivity | Considers timing and duration of cash flows | Ignores timing of returns, only total value matters |

| Use Case | Comparing investments over different time horizons | Assessing total capital growth regardless of investment period |

| Calculation Complexity | Complex, requires solving rate equating net present value to zero | Simple ratio of total value to invested capital |

| Investor Insight | Shows efficiency of capital use and timing | Shows total capital multiple without time context |

Understanding IRR and MOIC: Core Concepts

IRR (Internal Rate of Return) measures the annualized rate of return on an investment, reflecting the time value of money and the speed at which capital is returned. MOIC (Multiple on Invested Capital) calculates the total value created relative to the initial investment, without accounting for the timing of cash flows. Comparing IRR and MOIC provides a comprehensive view of an investment's performance, balancing growth magnitude with investment duration.

How IRR and MOIC Measure Fund Performance

IRR (Internal Rate of Return) measures fund performance by calculating the annualized percentage return accounting for the timing of cash flows, providing insight into the efficiency and speed of investment growth. MOIC (Multiple on Invested Capital) quantifies overall value creation by comparing the total capital returned to the capital invested, reflecting the absolute gain without time consideration. Together, IRR evaluates the velocity of returns while MOIC emphasizes total profitability, offering complementary perspectives on fund performance.

Calculating IRR: Methodology and Interpretation

Calculating IRR involves determining the discount rate that sets the net present value (NPV) of all cash flows from an investment to zero, reflecting the annualized effective compounded return. MOIC measures the total value multiple of invested capital without considering the time value of money, making IRR a more precise metric for assessing investment performance over time. Accurate interpretation of IRR requires understanding its sensitivity to cash flow timing and recognizing it as a rate expressing growth efficiency rather than absolute profit.

Calculating MOIC: Formula and Practical Insights

MOIC (Multiple on Invested Capital) is calculated using the formula: MOIC = Total Value / Invested Capital, providing a straightforward measure of investment performance. Unlike IRR, which accounts for the time value of money through complex discounted cash flow analysis, MOIC offers a raw multiple, highlighting total capital returned relative to capital invested. Understanding MOIC assists fund managers and investors in evaluating absolute returns without the influence of investment duration, complementing IRR's time-sensitive insights.

Key Differences Between IRR and MOIC

IRR (Internal Rate of Return) measures the annualized percentage return on invested capital, accounting for the timing and magnitude of cash flows, which makes it sensitive to the speed of investment returns. MOIC (Multiple on Invested Capital) represents the total return on investment as a multiple of the original capital, without considering the duration of the investment period. The key difference lies in IRR's time value of money focus versus MOIC's simplicity in showing gross multiples, providing complementary insights into investment performance.

When to Use IRR vs MOIC in Fund Analysis

IRR (Internal Rate of Return) measures the annualized rate of return, capturing the time value of money and making it ideal for comparing investments with varying durations or cash flow timings. MOIC (Multiple on Invested Capital) provides a simple total return multiple, best suited for evaluating the absolute profitability of an investment regardless of time. Fund managers rely on IRR to assess performance efficiency over time, while MOIC is preferred for clear visibility of total capital growth, especially in later-stage or realized investments.

Advantages and Limitations of IRR

IRR (Internal Rate of Return) provides a time-weighted measure of investment performance, capturing the annualized growth rate of invested capital and allowing for comparisons across different projects or funds. Its advantage lies in reflecting the timing of cash flows, which is critical for assessing the profitability of investments with irregular distributions. However, IRR can be misleading when used alone due to potential reinvestment rate assumptions and difficulties in comparing investments of different durations or cash flow patterns, making MOIC (Multiple on Invested Capital) a complementary metric for evaluating total value creation.

Advantages and Limitations of MOIC

MOIC (Multiple on Invested Capital) provides a straightforward measure of total value generated relative to invested capital, making it easy to communicate fund performance without reliance on time value assumptions. Its advantage lies in reflecting absolute returns and capital multiples, which can be more intuitive for investors focused on total cash-on-cash outcomes. However, MOIC does not account for the investment holding period or the timing of cash flows, limiting its ability to measure the efficiency or speed of returns compared to IRR (Internal Rate of Return).

Impact of Time Horizon on IRR and MOIC

The Internal Rate of Return (IRR) is highly sensitive to the time horizon as it annualizes returns, making shorter investment periods appear more attractive by exaggerating the growth rate. In contrast, Multiple on Invested Capital (MOIC) measures total cash-on-cash returns without accounting for time, providing a straightforward assessment of total value creation regardless of investment duration. Longer holding periods tend to diminish IRR even if MOIC remains high, emphasizing the importance of evaluating both metrics together to understand performance over time.

Real-World Examples: IRR vs MOIC in Fund Reporting

In fund reporting, IRR (Internal Rate of Return) measures the annualized growth rate of invested capital, capturing the time value of money for investments like private equity or venture capital funds. MOIC (Multiple on Invested Capital) represents the total value generated relative to the original investment, providing a straightforward snapshot of overall performance without accounting for investment duration. Real-world fund reports frequently highlight discrepancies where high MOICs may mask low IRRs due to longer investment holding periods, emphasizing the necessity of evaluating both metrics for comprehensive performance analysis.

Important Terms

Cash Flow Waterfall

The cash flow waterfall allocates investment returns in a prioritized sequence, significantly affecting both IRR (Internal Rate of Return) and MOIC (Multiple on Invested Capital) by determining the timing and distribution of cash flows to investors. Optimizing the waterfall structure enhances IRR by accelerating cash distributions while maximizing MOIC by ensuring a higher cumulative return relative to the invested capital.

Time-Weighted Return

Time-Weighted Return (TWR) measures investment performance by eliminating cash flow timing effects, focusing on compound growth rate comparable to IRR, while MOIC calculates total value multiple independent of time duration.

Gross IRR vs Net IRR

Gross IRR measures the total return on an investment before fees and expenses, while Net IRR reflects the actual investor return after fees, both differing from MOIC which quantifies the total cash multiple on invested capital regardless of timing.

Exit Multiple

Exit Multiple, a key performance metric in private equity, measures the ratio of exit value to initial investment, directly influencing both IRR (Internal Rate of Return) and MOIC (Multiple on Invested Capital); a higher exit multiple generally boosts MOIC as it reflects total value creation, while IRR captures the speed of value realization over time. While MOIC quantifies overall investment growth without considering timing, IRR integrates exit multiple with the investment duration, providing a time-weighted measure of profitability essential for evaluating investment performance.

DPI (Distributions to Paid-In)

DPI (Distributions to Paid-In) measures the cash returned to investors relative to their invested capital and is a key metric for assessing realized returns, often compared with IRR (Internal Rate of Return) which captures the annualized profitability of investments inclusive of timing. While IRR reflects the efficiency and speed of returns, MOIC (Multiple on Invested Capital) quantifies the total gross return multiple without considering the time value of money, making DPI a crucial indicator of actual cash flows distributed versus the theoretical growth captured by IRR and MOIC.

TVPI (Total Value to Paid-In)

TVPI (Total Value to Paid-In) measures the overall value generated by an investment relative to the capital paid in, combining both realized and unrealized returns to capture the full performance. While IRR (Internal Rate of Return) reflects the annualized growth rate considering timing of cash flows, MOIC (Multiple on Invested Capital) provides a straightforward ratio of total value to invested amount, with TVPI bridging both by incorporating time-adjusted value and total capital efficiency.

J-Curve Effect

The J-Curve Effect illustrates how IRR initially dips below zero during early investment phases while MOIC steadily increases, reflecting eventual capital growth despite early negative returns.

Hurdle Rate

Hurdle rate represents the minimum acceptable return on an investment, serving as a benchmark against the internal rate of return (IRR) to evaluate project viability, while MOIC (multiple on invested capital) quantifies the total value generated relative to the original investment without considering time value. Comparing IRR to the hurdle rate incorporates the investment's time-sensitive profitability, whereas MOIC provides a straightforward measure of return magnitude, making both metrics complementary for comprehensive investment analysis.

Clawback Provision

A clawback provision ensures that the general partner returns excess profits if the internal rate of return (IRR) falls below a predetermined hurdle compared to the multiple on invested capital (MOIC), aligning financial incentives with investor returns. This mechanism balances the timing focus of IRR with the total value generated measured by MOIC to protect limited partners from disproportionate distributions.

Catch-up Mechanism

The catch-up mechanism enables investors to receive a higher proportion of profits after achieving a preferred IRR, aligning returns closer to the targeted MOIC before general partner carried interest applies.

IRR (internal rate of return) vs MOIC (multiple on invested capital) Infographic

moneydif.com

moneydif.com