A subscription facility is a short-term loan secured against investors' committed capital to enhance liquidity and accelerate deal execution in private equity funds. Capital calls require fund managers to request committed capital from investors only when needed, resulting in slower cash flow but minimizing interest expenses. Choosing between subscription facilities and capital calls impacts fund efficiency, cost management, and investor relations.

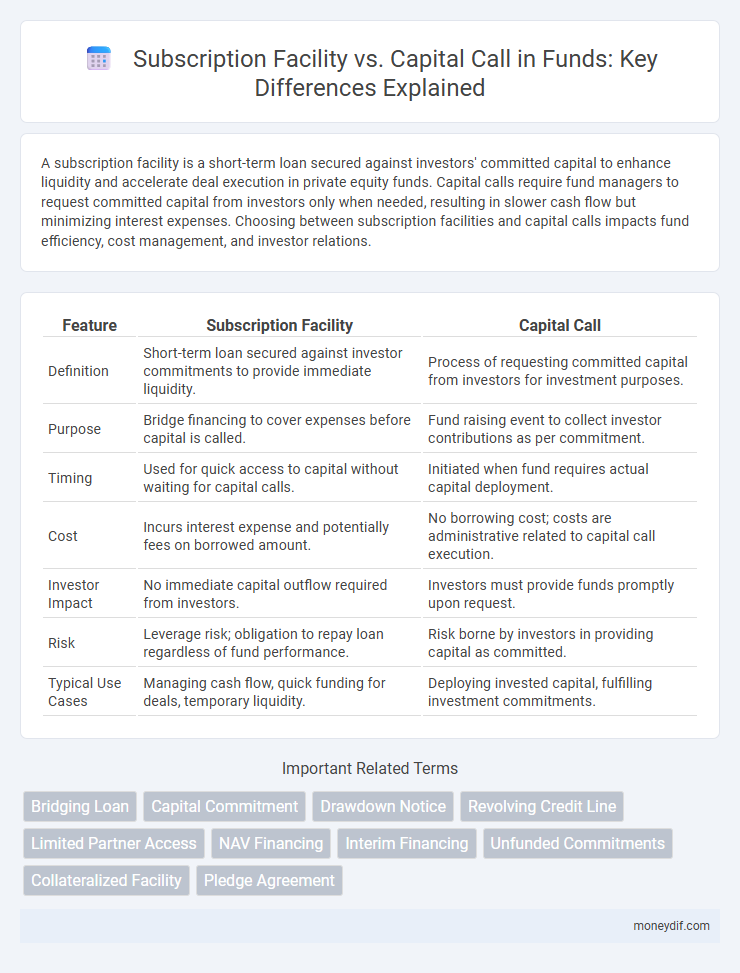

Table of Comparison

| Feature | Subscription Facility | Capital Call |

|---|---|---|

| Definition | Short-term loan secured against investor commitments to provide immediate liquidity. | Process of requesting committed capital from investors for investment purposes. |

| Purpose | Bridge financing to cover expenses before capital is called. | Fund raising event to collect investor contributions as per commitment. |

| Timing | Used for quick access to capital without waiting for capital calls. | Initiated when fund requires actual capital deployment. |

| Cost | Incurs interest expense and potentially fees on borrowed amount. | No borrowing cost; costs are administrative related to capital call execution. |

| Investor Impact | No immediate capital outflow required from investors. | Investors must provide funds promptly upon request. |

| Risk | Leverage risk; obligation to repay loan regardless of fund performance. | Risk borne by investors in providing capital as committed. |

| Typical Use Cases | Managing cash flow, quick funding for deals, temporary liquidity. | Deploying invested capital, fulfilling investment commitments. |

Understanding Subscription Facilities in Fund Management

A subscription facility is a short-term credit line that allows a fund to borrow against committed but uncalled capital from limited partners, providing immediate liquidity without the need to wait for capital calls. This financing tool accelerates investment pacing and optimizes cash management by reducing delays associated with capital calls, which require fundraising approval and fund investor notifications. Understanding subscription facilities is crucial for fund managers seeking to enhance operational efficiency and maintain flexibility in deploying capital.

What is a Capital Call? Key Fundamentals

A capital call is a formal request by a fund manager to investors for a portion of their committed capital, essential to finance investments or cover fund expenses. This mechanism ensures that funds are drawn down only when needed, improving cash flow management and minimizing idle capital. Understanding the timing, amount, and contractual terms of capital calls is crucial for both fund managers and limited partners to maintain liquidity and meet financial obligations.

Subscription Facility vs Capital Call: Core Differences

A Subscription Facility is a short-term bridge loan secured against limited partners' capital commitments, providing immediate liquidity for fund operations without waiting for capital calls. Capital Calls require fund managers to request committed capital from investors, causing potential delays and administrative burdens. Subscription Facilities enable faster deployment of capital and smoother cash flow management compared to traditional Capital Calls.

Advantages of Using Subscription Facilities for Funds

Subscription facilities provide funds with immediate liquidity by leveraging investors' committed capital without waiting for capital calls, enhancing cash flow management and deal execution speed. These facilities reduce the administrative burden and costs associated with frequent capital calls, thereby streamlining fund operations. By optimizing capital deployment timing, subscription facilities improve fund performance metrics and investor experience, making them a strategic advantage in fund finance.

Risks and Limitations of Capital Call Financing

Capital call financing exposes funds to potential liquidity risks as investors may delay or default on their commitments, impairing cash flow management. This method also limits flexibility since capital must be drawn in predetermined amounts and schedules, potentially causing funding mismatches with investment opportunities. Legal and administrative complexities arise from capital call enforcement, increasing operational costs and regulatory scrutiny.

Impact on Fund Liquidity: Subscription Facility vs Capital Call

Subscription facilities enhance fund liquidity by providing immediate cash flow, enabling timely investments without waiting for capital calls to be fulfilled. Capital calls depend on limited partners' payment timing, which can delay cash availability and restrict fund agility. Utilizing subscription facilities reduces reliance on capital call proceeds, improving fund operational efficiency and investment pacing.

Cost Comparison: Subscription Facility vs Capital Call

Subscription facilities generally incur interest costs and arrangement fees, which can increase overall fund expenses compared to capital calls that typically involve fewer direct costs. Capital calls, while potentially slower in accessing liquidity, avoid debt-related expenses by directly drawing committed capital from investors. Evaluating the trade-off between borrowing costs of subscription facilities and operational delays of capital calls is crucial for optimizing fund cost efficiency.

Investor Considerations in Fund Financing Structures

Investors prioritize subscription facilities in fund financing structures for their ability to provide quick liquidity without immediate capital deployment, enhancing fund operational efficiency. Unlike capital calls, which require investors to commit funds upon demand, subscription facilities can reduce the frequency and administrative burden of capital draws, improving investor cash flow management. Evaluating the cost implications and risk exposure associated with each financing method is critical for investors to align fund strategy with their liquidity preferences and return expectations.

Effects on Fund Performance and Reporting

Subscription facilities provide immediate liquidity, enabling timely investments without waiting for capital calls, which enhances fund performance by reducing uninvested cash drag. Capital calls, while aligning cash inflows directly with investment needs, may delay deployment and complicate cash flow forecasting, impacting reporting accuracy and fund return calculations. The choice between subscription facilities and capital calls significantly influences fund liquidity management, cash flow timing, and the precision of performance metrics reported to investors.

Best Practices for Managing Fund Workflows

Subscription facilities streamline fund liquidity management by providing short-term bridge financing, reducing the pressure of immediate capital calls from investors. Best practices for managing fund workflows include closely monitoring leverage ratios and aligning subscription facility drawdowns with anticipated capital call schedules to optimize cash flow efficiency. Implementing automated tracking systems enhances transparency and coordination between fund administrators and investors, ensuring timely repayments and compliance with regulatory requirements.

Important Terms

Bridging Loan

A bridging loan provides immediate capital by leveraging a subscription facility that advances funds based on investors' uncalled commitments, offering faster access compared to a traditional capital call process.

Capital Commitment

Capital commitment in private equity involves investors legally pledging funds, where subscription facilities provide lenders short-term credit against these commitments before capital calls are made to draw actual investor contributions.

Drawdown Notice

A Drawdown Notice triggers a capital call under a Subscription Facility, enabling the fund manager to access committed investor capital for investment or operational purposes.

Revolving Credit Line

A Revolving Credit Line offers flexible access to funds, enabling subscription facilities to bridge capital calls by allowing investors to draw down capital as needed rather than committing it upfront. Unlike capital calls, which require investors to provide funds only when requested by the fund, subscription facilities use the revolving credit line to optimize liquidity management and reduce cash drag during investment periods.

Limited Partner Access

Limited Partner access in a Subscription Facility allows LPs to leverage committed capital through revolving credit lines, enabling quicker liquidity compared to traditional Capital Calls that require direct capital contributions. This mechanism optimizes fund cash flow management by reducing capital call frequency and facilitating smoother capital deployment processes.

NAV Financing

NAV financing leverages a subscription facility to provide immediate liquidity against committed capital, reducing reliance on traditional capital call timing and enhancing fund cash flow management.

Interim Financing

Interim financing through a Subscription Facility provides quick access to capital by leveraging limited partners' commitments, whereas Capital Calls require formal requests for committed funds, often resulting in slower liquidity during fund operations.

Unfunded Commitments

Unfunded commitments in a subscription facility allow private equity funds to access capital through short-term borrowing against limited partners' future capital calls, enhancing liquidity without immediate capital calls.

Collateralized Facility

A collateralized facility in subscription finance secures borrowing against investors' committed capital, offering faster access to funds compared to traditional capital call lines that rely on periodic capital calls from investors.

Pledge Agreement

A Pledge Agreement in the context of a Subscription Facility secures the lender's interest by granting a lien on the investor's rights to future capital contributions, enabling immediate liquidity without waiting for capital calls. In contrast, Capital Call agreements directly obligate investors to provide committed capital upon demand, typically without encumbering the subscription agreements as collateral.

Subscription Facility vs Capital Call Infographic

moneydif.com

moneydif.com