Preferred return represents the fixed annual return investors receive before the fund manager earns any performance fees, ensuring priority repayment on invested capital. The hurdle rate is a benchmark return that the fund must exceed for the manager to participate in profit-sharing, often set as a minimum preferred return threshold. Understanding the difference between preferred return and hurdle rate is crucial for evaluating investment risk and fund manager incentives.

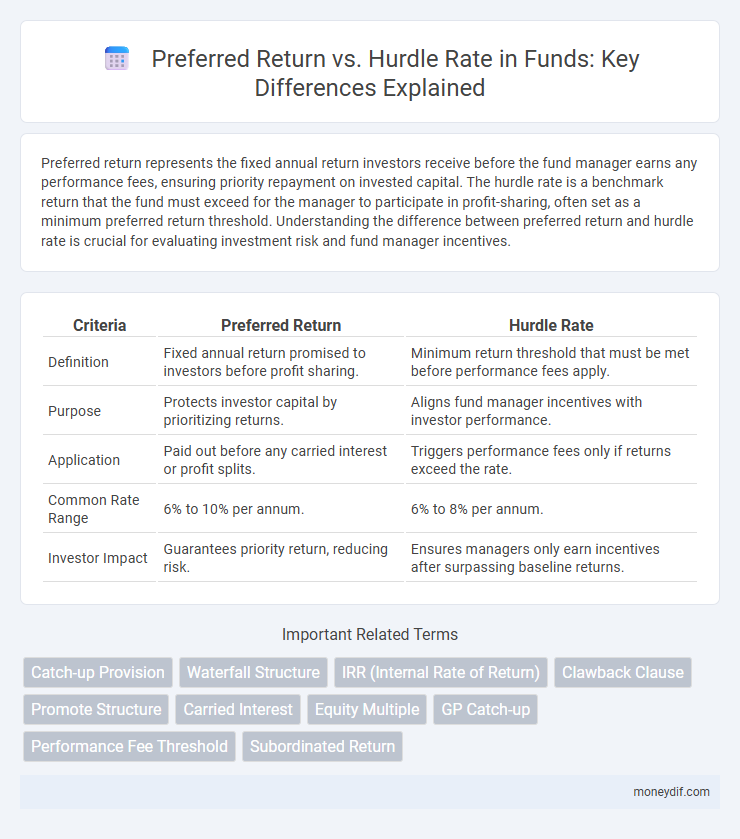

Table of Comparison

| Criteria | Preferred Return | Hurdle Rate |

|---|---|---|

| Definition | Fixed annual return promised to investors before profit sharing. | Minimum return threshold that must be met before performance fees apply. |

| Purpose | Protects investor capital by prioritizing returns. | Aligns fund manager incentives with investor performance. |

| Application | Paid out before any carried interest or profit splits. | Triggers performance fees only if returns exceed the rate. |

| Common Rate Range | 6% to 10% per annum. | 6% to 8% per annum. |

| Investor Impact | Guarantees priority return, reducing risk. | Ensures managers only earn incentives after surpassing baseline returns. |

Introduction to Preferred Return and Hurdle Rate

Preferred return is a fixed percentage return that limited partners receive before the general partner earns any carried interest. Hurdle rate represents the minimum internal rate of return (IRR) a fund must achieve before performance fees are paid to the general partner. Both metrics are critical in structuring private equity and real estate funds to align investor and manager incentives.

Defining Preferred Return in Fund Structures

Preferred return in fund structures is a predetermined rate of return that limited partners receive before the general partners can participate in profit sharing. It acts as a priority threshold ensuring investors are compensated for their risk prior to the general partner earning carried interest. This mechanism aligns incentives by guaranteeing limited partners a minimum return, typically expressed as an annual percentage, before profit distribution occurs.

Understanding the Hurdle Rate Concept

The hurdle rate in a fund represents the minimum return that must be achieved before the general partner can participate in profit-sharing, serving as a performance benchmark. Unlike the preferred return which is a fixed percentage paid to limited partners, the hurdle rate ensures alignment between a fund's performance and the incentive fees earned by the manager. Understanding this concept helps investors evaluate the fund's risk-reward profile and the manager's compensation structure effectively.

Key Differences Between Preferred Return and Hurdle Rate

Preferred Return represents the minimum annual return investors receive before the fund manager earns performance fees, ensuring limited partners recover their initial investment and a specified profit. The Hurdle Rate is a benchmark rate that must be exceeded for the manager to participate in profit-sharing, often set as a percentage tied to the fund's targeted or risk-free return. Key differences include that Preferred Return guarantees priority cash flow to investors, while the Hurdle Rate triggers the fund manager's carried interest only after surpassing this threshold, influencing alignment of incentives and fund profitability.

How Preferred Return Works in Practice

Preferred return functions as a minimum annual profit percentage that fund investors receive before the fund manager earns any carried interest. This ensures that limited partners are compensated first, typically set between 6% to 8%, aligning incentives and reducing risk exposure. Once the preferred return is met, the fund's profits exceeding this threshold are split according to the hurdle rate structure, defining the manager's share of performance gains.

Role of Hurdle Rate in Performance Fees

The hurdle rate establishes a minimum return threshold that a fund must achieve before performance fees are paid to the manager, aligning incentives with investor returns. It acts as a performance benchmark, ensuring that fund managers are rewarded only when returns exceed this predefined rate, typically expressed as an annual percentage. This mechanism protects investors by promoting prudent risk-taking and preventing excessive fees on below-target performance.

Implications for Investors and Fund Managers

Preferred Return guarantees investors a minimum annual return before fund managers receive performance incentives, aligning investor protection with manager compensation. Hurdle Rate functions as a performance benchmark that fund managers must exceed to earn carried interest, motivating higher fund performance but potentially delaying manager payouts. Understanding these mechanisms helps investors assess risk-reward balance while enabling fund managers to structure incentive fees effectively.

Real-World Examples: Preferred Return vs Hurdle Rate

Preferred return often guarantees investors a fixed annual return, typically around 8%, before the fund manager receives performance fees, exemplified by real estate funds offering stable cash flows to limited partners. Hurdle rate, commonly set near 10%, acts as a benchmark that fund managers must exceed before earning carried interest, as seen in private equity firms structuring incentive payments to align interests with investors. Comparing actual fund performance, a preferred return ensures priority on distributions, while a hurdle rate incentivizes managers to outperform baseline returns, affecting overall investor gains in various funds.

Common Misconceptions and Clarifications

Preferred return often confuses investors who mistakenly believe it guarantees a fixed annual profit, while it actually represents a threshold rate the fund must achieve before profit-sharing with managers begins. The hurdle rate is frequently misunderstood as an additional return above the preferred return, but it specifically sets the minimum performance level that triggers carried interest payments. Clarifying these distinctions helps investors accurately assess fund economics and avoid overestimating expected returns.

Choosing the Right Structure for Your Fund

Preferred return represents the minimum profit percentage investors receive before the general partner earns carried interest, often set between 6% and 10%. Hurdle rate functions as a benchmark return that the fund must exceed for performance fees to be activated, commonly applied in private equity and venture capital structures. Selecting the right structure depends on aligning investor expectations with fund strategy, balancing risk, and optimizing incentive mechanisms to drive performance aligned with preferred returns or hurdle benchmarks.

Important Terms

Catch-up Provision

The catch-up provision allows general partners to receive a larger share of profits after limited partners achieve the preferred return or hurdle rate, aligning interests by accelerating GP compensation once the hurdle rate is met.

Waterfall Structure

A waterfall structure allocates returns by first ensuring the preferred return is met before distributing excess profits according to the hurdle rate tiers.

IRR (Internal Rate of Return)

The Internal Rate of Return (IRR) measures investment profitability by comparing the Preferred Return, a fixed minimum investor payout, against the Hurdle Rate, the required threshold IRR that must be exceeded before profit sharing with sponsors begins.

Clawback Clause

A clawback clause ensures that investors receive the preferred return before sponsors earn carried interest, maintaining alignment between preferred return thresholds and hurdle rate requirements.

Promote Structure

Promote structure allocates carried interest to sponsors after investors receive their preferred return, typically triggered once the hurdle rate--usually set between 8% and 12% IRR--is achieved, aligning incentives by rewarding sponsors for exceeding minimum investor returns.

Carried Interest

Carried interest typically accrues to general partners only after investors receive a preferred return or hurdle rate, ensuring profits surpass a specified threshold before profit sharing begins.

Equity Multiple

Equity multiple measures total investment returns relative to invested capital, while preferred return sets a minimum investor yield before sponsor profits and hurdle rate defines escalating profit share thresholds.

GP Catch-up

GP catch-up allows general partners to receive a higher share of profits after limited partners achieve the hurdle rate, ensuring alignment of incentives before preferred returns are fully distributed.

Performance Fee Threshold

The Performance Fee Threshold is the minimum return investors must achieve, typically aligned with the Preferred Return or Hurdle Rate, before the fund manager earns carried interest or performance fees.

Subordinated Return

Subordinated return refers to the profits earned by general partners after achieving the preferred return, which acts as a minimum yield for limited partners before surpassing the hurdle rate that triggers carried interest.

Preferred Return vs Hurdle Rate Infographic

moneydif.com

moneydif.com