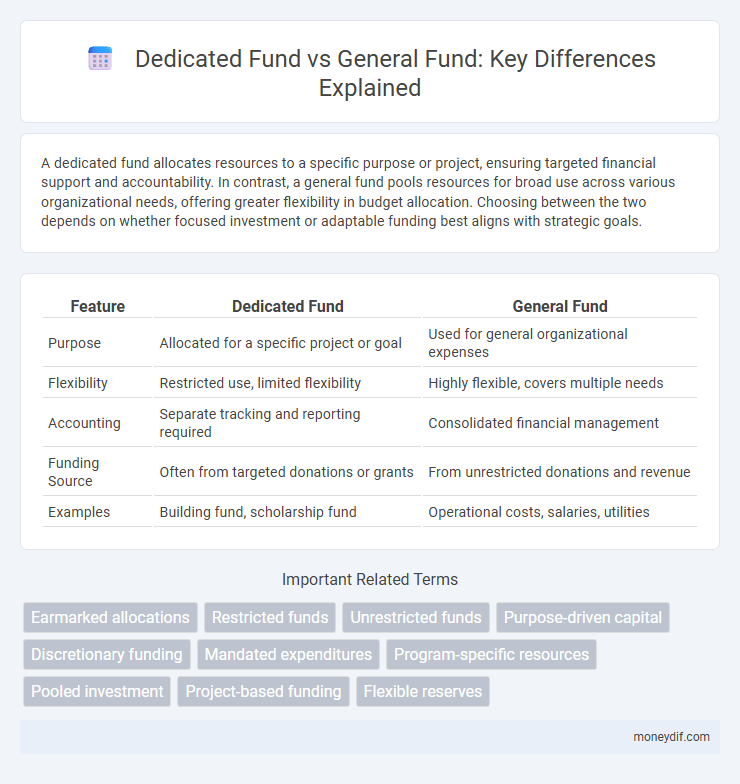

A dedicated fund allocates resources to a specific purpose or project, ensuring targeted financial support and accountability. In contrast, a general fund pools resources for broad use across various organizational needs, offering greater flexibility in budget allocation. Choosing between the two depends on whether focused investment or adaptable funding best aligns with strategic goals.

Table of Comparison

| Feature | Dedicated Fund | General Fund |

|---|---|---|

| Purpose | Allocated for a specific project or goal | Used for general organizational expenses |

| Flexibility | Restricted use, limited flexibility | Highly flexible, covers multiple needs |

| Accounting | Separate tracking and reporting required | Consolidated financial management |

| Funding Source | Often from targeted donations or grants | From unrestricted donations and revenue |

| Examples | Building fund, scholarship fund | Operational costs, salaries, utilities |

Understanding Dedicated Funds and General Funds

Dedicated funds are financial resources allocated for specific purposes, ensuring targeted use and accountability, often supporting projects like education, healthcare, or infrastructure. General funds consist of unrestricted revenue that government entities or organizations use to cover day-to-day operations, providing flexibility in budget management. Understanding the distinction between these funds highlights how financial planning balances specialized initiatives with overall organizational needs.

Key Differences Between Dedicated and General Funds

Dedicated funds are allocated for specific purposes or projects, ensuring funds are used exclusively as intended, while general funds provide financial flexibility for a wide range of organizational needs without restrictions. Dedicated funds often require detailed tracking and reporting to comply with donor or legal requirements, whereas general funds support broader operational expenses and strategic initiatives. Accountability measures for dedicated funds are typically more stringent, reflecting their purpose-bound nature compared to the unrestricted allocation of general funds.

Purpose and Usage of Dedicated Funds

Dedicated funds are allocated for specific projects or purposes, ensuring that resources are exclusively used to meet predetermined objectives such as infrastructure development, healthcare, or education. These funds provide financial transparency and accountability by restricting expenditures to their intended use, unlike general funds that support a wide range of governmental functions without earmarking. The targeted nature of dedicated funds enhances efficient resource management and aligns financial planning with strategic priorities.

Allocation and Flexibility in General Funds

General funds offer broad allocation flexibility, allowing resources to be distributed across multiple departments and projects without stringent restrictions. This unrestricted nature facilitates adaptive budget management, enabling quick response to changing organizational priorities or emergent needs. Dedicated funds, however, are earmarked for specific purposes, limiting their use but ensuring targeted investments and accountability.

Advantages of Dedicated Funds

Dedicated funds offer targeted financial resources that enhance accountability and ensure funds are used for specific purposes, improving transparency in budget management. They provide reliable long-term funding streams for priority projects, reducing competition with other budgetary demands. This focused allocation promotes effective planning and implementation of initiatives aligned with strategic goals.

Limitations of General Funds

General funds often face limitations due to their unrestricted nature, leading to potential misallocation of resources and lack of accountability. This unrestricted usage can result in insufficient funding for specific projects or programs that require dedicated support. In contrast, dedicated funds provide targeted financial resources, ensuring that allocated money is used effectively for intended purposes.

Financial Management Strategies: Dedicated vs General Funds

Dedicated funds are allocated for specific projects or purposes, ensuring targeted financial management and accountability, while general funds provide flexible resources for overall operational expenses and unforeseen needs. Strategic financial management involves balancing dedicated funds' restricted use with the adaptability of general funds to optimize organizational stability and growth. Effective oversight includes monitoring fund restrictions, aligning expenditures with objectives, and maintaining liquidity across both fund types.

Transparency and Accountability in Fund Types

Dedicated funds offer enhanced transparency and accountability by allocating resources to specific purposes, enabling stakeholders to track expenditures and outcomes with precision. In contrast, general funds pool resources without restrictions, which can obscure spending details and reduce accountability. The clear earmarking in dedicated funds supports rigorous auditing and reporting, fostering trust among contributors and beneficiaries.

Real-World Examples: Dedicated and General Funds

In New York City, the Education Fund operates as a dedicated fund exclusively supporting public school improvements, while the General Fund finances a broad range of city services, including public safety and sanitation. Similarly, in California, the Transportation Improvement Fund is a dedicated fund allocated for infrastructure projects, contrasting with the General Fund that covers statewide administrative expenses and diverse community programs. These examples illustrate how dedicated funds ensure targeted resource allocation, whereas general funds provide flexible financing for multiple government priorities.

Choosing the Right Fund Structure for Your Organization

Dedicated funds provide targeted financial resources with specific restrictions that enhance accountability and transparency, making them ideal for projects requiring precise budgeting and donor confidence. General funds offer flexible allocation across multiple departments or initiatives, supporting operational agility and broader organizational needs without strict spending limits. Selecting the appropriate fund structure depends on balancing the need for financial control against the necessity for adaptable resource deployment aligned with strategic goals.

Important Terms

Earmarked allocations

Earmarked allocations refer to funds designated for specific purposes within a government or organization, distinguishing them from general funds that support broad and flexible use. Dedicated funds ensure targeted spending such as infrastructure or education, while general funds provide financial flexibility for overall budgetary needs.

Restricted funds

Restricted funds are financial resources allocated for specific purposes or projects, unlike general funds that allow for flexible use across various organizational needs. Dedicated funds, a subtype of restricted funds, are earmarked by donors or legal agreements for designated programs, ensuring accountability and compliance with funding terms.

Unrestricted funds

Unrestricted funds provide organizations with flexible financial resources, unlike dedicated funds which are restricted to specific purposes, while general funds typically encompass all unrestricted resources available for general operational use.

Purpose-driven capital

Purpose-driven capital allocates resources through dedicated funds tailored to specific social or environmental goals, unlike general funds which invest broadly without targeted impact criteria.

Discretionary funding

Discretionary funding refers to budget allocations that government agencies can spend at their discretion, contrasting with dedicated funds which are earmarked for specific purposes and cannot be reallocated. General funds comprise discretionary funding sources allowing flexible use across various programs, whereas dedicated funds stem from specific revenue streams restricted to designated projects or services.

Mandated expenditures

Mandated expenditures are typically funded through dedicated funds, which are restricted for specific purposes such as education, transportation, or health services, ensuring consistent allocation and financial stability for these programs. In contrast, general funds are more flexible and can be used for a broader range of government services, but lack the legal obligation or earmarked status that dedicated funds have for mandated expenditures.

Program-specific resources

Dedicated funds allocate program-specific resources exclusively for targeted initiatives, whereas general funds provide flexible financial support for multiple programs and operational needs.

Pooled investment

Pooled investments aggregate capital from multiple investors into a single fund, with dedicated funds offering tailored strategies for specific investor groups, while general funds provide broader diversification across various assets without investor-specific customizations. Dedicated funds typically allow greater control and transparency for investors, whereas general funds emphasize liquidity and simplified management.

Project-based funding

Project-based funding allocates resources specifically for individual projects, often sourced from dedicated funds tied to particular initiatives, ensuring targeted financial support and accountability. In contrast, general funds provide flexible financing not restricted to specific projects, allowing broader use across various organizational needs but potentially diluting focus on project outcomes.

Flexible reserves

Flexible reserves provide an organization's financial stability by allowing funds to be allocated across various needs without strict constraints, contrasting with dedicated funds earmarked for specific purposes within the general fund. Unlike restricted or dedicated funds, flexible reserves enhance operational agility by supporting unforeseen expenses and strategic opportunities, ensuring long-term fiscal health and responsiveness.

Dedicated fund vs General fund Infographic

moneydif.com

moneydif.com