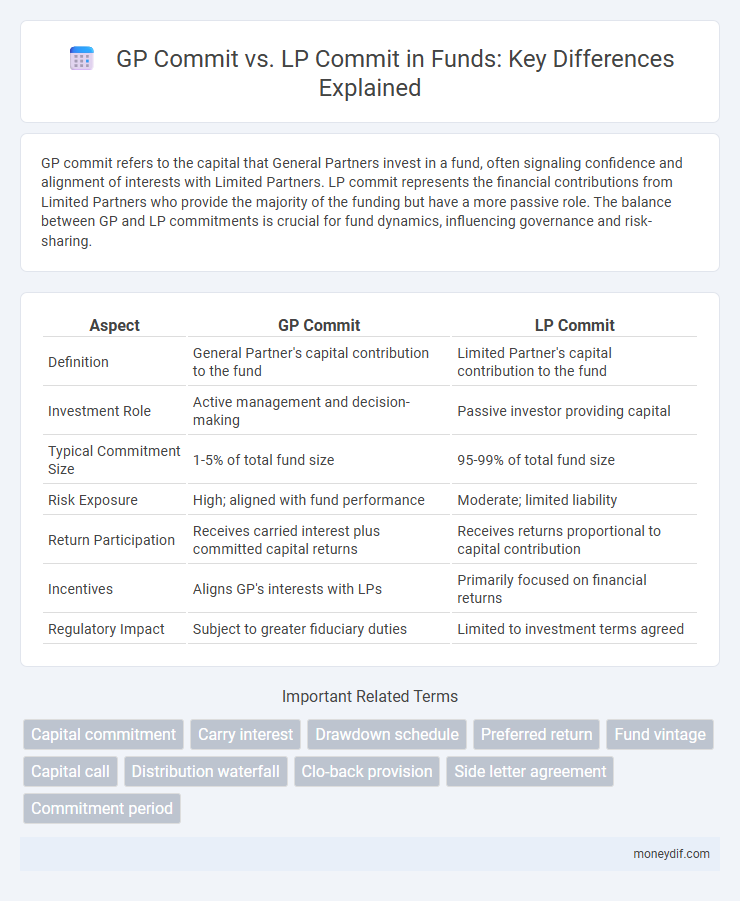

GP commit refers to the capital that General Partners invest in a fund, often signaling confidence and alignment of interests with Limited Partners. LP commit represents the financial contributions from Limited Partners who provide the majority of the funding but have a more passive role. The balance between GP and LP commitments is crucial for fund dynamics, influencing governance and risk-sharing.

Table of Comparison

| Aspect | GP Commit | LP Commit |

|---|---|---|

| Definition | General Partner's capital contribution to the fund | Limited Partner's capital contribution to the fund |

| Investment Role | Active management and decision-making | Passive investor providing capital |

| Typical Commitment Size | 1-5% of total fund size | 95-99% of total fund size |

| Risk Exposure | High; aligned with fund performance | Moderate; limited liability |

| Return Participation | Receives carried interest plus committed capital returns | Receives returns proportional to capital contribution |

| Incentives | Aligns GP's interests with LPs | Primarily focused on financial returns |

| Regulatory Impact | Subject to greater fiduciary duties | Limited to investment terms agreed |

Understanding GP Commitments in Fund Structures

GP commitments represent the capital that general partners invest alongside limited partners in a fund, aligning interests and demonstrating confidence in the fund's strategy. These commitments typically range from 1% to 5% of total fund size, serving as a critical incentive for GPs to maximize fund performance and protect LP investments. Understanding the scale and rationale behind GP commitments clarifies the risk-sharing dynamics and governance structures inherent in private equity and venture capital funds.

Overview of LP Commitments: Key Points

Limited Partner (LP) commitments typically represent the majority of the capital in a fund, reflecting a binding pledge to invest a specified amount over the fund's life. GP commitments, usually smaller in size, demonstrate the General Partner's alignment with LP interests and confidence in the fund's performance. Understanding the scale and structure of LP commitments is essential for assessing fund stability, capital availability, and investor confidence.

GP Commit vs LP Commit: Core Differences

GP commit refers to the General Partner's investment in a fund, typically representing 1-5% of the total fund size, signaling alignment of interests with Limited Partners. LP commit denotes the Limited Partners' capital contributions, usually comprising 95-99% of the fund, providing the bulk of the investment capital. The core difference lies in risk exposure and control, as GPs manage fund operations and bear more responsibility, whereas LPs are primarily passive investors.

Why GPs Commit Their Own Capital

General Partners (GPs) commit their own capital to align interests with Limited Partners (LPs), demonstrating confidence in the fund's potential for generating returns. This personal financial stake incentivizes GPs to diligently manage investments and optimize portfolio performance. GP commits also serve as a signal of credibility and commitment, enhancing investor trust during capital raising.

The Importance of LP Commitments in Fundraising

Limited Partner (LP) commitments are crucial in fundraising as they provide the primary capital pool for investment funds, directly influencing the fund's size and credibility. General Partner (GP) commitments, although typically smaller, signal confidence and alignment of interests between fund managers and investors, enhancing trust. Strong LP commitments attract additional capital, driving successful fund closure and ensuring sufficient resources for portfolio growth.

Alignment of Interests: GP Commit and LP Commit

GP commit and LP commit are crucial components in private equity funds, directly impacting alignment of interests between General Partners (GPs) and Limited Partners (LPs). GP commit typically ranges from 1% to 5% of the total fund size, ensuring GPs have significant skin in the game, which incentivizes diligent fund management and value creation. LP commit, representing the majority of capital, relies on GP's committed capital as a signal of confidence, fostering trust and aligning both parties' financial interests for optimal fund performance.

Impact of GP Commit Size on Investor Confidence

The size of the General Partner (GP) commit significantly influences investor confidence, as a larger GP commit aligns the interests of GPs and Limited Partners (LPs), signaling strong commitment and skin in the game. Studies show that funds with GP commits typically ranging from 1% to 5% of total capital raise more LP capital and attract higher-quality investors. This alignment reduces perceived agency risk and enhances trust, ultimately supporting improved fundraising outcomes and long-term fund performance.

LP Commitment Structures: Common Practices

LP commitment structures typically involve fixed capital contributions over the fund's life, often spread through capital calls to manage cash flow efficiently. Common practices include tiered commitments, where LPs commit to initial capital with optional follow-on investments, and anchor LPs securing larger commitments upfront to boost fund credibility. These structures balance capital availability with risk sharing, aligning LP incentives with fund performance and long-term growth.

Negotiating GP and LP Commit Levels in Funds

Negotiating GP and LP commit levels in funds requires aligning incentives through carefully calibrated equity stakes, often ranging from 1% to 5% for General Partners (GPs) to demonstrate skin in the game and assure Limited Partners (LPs) of commitment. LP commit levels are typically set higher, reflecting their primary capital contribution, with negotiation focusing on balancing risk, return expectations, and governance rights. Effective negotiation hinges on transparent communication about fund strategy, capital deployment plans, and exit horizons to ensure mutual alignment and optimize fund performance.

Regulatory and Reporting Implications of GP vs LP Commits

GP commits, typically ranging from 1% to 5% of the fund size, are subject to heightened regulatory scrutiny due to the general partner's active management role and fiduciary responsibilities. LP commits, often constituting the majority of the fund's capital, face distinct reporting requirements primarily focused on transparency and disclosure under securities laws like the SEC's Regulation D or AIFMD in Europe. The differentiation in commitments drives varying compliance obligations, with GPs needing to ensure robust internal controls and adherence to conflict-of-interest regulations, while LPs prioritize periodic financial reporting and valuation transparency.

Important Terms

Capital commitment

Capital commitment refers to the total amount of capital that investors, including General Partners (GPs) and Limited Partners (LPs), agree to contribute to a private equity or venture capital fund. GP commitments typically range from 1% to 5% of the fund size, serving to align interests, while LP commitments constitute the majority of the capital, often exceeding 90% of the total fund commitment.

Carry interest

Carry interest represents the share of profits that General Partners (GPs) earn as performance compensation, typically around 20% of fund gains, incentivizing GPs to maximize returns. GP commits, usually 1-5% of total capital, align their interests with Limited Partners (LPs), who provide the majority of the capital but receive returns after the GP's carried interest is paid.

Drawdown schedule

A drawdown schedule outlines the timeline and amounts for capital calls from Limited Partners (LPs) based on the General Partner's (GP) commitments, ensuring that committed funds are systematically requested and deployed. This schedule aligns LP contributions with the GP's investment needs, balancing liquidity and capital efficiency throughout the fund lifecycle.

Preferred return

Preferred return ensures limited partners (LPs) receive a priority return on their invested capital before general partners (GPs) participate in profits, aligning interests through GP commit, which requires GPs to invest their own capital alongside LPs. This GP commit typically ranges from 1% to 5% of total capital, reinforcing commitment and confidence while balancing risk and return between both parties.

Fund vintage

Fund vintage refers to the year a private equity fund makes its initial investments, shaping performance benchmarks and market conditions comparison. General Partner (GP) commits represent the capital contributed by fund managers, typically ranging from 1% to 5% of total commitments, aligning their interests with Limited Partners (LPs) who provide the majority of the capital.

Capital call

Capital calls represent the process by which General Partners (GPs) request committed funds from Limited Partners (LPs) to finance investments or cover expenses in a private equity fund. The GP commit signifies the amount the General Partner invests alongside LPs, aligning interests and often ranging from 1% to 5% of total committed capital, while LP commits constitute the bulk of the fund's capital, typically accounting for 95% to 99%.

Distribution waterfall

The distribution waterfall in private equity defines the sequence of cash flow allocations, prioritizing LP commitments for return of capital and preferred returns before GP commitments receive carried interest. GP commit is typically a smaller percentage aligned with LP commitments, incentivizing GP performance while ensuring LPs recover their invested capital and hurdle rates first.

Clo-back provision

The Clo-back provision ensures General Partners (GPs) contribute their full committed capital alongside Limited Partners (LPs), aligning investment interests and maintaining proportional ownership during capital calls. This mechanism protects LPs from dilution by requiring GPs to match their commitment percentage relative to the total capital deployed.

Side letter agreement

A side letter agreement often clarifies or modifies the terms of the GP commit versus LP commit, specifying obligations, exceptions, or preferred treatment in private equity fund structures.

Commitment period

The commitment period defines the timeframe during which General Partners (GPs) and Limited Partners (LPs) are obligated to fulfill their capital commitments to a fund, with GPs typically committing a smaller percentage of the total capital compared to LPs. This period is crucial for capital calls and investment pacing, ensuring GPs deploy committed capital effectively while LPs meet their funding obligations.

GP commit vs LP commit Infographic

moneydif.com

moneydif.com