Seed funds invest early in startups to support initial growth and product development, often taking higher risks for potentially significant returns. Anchor funds provide stability by committing substantial capital to a fund during its launch, attracting additional investors and enhancing fund credibility. Both types play crucial roles in the fundraising ecosystem, with seed funds driving innovation and anchor funds ensuring financial confidence.

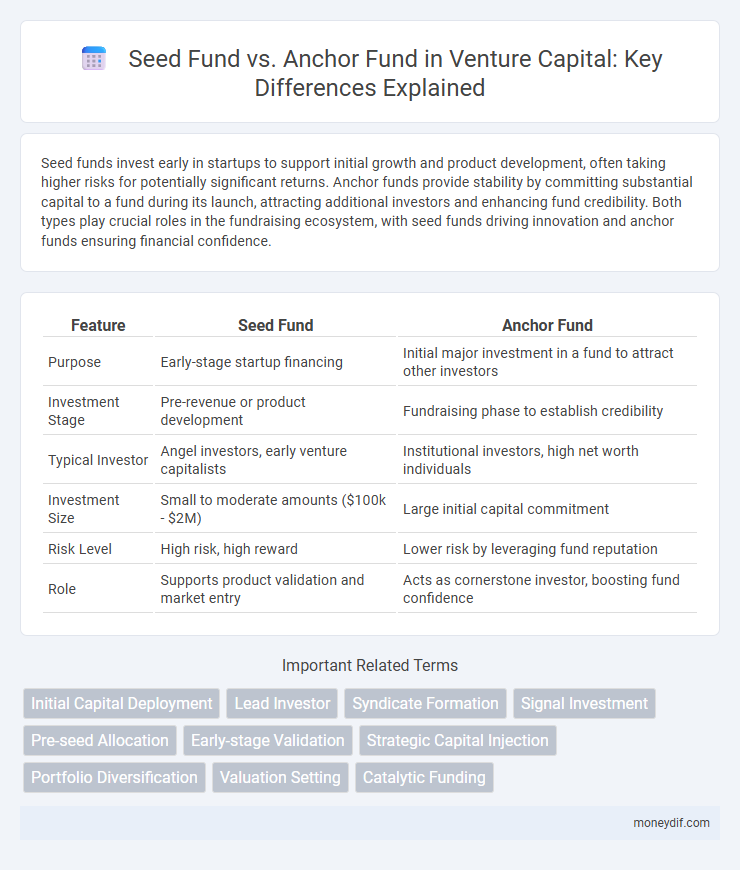

Table of Comparison

| Feature | Seed Fund | Anchor Fund |

|---|---|---|

| Purpose | Early-stage startup financing | Initial major investment in a fund to attract other investors |

| Investment Stage | Pre-revenue or product development | Fundraising phase to establish credibility |

| Typical Investor | Angel investors, early venture capitalists | Institutional investors, high net worth individuals |

| Investment Size | Small to moderate amounts ($100k - $2M) | Large initial capital commitment |

| Risk Level | High risk, high reward | Lower risk by leveraging fund reputation |

| Role | Supports product validation and market entry | Acts as cornerstone investor, boosting fund confidence |

Introduction to Seed Fund and Anchor Fund

Seed funds provide early-stage capital to startups, enabling product development and market entry with high-risk investment potential. Anchor funds act as primary investors in new funds, attracting additional capital by establishing credibility and stability. Both play crucial roles in the venture capital ecosystem, supporting innovation and funding growth.

Key Differences Between Seed Fund and Anchor Fund

Seed funds typically invest in early-stage startups, providing capital for product development and market entry, while anchor funds are larger investors that establish credibility and attract additional investors in a fund or project. Seed funds often assume higher risk with smaller investment sizes, whereas anchor funds commit substantial amounts to stabilize and boost confidence in the fund's overall portfolio. The primary difference lies in their investment stage focus and role within the funding ecosystem--seed funds drive initial growth, and anchor funds serve as foundational backers.

Definition and Purpose of Seed Fund

A seed fund is an early-stage investment vehicle designed to finance startups and emerging companies during their initial development phase, providing essential capital to validate ideas and build prototypes. It aims to support innovation by enabling entrepreneurs to transform concepts into viable businesses, often before revenue generation. Unlike anchor funds, which anchor larger investment rounds by attracting subsequent investors, seed funds primarily focus on high-risk, early opportunity capture.

Definition and Role of Anchor Fund

An anchor fund is a key investment vehicle that provides initial capital to kickstart a fundraising round, often attracting additional investors by signaling confidence and stability. Unlike seed funds, which primarily focus on early-stage startups and provide the first formal equity investment, anchor funds typically invest larger amounts at the start of a fund's lifecycle to build momentum. The role of an anchor fund is crucial for enhancing credibility, reducing perceived risk, and accelerating the fundraising process for emerging or niche investment funds.

Investment Stages: Seed vs. Anchor

Seed funds primarily invest during the earliest stage of startup development, providing capital for product development and initial market entry. Anchor funds engage at a later stage, often during Series A or subsequent rounds, aiming to stabilize and scale promising ventures. The distinct investment stages dictate risk profiles and expected returns, with seed funds embracing higher risk and potential for exponential growth, while anchor funds focus on consolidation and market expansion.

Typical Investors in Seed and Anchor Funds

Typical investors in seed funds primarily include angel investors, early-stage venture capitalists, and incubators seeking high-growth startups in nascent markets. Anchor funds attract institutional investors, such as pension funds, endowments, and sovereign wealth funds, aiming for stable, diversified portfolios with early but lower-risk capital commitments. Seed fund investors prioritize innovative potential and scalability, whereas anchor fund investors emphasize portfolio stability and strategic partnerships.

Risk Profiles: Seed Fund vs. Anchor Fund

Seed funds typically involve higher risk as they invest in early-stage startups with unproven business models and limited market traction. Anchor funds tend to have a lower risk profile, often supporting more established ventures or acting as initial cornerstone investors, providing stability and confidence to other investors. Understanding these risk profiles helps investors align their portfolio strategy with their risk tolerance and investment horizon.

Benefits and Challenges of Each Fund Type

Seed funds provide early-stage capital, enabling startups to develop prototypes and gain market validation, but they carry high risk due to limited business track records and uncertain returns. Anchor funds offer substantial capital to stabilize and attract other investors in a fund, enhancing credibility and fundraising, yet they may impose stringent control and longer lock-in periods on portfolio companies. Both fund types play critical roles in startup ecosystems, balancing opportunity for growth with varying degrees of financial exposure and operational influence.

Impact on Startup Growth and Development

Seed funds provide early-stage capital crucial for product development, market validation, and initial team building, directly accelerating startup growth by enabling rapid experimentation and iteration. Anchor funds, often larger and positioned later in the funding cycle, offer stability and credibility, attracting additional investors while supporting scaling operations and market expansion. Both funds play complementary roles in startup development, with seed funding igniting innovation and anchor funding driving sustained growth and investor confidence.

Choosing Between Seed Fund and Anchor Fund

Choosing between a seed fund and an anchor fund depends on the investment stage and risk tolerance of the investor. Seed funds specialize in early-stage startups, offering higher risk but potentially greater returns through initial equity stakes. Anchor funds provide stable capital to later-stage ventures or funds, reducing risk exposure and attracting additional investors with their reputation and financial commitment.

Important Terms

Initial Capital Deployment

Initial capital deployment in seed funds typically involves investing smaller amounts in early-stage startups to validate business models and drive product development, whereas anchor funds allocate larger sums to stabilize and scale promising ventures, attracting further investor interest. Seed funds focus on high-risk, high-reward opportunities during the pre-revenue phase, while anchor funds prioritize backing established startups with proven traction to ensure steady growth and market expansion.

Lead Investor

A Lead Investor in a Seed fund typically takes an active role in startup due diligence, valuation, and setting terms, often bringing credibility and attracting co-investors, whereas an Anchor fund in later-stage investments commits a significant capital portion early to stabilize the round and attract other investors. Seed fund Lead Investors focus on high-risk, early-stage ventures, while Anchor funds prioritize mitigating risk in more mature funding rounds.

Syndicate Formation

Syndicate formation in startup investing often involves seed funds providing early-stage capital with higher risk tolerance, while anchor funds contribute substantial validation and stability by committing significant capital early in funding rounds. This strategic partnership enhances deal flow, accelerates capital deployment, and boosts investor confidence, optimizing the scalability and success potential of emerging ventures.

Signal Investment

Signal Investment strategically utilizes seed funds to support early-stage startups with high growth potential, enabling initial capital infusion and market validation. In contrast, anchor funds provide larger, more stable investments to established ventures, offering credibility and attracting additional investors for scaling and expansion.

Pre-seed Allocation

Pre-seed allocation typically involves smaller capital injections aimed at validating ideas before the seed fund invests in scalable growth, whereas anchor funds provide significant strategic backing to attract subsequent investors in early funding rounds. Seed funds prioritize startups showing initial traction, whereas anchor funds often serve as prominent early backers to enhance credibility and market confidence.

Early-stage Validation

Early-stage validation plays a crucial role in differentiating Seed funds, which primarily invest in startups showing product-market fit potential, from Anchor funds that focus on providing strategic support and credibility during initial fundraising rounds. Seed funds emphasize validating market demand and business models, whereas Anchor funds act as lead investors to attract subsequent syndicate participants and enhance valuation confidence.

Strategic Capital Injection

Strategic capital injection through seed funds provides early-stage startups with essential financing to accelerate product development and market entry, while anchor funds typically offer larger investments to stabilize growth and attract additional investors by signaling confidence. Seed funds focus on ideation and prototype phases, whereas anchor funds play a critical role in scaling operations and preparing companies for subsequent funding rounds or public offerings.

Portfolio Diversification

Seed funds focus on early-stage investments with higher risk and potential returns, while anchor funds provide stable, large-scale capital, making balanced portfolio diversification essential for optimizing risk-adjusted returns.

Valuation Setting

Valuation setting in Seed fund rounds typically focuses on early-stage potential, emphasizing market opportunity, team strength, and product development milestones, whereas Anchor funds demand more rigorous valuation metrics backed by initial traction and revenue forecasts. Understanding these distinctions is crucial for startups to align expectations and secure optimal investment terms during fundraising.

Catalytic Funding

Catalytic funding bridges the gap between seed funds and anchor funds by providing early-stage investments that de-risk projects, encouraging larger anchor funds to commit capital. This approach accelerates innovation by leveraging small, flexible seed investments to attract substantial anchor funding, thereby amplifying impact and scaling growth efficiently.

Seed fund vs Anchor fund Infographic

moneydif.com

moneydif.com