Vintage year refers to the specific year when a fund makes its first investment, marking the starting point for measuring performance and market conditions. Fund inception is the date when the fund is officially established, which may precede the vintage year if initial capital deployment happens later. Understanding the distinction between vintage year and fund inception is crucial for accurately assessing fund returns and comparing strategies across different market cycles.

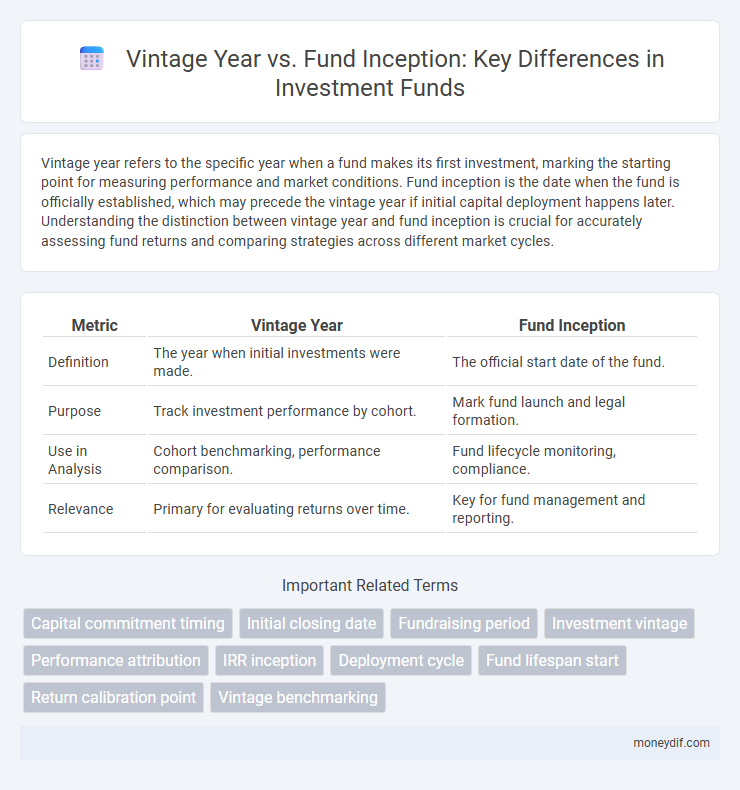

Table of Comparison

| Metric | Vintage Year | Fund Inception |

|---|---|---|

| Definition | The year when initial investments were made. | The official start date of the fund. |

| Purpose | Track investment performance by cohort. | Mark fund launch and legal formation. |

| Use in Analysis | Cohort benchmarking, performance comparison. | Fund lifecycle monitoring, compliance. |

| Relevance | Primary for evaluating returns over time. | Key for fund management and reporting. |

Understanding the Concepts: Vintage Year and Fund Inception

Vintage year refers to the specific calendar year when a private equity fund makes its initial investments, serving as a critical indicator for comparing fund performance within the same economic cycle. Fund inception denotes the official launch date when the fund begins operations and starts raising capital from investors. Distinguishing vintage year from fund inception helps investors analyze market conditions and timing impacts on overall fund returns.

Key Differences Between Vintage Year and Fund Inception

Vintage year refers to the specific calendar year in which a fund makes its initial investments, serving as a critical benchmark for performance comparison across similar funds. Fund inception, on the other hand, marks the official launch date of the fund, indicating when it began operations and started raising capital. The key difference lies in vintage year reflecting actual investment activity timing, while fund inception indicates the formal start of the fund's lifecycle.

Why Vintage Year Matters in Fund Performance Analysis

Vintage year represents the specific year a fund begins making investments, serving as a critical benchmark for comparing performance across funds established in different economic cycles. Fund inception date marks when the fund officially launches but may differ from vintage year if actual investments start later, impacting the relevance of performance metrics. Analyzing vintage year allows investors to account for market conditions at the time of initial investments, enabling more accurate assessments of fund performance relative to peers and overall economic trends.

The Role of Fund Inception in Tracking Fund History

Fund inception marks the official launch date of a fund, serving as a crucial reference point for evaluating its historical performance and investment strategy over time. Unlike the vintage year, which indicates the year when the fund began making investments, fund inception encompasses the entire operational timeline, including capital raising and portfolio management phases. Tracking fund inception helps investors assess long-term fund management effectiveness and benchmark returns against market cycles and comparable funds.

How Vintage Year Influences Returns Benchmarking

Vintage year serves as a critical benchmark for evaluating private equity fund performance, as it groups funds launched within the same time frame, reflecting similar market conditions and economic cycles. Comparing returns based on vintage year enables investors to understand relative performance and risk-adjusted returns more accurately, filtering out distortions caused by varying economic environments. Fund inception date alone lacks this contextual significance, making vintage year a superior metric for consistent and meaningful benchmarking.

Reporting Standards: Vintage Year vs Fund Inception

Reporting standards distinguish between vintage year and fund inception to provide clarity in performance measurement and benchmarking. Vintage year represents the calendar year in which the fund makes its first investment, serving as a critical reference for comparing funds within the same economic cycle. Fund inception marks the official launch date of the fund, which may precede the vintage year, impacting cash flow timing and valuation reporting under industry standards such as IFRS or GAAP.

Impact on Investor Decision-Making: Vintage Year vs Inception

Vintage year serves as a critical indicator of a fund's market timing and economic cycle exposure, influencing risk assessment and expected returns. Fund inception date offers context on fund manager experience and track record but may not reflect current investment environment nuances. Investors weigh vintage year heavily to gauge comparative performance and alignment with prevailing market conditions, shaping portfolio diversification and timing strategies.

Industry Practices: Categorizing Funds by Vintage Year or Inception

Fund industry practices differentiate between vintage year and fund inception to categorize investments accurately based on market timing and economic cycles. The vintage year represents the calendar year when the fund makes its first investment, crucial for performance benchmarking and comparative analysis across market conditions. In contrast, fund inception marks the official start date of the fund's lifecycle, which may precede actual investment activity, impacting reporting timelines and investor communications.

Common Misconceptions About Vintage Year and Fund Inception

Vintage year often gets mistaken as the fund's inception date, but it actually refers to the year in which a private equity fund makes its initial capital commitment. Unlike the fund inception, which marks the formal launch or legal establishment of the fund, the vintage year signals the primary investment period and is crucial for benchmarking performance against peers. This distinction matters for investors tracking fund cycles and returns, as vintage year better reflects the timing of investments and market conditions affecting fund performance.

Best Practices for Managers: Disclosing Vintage Year and Fund Inception

Best practices for fund managers emphasize clear disclosure of both vintage year and fund inception to enhance transparency and investor trust. The vintage year, reflecting the year of initial capital deployment, allows investors to benchmark fund performance against market cycles, while fund inception indicates the legal formation date, crucial for understanding fund lifecycle stages. Precise communication on these dates supports informed decision-making and aligns expectations regarding fund maturity and return timelines.

Important Terms

Capital commitment timing

Capital commitment timing often aligns with the fund inception but can vary based on the vintage year, which marks the initial investment period. Vintage year impacts performance benchmarks while fund inception denotes when commitments start being drawn, influencing cash flow and capital deployment schedules.

Initial closing date

The initial closing date marks the official start of a fund's capital commitments, often occurring after the vintage year, which represents the calendar year when the fund begins deploying capital. Fund inception refers to the date when the fund is legally established, typically preceding the initial closing date and vintage year, setting the groundwork for investment activities.

Fundraising period

The fundraising period typically begins after the fund inception date but may vary depending on the vintage year, which marks when the fund starts making investments. Understanding the alignment between vintage year and fundraising timeline is crucial for analyzing capital deployment and return expectations in private equity or venture capital funds.

Investment vintage

Investment vintage refers to the year when a fund makes its first capital call, often compared against the vintage year indicating the initial investment period for benchmarking performance.

Performance attribution

Performance attribution analysis compares returns based on vintage year and fund inception to isolate the impact of timing and market cycles on overall fund performance. Vintage year attribution focuses on the entry point of capital deployment, while fund inception analysis considers the entire lifecycle, enabling investors to assess time-sensitive risk and return patterns accurately.

IRR inception

IRR inception measures the internal rate of return starting from a fund's vintage year, which marks the initial capital deployment, rather than the formal fund inception date when the fund is legally established. This distinction is critical for accurately assessing performance as vintage year reflects actual investment timing and market conditions influencing returns.

Deployment cycle

The deployment cycle of a private equity fund often spans several years following the fund inception, with capital typically invested in portfolio companies during the first 3 to 5 years corresponding to the fund's vintage year. This vintage year marks the initial investment period, impacting the timing and pace at which capital deployment occurs throughout the fund's life cycle and subsequent realization phases.

Fund lifespan start

Fund lifespan start is defined by the fund inception date, which typically follows the vintage year indicating the calendar year when the fund first began making investments.

Return calibration point

Return calibration points based on vintage year versus fund inception provide crucial benchmarks for evaluating private equity performance over comparable market cycles. Aligning returns with vintage year allows investors to measure fund performance relative to peers initiated within the same economic environment rather than solely by fund inception date.

Vintage benchmarking

Vintage benchmarking compares investment performance by grouping funds according to their vintage year, which corresponds to the year of fund inception. This method allows for a more accurate evaluation of returns by accounting for market conditions and economic cycles prevalent during each fund's initial investment period.

vintage year vs fund inception Infographic

moneydif.com

moneydif.com