Quasi-endowments are funds designated by a board for long-term investment but can be spent at the board's discretion, unlike true endowments which are donor-restricted and typically must be preserved in perpetuity. True endowments provide a permanent source of income, ensuring sustained support for the institution's mission, whereas quasi-endowments offer more flexibility in managing financial resources. The distinction affects investment strategies, spending policies, and legal obligations tied to fund management.

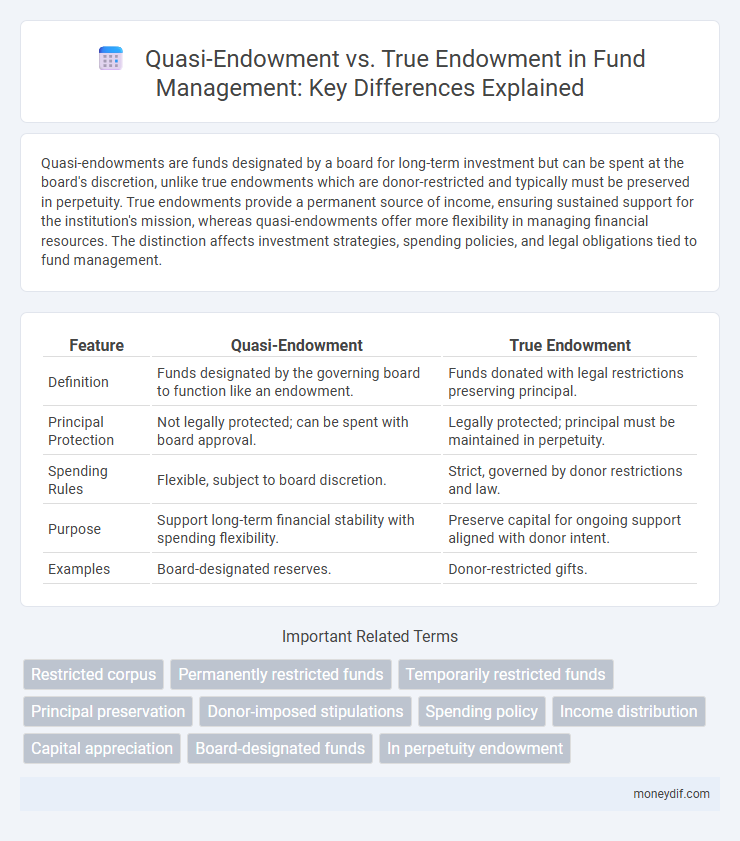

Table of Comparison

| Feature | Quasi-Endowment | True Endowment |

|---|---|---|

| Definition | Funds designated by the governing board to function like an endowment. | Funds donated with legal restrictions preserving principal. |

| Principal Protection | Not legally protected; can be spent with board approval. | Legally protected; principal must be maintained in perpetuity. |

| Spending Rules | Flexible, subject to board discretion. | Strict, governed by donor restrictions and law. |

| Purpose | Support long-term financial stability with spending flexibility. | Preserve capital for ongoing support aligned with donor intent. |

| Examples | Board-designated reserves. | Donor-restricted gifts. |

Introduction to Endowment Funds

Endowment funds consist of principal donations invested to generate ongoing income for an institution, with true endowments requiring that the principal remains intact indefinitely. Quasi-endowments differ by allowing the institution's governing board to spend the principal at their discretion, providing greater flexibility. Understanding these distinctions is crucial for managing fund sustainability and aligning with donor restrictions.

Defining Quasi-Endowment Funds

Quasi-endowment funds, often called board-designated endowments, are funds where the principal can be spent at the discretion of an institution's governing board, unlike true endowments which have donor restrictions preserving the principal indefinitely. These funds provide greater flexibility in spending, allowing institutions to support various programs without violating donor intent. Quasi-endowments are classified as unrestricted funds in financial statements, enhancing liquidity for operational or strategic needs.

Understanding True Endowment Funds

True endowment funds consist of principal amounts preserved in perpetuity, with only the investment income available for spending, ensuring long-term financial stability for the institution. These funds are legally restricted, often by donor stipulations, to maintain the original gift's value while supporting specific purposes. Understanding true endowment funds is essential for effective fund management and aligning spending policies with institutional goals.

Key Differences: Quasi-Endowment vs True Endowment

Quasi-endowments differ from true endowments primarily in the donor's intent and spending restrictions; quasi-endowments are funds designated by an institution's board for long-term investment but allow principal spending, while true endowments require the principal to remain intact in perpetuity, with only the income or a defined portion available for expenditure. The governance of quasi-endowments is typically more flexible, permitting board discretion to appropriate funds, whereas true endowments have legally binding restrictions set by the donor, often governed by the Uniform Prudent Management of Institutional Funds Act (UPMIFA). Understanding these distinctions is crucial for fund management, affecting investment strategies and spending policies to align with donor restrictions and institutional objectives.

Legal and Regulatory Considerations

Quasi-endowments differ from true endowments in that they are funds designated by a board for long-term investment but lack donor-imposed restrictions, affecting their legal treatment and flexibility under state laws such as the Uniform Prudent Management of Institutional Funds Act (UPMIFA). True endowments are subject to strict donor restrictions, requiring adherence to specific spending and preservation rules, which significantly influence regulatory reporting and fiduciary responsibilities. Understanding these distinctions is critical for compliance, as quasi-endowments allow greater discretion in fund management, whereas true endowments necessitate strict compliance with donor intent and regulatory frameworks.

Advantages of Quasi-Endowment Funds

Quasi-endowment funds offer greater flexibility by allowing institutions to temporarily or permanently invest assets while retaining the option to spend principal, unlike true endowments which legally restrict principal spending. This adaptability supports immediate financial needs and strategic priorities without violating donor restrictions. Moreover, quasi-endowments can enhance liquidity management and provide a valuable revenue stream during economic fluctuations.

Benefits of True Endowment Funds

True endowment funds provide perpetual financial support by preserving principal while using investment income for designated purposes, ensuring long-term sustainability for institutions. They offer enhanced donor confidence through legally restricted use, fostering larger contributions and stable funding over time. The growth potential and protection against inflation make true endowments a reliable source for funding scholarships, research, and operational costs.

Use Cases and Typical Applications

Quasi-endowments offer flexibility for institutions to use the principal or income for general purposes, making them ideal for operational funding or short-term projects that require easily accessible resources. True endowments typically preserve the principal indefinitely, providing a stable, long-term financial foundation for scholarships, faculty positions, or capital improvements. Fund managers prioritize quasi-endowments for liquidity and adaptability, while true endowments support perpetual mission-driven goals and sustainability.

Financial Management and Spending Policies

Quasi-endowments, also known as board-designated funds, allow institutions greater flexibility in financial management by enabling spending of principal alongside income, unlike true endowments which legally restrict spending to income generated, preserving the principal. Spending policies for quasi-endowments often prioritize liquidity and operational needs, facilitating more responsive allocation of resources in volatile markets. True endowment spending policies focus on maintaining intergenerational equity, typically following a fixed payout rate based on a smoothing model to stabilize income over time.

Choosing the Right Endowment Structure

Selecting the appropriate endowment structure depends on the institution's financial goals and spending policies, with quasi-endowments offering more flexibility as the principal can be accessed or spent by the governing board, whereas true endowments legally restrict spending to income generated, preserving the original gift in perpetuity. Institutions seeking long-term capital preservation with predictable income streams benefit from true endowments, while organizations needing adaptability in fund usage may prefer quasi-endowments for operational support. Understanding IRS rules and donor intent is critical when establishing either structure to ensure compliance and align with strategic fund management objectives.

Important Terms

Restricted corpus

Restricted corpus refers to the principal amount in quasi-endowments that donors or institutions limit from being spent, contrasting with true endowments where the principal is permanently preserved while only income generated is available for expenditure. Quasi-endowments differ as their corpus can be appropriated by the institution at its discretion, providing greater flexibility but less permanence compared to true endowments.

Permanently restricted funds

Permanently restricted funds include true endowments, which require the principal to be maintained indefinitely, contrasting with quasi-endowments where the board can spend the principal at its discretion. True endowments create long-term financial stability by restricting fund usage to income only, while quasi-endowments offer flexible funding for institutional needs.

Temporarily restricted funds

Temporarily restricted funds are financial assets designated by donors for specific purposes or time periods, differing from quasi-endowments, which are funds set by a board for investment with the possibility of principal withdrawal, unlike true endowments where donor restrictions typically prohibit spending the principal. Understanding the distinctions between quasi-endowments and true endowments is crucial for nonprofit organizations to ensure compliance with donor intent and proper fund management under accounting standards like FASB ASC 958.

Principal preservation

Principal preservation in quasi-endowments allows discretionary spending of the corpus while true endowments mandate maintaining the principal intact to generate perpetual income.

Donor-imposed stipulations

Donor-imposed stipulations distinguish quasi-endowments, which the governing board can spend at its discretion, from true endowments, where funds are permanently restricted by donor intent for specific long-term purposes.

Spending policy

Spending policies for quasi-endowments typically allow institutions more flexibility to allocate funds for current operational needs, whereas true endowments impose stricter legal restrictions that require preserving the principal and spending only the investment income. This distinction influences budgeting strategies, as quasi-endowments often function like expendable funds, while true endowments prioritize long-term financial stability and donor intent compliance.

Income distribution

Income distribution from quasi-endowments is less predictable and often subject to institutional policies, whereas true endowments generate stable, long-term income through permanent principal preservation and investment returns.

Capital appreciation

Quasi-endowments allow institutions to spend principal funds flexibly for capital appreciation, while true endowments restrict spending to investment income, preserving principal to generate long-term growth.

Board-designated funds

Board-designated funds are internally restricted by the board for specific purposes, resembling quasi-endowments, while true endowments consist of donor-restricted funds that must be maintained in perpetuity according to legal and donor-imposed restrictions.

In perpetuity endowment

In perpetuity endowments refer to funds intended to be maintained forever, generating income for designated purposes, distinguishing quasi-endowments which can be spent by the institution, from true endowments where principal is preserved indefinitely. True endowments are legally restricted to maintain the corpus perpetually, while quasi-endowments provide the institution discretion to use the principal if necessary.

Quasi-endowment vs True endowment Infographic

moneydif.com

moneydif.com