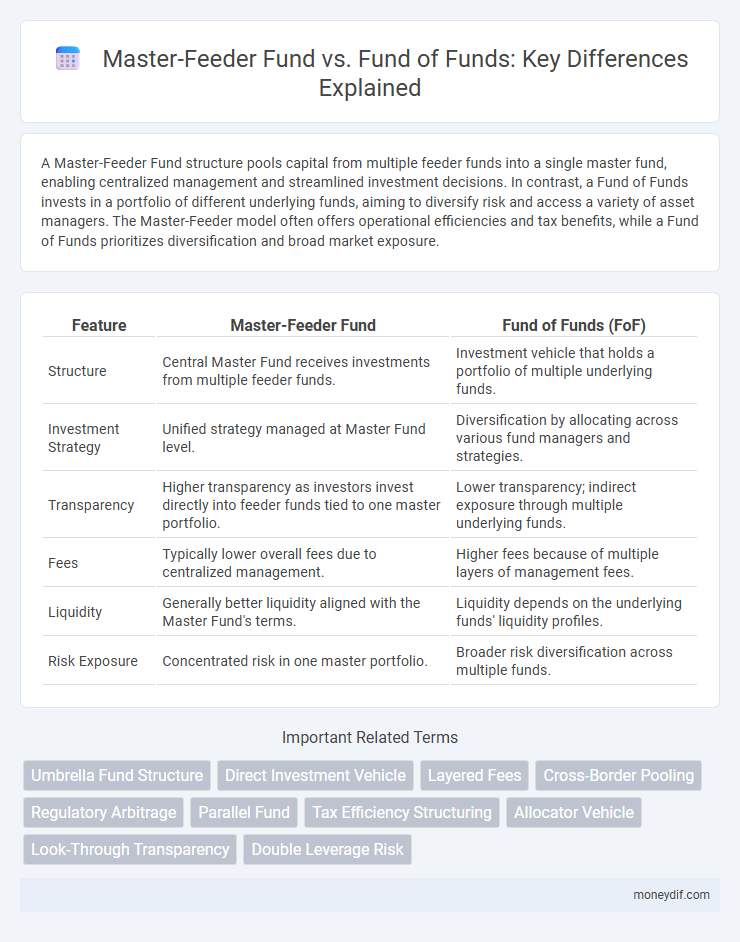

A Master-Feeder Fund structure pools capital from multiple feeder funds into a single master fund, enabling centralized management and streamlined investment decisions. In contrast, a Fund of Funds invests in a portfolio of different underlying funds, aiming to diversify risk and access a variety of asset managers. The Master-Feeder model often offers operational efficiencies and tax benefits, while a Fund of Funds prioritizes diversification and broad market exposure.

Table of Comparison

| Feature | Master-Feeder Fund | Fund of Funds (FoF) |

|---|---|---|

| Structure | Central Master Fund receives investments from multiple feeder funds. | Investment vehicle that holds a portfolio of multiple underlying funds. |

| Investment Strategy | Unified strategy managed at Master Fund level. | Diversification by allocating across various fund managers and strategies. |

| Transparency | Higher transparency as investors invest directly into feeder funds tied to one master portfolio. | Lower transparency; indirect exposure through multiple underlying funds. |

| Fees | Typically lower overall fees due to centralized management. | Higher fees because of multiple layers of management fees. |

| Liquidity | Generally better liquidity aligned with the Master Fund's terms. | Liquidity depends on the underlying funds' liquidity profiles. |

| Risk Exposure | Concentrated risk in one master portfolio. | Broader risk diversification across multiple funds. |

Introduction to Master-Feeder Funds and Fund of Funds

Master-Feeder Funds structure pools capital from multiple feeder funds into a single master fund, allowing efficient management and consolidated investment strategies across diverse investor groups. Fund of Funds invest in a portfolio of different funds, providing diversification and professional management without direct investment in individual securities. Both structures optimize capital allocation but serve distinct investor needs through centralized management versus diversified fund selection.

Structural Overview: How Each Fund Operates

A Master-Feeder Fund operates with multiple feeder funds pooling capital into a single master fund that makes investment decisions and manages assets collectively. By contrast, a Fund of Funds invests directly in multiple underlying funds, each with independent management strategies and objectives. The structural distinction impacts transparency, fees, and operational complexity, with Master-Feeder Funds offering consolidated management while Fund of Funds provide diversified exposure across separate fund entities.

Key Objectives: Comparing Investment Goals

Master-feeder funds aim to pool capital from multiple feeder funds into a single master fund to streamline management and achieve large-scale investment efficiency. Fund of funds diversify risk by investing in a portfolio of various underlying funds, targeting broad exposure across asset classes and strategies. While master-feeder structures focus on operational consolidation and cost efficiency, fund of funds prioritize diversification and asset allocation across multiple fund managers.

Legal and Regulatory Considerations

Master-Feeder funds face complex cross-jurisdictional regulatory scrutiny as the master fund consolidates investment activities subject to differing securities laws, tax regulations, and reporting requirements in both feeder and master jurisdictions. Fund of funds must navigate disclosure mandates and compliance obligations pertinent to multiple underlying funds, often triggering layered regulatory oversight and increased due diligence standards. Legal structures in master-feeder arrangements commonly emphasize tax efficiency and investor eligibility, while fund of funds prioritize diversification rules and investor protection under varying fund governance frameworks.

Tax Implications for Investors

Master-feeder funds typically offer tax efficiency by consolidating investments into a master fund, allowing investors to benefit from pass-through taxation and reducing double tax layers. Fund of funds often involve multiple fund layers, which may lead to increased tax reporting complexity and potential double taxation on distributions. Investors should carefully evaluate the tax structures, as master-feeder funds can provide cost-effective tax advantages compared to the potentially higher tax burdens in fund of funds arrangements.

Diversification and Risk Management Strategies

Master-Feeder funds enhance diversification by pooling capital from multiple feeder funds into a single master fund, allowing for consolidated investment strategies and centralized risk management that reduces operational costs. Fund of Funds achieve diversification by investing in a variety of underlying funds, spreading risk across different managers, asset classes, and strategies, which mitigates idiosyncratic risk but often involves higher fees and layered risks. Both structures offer risk management benefits; Master-Feeder funds provide direct oversight of portfolio composition, while Fund of Funds rely on manager selection and allocation diversification to manage overall portfolio volatility.

Cost Structure: Fees and Expenses Analysis

Master-Feeder Funds typically incur lower overall costs due to consolidated management and operational expenses, reducing duplicative fees across feeder funds. Fund of Funds involve double layers of fees, including management and performance fees at both the underlying funds and the fund of funds level, increasing total expense ratios. Investors in Master-Feeder structures benefit from streamlined costs, while Fund of Funds investors pay a premium for diversified exposure and professional asset selection.

Liquidity and Redemption Policies

Master-feeder funds typically offer enhanced liquidity through streamlined redemption processes coordinated at both the master and feeder levels, often with shorter redemption notice periods compared to fund of funds. Fund of funds generally impose longer lock-up periods and extended redemption windows due to layers of underlying investments, which can delay liquidity for investors. Understanding the redemption policies and liquidity frameworks is crucial for investors seeking timely access to their capital in complex fund structures.

Performance Attribution and Returns

Master-Feeder Funds centralize portfolio management and can achieve consistent performance attribution by pooling assets into a single master fund, enabling streamlined management and reduced operational duplications. Fund of Funds diversify across multiple underlying funds, which may dilute returns due to layered fees and complex return attributions across heterogeneous strategies. While Master-Feeder structures often exhibit clearer direct attribution to specific asset allocations, Fund of Funds provide broader diversification benefits but with potentially lower net returns after expense ratios.

Choosing Between Master-Feeder and Fund of Funds: Factors to Consider

Choosing between a Master-Feeder Fund and a Fund of Funds depends on factors such as investor type, regulatory considerations, and tax efficiency. Master-Feeder structures are ideal for pooling capital from U.S. and offshore investors into a centralized master fund, optimizing operational costs and regulatory compliance. Fund of Funds offer diversified exposure across multiple underlying funds, appealing to investors seeking broad risk distribution but often involve higher fees and layered management.

Important Terms

Umbrella Fund Structure

An Umbrella Fund Structure streamlines asset management by housing multiple sub-funds under a single legal entity, enhancing operational efficiency compared to Master-Feeder Funds that consolidate investments from feeder funds into a master fund for centralized management. Unlike Fund of Funds, which invest in multiple separate funds to diversify risk, Umbrella Funds benefit from shared administration and regulatory compliance, reducing costs and simplifying investor access across diverse strategies.

Direct Investment Vehicle

Direct Investment Vehicles allow investors to pool capital for targeted asset acquisition, differing from Master-Feeder Funds where multiple feeder funds invest in a single master fund to optimize tax efficiency and regulatory compliance. Fund of Funds aggregate investments across various underlying funds, focusing on diversification rather than direct asset ownership, contrasting with the direct control and streamlined structure of Direct Investment Vehicles in private equity or real estate sectors.

Layered Fees

Layered fees in Master-Feeder Funds often result from multiple management and performance fees applied at both the feeder and master fund levels, increasing the overall expense ratio compared to Fund of Funds, which typically charge fees at the underlying fund and fund-of-funds levels but may offer more fee transparency. Understanding the fee structures and their impact on net returns is critical for investors assessing cost efficiency between Master-Feeder Funds and Fund of Funds investment vehicles.

Cross-Border Pooling

Cross-border pooling in Master-Feeder funds enables efficient capital aggregation and tax optimization by channeling investor capital from multiple jurisdictions into a single master fund, enhancing liquidity and reducing administrative costs. Unlike Fund of Funds, which invest in multiple underlying funds increasing layers of fees and complexity, Master-Feeder structures provide a direct investment approach with consolidated reporting and streamlined asset management across borders.

Regulatory Arbitrage

Regulatory arbitrage occurs when investment managers structure Master-Feeder Funds to exploit differences in international tax and regulatory standards, enabling feeders to access diversified assets while benefiting from favorable jurisdictions. In contrast, Fund of Funds typically faces more consolidated regulatory oversight, limiting flexibility compared to the segmented operational and tax advantages found in Master-Feeder structures.

Parallel Fund

A Parallel Fund operates alongside a Master-Feeder Fund structure, allowing different investor groups to invest simultaneously in the same underlying assets while maintaining separate legal entities for regulatory and tax efficiency. In contrast, a Fund of Funds invests indirectly by allocating capital into multiple funds, including Master-Feeder or Parallel Funds, to achieve diversified exposure across various strategies and managers.

Tax Efficiency Structuring

Tax efficiency structuring in Master-Feeder Fund setups allows investors to benefit from consolidated management and flow-through tax treatment, minimizing double taxation and optimizing cross-border tax liabilities. In contrast, Fund of Funds structures may experience less tax efficiency due to multiple layers of fees and potential withholding taxes, impacting overall investor returns.

Allocator Vehicle

Allocator vehicles, such as Master-Feeder Funds and Fund of Funds, strategically optimize capital allocation by aggregating investor capital into diversified portfolios, with Master-Feeder Funds focusing on unified investment execution through feeder entities while Fund of Funds invest across multiple underlying funds to achieve broad diversification.

Look-Through Transparency

Look-Through Transparency enables investors in Master-Feeder Funds to directly access underlying asset-level information for precise tax reporting and compliance, unlike Fund of Funds where investments are pooled, and transparency is limited to top-level holdings. This enhanced visibility in Master-Feeder structures facilitates accurate attribution of income, gains, and losses across multiple jurisdictions, optimizing tax efficiency and regulatory adherence.

Double Leverage Risk

Double leverage risk arises when a master-feeder fund structure uses borrowed funds at both the feeder and master fund levels, amplifying exposure and potential losses beyond those of a typical fund of funds. In contrast, fund of funds generally invest in underlying funds without additional leverage, resulting in lower cumulative leverage risk compared to the double leverage inherent in master-feeder arrangements.

Master-Feeder Fund vs Fund of Funds Infographic

moneydif.com

moneydif.com